Murphy and Co-Host Twin Spin

==> In the latest Lara-Murphy Show, we argue that we’re in a real estate bubble.

==> In the latest Contra Krugman, we kinda sorta endorse Krugman’s critique of Paul Ryan on fiscal matters.

MRUniversity: The Solow Model and the Steady State

I am linking to this as a supplement in my Liberty Classroom course on the History of Economic Thought. This is simply amazing how well they get across the concept in such a short time. The animations / sound effects are perfect for such an esoteric topic.

Baffled by CNBC

I’m not kidding, I have no idea what is going on in this CNBC story on the recent jobs report. Here are some excerpts:

Hurricanes Harvey and Irma damaged not only Texas and Florida but also the U.S. jobs picture, as payrolls fell by 33,000 in September. That drop came even as the unemployment rate fell to a 16-year low of 4.2 percent, the Bureau of Labor Statistics reported Friday.

…

Economists surveyed by Reuters expected payroll growth of 90,000 in September, compared with 169,000 in August. The unemployment rate was expected to hold steady at 4.4 percent. It declined even as the labor-force participation rate rose to 63.1 percent, its highest level all year and the best reading since March 2014.

So, how are all of those facts possible? Did millions of elderly people die in the month?

And then there’s this, later in the article: “Revisions will bear watching in coming months, as the final payrolls number comes from the Labor Department’s byzantine estimation methods. The department’s household survey showed the actual level of employed Americans grew by 906,000 while the unemployment rolls fell by 331,000. The report indicated a record 154.3 million Americans at work.”

I realize they are looking at different sampling techniques, but… Is it really correct that one method says payrolls fell by 33,000, while another says the level increased by 906,000? I think possibly the later quotation is referring to year-to-date numbers?

It shouldn’t be this hard to figure out what the actual statistics (as bogus as they may be) indicate. This is a horribly written article.

Ryan Griggs on Why He Went From Atheism to Christianity

It’s a nuanced take, to be sure, which is similar to my journey. (At one intermediate point I thought Jesus was a regular guy who truly–but erroneously–believed he was the messiah, and so could heal people with similar religious views by the power of suggestion.)

For reference, Ryan used to be in our PhD program at Texas Tech but decided he no longer wanted to go into academia.

Does the Rest of Society Care if You Work?

So if you followed my orders, you have already listened to my critique of Paul Krugman, when he claims that the rest of society doesn’t benefit if rich people work more. (Krugman says that free-market economists like to claim that workers get paid their marginal product, so–he concludes–they can’t then turn around and say marginal income tax cuts will shower benefits on society at large.)

Well, one of my economist friends reminded me of the below passage from David Friedman’s classic book, The Machinery of Freedom. Check it out:

The media provide a striking example of the difference between the effects of public and private property, but it is an example that shows only part of the disadvantage of public property. For the ‘public’ not only has the power to prevent individuals from doing what they wish with their own lives, it has a positive incentive to exercise that power. If property is public, I, by using some of that property, decrease the amount available for you to use. If you disapprove of what I use it for, then, from your standpoint, I am wasting valuable resources that are needed for other and more important purposes—the ones you approve of. Under private property, what I waste belongs to me. You may, in the abstract, disapprove of my using my property wastefully, but you have no incentive to go to any trouble to stop me. Even if I do not ‘waste’ my property, you will never get your hands on it. It will merely be used for another of my purposes.

This applies not only to wasting resources already produced, but to wasting my most valuable property, my own time and energy. In a private-property society, if I work hard, the main effect is that I am richer. If I choose to work only ten hours a week and to live on a correspondingly low income, I am the one who pays the cost. Under institutions of public property, I, by refusing to produce as much as I might, decrease the total wealth available to the society. Another member of that society can claim, correctly, that my laziness sabotages society’s goals, that I am taking food from the mouths of hungry children.

Consider hippies. Our private-property institutions serve them just as they do anyone else. Waterpipes and tie-dyed shirts are produced, underground papers and copies of Steal This Book are printed, all on the open market. Drugs are provided on the black market. No capitalist takes the position that being unselfish and unproductive is evil and therefore that capital should not be invested in producing things for such people; or, if one does, someone else invests the capital and makes the profit.

It is the government that is the enemy: police arrest ‘vagrants’; public schools insist on haircuts for longhairs; state and federal governments engage in a massive program to prevent the import and sale of drugs. Like radio and television censorship, this is partly the imposition of the morals of the majority on the minority. But part of the persecution comes from the recognition that people who choose to be poor contribute less to the common ends. Hippies don’t pay much in taxes. Occasionally this point is made explicit: drug addiction is bad because the addict does not ‘carry his share of the load’. If we are all addicts, the society will collapse. Who will pay taxes? Who will fight off foreign enemies?

Do you see the potential problem here? Let me spell it out.

(A) Years ago, when I read David Friedman’s book, I’m pretty sure I gave him a mental high-five when he argued, “In a market economy, everybody keeps what he produces, so nobody else feels threatened by a person’s work effort. So it fosters a live and let live approach.”

(B) Last week, when Krugman argued that the rest of society doesn’t care if rich people work more, I went ballistic.

Am I just a hypocrite or can we reconcile this?

Contra Krugman: You Have Homework

All right, I must insist that if you are a regular reader of this blog, you should listen to the latest Contra Krugman. It’s on the short side and is pretty focused on economics. (If you don’t normally listen, you’re probably thinking, “Isn’t that what every episode is like?” Eh, yes and no.)

Tell me if you think I am right in the comments, or if you think I’m misunderstanding Krugman / leaving out something important.

Then tomorrow, I’m going to bring up something else. But I think it’s best if you just focus narrowly on Krugman’s blog post and my response in the episode, and then consider the subsequent thing that I will bring up.

The Year of Jubilee and Human Capital

My study partner and I are going over Leviticus 25 and we are reading Matthew Henry’s (full) commentary. In the year of Jubilee (which happens every 7 cycles of 7 years, so scholars say it is either every 49 or 50 years), all property returns to the family. In other words, no matter how foolishly you conduct your financial affairs, if you’re a child of Israel you can’t permanently alienate your birthright.

There’s obviously a ton of spiritual significance to that (and how it relates to the gospel message of salvation), but check out this commentary from Henry:

By this means it was provided, [1.] That their genealogies should be carefully preserved, which would be of use for clearing our Saviour’s pedigree. [2.] That the distinction of tribes should be kept up; for, though a man might purchase lands in another tribe, yet he could not retain them longer than till the year of jubilee, and then they would revert of course. [3.] That none should grow exorbitantly rich, by laying house to house, and field to field (Isa. 5:8), but should rather apply themselves to the cultivating of what they had than the enlarging of their possessions. The wisdom of the Roman commonwealth sometimes provided that no man should be master of above 500 acres.

Now a secular libertarian would bristle at the above; it sounds too much like Piketty. But my point is this: Given what would actually happen to the Jewish people in the coming centuries, could one argue that this institution of the Jubilee prepared them by making the most industrious Jewish people develop their human capital “intensively,” rather than acquiring large tracts of land as other nations would?

Does this institution help explain why the Jewish people seem remarkably resilient in the face of periodic diasporas?

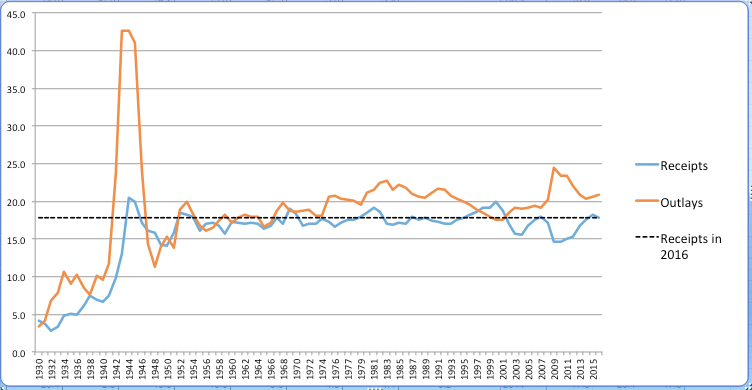

Tax Reform

I have a new post at IER talking about tax reform. I used this chart to argue that it’s totally fine for GOP to cut taxes, period. (No need for “revenue neutrality.”) If you’re worried about the debt–which you should be–then cut spending too, which is also at historically high levels.

Recent Comments