Murphy Talk on “Spreading the Gift” at “Anarchy in the NYC” Event

On April 20 I gave the opening talk at the “Anarchy in the NYC” event. In case you don’t know, this event featured a bunch of young anarchists of various persuasions, as well as bands. So I had to unveil Tough Guy Murphy for this one.

One last caveat: There is about 45 seconds of lost footage in the video below, and it occurs at a crucial part near the end after I give the NBA and writers analogies. The talk is still comprehensible, but the “a ha” punchline loses some of its force. In any event, my opening joke about testicles survives, and I think that’s all that really counts.

Why “Potential GDP” Loads the Keynesian Deck

Krugman is back to his oh-so-objective presentation of the facts, which smuggle in the Keynesian policy prescriptions:

There is some tendency among economic commentators to think that austerity policies in a deeply depressed economy are mainly a European thing; you even find a fair number of people imagining that the United States is still engaged in fiscal stimulus. But the truth is that federal stimulus is years behind us, while state and local governments have cut back, so the overall story is one of fiscal contraction that’s smaller than in Europe, but not by that much.

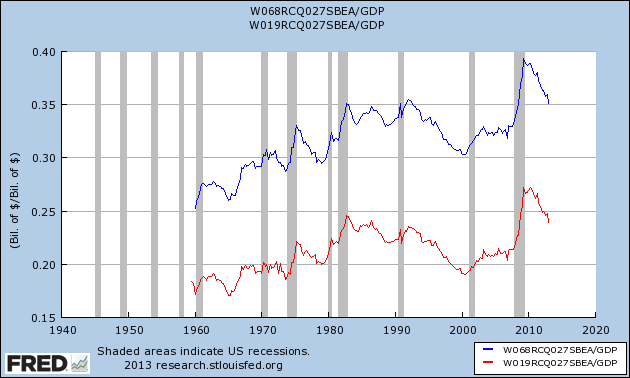

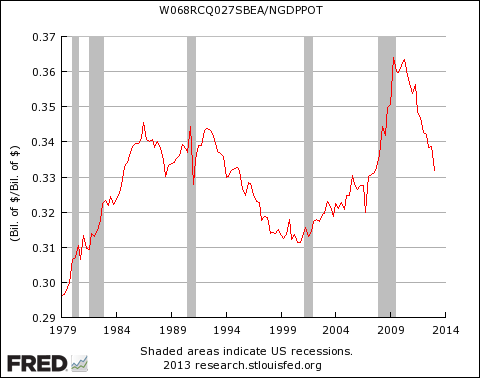

To see what’s going on, you need to do two things. First, you should include state and local; second, you shouldn’t divide by GDP, because a depressed GDP can cause the spending/GDP ratio to rise even if spending falls. So it’s useful to look at the ratio of overall government expenditure to potential GDP — what the economy would be producing if it were at full employment; CBO provides standard estimates of this number. And here’s what we see:

Spending is down to what it was before the recession, and also significantly lower than it was under Reagan….So this is actually a picture of very bad policy.

Yes, this is a decent way to analyze the world, assuming that the economy is fundamentally suffering from a lack of demand and that government spending would fill the gap. But if the Austrian story were correct–that the economy had years of unsustainable, phony prosperity that actually ate away the underlying capital structure–then the above analysis is totally misleading.

Let’s see what happens if we take (a) total government and (b) federal government expenditures, and divide by actual GDP, not “potential” GDP. We find this:

Huh, how ’bout that? According to this metric, government spending (whether total or just federal) is still higher than at just about any point in the last 50 years, save for the crisis period itself and a few little blips. Couple that with the fact that the economy right now is arguably worse than it was during the Great Depression–both DeLong and Krugman tell us this is so–and it’s a good prima facie case that massive government spending hurts the economy. That should make sense, because it lines up perfectly with commonsense “micro” thinking.

Yet even on Keynesian grounds, it’s not obvious to me that “government spending as a share of potential GDP” is the right metric. Suppose we have an economy where government spending is initially $0, private spending is $100 billion, unemployment is 90%, and potential GDP is $1 trillion. Then in the next period, the government runs a deficit of $100 billion.

According to a Krugman/DeLong analysis, I would expect this to have a humongous multiplier. So not only would there be no crowding out, but in fact total private spending would increase, let’s say to $120 billion. Thus GDP in the next period would be $120 billion + $100 billion = $220 billion, a 120% increase. Unemployment would probably fall by more than 10 percentage points. It would seem a good Keynesian would explain the smashing success of this pump-priming by saying, “Ah, the deficit went from 0% of GDP to 100% of GDP (or 45.5% if you use the 2nd-period GDP figure). So no kidding the economy more than doubled.”

And yet, judging from Krugman’s preferred metric, you would have to explain the record-shattering growth in GDP by saying that the deficit went from 0% of potential GDP to 10% of potential GDP.

Don’t get me wrong, you can flip things to the other extreme and come up with cases where relying on deficits as a share of actual GDP would be misleading (within the Keynesian paradigm). For example, suppose we have an economy that initially is all government spending. It’s $1 trillion government spending (all deficit), with $0 private spending, with full employment. Then the government cuts its budget in half, and the private economy doesn’t pick up any of the slack. So total GDP falls from $1 trillion down to $500 billion, and unemployment shoots up to 50% or so. Yet the government deficit as a share of GDP would be the same, at 100% of GDP.

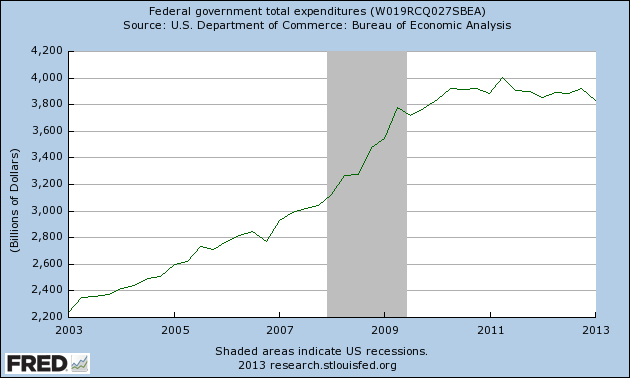

UPDATE: Oh, by the way, Krugman’s line about “the truth is that federal stimulus is years behind us” makes you think there have been crazy spending cuts at the federal level. In fact:

So yes, the stimulus is “years behind us” and federal spending is still about where it was, during the height of the “emergency stimulus spending.”

THE ZOMBIE RETURNS! Woods-Murphy Live in NYC, June 8

Oh my, Tom and I are cooking up…something wonderful. This is one artist’s rendition of the phenomenon:

Here’s Tom’s main event page, here’s the Facebook event page, and here is where you get tickets. If you know you’re going–and unless your wife will be in labor, why would you miss this?–act now, because special discount pricing ends May 1.

Krugman vs. Murphy: The Animated Series

So Noah Smith has a pretty funny post, casting Krugman as Voltron versus me (and a bunch of others) as the monotonous grab-bag of robot monsters.

On Facebook some people were offering cartoonish rejoinders. Joshua Ammons showed what a two face Krugman is:

while Naomi Jeys dug up her caricature of me from a few months ago:

And yes, I am mixing DC and Marvel in this post. No rulers!

Stockman Bask

I am reviewing David Stockman’s book, The Great Deformation, for Barron’s. I want to run two things by you folks that gave me pause. These probably won’t make it into the review, but I’m nonetheless curious:

==> On page 61 he writes:

This arrangement [of Asian countries keeping their currencies artificially low vis-a-vis the dollar in order to boost exports to US] defied every tradition of sound international finance…During the nine years after 1991, the US trade accounts literally collapsed, with imports growing at 11 percent annually…The trade deficit thus surged from $66bn in 1991 to $450bn by the year 2000…It was an unfathomable figure by the canons of classic finance because it was literally upside down. The reserve currency country was supposed to run a trade surplus and export capital to less developed trading partners, not incur massive deficits and drain capital from them. [Bold added.]

It’s the part I put in bold that intrigues me. First, is that right? Has anyone else heard of such a relationship?

Next, how does this work under a commodity standard? Let’s say the whole world uses gold, and I mean literally they use gold as the money, not sovereign currencies that are redeemable in gold. Suppose one country just so happens to have the only gold mines left. How would that show up in the trade statistics? Depending on the accounting, you would arguably see that country run a perpetual trade deficit with the rest of the world, as it shipped out money every year, in exchange for net imports of goods.

==> On page 63 Stockman writes that Professor Taylor “had seen fit to name the rule in his own honor.” Is that right? The “Taylor Rule” got its name from Taylor himself, in narcissistic fashion?

Road to Serfdom? Not on Daniel Kuehn’s Watch

Commenting on the Boston suspect:

On this particular case, I don’t want to comment too specifically except to just make a blanket statement that I obviously think Tsarnev should be accorded the full protections of the Constitution. I hesitate to get outraged at what’s happened so far simply because my experience with Law and Order leads me to have some vague recollection that they can hold someone for a while without arresting them while looking into things, and I’m not sure how that works exactly. But those legalities aside (which they should exploit to the fullest as long as it’s legal), he needs to be Mirandized if we’re going to hold him.

No Pandering From Krugman

At this point we need an Excel spreadsheet to keep track of how many blog posts Paul Krugman has written, regarding the lessons we are to draw from the Reinhart-Rogoff fiasco. But this one really amused me, when Krugman explained:

Notice, however, that the problem with the original wasn’t that it failed to convey the nuances. The problem was that it was just plain wrong — wrong about America after the war, wrong about what a debt-growth correlation means. (It turns out that there was other wrongness too, but that was enough).

So the moral of the story should not be, “Don’t take strong positions”. It should instead be “Don’t take a strong position that some people want to hear if the position isn’t supported by theory and evidence”. Or maybe, even more briefly, “Don’t pander”.

And the trouble with where I think [Tyler] Cowen, at least, is going is the apparent suggestion that everyone who develops a prominent public profile in economics has to do it by pandering. No, they don’t — and specifically, I don’t think that’s what I do. I’ve taken very strong positions over the years; I’ve been wrong on some occasions; but I can’t think of any cases where I took a stronger position than my actual beliefs warranted.

Yes, I imagine the following remarks (just off the top of my head) all flow straight from an IS-LM model:

==> November 2012: “The truth is that the modern GOP is deeply anti-intellectual, and has as its fundamental goal not just a rollback of the welfare state but a rollback of the Enlightenment.”

==> May 2010: “A funny thing has been happening on Capitol Hill: lately, the Democrats have started exceeding expectations. Health reform, pronounced dead by all the usual suspects, happened (all hail Nancy Pelosi, arguably the greatest Speaker ever.)”

==> August 2009: “That said, Ben Bernanke’s performance over the past year deserves praise, and there’s nobody I’d rather have in his position. Congratulations, Ben.”

Recent Comments