BMS ep. 202: “What Did Bob Learn?” Part 1 of 3

Due to listener request, I detail some of the times I changed my mind over the years.

BMS ep 200: Vijay Boyapati Explains Why He Was Right About Inflation in 2010 and Bitcoin in 2018

An interesting discussion. Audio here, no video for this one.

New Developments in Austrian Interest Theory

Bob Murphy Show ep. 198 is a guest lecture I gave to Jonathan Newman’s online Master’s class for the Mises Institute. I set the historical table for BMS ep. 199, in which I talked with Jeff Herbener about his recent presentation at an Austrian conference on the pure time preference theory of interest. It was very surprising for me, because Jeff was much closer to my position than I expected, going into the discussion.

Audio for BMS ep 198 here, video below (with PowerPoint):

And then the audio for BMS ep 199 here, with video below:

Tyler Cowen’s Expansive Definition of Externalities

Jeff Bezos can spend his money on himself, or he could give it to other people, so they could spend it on themselves. If he opts for the former, this is a clear-cut negative externality. Right?

I think most economists would agree that that is a terrible argument. And yet, it seems to be what Tyler Cowen says, regarding old people spending their own money on themselves before they die, rather than passing it on to others. David R. Henderson shares my confusion.

Murphy Formally Withdrawing from the Auburn-Fairfax Peace Treaty

Several years ago, a bunch of Austrian economists affiliated with the Mises Institute agreed to a peace treaty with a bunch of economists affiliated with George Mason University. At the time, there had just been a really ugly online battle, not so much between the actual professional economists, but among their fan bases.

Although I remember well why we did it, I now am formally announcing my withdrawal from the treaty. To be sure, I will not engage in unprovoked aggression or other acts in violation of Internet etiquette, but I want to have a free hand in criticizing Tyler Cowen in my next blog post. Being Lawful Good in my D&D alignment, I felt it necessary to make this announcement first.

LSE Climate Economics “Expert”: Liar or Stupid?

I report, you decide.

I am working on a study for the Fraser Institute that relies on the work of William Nordhaus. Long-time readers of my stuff know the irony of this work, because Nordhaus won the Nobel (Memorial) Prize in 2018 for his pioneering work on climate economics, on the same weekend that the UN released its Special Report on limiting global warming to 1.5C. The irony comes from the fact that Nordhaus’ own work shows that even a 2.5C limit–let alone a 1.5C one–would be so economically damaging, that it would be better if governments did nothing at all about climate change.

So in response to a reviewer report on my study draft, I went digging around for more recent commentary on Nordhaus. I came across the following in an essay from Bob Ward, Policy and Communications Director, at the London School of Economics’ Grantham Research Institute on Climate Change and the Environment:

Professor Nordhaus stressed during his [Nobel acceptance] lecture that climate change is a very serious problem and that a universal carbon price should be introduced to curb greenhouse gas emissions.

Nevertheless, Professor Nordhaus’s latest results have been seized upon by climate change deniers and so-called ‘lukewarmers’, who deny the risks of climate change. For instance, Dr Bjorn Lomborg, who has a track record of misrepresenting the results of climate research, recently wrote in another inaccurate and misleading article for ‘Project Syndicate’ that Professor Nordhaus’s showed “aiming to reduce temperatures more drastically, to within 2.5°C of preindustrial levels, would drive the cost beyond $130 trillion, leaving us $50 trillion worse off”.

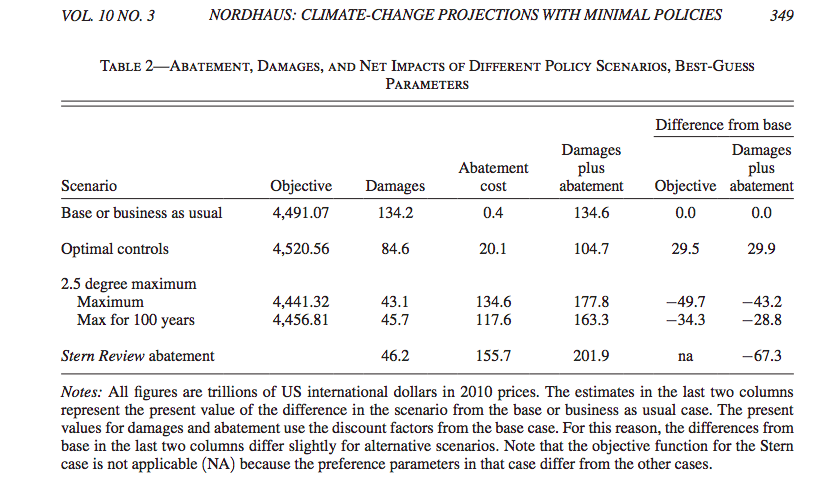

In fact, the journal paper by Professor Nordhaus to which Dr Lomborg claims to have been referring shows clearly that unabated climate change would lead to damages of US$134.2 trillion (discounted present value, 2010 prices) as a result of global warming that would exceed 4°C by the end of the century. By contrast, limiting global warming to 2.5°C would cost US$134.6 trillion, but would still lead to damages of US$43.1 trillion.

Now what is hilarious is that (a) if you go to the Nordhaus paper that Ward links to, you will see Bjorn Lomborg’s summary is correct (looking at the “Objective [function]” column, or the dollar figure is $43.2 trillion if you look that way), and (b) once you know the scoop, you can re-read Ward’s own summary and see that it doesn’t contradict what Lomborg said. (!) I’ve attached the relevant table below for your convenience.

So my question: Did Bob Ward just not know how to read Nordhaus’ table, and confidently call Lomborg a denier, and his article inaccurate and misleading, out of ignorance? Or did Ward know that Lomborg had correctly summarized Nordhaus’ table, and was just hoping most readers wouldn’t bother to check or know how to?

Bob Murphy Triple Play

==> Here’s my recent article for mises.org, explaining and criticizing one of the important contributions of the late Nobel laureate, Robert Mundell.

==> BMS ep. 196, in which Stephan Livera interviews me on the economics of Bitcoin. (There’s some new ground I cover in this one, if you’ve heard me talk about Bitcoin before.)

==> BMS ep. 197, in which I interview David Beckworth on the logic of NGDP targeting, and what the Fed is up to. Audio here, video below:

Recent Comments