Because He’s God

A quick one: A lot of atheists / agnostics argue with me by pointing out that if humans did the sorts of things that occur in the Old Testament, I would be (rightly) horrified. Why then does this Yahweh character get a pass?

Because He’s God.

That’s not a cop out, it’s a perfectly fine answer. Consider this: When people hesitate to do something newfangled, like alter the DNA of a child in the womb, one way of expressing this is to say, “We can’t play God.” Whether or not you agree with the application of that principle in a certain instance, surely you can understand the coherence of the statement.

So another way of saying the point of the present blog post: Humans aren’t allowed to play God, but God is.

It would be immoral for me to go up to some stranger, Joe Smith, and shoot him in the head. It is not immoral for God to design a universe the internal logic of which dictates that a stranger walks up to Joe Smith and shoots him in the head. If you think that is immoral, then it’s also immoral anytime God makes anyone ever die, period. So then you are left complaining that God didn’t condemn us to this physical universe for all of eternity, instead of giving us a chance to bask with Him in paradise, which is a pretty silly complaint when you stop and think it through.

Applying Krugmanian Lessons to the 1990s

Poor Alex Tabarrok. He makes a simple blog post, pointing out the hilarious heads-we-win-tails-you-lose stance of Krugman et al., and the targets of his critique focus on something completely incidental. I will probably muddy the waters myself by focusing on the “incidental” part of his post, but so be it. First, though, let’s review:

1) On April 27, Mike Konczal argued that the new GDP report put the nail in the coffin of the market monetarists versus the Keynesians: The Fed had ramped up its asset purchases, while the Congress slashed spending, and oh man the economy is awful. Krugman agreed with Konczal.

2) Scott Sumner said wait a tic, the GDP report shows stronger growth last quarter than the two years before the (alleged) austerity. So huh?

3) Then the surprisingly good (in blogosphere circles) jobs report came out. Now Krugman et al. are really in an awkward spot. They just set up a test, saying the current state of the economy is an up-or-down vote on Sumner vs. Krugman, and it’s not looking so hot for the Nobel laureate. Scott Sumner claims victory in his ever-so-subtle style.

4) Alex Tabarrok tries to be very calm and professional about it. He takes the very measure of “austerity” that Krugman used–total government expenditures as a share of “potential GDP”–and shows that yes indeed, that measure has fallen like a rock; it’s down 3 percentage points over the last 3 years (those are my estimates from eyeballing the chart). And yet, real economic growth hasn’t suffered at all in this period. So Tabarrok wants Krugman et al. to explain this anomaly. Krugman has been warning his readers that US austerity is really awful when we’re in a fix like we’re in right now, and yet, according to Krugman’s measure of “austerity,” the awfulness has been happening for more than 2 years, with apparently no negative effect on growth.

5) Unfortunately, Tabarrok also wrote a single sentence in his post about his chart during the 1990s Clinton boom. This is what Krugman seized upon, in his I’m-surrounded-by-frickin-idiots response.

6) Matt Yglesias beat up on Tabarrok a bit too, but eventually came around to kinda sorta admitting yeah, Sumner wins the Internet.

7) On Twitter, Tabarrok tries to walk back his single sentence about the 90s, and wants the Internet Keynesians to focus on the fact that one week ago, Konczal said the GDP report proved Krugman beats Sumner, so why doesn’t the jobs report prove the opposite? (And also, why is an increase in GDP growth proof that Sumner is wrong?!) As far as I could see, no Internet Keynesian even attempted to answer him. They just wanted to make sure he realized how utterly stupid his single sentence about the 1990s was.

Anyway, let me engage in the acme of foolishness by looking at the Clinton boom. The problem was that Alex had mentioned that Krugman’s preferred austerity measure fell sharply during the 1990s, even as the economy boomed. Yglesias, DeLong, et al. jumped in to say Alex was forgetting the all-important zero lower bound: Because the fed funds rate was positive during the 1990s, the Fed could easily offset the impact of lower aggregate demand, emanating from (relative) cuts to government spending.

So at this point, I thought to myself, “Bob, what would the data have to look like, to make this excuse appear totally wrong?” Well, if you saw Krugman’s “austerity” measure going through the roof, and you saw the economy booming in response, and you saw the Fed raise (real) interest rates, then that would sorta mess up DeLong and Yglesias’ story, right? I mean, suppose for the sake of argument the data looked like this:

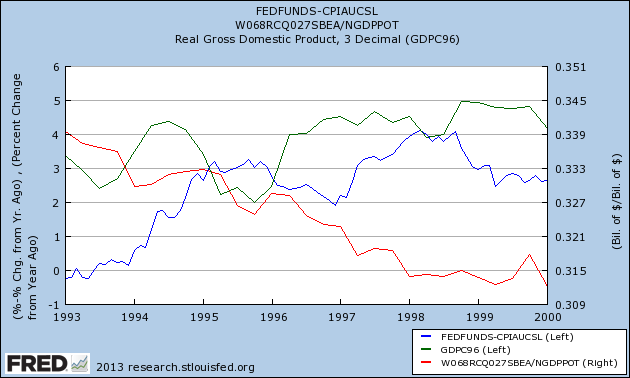

The chart above shows that total government spending as a share of potential GDP (red line) went from about 34% in 1993 to 31.5% by late 1998. That’s some severe fiscal tightening.

And yet, the economy didn’t suffer. Year/year real GDP growth (green line) stayed strong throughout the period, and was hitting 5 percent by late 1998. Hmm that’s kind of weird, right? How is it possible that we had severe fiscal tightening, while the economy continued to boom?

Oh, it’s because we weren’t at the zero lower bound! Thus the Fed must have engaged in looser money to offset the fiscal contraction. You can see this in the blue line above, where the fed funds rate minus the yr/yr CPI inflation rate increased by 400 basis points over the period in question. Wait what–?!

Don’t worry, kids, no Keynesian was harmed in the making of this blog post. They can just say, “Oh c’mon Murphy, man you guys are dumb. The economy was obviously booming hard. In the absence of the government ‘cuts,’ Greenspan would have had to raise inflation-adjusted interest rates by, say, 600 basis points. But since the government pulled back its spending, Greenspan only raised them 400 points. Thus monetary offset of the fiscal contraction. Duh.”

Finally, note that I’m not even saying it would be intellectually dishonest for our Keynesian friends to make that move. But they should at least have the decency to stop pretending their position is objectively based on the hard data, whereas their opponents walk around with confirmation bias.

Krugman’s Botched Inflation Call and Scary Other-Country Reference

Ideally someone else would make this post, since it will seem petty and defensive coming from me, but sometimes you look inside yourself and realize that you are the only one who can get the job done.

Anyway, I think it’s fair to say that Paul Krugman has been running around for a good two years with variants of the following (which are my words, but very much in the spirit of what he’s been saying):

[FAKE PAUL KRUGMAN QUOTE]: I can’t believe the shameless dogmatism of these right-wingers. Ever since the crisis unfolded, they’ve been trotting out scary-looking charts of the monetary base, predicting huge surges in [price] inflation, and even saying the US was headed the way of Zimbabwe. Well, history has shown them to be totally wrong. And yet, even though their model spit out erroneous predictions about inflation, they continue with the same policy recommendations that they were giving in the beginning. It’s really astounding to behold.

I’m not even going to bother citing the above; Krugman has obviously been making that type of case repeatedly for years now.

In this context, let’s review a Krugman post from February 2010 when he wrote:

Now, the measurement issue: we’d like to keep track of this sort of inflation inertia, both on the upside and on the downside — because just as embedded inflation is hard to get rid of, so is embedded deflation (ask the Japanese)…

The standard measure tries to do this by excluding the obviously non-inertial prices: food and energy. But are they the whole story? Of course not…Hence the growing preference among many economists for measures like medians and trimmed means, which exclude prices that move by a lot in any given month, presumably therefore isolating the prices that move sluggishly, which is what we want.

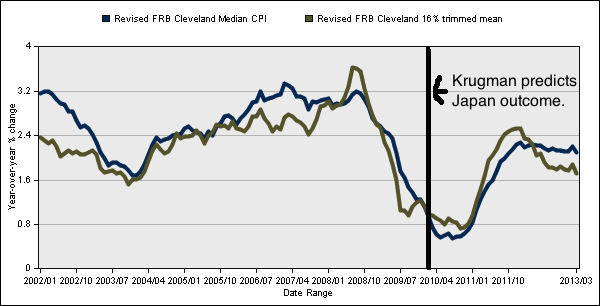

And what these measures show is an ongoing process of disinflation that could, in not too long, turn into outright deflation:

Japan, here we come.

So in conjunction with that chart, Krugman is clearly predicting that the line will keep falling, perhaps even crossing into negative territory, and then will stay down there indefinitely. That’s what happened in Japan, after all: According to this website, over the last 20 years Japan’s CPI has been virtually flat. (This more official-looking site shows Japan’s annual CPI increases have been slightly negative, typically, for the last decade.)

So, how did Krugman’s prediction pan out? Is it true that the Cleveland Fed’s measures of yr/yr median and trimmed CPI kept falling, perhaps even going into negative territory, and then stayed there for years on end? Here’s the chart from the Cleveland Fed (Krugman’s source):

Oops. Krugman’s prediction totally blew up in his face about 7 months later. Rather than falling into negative territory, and not even just staying at its current level, both of the “core” inflation measures roughly tripled more than doubled, jumping back up to almost their pre-recession levels.

In light of his model’s bad inflation predictions, what did Krugman do? Well just recently, when linking to this old post, Krugman explained, “(In that post, I worried about deflation, which hasn’t happened; I’ve written a lot since about why).”

Now if memory serves, Krugman back in early 2010 favored massive government and Fed stimulus to prop up aggregate demand, because we were headed into Japanese-style deflation. When it turned out he was totally wrong about that prediction, he then began calling for— Oh.

Look, I’m not being coy here. If we only cared about the one specific measure of, “Which economist gave his readers a more accurate guess as to what the government’s official CPI numbers would be, over the next five years?” then Krugman was less wrong than me. But he was wrong, and he didn’t even get the direction right.

Yet that’s fine, in Krugman’s book. He’s a scientist, after all. He can still offer the exact same policy recommendations, because he’s “written a lot since” his erroneous worries, tweaking his story about downward wage rigidity blah blah blah.

In contrast, the people warning of large price inflation are supposed to hang up their keyboards and go fishing. They aren’t allowed to say, “Hmm, maybe paying interest on excess reserves, or the situation in Europe, or the effects of ObamaCare, might be contributing to the surprisingly large demand to hold cash…” Nope, that would just be grasping at straws on their part, a ridiculous inability to admit they were wrong about how prices would behave.

“The Magic of Mises University”

This is a neat video, especially since I know the camera tricks involved with my cameo.

Last Day for Discount Tix to RETURN OF THE ZOMBIE (Woods-Murphy Live)

Today is the last day you can get discount tickets to the NYC extravaganza Tom Woods and I are cooking up for June 8….

Here’s Tom’s main event page, here’s the Facebook event page, and here is where you get tickets.

Nick Rowe Has Solved the Mystery of the Great Recession

Relying on a “very important post” from David Beckworth, Nick informs us that the financial crisis of 2008 occurred because people began expecting it in 2005.

Call me hard to please, but I want more, Nick.

Potpourri

==> My thoughts on Earth Day.

==> In the context of the standard debates, I would be classified as an “open borders” kind of guy, but I think that is a terrible label. Somebody should ask Bryan Caplan why they don’t call it “freedom of migration” or “no CheckPoint Charlies” or something. “Open borders” sounds like you’re putting a bullseye on your crotch.

==> In this single post, Roderick Long has anticipated everything that will ever be said (in English) about the Nonaggression Principle.

==> Come on.

==> For those who know Nelson Nash (founder of the “Infinite Banking Concept”), check out this interview he gave in June 1961 when the government was trying to take over the timber industry. (Nash was originally a forester before going into life insurance.) The article has “federal takeover” in the title.

==> This is pretty funny about the King of Sweden (naughty word).

==> This is possibly the worst argument against anarcho-capitalism I have ever read, except maybe the time an outbreak of food poisoning at Jack in the Box a few years ago proved that we needed a federal food inspection agency to keep food safe, since otherwise there would be outbreaks of food poisoning in a laissez-faire world.

ADDED:==> Here’s a defense of anarcho-capitalism.

==> Mosler vs. Murphy: It’s ON, and will be LIVE at Columbia University on June 3. CNBC’s John Carney will moderate.

==> The caustic von Pepe sends this harsh Selgin comment. Yikes!

==> Haven’t read it yet–econometrics is boring, Barbie–but this paper has arguably made Daniel Kuehn more famous than me. And you guys wondered why I linked to him so much. (Daniel, if this Austrian thing fizzles, please keep me in mind for unwinding the Maiden Lane portfolios.)

Recent Comments