Ben Powell on the Minimum Wage, and Question From Uncle Bob

I hadn’t yet read this Ben Powell HuffPo piece on the minimum wage issue. A lot of it we have already seen before, but he gave some interesting facts I didn’t know.

Yet here’s something that is really bothering me in our discussions. Ben writes:

Informed apologists for minimum wage laws often cite David Card and Alan Krueger’s 1997 book, Myth and Measurement, which argued that the negative employment aspects of the minimum wage are minimal to non-existent. Of course, one reason they found little evidence of negative effects is precisely because the minimum wage has been kept low enough that it is not binding for the vast majority of workers.

More importantly, nearly 20 years of research since that study has pointed in the other direction. Economists David Neumark and William Wascher surveyed the vast literature studying the effect of the minimum wage in their recent book, Minimum Wages. They find that the bulk of the evidence accumulated over the last 20 years indicates that the minimum wage reduces employment for the least skilled workers and lowers their earnings. Card and Kruger’s study is an outlier, not the norm.

So what is the story? I know Ben is not misrepresenting Neumark and Wascher; even the literature reviews done by the people Krugman likes, say that that is what Neumark and Wascher report.

So what’s the deal? We’ve got “our guys” saying the literature is on our side, while “their guys” say the literature is on their side.

As much as I am surprised that economists disagree on which way employment moves after a minimum wage hike, I am absolutely astonished that economists disagree on which way economists think employment moves after a minimum wage hike.

(That’s not a typo; you may need to re-read that last sentence to fully appreciate the masterful prose here at Free Advice.)

Memories of Armen Alchian

Arman Alchien is one of those economists–like Wicksteed–that I would read a lot more of, if I were on a deserted island. (That’s a compliment to them, and a criticism of myself.) He recently died, as most of you know, and so a lot of people who knew him were giving their appreciations. One of the more interesting ones for Austrians was from David R. Henderson, because he gave a Hayek anecdote as a bonus.

The mourning von Pepe reminded me that I reviewed a fantastic paper by Alchian and Benjamin Klein, arguing that asset prices should be included in the measure of price inflation. (I’d like to say that von Pepe only brought that paper to my attention after my ill-fated wager, but no, he had been telling me to read it for a while.)

On the other hand, I thought Alchian missed the boat entirely in an argument he gave about bank reserves. (Again, von Pepe reminded me of that post, which I had completely forgotten involved Alchian.)

Others on the Minimum Wage

==> David R. Henderson writes a neat summary and critique of the Card & Krueger work. (Daniel Kuehn doesn’t get it.) In the comments, Bill Woolsey leaves a fantastic summary of the various issues.

==> Don Boudreaux says that if we can raise employment costs by 24% with no dire effect on employment, would it also work if we reduced productivity by 24% (by mandating 15-minute breaks every hour)? (Daniel Kuehn doesn’t like it.)

More on the Minimum Wage

Some people thought I was reacting to comments on this blog, but actually, I am reacting to the peanut gallery on Facebook. I.e. I’m not here trying to convince a mainstream economist, rather I’m trying to convince someone who is sympathetic to Rothbardianism but thinks college professors don’t know what it’s like on the streetz.

Krugman: High Deficits Are Due to Either a Depression or a Recovery, But Never to My Policies

I keep waiting for time to “do this justice,” but that’s not going to happen. So let me quickly make my point:

I was flabbergasted a couple of weeks ago to read Krugman dismiss the CBO report on the budget outlook in this way:

Yesterday the CBO came out with its updated budget outlook — and the release was met with a collective yawn. Why? Basically, because the projections over the next decade just didn’t show the kind of fiscal disaster everyone in DC wants to believe in. That’s not to say that the outlook is completely benign — CBO still thinks we’ll end the decade with high debt by historical standards…[b]ut there’s nothing there lending comfort to the Greece, Greece I tell you crowd.

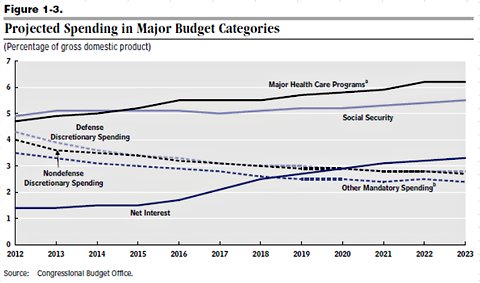

And there’s one especially telling point. CBO does show rising deficits by the end of the decade — but not, it turns out, mainly because of rising entitlement spending. Here’s their chart:

The big driver here is CBO’s assumption that interest costs on federal debt will rise sharply. And that’s not mainly because of rising debt; it’s because of an assumed rise in interest rates.

Why is this important? Well, one of the lines used by people determined to panic about the deficit is to say that relatively optimistic projections are based on the assumption that the economy will recover smoothly, and that there won’t be any setbacks. What people saying this fail to realize is that if recovery falters, it’s also more or less certain that interest rates will stay low, offsetting much of the deficit impact. [Bold added.]

Everyone got that? The CBO is showing that federal interest payments alone are going to more than double (as a share of the economy), eventually breaking 3% of GDP. So surely that is something to keep in mind, when we worry about the trillions in debt that the federal government has been wracking up these last few years–with Krugman wishing the numbers were higher.

And yet, no, to think this way just further underscores how stupid the deficit-phobes are, because they aren’t realizing that the rise in debt service payments will simply reflect a healthy economy (and its associated rise in interest rates).

This is classic. For the last four years, Krugman has constantly lecture people on the “myth” that Obama is a big-deficit guy. Why, it was all about the surging social safety net payments, and the reduced tax receipts, caused by the depressed economy. It just looked like we had big deficits, but it was an illusion that fooled idiots who can’t see how a bad economy changes things.

Now, when the CBO forecasts rising deficits down the road, Krugman explains that no, this too is an illusion. It only looks like we’re going to have big deficits, but it will be an illusion that fooled idiots who can’t see how a good economy changes things.

Let me make my point in another way: In various posts recently–here, here, and here, for example–Krugman carefully walks through the budget numbers, showing how the US actually doesn’t have a “structural budget deficit problem” at all. Never once did Krugman say, “Oh, by the way, a full 1.5% of GDP in these calculations is due to the low interest rates caused by the slump, so let’s make sure we keep that humongous factor in mind.”

Nope, the first time I have ever heard Krugman bring up this issue, is when he’s explaining that rising interest rates are associated with a healthy recovery.

So in summary, as usual, we have a Krugman Kontradiction: If he wants to ignore the fact that the debt is relatively easy to float right now, because of low interest rates, that’s defensible: but then he can’t bring it up to excuse the high debt burden the CBO is forecasting in a decade. Or, if Krugman wants to say the high debt burden in a decade should have an asterisk next to it, reflecting the change in interest rates, that’s defensible, but then Krugman can’t ignore today’s low interest rates when explaining away Obama’s fiscal policies.

Yet as is his wont, Krugman goes to the Blogger’s Buffet, only grabbing the “interest rates change depending on the economy” appetizer when it helps the point he’s trying to make that day.

Landsburg Frames the Minimum Wage Debate Very Strangely

Ahh, it seems Steve Landsburg is no longer cuddly. Instead of worrying about the unskilled inframarginal workers, he is now concerned about upper middle class college kids working at Wendy’s on their summer breaks.

There’s nothing wrong with Steve’s post as far as it goes, but it would be like Obama proposing to increase the sentencing on drug dealers by 6 months, and then economists have a big debate about whether this particular policy move will increase gun violence. Then Steve Landsburg chimes in and argues that it is wrong to worry about whether this particular marginal change will affect gun violence. Period.

In case I’m being too coy: Even if it were true that raising the federal minimum wage from $7.25 to $9 will have negligible effects on total employment (which I highly doubt), and even if it were true that every single person working right now for minimum wage would be willing to take the gamble (Steve’s point), it is odd that free-market economists wouldn’t still go ahead and make the broader point that there are hundreds of thousands (millions?) of people in the US right now with low skills who want to work, but are prevented by law. They aren’t the ones facing the “gamble” right now that Steve describes, because maybe they only have productivity justifying a wage rate of $5/hour.

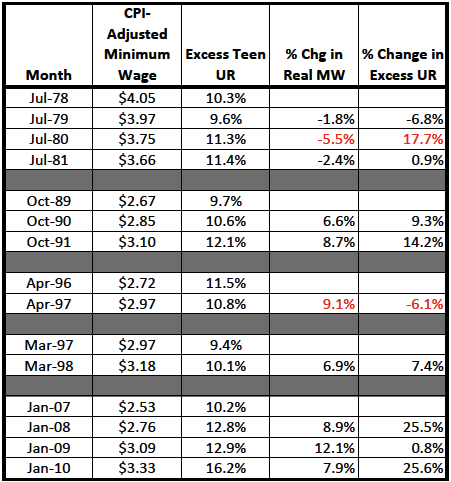

Anyway, I wasted yet another hour of my life in an empirical exercise that will not make anyone change his or her mind. I used this Department of Labor website to get every change in the federal minimum wage since 1978, and then I got the CPI-adjusted minimum wage for the 6th month before and the 6th month after each change. Then I got the national unemployment rate and the 16-19 year-old unemployment rates, to calculate the “excess teen unemployment rate.” Below are my findings:

(As always with Free Advice, this is stuff I’m whipping off instead of doing work for paying clients, so I’m not double-checking any of these numbers….Read at your own risk.)

Generally speaking the pattern holds up. I put in red the only two entries that surprised me, because they involved such a big move in the minimum wage and yet the excess teen UR rate went the “wrong” way. Of course we can come up with all kinds of stories to explain them away, but I wouldn’t have done so if they had shown what I wanted. So, I’ll just post the table and let you guys argue about it.

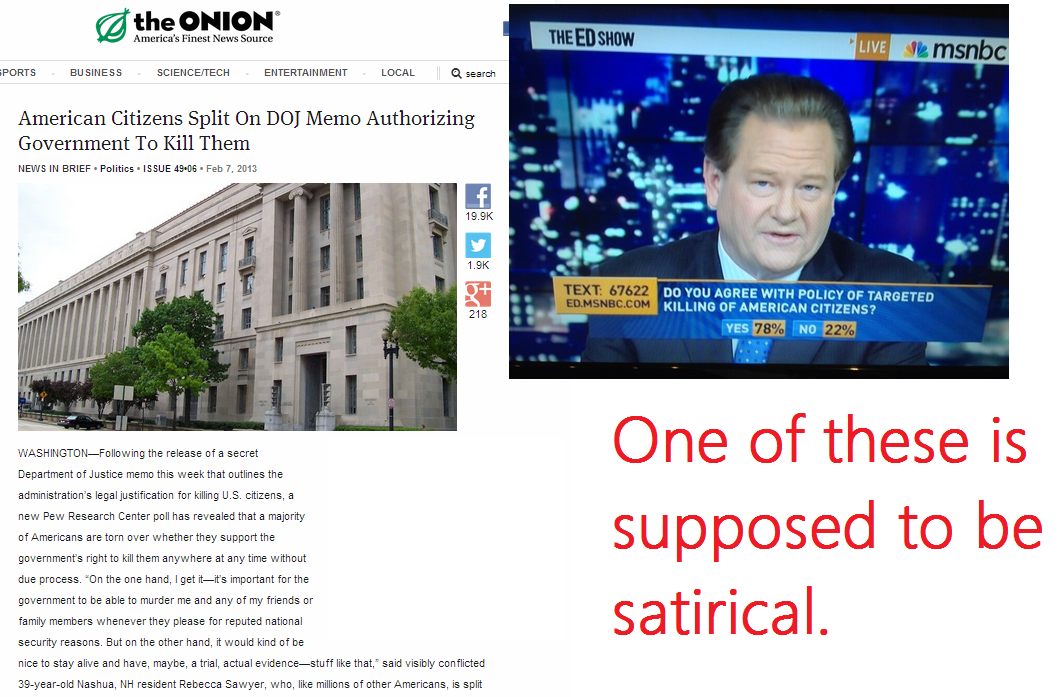

Humorous Interlude

From a recent Tom Woods post:

“Who will build the roads?” is the question that belongs at the top of every libertarian drinking game. If we didn’t have forced labor, the argument runs, there would be no roads. There’d be a Sears store over there, and your house over here, and everyone involved would just be standing there scratching their heads.

Recent Comments