Von Pepe Is Bearish On China

The brooding von Pepe–who discovered something about himself after the Oprah incident–emails me to bring up the issue of China, which he thinks is classic Austrian business cycle material.

I want to be clear that I do not follow China, and I trust their official statistics less than the BLS. But von Pepe sends this information from UBS bank stating that steel and cement are likely oversupplied and that perhaps the government is restricting loans to these industries to try to pop a bubble in progress.

Von Pepe thinks that cement and steel are great fits for the ABCT template. Low interest rates, State-directed construction, build early stage manufacturing with cheap money/credit… He thinks it’s a perfect recipe for a textbook ABCT.

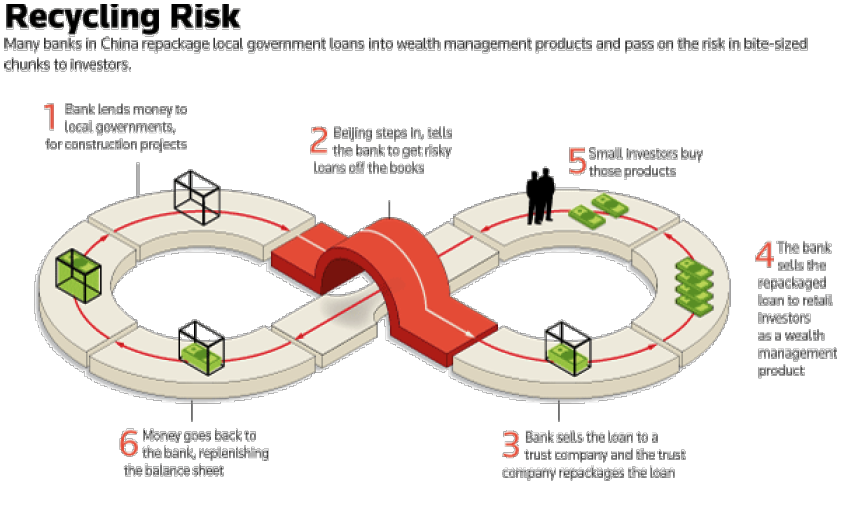

Von Pepe reminds us that Jim Chanos is short China, and also sends me this chart about the shadow and/or investing circularity for China:

Now that I’ve given you a topic, discuss…

I thought at the time that China was actually making a smart move to tell the banks to cut back on the bad loans. The figure shows how the reaction will typically be to circumvent whatever regulations you impose. Banks pretty much have an implied government backstop no matter what so this could lead to continuationof the bubble.

How much of this money is coming from exporting our diluted currency? BRIC ccountries have been complaining for some time that our QE is raising their asset prices.

We run a trade deficit with every BRIC except Brazil so the answer is ZERO with the possible exception of Brazil.

Top Ten Countries with which the U.S. has a Trade Deficit

For the month of March 2013

Year To Date

Deficit in Deficit in

Millions Millions

Country Name of U.S. $ of U.S. $

China -17,886.26 -69,086.08

Japan -6,555.36 -18,577.81

Mexico -5,262.85 -13,118.20

Germany -5,137.65 -13,842.12

Canada -2,255.23 -9,760.79

Ireland -2,145.48 -6,223.86

Saudi Arabia -2,130.39 -5,778.22

India -1,800.38 -4,496.69

Italy -1,750.36 -4,833.06

Russia -1,575.01 -3,847.81

If imports are exceeding exports, doesn’t that mean money is flowing out?

It would make sense to expect that investors would take cheap money here and invest for higher returns abroad.

The BRIC inflation complaints were not based onour investments but instead based on the idea that with their currencies partially pegged to the dollar, our currency dilution policies cause inflation for them.

Yes and no. There is and will be a bust, but the market reforms continue and there is just so much potential for inland growth that I think the bust will be much more difficult to notice than in a typical first world bust. So like “inflation” sometimes happens without an obvious rise in prices, China will have some sectors bust within general growth.

Yes and no. China is an centrally directed economy (also centrally planned, but to lesser extent), so what they will do will cause the whole country to became more unstable with each “adjustment” made by Bejing. As I can attest from experience (Polish, remembering quite well hyperinflation etc. from late 1980), this is typical of this type of economy. Growth there may be, but the instability will move to other branches of economy, as you cannot think of any one of them as independent from the rest. Especially when there are already busts in some of the sectors and government already tries to limit its range. \Which will have, of course, effects in the long term opposite to the inteded ones, but…

It is not centrally directed. It has its fair share of government boondoggles, but you don’t “direct” 1.3 billion people. Particularly not Mainland Chinese (this is not exactly a compliment).

Well… Land is owned by state. You can only lease it for 99 years. You want to start business in China, as a foreigner, you have to first state what kind. Buy from China? Ok, but: have to have rent office (not any office, only the one pointed by local government official, usually local party leader), have to hire staff (again: one sent to you by said party leader), have to pay tax on your turnover. If you want to sell to China: no way; you will not get permit. Want to produce? Ok, but if want to sell in Cina, then max. 50% of production, and extra permit required. Also required is a Chinese business partner. Yes, one sent to you by local party official. This partner gets 50% of the share of business just for partnering up, so if you building factory, then you’re owner of only half of it and it’s equipment and stock. Also applies to all technology – so you need to transfer ownership of all your patents to the business, all licenses bought etc.

As far as I know Chinese government (state and local) gets to decide who, where, what and how much can do/produce/sell in regard of Chinese as well.

China is basically neocommunist/going to fascist state, which means that economy is tightly controlled. You’ll be suprised how far can you go in an attempt to controll 1.3 billion people, most of which are well indoctrinated.

Remember that China is the motherland of Confusianism. Which is, basically, early attempt in “directing” mass of Chinese people…

“Neocolonialism”, my butt.

In the technology game, catching up is much easier than getting ahead. The Chinese have just been collecting tech left over from the 20th Century, their huge growth was because they started so far behind, I mean its a good thing overall, but growth must naturally curb after the low hanging fruit is picked and their carchup phase comes to an end. That’s basically where they are at.

Having said that, 7% growth is not strictly necessary, some countries are over the moon about 2% growth.

I’m not sure China is going to have a big bust. Remember Chanos has been short China for at least two or three years. There has to be some statute of limitations on a prediction. Every economy will run into some kind of slowdown or recession at some point so in that sense people constantly predicting doom can always find validation.

Beijing is about the only country where the Austrian analysis is semi-valid. I say semi because even when the Austrians are right, they’re wrong, the misallocation of resources comes from the fiscal, not monetary side.

The fiscal source of misallocation can only be enabled by the monetary side.

Actually it comes from both. It’s not one or the other.

You’re wrong, as usual.

Are we discussing China in its current borders, or its borders from 500 years ago. The definition of China has changed …

Depends. Are we talking about the same definition of bad humor as a few days ago?

Yeah, there is a chance that ethnic tensions will break it up like the Soviet Union broke up, but I’d put that at only a small chance, people like the Tibettans or the Uigars have no significant political, economic or military power – they are helpless, so what leverage can they apply?