Even Without Tom Woods, I’m Still Contra Krugman

Because of the hurricane, I had to host episode 103 by myself. The issue was Krugman’s column discussing Jeff Sessions’ statement about DACA. Some highlights:

6:00 From the media and pundit reactions, you’d think Trump announced women couldn’t vote anymore. But in truth, this was a 5-year-old policy that Obama himself said was a temporary stop-gap measure at the press conference unveiling it.

8:20 Krugman’s description of Sessions’ statement is “incredibly dishonest”–not a phrase I use lightly. Krugman outdid himself on this one.

14:45 I again explain why Trump says the US is the “highest taxed nation” when talking about tax reform.

16:00 I high-five Krugman’s ridicule of the notion that there’s a fixed number of jobs, in the context of the immigration debate. (Remember, I’m tough but fair.)

17:00 It creeps me out to view immigrants at tax cattle a la Krugman.

18:20 I critique the “secular stagnation” approach.

20:20 I flip the Japan example.

22:10 I give a backhanded compliment to comedian Dave Smith, who will be performing on the Contra Cruise.

23:00 At this point I put aside Krugman’s column and just start talking immigration, in terms of the economics and libertarian theory.

28:30 I criticize the slogan “open borders.”

30:20 “OK Murphy, given that we don’t live in your an-cap utopia, what should the federal government’s policy actually be?”

Amplifying Oren Cass on a Carbon Tax, Part 2

Even professional economists, take note. Cass makes a great point that I haven’t seen stressed anywhere else. I’ll quote him first, then I’ll quote from my article to elaborate on his insight.

CASS: Nor does describing a carbon tax as “revenue neutral” do anything to improve its appeal. Promising to use the revenue for tax cuts or a rebate does not guarantee its best use or a net positive economic impact, nor does it make the policy somehow free. To the contrary, a revenue-neutral tax is guaranteed to be costly precisely because it holds government revenue constant while also increasing costs to private actors by driving them toward higher-cost energy technologies. The effect is most obvious in a world where the tax has driven emissions to zero, and government revenue comes from all of its pre-tax sources, except consumers also find themselves motivated by the tax’s existence to pay the full cost of electric vehicles and solar panels. In this respect, the tax operates much like the minimum wage; it imposes large and plainly government-created costs in the form of “off-budget” spending for which the government is never held accountable. [Bold added.]

And now here’s me, amplifying the above:

Suppose that the U.S. government implemented an outrageously high carbon tax—something like $2,000 per ton—and enforced it vigorously. The price of conventional gasoline would skyrocket some $16 per gallon, while electricity prices would soar because coal- and natural gas-fired power plants would suddenly have outrageous taxes to pay.

In this regime, the amount of U.S. carbon dioxide emissions would fall drastically, so that even with the very high rate of carbon tax, it’s possible that within a decade very little revenue would be coming in. (Remember, total carbon tax receipts per year are annualtons of emissions multiplied by carbon tax per ton.) In this scenario, the tax rates on labor and capital would have to be basically what they were before the new, draconian carbon tax, because of the assumption of “revenue neutrality.” In other words, if the draconian carbon tax isn’t bringing in much revenue since the carbon base gets driven to basically zero, then there isn’t much in the kitty to offset the pre-existing taxes.

So what can we say about the state of the conventional economy? It clearly isn’t benefiting from any “pro-growth” kick emanating from “Pigovian tax reform.” No, in this extreme scenario, the pre-existing distortionary taxes haven’t been cut at all.

However, the situation isn’t simply a wash. Even though it’s not bringing in new revenue, the massive $2,000 per ton carbon tax is definitely forcing Americans to alter their behavior. Nobody would be driving gasoline-powered vehicles, and all coal- and natural gas-fired power plants would be shuttered. Americans’ standard of living would have collapsed, as transportation and energy had become outrageously expensive.

…

It’s not enough just to observe, “Greenhouse gas emissions are a negative externality while we want to encourage work and saving.” The numbers matter. Even if “taxing bads, not goods” leads to a “win-win” upfront, it’s possible that the numbers move and cause the flipside to occur in a decade or two.

Let me make sure the reader understands the point of my exaggerated example. I picked a ridiculously high carbon tax of $2,000 per ton to make Cass’s point crystal clear. But even at a more moderate level, we still have to take into account the subtle mechanism at work: The more successful a carbon tax is at inducing people to alter their behavior, then the less revenue it raises. The impact of a carbon tax on the conventional economy is not necessarily directly proportional to the amount of revenue it raises, and so in general we can’t rely on catchy slogans like “tax bads, not goods.” To assess the economic cost of complying with a carbon tax—which could be compared to the ostensible benefits of avoided future climate change damages—we need to look at specifics. A very low carbon tax rate won’t raise much revenue, and so won’t allow for much tax reduction elsewhere, but on the other hand a very high carbon tax rate might not raise much revenue either.

“That’s the Story of the Hurricane”

I am always happy to read a defense of the person receiving a Two Minute Hate, even if it’s a Fed official who seemed to subscribe to the Broken Window Fallacy. In that spirit, here is David R. Henderson defending William Dudley’s remarks about the hurricane. (Also notice Scott Sumner’s caveat in the comments.)

To try to minimize confusion in the comments here at Free Advice, this is what’s going on:

1) A kid breaks a shop window in 19th century France and normal people say, “That’s bad.”

2) A smug contrarian says, “On the contrary, the lad’s activity will provide employment for the glazier, who now has to replace the window. It stimulates economic activity and makes the community richer.”

3) Bastiat points out that this is shortsighted, and overlooks the employment that the storekeeper’s spending could have given to (say) the tailor who could’ve made him a new shirt. Total employment is the same either way, but now the community is poorer to the tune of one shirt.

4) (Hundreds of people commit the “Broken Window Fallacy” up through 2017, providing employment for smug libertarians to mock them and make our movement richer.)

5) William Dudley says the recent hurricanes will increase measured economic activity (i.e. official real GDP) because people will have to rebuild.

6) David R. Henderson clarifies that Dudley said “unfortunately,” and that there is no fallacy here. People are poorer, but they may indeed reduce the amount of leisure they otherwise would have enjoyed, in order to work more. Total measured real income will be higher than it otherwise would have been, but the community will be poorer, especially if we include “leisure enjoyment” in the measure of consumption. Note here that “poorer” means “lower wealth.” If someone takes away your house and your car, but then gives you a job offer giving you a $50,000 annual raise, the market value of your output is higher that year, but you still might end up “poorer” than you started.

7) Scott Sumner points out that even David’s defense of Dudley only works for small amounts of damage, because if the damage is too severe, then the reduced capital stock makes labor less efficient. So even if people work more hours, measured GDP might be lower until the capital stock is replenished.

8) Notice that points (1) – (7) do NOT rely on the Keynesian move of classifying “classical economics” as applying only to the special case of full employment. To see that discussion, read this old post where I gently push back against Matt Yglesias and Daniel Kuehn.

A 500-Year Protest Event

(Like a 500-year flood event? Work with me people.)

At my church they are starting a Bible study on Luther. The news hook is that 2017 marks the 500th anniversary of the posting of the 95 Theses, which started the Protestant Reformation.

Having been raised Catholic but now being a Protestant, let me say that I think a lot of people on both sides are way too smug in their critiques of each other. (This isn’t really a reflection on Christians; I think it’s true of people. I notice the same pattern in politics and economics.)

For this post, let me just reiterate the single biggest difference in my personal experience, going through the two traditions. Every time I say this kind of stuff, people in the comments bite my head off and say I don’t know the first thing about Catholicism. OK fine, but I went to Catholic schools from kindergarten through senior year in high school (and was valedictorian in both schools), and I received the sacraments through Confirmation. And also, in conversations with other devout Catholics (who went to church every week) I heard similar viewpoints.

So here’s the difference: Before I encountered serious Protestants, I hadn’t seen someone use the Bible to argue a theological point. In particular, to argue about the source of your salvation. I thought that was ultimately something that was up to God, and you’d find out when you died if you made the cut.

In contrast, Protestant pastors every week will preach from the Bible–with people in the congregation pulling out a Bible to read along–and build a case for why it is faith in Christ alone that justifies you and washes away your sins. (Here are some standard passages, but FYI I think this guy’s handling of James is not great and I can totally get why a Catholic would think it was weak.) Even when they are going through books from the Old Testament, they will often wrap up by interpreting the events through lens of Jesus’ ministry and end by inviting people in the audience who have not accepted Jesus as their Savior to do so.

Here’s another difference, that is more “cultural” rather than doctrinal. When someone brought me to a Protestant service and introduced me to her acquaintances, this older woman shook my hand and asked, “Do you love the Lord?” I can’t remember what I said, but I remember at the time thinking that I didn’t even really understand what she meant by such a question.

Well, now I totally get it, and yes I love Jesus. (To be 100% clear, of COURSE I am not saying, “Catholics don’t love Jesus.” I really hope that’s not how this post is coming off in tone.) In fact, I think you could do a lot worse in life than if you lived it by often reflecting to yourself and others on how much you love Jesus. Just like, if you fall in love with someone romantically and it makes everything about your life better–not just “What will I do on the holidays?” but also sticking to your diet, dealing with your awful boss, or coping with a sick parent–all the more so, if you are in love with Jesus it transforms your life.

But I would never have discovered this perspective had I not started going to Protestant services.

Our Culture’s Touching Faith in Science

I am not saying that sarcastically. I mean every bit of that title literally. First, our culture has (non-scientific, which is not the same as unscientific) faith in science. And second, I find it touching.

My recent Twitter commentary on (physicist) Brian Greene motivated this post:

I’m guessing many of you read Greene’s post and want to give him a “hell yeah!”

But why? How do you know that his statement is true? Did you run a double-blind experiment? Are you using science to tell you that science is better than non-science?

What if I tell you that the Bible says the Bible contains more wisdom than science? I’m guessing you won’t be persuaded, because you know–going into the analysis–that science is the best way to discover truth.

(And if so, it’s not surprising that when you test your faith in science–by using the scientific method–the answer comes back, “Science FTW.”)

More on Flood Statistics

In my previous post, there was still some confusion in the comments. And on Twitter, I got the sense that even trained economists didn’t understand what the big deal was.

So remember, the claim is that the phrase “100-year flood event” or “500-year flood event” is very misleading. When the government data agency gives such a designation, it is referring to the probability of an annual occurrence. For example, a “100-year flood event” is defined as “a flood event that has a 1% probability of occurring in any particular year.” People erroneously think that means the same thing as, “We expect a flood like this to happen once per century,” but no, that’s not really what it means.

Let’s imagine instead that we’re talking about a “4-year flood event.” In other words, there is a 25% chance each year that we’ll see a flood of this magnitude.

Now, over a given 4-year stretch, what is the expected number of such floods? More specifically, what is the mathematical expectation of the number of floods we’ll observe?

One way to calculate this is to say each year we have an expectation of 0.25 floods, times 4 total years, means an expectation of 1.0 floods over the course of 4 years.

However, is that the same thing as saying, “We expect to see 1 flood over a 4-year stretch?”

I don’t think so. First, let me ask a different question: “Do you expect it to rain tomorrow?”

How do you answer? Surely, if the person thinks there is less than a 50% chance of rain tomorrow, then he can’t possibly answer, “Yes I expect it to rain tomorrow.” Right?

So by the same token, if you think there is less than a 50% probability that we will see 1 flood during a 4-year stretch, then it is arguably incorrect to say, “I expect to see 1 flood during a 4-year stretch.”

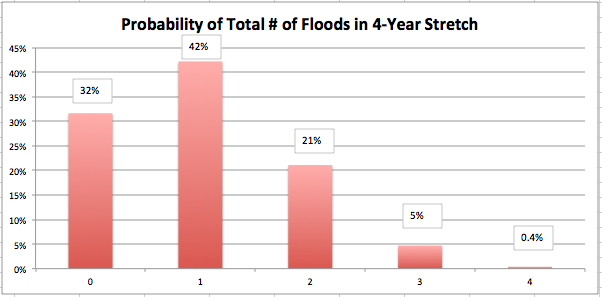

Here’s the actual breakdown of possible outcomes:

As the chart shows, there is only a 42% chance that we will observe exactly 1 flood during any 4-year interval. So if someone asks me, “Do you expect 1 flood to occur in the next 4 years,” I could plausibly answer, “No, because there is a 58% chance that something besides 1 flood will occur.”

This isn’t just a matter of semantics. It can definitely mislead people in certain settings.

For example, when people learn that their house is located in a “100-year flood zone,” they think their house is only going to get hit with a flood “once per century,” and so they might not buy flood insurance.

However, since what this actually means is that there is a 1% chance each year of such a flood, we can tell such a homeowner that over the course of his 30-year mortgage, there is a 26% chance of being hit by such a flood at least once. That sounds a lot more deserving of flood insurance than, “You’ll get hit by a flood like this once a century.”

Amplifying Oren Cass on a Carbon Tax, Part 1 of 2

My latest post at IER amplifies some of the points Oren Cass made in a fantastic essay he wrote (two years ago) on the case for a US carbon tax. (I just came across the essay recently.) Here’s an excerpt:

Let me paraphrase Cass’s remarks to make sure the reader appreciates them. Cass was studying a very scholarly tome put out jointly by several organizations that support a carbon tax.

In order to demonstrate its potency, the book argued that a carbon tax had the power to reduce U.S. emissions in half by the year 2050. But in order to achieve that drastic result, the authors assumed a carbon tax that hit $163 per ton in the year 2050.

In the next chapter of the book, the authors sought to reassure the reader that the “Macroeconomic Effects of Carbon Taxes” wouldn’t be so awful. Yet the figures showing the impacts on the economy assumed a carbon tax that maxed out in 2050 at less than $90 per ton.

As Cass wryly observes, these are not the same carbon tax—it was much more aggressive in Chapter 4 when the authors wanted to showcase its ability to tackle climate change, but it became much weaker in Chapter 5 when the authors wanted to illustrate its benignity.

A Surplus of Articles on Price Gouging

I pile on. However, all modesty aside, I think I collected everybody’s good points into a one-stop-shop for you and your normal co-workers/relatives. I also hit an issue related to philanthropy that many standard “economistic” defenses of price gouging miss. Two excerpts:

In the path of an incoming storm, where thousands of people want to evacuate the coast, depending on refinery interruptions and other bottlenecks, it’s possible that some local stations will run out of gas if they don’t raise their prices significantly. The people who are lucky enough to get to the stations first will naturally fill the tank up, before getting on the interstate to get out of Dodge. Then the unlucky followers will see the gas station is empty, and may end up stalling on the interstate. The authorities then have a problem of dealing with stranded motorists who are stuck not because of flooding, but because they ran out of fuel during their escape.

In contrast, if the few relevant station owners charge $15 per gallon, then people who had (say) a half-tank in their car when the storm hit, will say, “That’s outrageous!” and get back on the highway, to see if prices are any better in another 50 miles. At a price of $15, only people who are about to run out of gas will buy any, and even they will only purchase enough to give them some breathing room. They too will probably take their chances and hope that gas is cheaper if they move away from the storm.

and

Suppose instead, however, that the owner charges the full $14, but then donates his $1,000 windfall to a local relief effort that is handing out free packets of food and dry clothes to families who were flooded out of their homes and have literally nothing (including wallets). Or to make the point even more clearly, suppose he donates the $1,000 windfall to a local organization that uses the money to buy bottled water and hand it out to desperate people?

Once we go down this path, we see that the insistence on charging only $4 for the cases of water really just means that our hypothetical store owner is concentrating his $1,000 worth of charity on the particular Houstonians who happen to walk into his store and pull out their credit card to make a big purchase. What are the odds that these people are the ones in Houston most in need of his implicit $1,000 charitable donation that day?

Recent Comments