Mike Norman Throws Down the Gauntlet

You need to familiarize yourself with this, if you hope to understand my forthcoming response.

(Ron Paul et al. are coming to town in one week, so I can’t deal with this just yet. But soon…)

P.S. Here’s the audio of the speech he’s referring to, and here’s the original debate between Mosler and me.

Steve Landsburg, Destroyer of Worlds

I stand in awe of Steve Landsburg’s mind, though sometimes I question the uses to which he deploys it. For example, I’m sure the math is correct (given his assumptions) behind his latest, counterintuitive result:

[E]ven in a thoroughly non-Keynesian world where markets work perfectly…and recessions cure themselves, we might still want [a destructive] hurricane.

Or, because we can’t always call forth hurricanes when we need them, we might want our government to simulate their effects by diverting funds from useful to destructive spending projects — or just occasionally showing up at people’s houses and trashing their furniture.

Here’s why: Hurricanes make us collectively poorer. When we’re poorer, we work more. When we work more, the government collects additional income tax revenue. But — taking total government spending as given — the government can’t continue to collect additional revenue forever; sooner or later it must lower tax rates. (This assumes we’re on the good side of the Laffer curve…) When tax rates fall, labor markets work more efficiently. So much so, in fact, that the efficiency gains can more than compensate for the initial destruction.

Now I know a bunch of you are going to go nuts over the premises in Steve’s argument above, most notably the idea that the government would hold total spending constant in the face of an influx of new revenues. But still, I like to play new games, and I’m willing to abide by Steve’s rules. Here’s what I think:

==> A previous, super-counterintuitive Landsburg result is that we should (he claims) encourage more people to sleep around, in order to reduce the transmission of HIV. But, assuming the spread of HIV is akin to a hurricane and stimulates more spending on health care treatments etc., I now conclude that Steve’s new result proves he was wrong about HIV, just like I said at the time.

==> Let’s drop the cuteness and focus on Steve’s new result. In conventional Pigovian terms, what’s going on here is that there is a “market failure.” When you’re deciding how much to work, you’re considering the after-tax return (and other advantages such as developing your human capital) in light of your forfeited leisure. But if the government indeed holds spending constant, such that more work on your part leads to lower marginal tax rates, then you are conferring a positive externality and thus aren’t working enough.

So, in order to correct this market failure, the government should either (a) subsidize you–with the money for the subsidy being raised ideally through a new lump-sum tax–for working more, on the margin, or (b) should tax you (on the margin) for not working.

I’m not going to check the math, but it would be neat if the Pigovian optimal solution turned out to exactly counterbalance the distortions of the income tax, so that we replaced it on net with a lump-sum tax that brought in the same revenues.

Potpourri

==> Don Boudreaux has a good discussion of the claim that Hayek is a liquidationist–not that there’s anything wrong with that. (HT2 von Pepe)

==> Pete Boettke is puzzled that the Austrians seem to be almost alone in thinking “micro” relationships are crucial to understanding macro disturbances. Me too.

==> John Carney sent me his recent article arguing that actually, the natural rate of interest is probably really low right now, meaning Bernanke is not distorting the loan market. My quick reaction is to say no, I still think interest rates should go up when you suddenly realize you are poorer than you thought yesterday, particularly in the context of a financial panic. Yes, you want people to save more, and that’s why interest rates should go up. Just like if you suddenly realize there are fewer engineers than we thought yesterday, we want the price for engineering services to shoot up. We don’t want the price to drop in order to “provide a soft landing” to help us deal with the “negative productivity shock.” (I’m not saying Carney invoked those phrases, but other proponents of low interest rates do.)

==> I actually think Brad DeLong asked Milton Friedman a very good question. It serves to show (in my mind at least) that Krugman is being a bit unfair when he makes it sound as if modern libertarians are wrong to be suspicious of embracing Friedman for his interventionist banking views. E.g. if there were a doctor who amputated people’s legs when they had a headache, I’d be nervous about letting him treat me for the flu, even if he assured me that in his view, amputation was a terrible procedure for the flu. And my reluctance–rather than analyzing each illness and treatment “on its objective merits”–wouldn’t be evidence of ideological bias, it would be common sense.

==> I suppose if I complain about the government revising the GDP figures for the 20th century, I’ll be accused of more Austrian whining.

==> This site claims the Fed has lost $192 billion if it marked-to-market its bond portfolio. I’m imaging them asking Scott Sumner why Treasury yields went up, and him answering, “I have no idea whatsoever.”

==> A federal judge has declared Bitcoin a currency, though the reasoning (at least as summarized in this report) seems goofy.

The Bob Murphy Variety Show, Porcfest 2013

If you’re pressed for time:

==> I redeem (?) my Bobby Darrin street cred in the very beginning.

==> Starting around 23:00 I begin to violate six different rules of live entertainment.

After Further Review, Yes, Krugman Is Indeed a Big Meanie

Paul Krugman lately has been seemingly intentionally going out of his way to provoke free-market economists, first by saying Milton Friedman will some day be merely “an extended footnote” in the history of economic thought, and then by saying of Friedrich Hayek: “…back in the 30s nobody except Hayek would have considered his views a serious rival to those of Keynes…”

My simple response is this. Others, however, have done more.

==> Here’s Scott Sumner contrasting Friedman with the Keynesians of his day.

==> Alex Tabarrok quotes Alvin Hansen reviewing Hayek’s Prices and Production in that little-known journal, the American Economic Review, in 1933, where he wrote:

The present volume is, it seems to me, the only book of recent years which at all approaches Keynes’s A Treatise on Money in the impetus it has given to renewed interest and discussion of business-cycle theory. This in itself is high praise. Altogether aside from the soundness of its conclusions, the value of the book and its important place in the recent literature of cycle theory is unquestioned.

Tabarrok also quotes the Nobel Committee, since there was that whole Prize thing, which said: “von Hayek’s contributions in the field of economic theory are both profound and original. His scientific books and articles in the twenties and thirties aroused widespread and lively debate.” (And please don’t tell me there’s no such thing as the Nobel Prize in Economics. I know.)

==> Don Boudreaux quotes that nobody, John Hicks, who wrote in his 1967 article “The Hayek Story”:

When the definitive history of economic analysis during the nineteen thirties comes to be written, a leading character in the drama (it was quite a drama) will be Professor Hayek…. Hayek’s economic writings … are almost unknown to the modern student; it is hardly remembered that there was a time when the new theories of Hayek were the principal rival of the new theories of Keynes. Which was right, Keynes or Hayek?

==> Daniel Kuehn highlights a comment from Ryan Murphy (and clarified by Kevin Donoghue) that, according to Snowdon & Vane, from 1931-1935 Hayek was the third-most cited economist in the world, after Keynes and Robertson.

(However, before you at least give a gracious nod to Daniel Kuehn and Kevin Donoghue–both fans of Krugman–be aware that they are not prepared to say he was wrong. Daniel is turtles all the way down, as usual, in his parsing, whereas Kevin is still open to the idea that Krugman could be technically wrong because Hayek’s mother probably thought he was a rival to Keynes, but other than that Krugman might very well be right.)

==> And these guys actually wonder aloud, “Man, why do free-market economists get so riled up by Krugman? I guess they really don’t like rigorous economic models. Only thing I can think of.”

A Story Illustrating Intelligent Design (ID) Theory

[UPDATE: In this post, Steve Landsburg and I take the argument to depths that only Marvel superheroes could withstand.]

I have known for quite some time that atheist critics didn’t even understand the actual position of ID theorists such as William Dembski, but (per Tom Woods’ suggestion that I check it out) I am sad to say that even Edward Feser seems to have deployed his considerable mental faculties into analyzing away Dembski’s obvious (to me) position.

In the present blog post, I’m not going to defend ID theory per se; I’m merely going to state what it is, since that seems to threaten/anger so many people that they refuse to deal with it on its own terms. It’s really quite straightforward. But first, to get us warmed up, a simple story:

William and Richard are on a ship that sinks at sea, and they wash up on an tropical island. As they explore, they stumble upon a large field with small bushes. The bushes are arranged in such a way that they look like letters, spelling, “STAY AWAY, YOU HAVE BEEN WARNED.” The following conversation ensues:

WILLIAM: Whoa, we should turn around. We don’t have any weapons.

RICHARD: What are you talking about? I haven’t seen any gorilla droppings or seen any poisonous snakes. What do we need weapons for?

WILLIAM: You’re kidding, right?

RICHARD: No.

WILLIAM: The bushes, the warning, I don’t want to meet whoever planted them.

RICHARD: What are you talking about?

WILLIAM: Someone obviously planted those bushes. And he wants us to stay out. He’s obviously been here a while so he might have prepared weapons.

RICHARD: I’m sorry…did you see anyone planting bushes? As far as I know, we’re the only humans on this island. Did you see a Snickers wrapper or any other evidence of humans?

WILLIAM: You’re kidding, right?

RICHARD: No.

WILLIAM: Well, I mean, the bushes.

RICHARD: Right. Bushes occur in nature. There are a whole bunch of trees in the jungle, too. I didn’t see the trees freak you out. Why are you so terrified of bushes?

WILLIAM: I, I mean, I really don’t know what to say. How can you not see what I’m talking about? The pattern in the bushes clearly shows somebody else is here–or at least, was here.

RICHARD: Hang on a second. Are you telling me that if we go and look at those bushes under a microscope, we’re going to see something that a biologist can’t explain? Is there anything special about those bushes, that wouldn’t be true of any other bush?

WILLIAM: Well, no, it’s not the bushes themselves or their internal operations, I’m just saying it’s the way they’re arranged–

RICHARD: Yes let’s talk about that. How should they have been arranged? What pattern should their location have had, such that you would not now be afraid to keep walking in that direction?

WILLIAM: Uh, if they didn’t spell out a warning, for starters.

RICHARD: And now we see the vagueness of your position. I would have thought you could be a little more specific, if we’re supposed to alter our plans on the basis of your superstitious panic attacks.

WILLIAM: You’re kidding, right?

RICHARD: No.

WILLIAM: OK, let me try it like this. What are the chances that the bushes just so happened to be growing in that pattern?

RICHARD: OK that’s a great question, but I do want to point out just how much ground you’ve already conceded. You’ve already granted that there is no other human on the island necessary to explain anything about the bushes or the environment in which they’re growing. You’ve been reduced to a desperate and ill-defined question about probability over initial conditions. How the heck can we even answer such a question? Your tone of voice makes it sound as if you know the answer is vanishingly small, and yet you don’t know that at all. For all you know, there could have been depressions in the ground, in the shape of letters, and that explains why the seeds originally settled there. I can explain everything just by referring to wind and gravity. Or do you also think wind is evidence of a scary person up over the hill? Maybe when that scary person sneezes, that’s what causes wind? My gosh, I thought people stopped reasoning like you back in the Middle Ages.

WILLIAM: You’re kidding, right?

RICHARD: No.

WILLIAM: Um, OK, let’s suppose we go and investigate, and do find that the ground is depressed in the shape of the letters.

RICHARD: I like it! Actually bringing some empiricism into this discussion. None of this reasoning because of your intuitions nonsense.

WILLIAM: But let me finish. Let’s say we go ahead and do that. Still, that would just mean the guy living on this island used a shovel or something to dig out the ground in that pattern. You’ve just pushed the argument back one step.

RICHARD: You’re kidding, right?

WILLIAM: No.

RICHARD: That is the most desperate, anti-scientific Hail Mary pass I’ve ever seen. Of course science can never give the full story, start to finish. But I just solved your initial “this makes no sense, waaaaaah, I have to invoke another human” concern, and instead of admitting defeat like a man, you shamelessly move on to some other objection. First you thought there had to be a guy planting trees, then when I blew up that story with simple biology and physics, you shifted the argument and said there had to be a guy digging holes with a shovel. What’s the point of even continuing this discussion, if you’re going to pull stunts like that?

WILLIAM: I agree, there is no point in continuing this discussion.

RICHARD: And one last thing: Even on your own terms, your position is goofy. Look, you kept saying there was a man or a guy on the island. But it could have been a woman. Or it could have been an intelligent alien who knows English. See what I’m saying? You obviously had this weird psychological need to believe that there was another man on this island, and you grabbed at any old argument to “prove” it, even though the argument you grabbed couldn’t possibly have served the end you really wanted.

WILLIAM: Well, right, sure, the fact that the bushes spelled out a warning just meant there had been an intelligence. I had to bring in stuff that I knew beforehand, in order to speculate on the identity of the intelligence.

RICHARD: Check and mate. You just smuggled in your prior beliefs through an ever shifting and imprecise “argument,” which failed on its own terms and is anyway completely eliminated through Occam’s Razor. Now I’m walking up over that hill.

Moments later, William hears a scream ring out from beyond the hill. He turns and runs in the other direction.

Back to the actual debate over ID: Michael Behe–the guy who (in)famously said that the bacterial flagellum exhibited too much design to have arisen through unguided evolution in the modern neo-Darwinian sense–does not have a problem with the idea that all of today’s cells share a common ancestor. Look, as this website even adds at the end of the discussion:

[QUOTE FROM BEHE]: In summary, as biochemists have begun to examine apparently simple structures like cilia and flagella, they have discovered staggering complexity, with dozens or even hundreds of precisely tailored parts. It is very likely that many of the parts we have not considered here are required for any cilium to function in a cell. As the number of required parts increases, the difficulty of gradually putting the system together skyrockets, and the likelihood of indirect scenarios plummets. Darwin looks more and more forlorn. New research on the roles of the auxiliary proteins cannot simplify the irreducibly complex syetem The intransigence of the problem cannot be alleviated; it will only get worse. Darwinian theory has given no explanation for the cilium or flagellum. The overwhelming complexity of the swimming systems push us to think it may never give an explanation. (p. 73)

[WEBSITE DISCUSSION]: Behe concludes that such irreducibly complex systems were ultimately the result of intelligent design. (It should be pointed out that Behe has no objections to the concept of universal common ancestry. His objections to evolution are limited to the rejection of the neo-Darwinian mechanism as a sufficient explanation for the origin of all biological systems.)

So yes, Behe is fine with the proposition that if we had a camera and a time machine, we could go observe the first cell on earth as it reproduced and yielded offspring. There would be nothing magical in these operations; they would obey the laws of physics, chemistry, and biology. The cells would further divide and so on, and then over billions of years there would be mutations and the environment would favor some of the mutants over their kin, such that natural selection over time would yield the bacterial flagellum and the human nervous system.

Yet Behe’s point is that when you look at what this process spits out at the end, you can’t deny that a guiding intelligence must be involved somehow. Now where William Dembski comes in, is that he tries to give operational meaning to terms like “specified complexity,” so that we can objectively study the types of phenomena that are obvious in my story above (about the arrangement of bushes), but apparently not so obvious when it comes to the structure of cells.

UPDATE: In my condensed statement of Behe’s position, I might be confusing him with Dembski a bit. I think it’s more accurate to say that Behe thinks that there could have been a single cell from which all life is descended, but that it was a “supercell” that contained all of the information (for bacterial flagella, the human eye, etc.) already coded inside it, which is just waiting for the right environmental triggers to deploy.

In contrast, I think Dembski with his “no free lunch” arguments is taking an even weaker position, and concedes that the “specified complexity” in today’s cells could have “entered” into organic molecules from the outside environment over time, a la the process of mutation and natural selection. But, Dembski claims, this is just pushing the problem back one step–it means the information containing the designs of the bacterial flagella, human eye, etc. were contained in the environmental landscape, so the Darwinian explanation hasn’t really solved the informational problem.

Now I know that when a believer in the modern neo-Darwinist position hears that, he or she will guffaw. But that was one of the points in my original story: Notice how William in the story is perfectly right in saying Richard has merely pushed the problem back a step, by supposing that there were indentations in the ground such that the wind and gravity could have “mindlessly” spelled out the message with the bushes. That’s what (I think) Dembski is trying to say, when neo-Darwinians say, “The complex structures we see in today’s cells just arose over time because the environment conferred differential fitness on random mutations.”

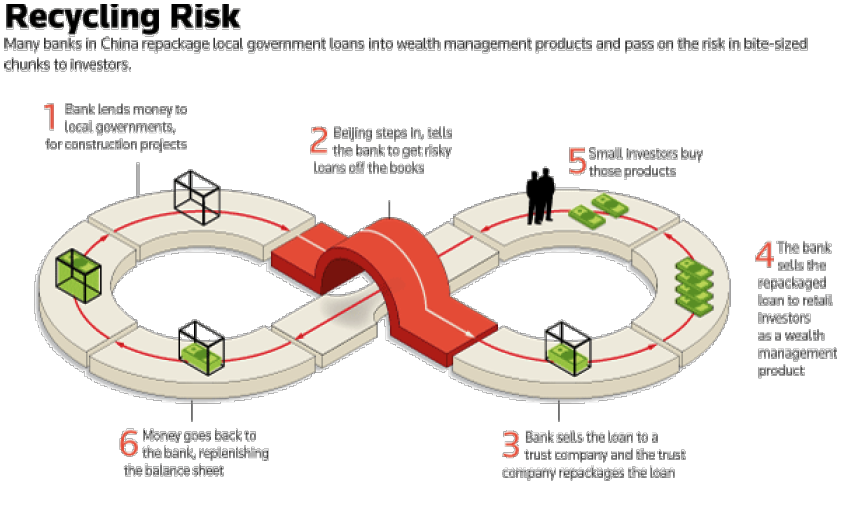

Von Pepe Is Bearish On China

The brooding von Pepe–who discovered something about himself after the Oprah incident–emails me to bring up the issue of China, which he thinks is classic Austrian business cycle material.

I want to be clear that I do not follow China, and I trust their official statistics less than the BLS. But von Pepe sends this information from UBS bank stating that steel and cement are likely oversupplied and that perhaps the government is restricting loans to these industries to try to pop a bubble in progress.

Von Pepe thinks that cement and steel are great fits for the ABCT template. Low interest rates, State-directed construction, build early stage manufacturing with cheap money/credit… He thinks it’s a perfect recipe for a textbook ABCT.

Von Pepe reminds us that Jim Chanos is short China, and also sends me this chart about the shadow and/or investing circularity for China:

Now that I’ve given you a topic, discuss…

A Petition That Scott Sumner Could Approve?

I kid, I kid. Presumably because of all of my recent inflation posts, Bill Sarubbi reminds me of this video:

Recent Comments