Tom Woods and I Rip Each Other

In the latest Contra Krugman, the official topic is the Graham-Cassidy health insurance bill, but Tom and I make fun of each other. Make sure to keep listening for the Easter egg at the end. Older listeners: Which song am I quoting?

Bursting Erdmann’s Bubble

[EDIT: I’ve added Erdmann’s second graph below.]

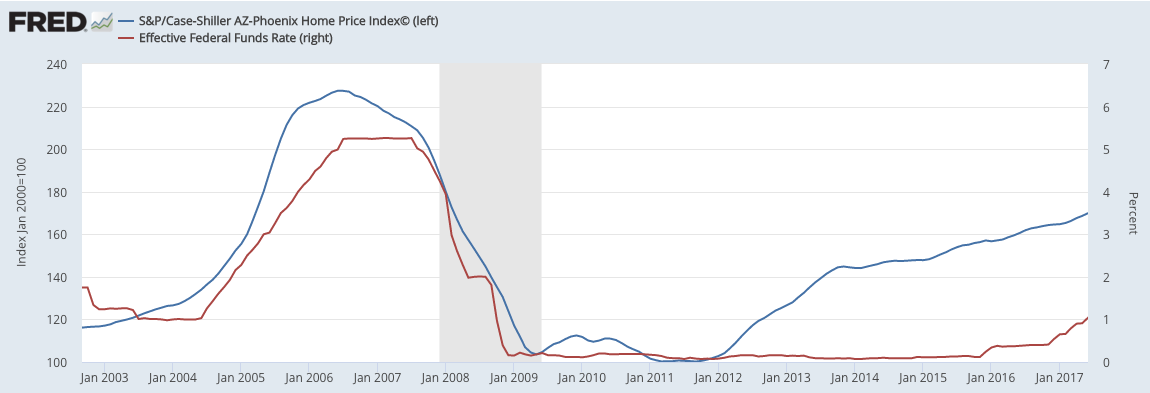

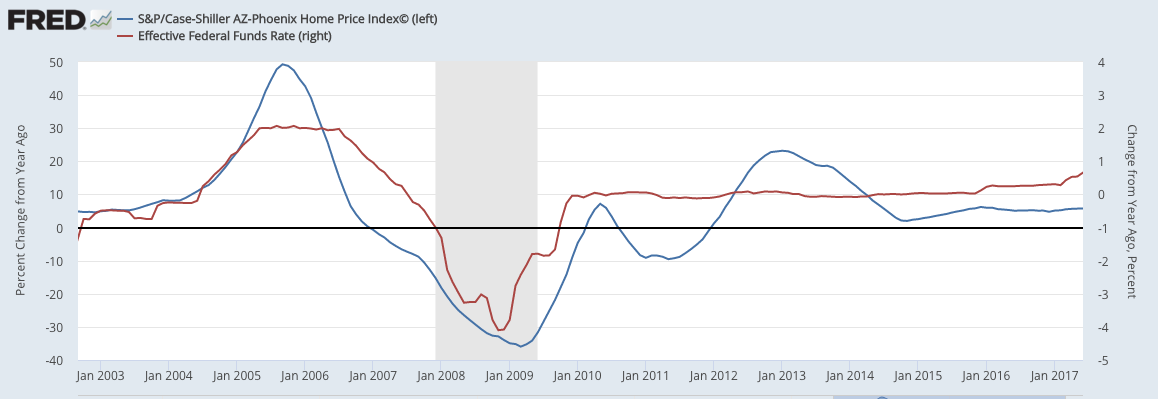

In a previous post I was talking about Austrian business cycle theory and the housing bubble. Kevin Erdmann thought he blew us up by posting these two charts:

and

Erdmann asked, “Would anyone care to make an ABC interpretation of those two graphs? Did low rates cause the bubble in Phoenix?”

Everyone see why he thinks it’s a mic drop? It looks like the Phoenix housing bubble followed rates up and then down, i.e. the exact opposite of the Austrian story.

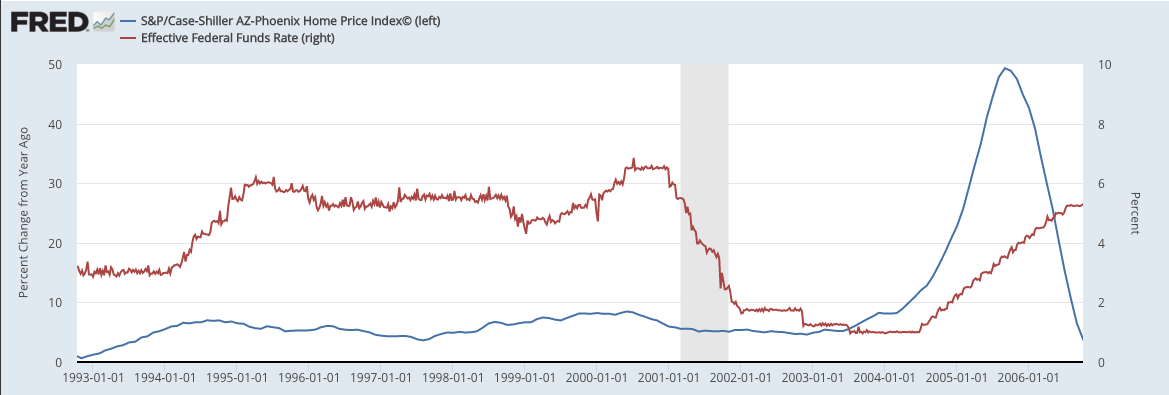

But of course, Erdmann is conveniently starting his chart when the housing bubble really kicks in. If you take a longer view, you see this:

And yes, that looks consistent with the claim that it was unprecedentedly low interest rates that sparked the bubble, and then when policymakers began raising rates, they pricked the bubble.

Wealth vs. Annual Output: It Depends on the Context to Know Which One Free Market Economists Support

Recently with the endorsements of the claim that hurricanes might be “good for the economy,” free market economists took to the airwaves to explain that this “broken window fallacy” foolishly focuses on the flow of output, while ignoring the stock of wealth. In other words, just because a natural disaster might boost official GDP, that is hardly an indicator of prosperity, because it’s simply replacing the portion of our accumulated wealth that had been destroyed.

In that context, I found it ironic when in our reading group tonight we covered this passage from Larry White’s The Clash of Economic Ideas:

Smith began The Wealth of Nations with the proposition that what matters for a nation’s well-being is not its hoard of accumulated treasure (as two centuries of mercantilist writers had believed), but its annual output or “produce,” the flow of goods and services, or what we today call national income or gross domestic product. It is this annual output that provides, either directly or by being traded for imports, “all the necessaries and conveniences of life which [the nation] annually consumes.” The Kingdom of Spain in Smith’s day had large hoards of gold and silver taken from the New World, but lower per capita consumption than Britain or the Netherlands. [White pp. 210-211]

Does everyone see the tension? White is literally saying that real GDP indicates prosperity; don’t get distracted by accumulated wealth, the way those silly mercantilists did.

Now to be sure, there’s not really any contradiction here. The mercantilists were wrong, and the people committing the broken window fallacy are indeed committing a fallacy. (Sometimes it’s possible that free market economists accuse someone unfairly of committing the fallacy.)

Even so, I thought it was ironic that the elevator pitches on both issues would end up yielding contradictory dicta for the layperson.

Also, even after we account for all of the subtleties, I now think it is flat out WRONG if free traders mock the accumulation of precious metals as foolish. To take Smith’s example (assuming White is presenting it fairly): The kingdom of Spain really is richer, if it has bigger stockpiles of gold and silver. For example, if there’s a bad harvest, the Spanish can use that stockpile of metal to import food from abroad.

Smith says what is prudence in the conduct of every family can scarce be folly in a great kingdom. Right, and every household maintains a checking account balance as well as cash in wallets and purses. If a households runs a trade surplus with the rest of the world and adds $1,000 to its checking account balance, nobody would say, “That will just raise prices, that’s dumb, that doesn’t actually make you richer.”

In general, I think free market economists need to just take a step back and reconsider their standard arguments more carefully. Don’t worry, you’re not going to end up endorsing tariffs. But some of our standard thought experiments don’t really prove what we claim, and it’s weird when our casual discussions (like the broken window fallacy and mercantilism) end up contradicting each other.

“Libertarian Law and Military Defense”

You just thought I’d sit back and phone in episodes of Contra Krugman from now on? Nope, I’m still pushing forward the boundaries of an-cap theory, baby.

For real, there is some new stuff in here that isn’t in my earlier work.

Potpourri

There are some old links on here, because Internet pages accrue on my iPhone when I’m traveling, and then I forget to post them on the blog when I’m at a computer. So this is a house-cleaning of sorts…

==> Obviously I’m biased, but something doesn’t sit right with me regarding Scott Sumner’s “I told you so” post regarding the Swiss franc. In general, take any government that is pegging its currency at a rate the market thinks is wrong. (Typically we imagine the government overvaluing the currency, but in this odd case the Swiss authorities were trying to undervalue the franc.) Some outsider could always take the position of, “If you throw in the towel, that will just make things worse. Trust me, just stick to the peg come hell or high water, and eventually speculators will back off.” Right? There’s no way to prove such an outsider wrong. Even if the government throws in the towel because of mounting concerns about the obvious downsides of the peg, the outsider could say, “You should’ve trusted me.”

I realize there is a subtlety with Scott’s discussion of the Swiss case in that he thinks he has another country (Denmark) that followed his advice, but it’s hard to know the relevant counterfactual. One might plausibly say to Scott, “The fact that our balance sheet is still growing even after we revalued, shows how insane it would have been to follow your advice.”

In other words, I think Scott is pulling a Krugman here, saying, “The stimulus would’ve worked if it had been bigger.” And since the authorities didn’t follow his advice, there’s no way to prove him wrong, but I think the evidence prima facie lines up with the people saying the original policy was unsustainable and risky.

==> David R. Henderson “reprints” a very prescient pre-9/11 column.

==> Back to Sumner: Again, something doesn’t sit right with me, in his discussion of Bitcoin and bubbles. I don’t think he packs it all into this post, but in conjunction with his other posts on this exact topic over the last year, I am pretty sure Scott’s position is this (paraphrasing of course): “Bitcoin was $300 at the end of 2014. A lot of people back then claimed it was in a bubble. Now, from that point to now, whether Bitcoin went up by a factor of ten, or crashed by 90%, all of that is consistent with the EMH.” OK fine. But Scott is also posting stuff along the lines of (paraphrasing): “A lot of EMH critics said Bitcoin was in a bubble. Let me look at the evidence…Nope! Turns out they were wrong. EMH is empirically validated yet again. Man I’m getting sick of winning. Don’t thank me, thank Fama.”

==> Someone on Twitter told me Dean Baker blew up the Austrian claim that easy money caused the housing bubble. Haven’t read it yet but I am curious to see the argument.

==> Don Boudreaux has a great point about the Hotelling model of businesses locating on a beach, and how that analogy is routinely applied to politics (median voter theorem). It’s a straightforward enough point but I never heard it before. (Fair warning Don, if you’re reading this, I stumbled on your old post because when I get the time I’m doing a quibbling critique of one of your anti-Trump trade posts.)

==> Another tour de force from Scott Alexander, this time on a viral article (posted after the Google employee controversy) claiming the differences between men and women have been exaggerated. A good excerpt:

Suppose I wanted to convince you that men and women had physically identical bodies. I run studies on things like number of arms, number of kidneys, size of the pancreas, caliber of the aorta, whether the brain is in the head or the chest, et cetera. 90% of these come back identical – in fact, the only ones that don’t are a few outliers like “breast size” or “number of penises”. I conclude that men and women are mostly physically similar. I can even make a statistic like “men and women are physically the same in 78% of traits”.

Then I go back to the person who says women have larger breasts and men are more likely to have penises, and I say “Ha, actually studies prove men and women are mostly physically identical! I sure showed you, you sexist!”

Potpourri

==> In the latest Contra Krugman, Tom and I bring Scott Horton on the show to talk about foreign policy post-9/11.

==> Scott Sumner shows how no matter what, everything is just what the Efficient Markets Hypothesis predicts. This time, it’s about Bitcoin.

==> Ryan Murphy pointed out to me that in the past he’s come out in favor of ABCT versus Friedman’s plucking model, in the context of the housing boom and bust.

Neeley vs. Murphy on Carbon Tax

We take our blog feuding to the big lights. An excerpt:

Suppose some mobsters go around killing people who owe them money on their gambling debts, and I point out to them, “Excuse me, fellas, if you just broke their legs with a baseball bat, more of them would be able to pay you off.” In this scenario, did I just admit that breaking people’s legs makes them more productive? Of course not. I was merely pointing out that breaking their legs hurt their productivity less than killing them outright.

Potpourri

==> I was on Mark Edge’s show to talk about price gouging.

==> In the latest Lara-Murphy Show, we talk about tax implications from surrendering a policy with large outstanding policy loans. It’s inside baseball but make sure you listen, if you are interested in IBC.

==> I really loved this essay by Russ Roberts. Some excerpts:

I don’t know what depresses me more — the stupidities and dishonesty and tolerance of darkness that come out of the President’s mouth or the response from those that oppose him. Given that I don’t like the President, you’d think I find the response of his enemies inspiring or important. But the responses scare me too, the naked hatred of Trump or anyone who supports or likes him. And of course, it goes way beyond Trump and politics. The same level of vitriol and anger and unreason is happening on college campuses and at the dinner table when families gather to talk about the hot-button issues of the day. Everything seems magnified.

…

The media is part of the problem. I follow a lot of mildy left-leaning journalists on Twitter who write for major publications and outlets. They are not fringe players. Their employers aren’t either. These reporters aren’t ideologues. They’re just right-thinking people who lean left. Somewhere along the line, they stopped pretending to be objective about Trump. They have decided he is dangerous and a liar and they write about it openly on Twitter. They mock him in a way they didn’t mock previous presidents who they didn’t particularly like. They may be right about the dangers posed by a Trump presidency. But their stance which violates long-standing norms of their profession amplifies the feelings of Trump supporters that those supporters are under attack from mainstream American culture.

…

Now I’m well aware of the intellectual paradoxes of believing in a Creator and living one’s life according to an ancient set of precepts. Many of those make me uncomfortable. Many bring comfort. I fully understand how someone could reject them as irrrational or stultifying. What bothers me is that I don’t think many of those who are surprised or outraged at my leading a religious life could begin to explain its appeal to me. It is simply unimaginable to them that an educated person could be religious.

Recent Comments