More on Minimum Wage

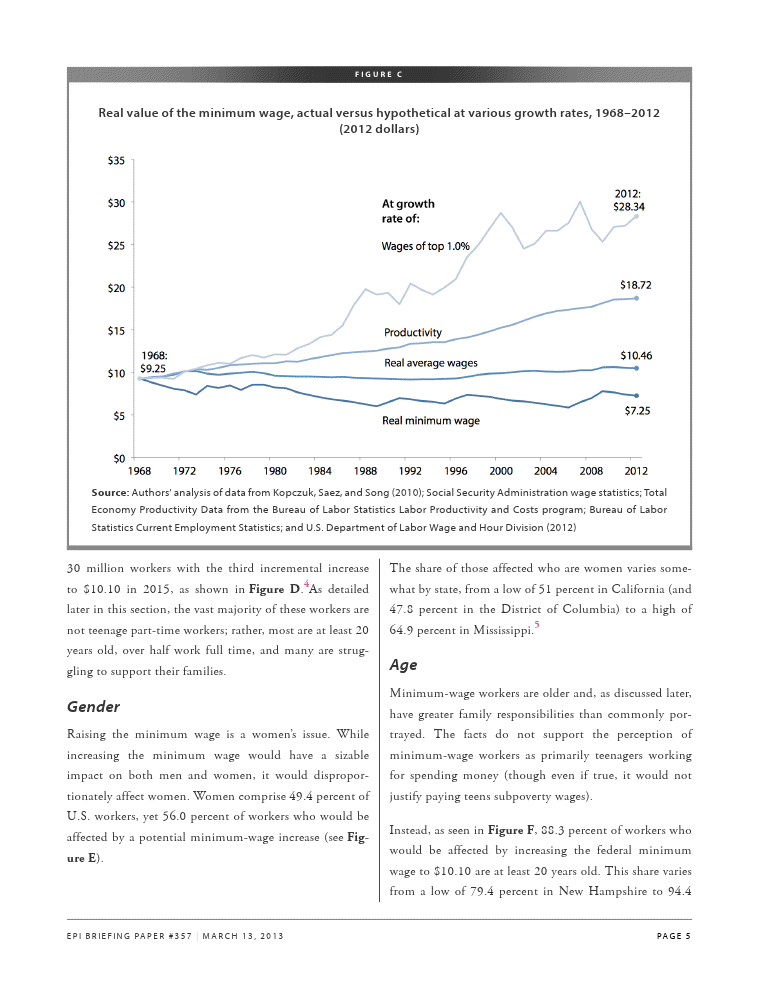

Daniel Kuehn reproduced the following chart from an EPI paper:

Daniel had this commentary:

It’s an interesting approach. One does wonder why we should expect the minimum wage to be so damaging given that it grows so much slower than productivity (again – local markets matter – it may grow at a slower rate but since it’s imposed on some low-price level areas that could still mean a high real minimum wage rate for those areas).

My first reaction was, “How do we know the minimum wage wasn’t damaging back in 1968?” I mean, suppose I tried to justify the Iraq invasion by showing that more US troops died in Vietnam. That wouldn’t really be a sensible argument, would it?

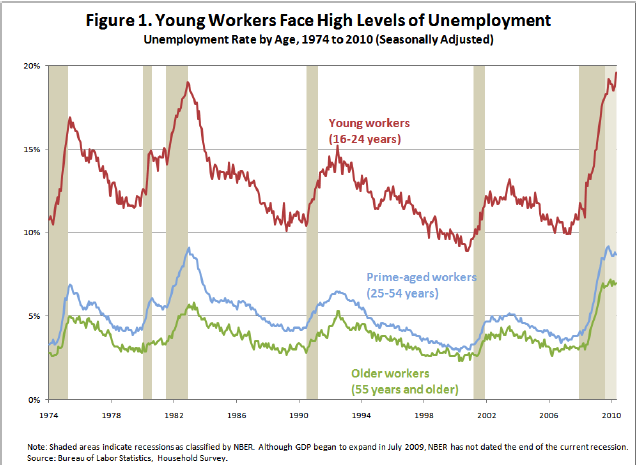

Anyway, I did a very quick search and found a JEC report with this chart:

I’m not saying this chart vindicates my position, but it does show that proponents of a minimum wage increase (or at least, those saying it won’t be harmful) need to do more than simply say, “This is nothing new.”

While We Were Sleeping…

…someone emailed me to say that the KrugmanDebate pledge total is over $104,000! It may have been due to the heroic efforts of Tom Woods when he was guest-hosting Peter Schiff’s show. (I always picture Tom watching me and thinking, “Bob reminds me a lot of myself, when I was less famous.”)

So you make your actual pledge here. But, if you want more details, go to this headquarters site (which yes, I need to update). And, if you’ve never watched the below, well you’re in for a surprise.

Great Posts on the Minimum Wage

It’s reassuring to see that if I ever decided to retire to the Caribbean permanently, my US-based free-market colleagues would carry forward the torch of liberty. Here are some great posts on the minimum wage:

==> Steve Landsburg

==> Bryan Caplan

==> Scott Sumner (though it’s on ObamaCare technically, but could be applied to minimum wages).

==> Mario Rizzo

Mafia Overrates Goodness of Government Officials

A few weeks ago I heard an interview on NPR about a mafioso-turned-informant Whitey Bulger that contained this amusing exchange:

DAVIES: I mean people didn’t believe he was an informant, right? Criminals.

CULLEN: Well, you know, one of the most incredible things that you see in the book, Dave, we ask Anthony Cardinale, a very, you know, a very well respected lawyer who has represented some of the most senior Mafia figures in the country, including John Gotti, Tony Salerno and Jerry Angiulo here in Boston. And Tony asked them all, separately, how come you, why didn’t anybody make a move on Bulger after the Globe put that in the paper. And they all said the same thing, they said they didn’t believe that the FBI would get into bed with somebody as vicious and as venal as Whitey Bulger. So the Mafia actually had a higher view of the FBI than it deserved.

One More On Krugman and Predictions

I am not sure everyone fully got my point about Krugman in this last post.

Look, Krugman has been absolutely apoplectic the last 3 years, jumping up and down on his blog, complaining that the press and public keep taking seriously the people who have “gotten everything totally wrong” in the crisis. He keeps lamenting that he used to think economic science was objective, and that someone’s credibility would be based on the predictions of his models. In the post I linked above, I quoted him as complaining that the people in charge in Europe, were the ones who had proved so incompetent in predicting the results of so-called austerity.

Now then, Ben Bernanke was hilariously wrong, at every step along the way, from 2005 through 2008 in the latter stages of the housing bubble.

Yet this is what Krugman said in August 2009 when Ben Bernanke was reappointed. Remember, this occurred after 4 straight years of non-stop error and failed predictions from Bernanke’s economic model:

Generally, I’m pleased. Bernanke has done a good job in the crisis — he’s been far more aggressive and creative than almost anyone else would have been in his place, partly because he’s a scholar of the Great Depression, partly because he took Japan’s lost decade seriously and was therefore intellectually prepared for a liquidity-trap world.

I do have one qualm, though, which isn’t really about Bernanke, but rather about the broader symbolism of the reappointment — namely, it unfortunately seems to be a reaffirmation of Serious Person Syndrome, aka it’s better to have been conventionally wrong than unconventionally right.

Thus, you’re not considered serious on national security unless you bought the case for invading Iraq, even though the skeptics were completely right; you’re not considered a serious political commentator unless you dismissed all the things those reflexive anti-Bushists were saying, even though they all turn out to have been true; and you’re not considered serious about economic policy unless you dismissed warnings about a housing bubble and waved off worries about future crises.

That said, Ben Bernanke’s performance over the past year deserves praise, and there’s nobody I’d rather have in his position. Congratulations, Ben.

I mean, you almost get the sense that Krugman doesn’t care about predictive track records, and merely has an affinity for people who share his worldview and policy prescriptions. Is there a term for this malady?

P.S. I’m going on a 9-day cruise with Peter Schiff and Mark Skousen. (There will be others; it’s not like the 3 of us just take a break to plot strategy.) Not sure what the Internet connection will be like on the Love Boat, so you may have to go cold turkey with Free Advice.

Krugman Judges People on Their Record

The average person on the Internet can’t hold more than 2 thoughts simultaneously, but I think Free Advice readers are above average. I have to go pack for my trip, so let’s see if you can divine my point in this post:

(1) Today Krugman returns to a familiar theme:

Joe Weisenthal is wrong. He writes that the unfolding economic disaster in Europe is what everyone predicted. Not so. It’s what he predicted, it’s what I predicted, but it’s not at all what many people were predicting. And the people who got it completely wrong happen to be the people still running European economic policy.

…

Readers sometimes complain about my frequent references to the things my friends and I got right, and others got wrong. But look, it’s not ego (or anyway it’s not just ego). Predictions are how you judge between models. If the world delivers results that are very much at odds with what your framework says should have happened, you’re supposed to reconsider your framework — as I did, for example, after I was wrong about interest rates in 2003.

…

Yet European leaders seem determined to learn nothing, which makes this more than a tragedy; it’s an outrage.

(2) Two days earlier, Krugman wrote:

In discussing fiscal policy, I’ve been fond of quoting St. Augustine: “Grant me chastity and continence, but not yet”. Trying to slash the deficit while the economy is still up against the zero lower bound is a really bad idea, because it will depress the economy further and hurt both growth and revenue.

…

But hey, I’m a crazy economic hippie, whom nobody agrees with — except, well, the chairman of the Federal Reserve. Allowing for the constraints of rhetoric that come with his position, Ben Bernanke’s testimony today was highly Krugmanesque…Of course, credentials aren’t dispositive here; Bernanke could be all wrong, failing to understand that if we don’t slash spending now now now we’ll turn into Greece, Greece I tell you. But these remarks should give pause to all the people who imagine that “nobody” except me and a couple of other crazies think that we’re paying far too much attention to short-term deficits.

(3) Bernanke tells us what his model predicts, over the years:

Ayn Rand Vindicated

From the WSJ:

Firearms manufacturers are well aware that if semiautomatic rifles are banned, bolt-action guns are next. It is a mistake to cede a millimeter on any issue, because it simply invites more demands. People in the gun culture know their opposition… Consider, by way of contrast, the foolish actions of Chesapeake Energy, a major producer of natural gas. Time magazine revealed last year that Chesapeake gave the Sierra Club $26 million. Presumably the Machiavellian reasoning was that the Sierra Club would use this money to attack Chesapeake’s competitor, the coal industry… Now the Sierra Club is trying to shut down hydraulic fracturing—the entire basis of Chesapeake’s natural-gas business. According to reports this week, the natural-gas boon from fracking could be a boon to the U.S. economy for 30 years, if the industry doesn’t fumble the opportunity… If Chesapeake’s managers had understood the environmental movement, they never would have subsidized Sierra Club.

Recent Comments