Tom Woods and I Push Back on Krugman’s Climate Hysteria

I think I missed blogging this; Contra Krugman Episode 14.

Incidentally with traveling and getting a bad cold, I have been behind. I will do Step #3 of my response to Beckworth soon…

Yet Another Example of Wildly Misleading Title

My friend from college (who is Catholic, incidentally, so I’m not saying he was an atheist with an axe to grind) posted this article on FB. We could see the headline blurb in the FB thumbnail, and it said: “Virginia Schools Shut Down After Islam Is Included in World Religion Lesson.”

Now I knew that couldn’t possibly be the actual situation. So I was curious to see exactly what got all those Christian parents riled up, such that someone actually thought the ridiculous title above was close enough to the truth to justify making it the title. Here’s the story in a nutshell:

Be careful what you write — or what you ask high school children to write — in parts of Virginia. Apparently, having a go at the centuries-old skill of Arabic calligraphy by copying out the Islamic statement of faith could do funny things to your brain.

Parents of pupils at Riverheads High School in Augusta County managed to get themselves so worked up when their children were taught something about Arabic culture — during a World Geography class when they learn about different cultures — that schools across the district had to be closed down.During a section where students learn about different world religions, teacher Cheryl LaPorte decided to demonstrate the intricacies of Arabic calligraphy, the earliest form of which dates back to the end of the 7th century, by asking the students to try to copy the shahada — the Islamic statement of faith, a basic proclamation that is one of the five Pillars of Islam.

The students were “not asked to translate the statement or to recite it,” said Augusta County Superintendent Eric Bond in a statement. Rather, the teacher aimed to give students an “idea of the artistic complexity of calligraphy.” The exercise was taken from a teacher workbook called World Religions. [Bold added.]

So here are my thoughts (some of which I unloaded on my poor friend’s FB page):

(1) I am sure a lot of the complaining parents are not people I would want to be friends with.

(2) The headline said it was a “world religion lesson,” which certainly led me to believe that it was a lesson in a class on world religion. But the text clarifies that it was a geography class. So on that count alone the title is misleading; it led you to think parents had expected schools to not mention Islam in a class on world religions.

(3) The parents weren’t upset that kids learned about Islam, they were upset that kids were asked to write out a pillar of faith.

(4) If this were just an exercise in calligraphy, how would the author of this article feel if kids were asked in a public school, in keyboarding class, to type out, “I accept Jesus as my personal Lord and savior”–you know, just to get a feel for where you put your fingers in typing position?

(5) They explained that the kids weren’t asked to translate it, as if that made it better. Would it be OK for French teachers to have their new students write out “Voulez-vouz coucher avec moi, ce soir?” to work on their cursive, so long as they didn’t tell them what it meant?

(6) In general, the stereotype of idiot Christians complaining about knowledge is about as accurate as the TV sitcom stereotype that all men are buffoons. Yes, there’s an element of truth and that’s why the joke works, but it’s rather inaccurate and is annoying when coming from a place of hypocrisy and smugness. For example, I don’t know a single Christian who cares about Starbucks holiday cups. But I know at least 5 who said during that national mockfest, “I don’t know a single Christian who cares about Starbucks cups.”

(7) I’m not saying this outcome is unique to Christians; this is how our world works now. But when you can see how your “opponents” on some issue focus on a non-representative blowhard from “your team” in order to score bogus points, keep in mind that that happens when the target is someone you don’t like, too.

Step #2 in My Dispute With Beckworth: Moving From Wages to Interest Rates

In Step #1 we established that the “tightness” or “looseness” of an employer’s wage policy involved the absolute level of wages, relative to what was previously expected. Changes in the expected future movement of wages was incidental, and indeed could give you the wrong answer, in cases where it went the opposite way from movements in the actual payment levels, relative to the original baseline path.

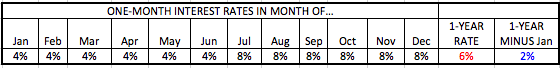

Now we have a similar scenario. As it turns out, not only does this particular company pay wages, but it also lets its employees borrow money. Employees can take loans from the company on either one-month or one-year terms, with corresponding (annualized) interest rates. Originally, here is the rate structure that Bobby and Davie expect to face in the coming year:

So starting next year, Bobby and Davie think that if they borrow money in the beginning of a month and have to pay it back at the end of that month, then the annualized interest rate they pay on such loans is 4% for any loan taken out from January through June, and 8% for any loan taken out from July through December. However, if they just decide in the beginning of the year to borrow the money for the whole year, then they can do that too, at an interest rate of 6%.

Notice that the one-year interest rate is the average of the individual monthly rates. That’s not a coincidence. Knowing the short-term rates ahead of time, someone could just roll over the loan month-to-month. (The math isn’t exact, but it’s pretty close: Rolling over a loan month-to-month works out to a cumulative interest rate for the year of about 5.98%.)

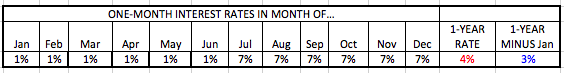

OK, now the boss comes in during the Christmas party and says, “Guess what folks? Our credit department didn’t do too much business this past year, and nobody in here defaulted, so starting next year, we’re going to loosen things up. Here is the new schedule of loan rates for next year, starting in January when you come back to work.”

Naturally, Bobby is very pleased by the news. He says to his buddy Davie, “This is great! With this looser, easier loan policy, it will be easier for me to swing that plasma screen TV I wanted to buy on credit. Relative to what I expected to pay in interest charges, now I am unambiguously better off. Whether I borrow in any given month, or whether I take out a loan for the whole year, I am always paying a lower interest rate than I had expected, before this announcement. Clearly this indicates that our credit department is loosening. Merry Christmas!”

Davie is not so keen on the news. He explains, “Bobby, you made the same mistake as you did with that Grinch wage announcement a couple of months ago. Look: The spread between the one-year rate and January’s one-month rate has increased. Before the announcement, it was 2 percentage points. But now it’s increased to 3 percentage points. And as we all know, the one-year interest rate always works out to the average of the expected short rates over that period. So if the spread jumps from 2 percentage points to 3 percentage points, it can only mean that we are expecting a bigger rate hike in the future, than we were before the announcement. Indeed, I can tell you specifically what it is: Short-term rates are going to jump up a whopping 6 percentage points in the second half of this year. Before the boss made his announcement, we were only expecting a 4 percentage point jump. So I don’t know how in the world you’re calling this increase in expected future rate hikes a ‘loosening’ of policy. These fiends are clamping down good and tight. Fits right in with their $300 wage cut this month, ya know?”

So who is right in this new dispute between Bobby and Davie?

Step #1 in My Dispute With Beckworth: Defining the Stance of Future Policy

I realize that when I’m being too cutesy, it’s not clear what my overall purpose is. So let me first state the overall situation, and then proceed to the (narrow) point of this particular post.

Overall: Recently, David Beckworth wrote a post defending Ted Cruz’s remarks about the Fed in 2008. David had two main empirical arguments: First, if we look at the spread between 1-year and shorter-term Treasury yields, we see that it increases going into the fall of 2008. There is a line of argument saying that that spread indicates how much the market expects short rates to rise in the future, and hence (David concluded) that was one piece of evidence that the market expected the Fed to tighten in the future, as 2008 rolled on. Second, if we look at professional forecasters’ views on T-bill yields, these went up as 2008 passed. So (David concluded) we have two lines of evidence that “the market” expected the Fed to raise nominal short-term rates later in 2008, and their views on this rate hike increased as time passed from spring of 2008 into later seasons, so isn’t this just what Ted Cruz was getting at?

Now, I think both of those points–when properly analyzed–go against David. In other words, using the very criteria he himself chose to make his case, I will show (I claim) that they both go against him, and provide evidence that the market, over time, expected the Fed to have a looser and looser policy as 2008 rolled on. In particular, using David’s criteria, I will show (I claim) that the Fed announcements in June, August, and September all made “the market” expect looser Fed policy in December 2008.

However, some of this stuff gets tricky, and so to make sure I don’t lose you guys, I want to start with baby steps and work my way up.

So in this opening post, let’s all agree on what we mean when we say that people expect a future tightening (or loosening) of policy. We need to start with simple, unambiguous examples, because David in the comments here was digging his heels in when I went right for the punchline. So I’m guessing that if even David–a professional economist–is not immediately seeing what my point was in the FRED chart I posted here, then a bunch of you guys didn’t really get how decisive (I claim) my demonstration was.

Now then, there are two employees, Bobby and Davie, and they each normally earn $120,000 per year. They get paid once per month. Normally, therefore, they get $10,000 per paycheck. In October they each get their normal, $10,000 paycheck. They each expect that they will likewise get paid $10,000 in November and then again in December.

But now the boss makes an announcement: “We are having a great 4th quarter, so we’re giving bonuses out. In November, you will have $1,000 added to your paychecks. In December, you will have $700 added to your paychecks. Good work people!”

Now there is a disagreement between Bobby and Davie on how to interpret this announcement. Bobby argues that relative to the original expected paychecks, they are now getting more. Specifically, they thought they’d be getting $10,000 in November, but actually they now expect to get $11,000. And they originally expected to get $10,000 in December, but now expect to get $10,700. Thus, relative to the expected path of wages before the announcement, the boss’ statement clearly signifies a “looser” or “more generous” wage policy path.

Davie thinks the exact opposite. He points out that before the announcement, he expected no change in wages in the future, going from November to December. But now, after the announcement, he is anticipating a tightening of wage policy, specifically a $300 cut in wages going from November to December. Thus, he classifies the boss’ announcement as a “tight” (less generous, stingy) wage policy.

With whom do you agree? I think it is crystal clear that Bobbie wins this argument. In general Davie’s shortcut might make sense, but in this particular situation it is clearly flawed and generates the exact opposite result from what we want.

Do any of you have a problem with this, in my silly wage story? I want you to pipe up now. If you don’t tell me why I’m wrong in the above at this point, I don’t want you to later re-litigate this point once you see how it proves fatal to the real-world David Beckworth’s argument about Fed policy in 2008.

But a request: Please DO NOT simply launch into why you think my example here is not analogous to the Fed situation. I want everyone who participates in the comments here to either say explicitly, “No Bob I think your hypothetical Bobbie is wrong and here’s why…” OR you agree that yes, Bobbie is right in this particular argument and Davie is wrong. Later on, when I try to move from this discussion to the Fed in 2008, you can dig your heels in if you want, but right now let’s make sure we all agree on what “tightening of expected future policy” means.

A Hypothetical Discussion About Employer Wage Policy

It is late October. The boss of a group of office workers makes an announcement regarding their paychecks for the rest of the year. Specifically, he announces that in addition to their base pay, all employees will receive a bonus of $1,000 added to the November paycheck and $700 added to the December paycheck. The following dialog is between the two brightest employees, both of whom studied economics in college.

BOB: Hey, this is pretty good news, huh? I could sure use some extra cash for the holidays.

DAVID: What jerks! I can’t believe management is slashing our pay in December.

BOB: Wha– what do you mean? They just announced we’re getting more money than we originally expected. This announcement signifies a generous wage policy.

DAVID: Are you daft? Before the announcement, I expected my paycheck in December to equal my paycheck in November. Now, I’m expecting a $300 fall in my paycheck, going into December. Just like ol’ management, sticking us with a tight wage policy at Christmas.

QUESTION #1: In the above dispute, who is making more sense–Bob or David?

QUESTION #2: Why did I choose these names?

Quick Project for Those Versed in Financial Markets

OK kids, here’s what I want. To sweeten the pot, the first person to post in the comments has the right to ask me for a $20 PayPal payment. And if someone’s comment is held up by the blog awaiting moderation, we’re going with the first person whose comment is visible. So keep that in mind…

I want to know what “the market” expected the federal funds rate to be on December 1, 2008. Please use some standard technique such as looking at the price of fed funds future market contracts. But I want to know what the market forecast of this particular item would be, on the following dates (ideally I’d like the implied level at closing for each of these dates, but if all you have is a daily average rate, that’s OK):

* June 24, 2008

* June 25, 2008

* June 26, 2008

* August 4, 2008

*August 5, 2008

* August 6, 2008

* September 15, 2008

* September 16, 2008

* September 17, 2008

The person to get the $20 offer is the one to first post the numbers for the above, but also we need the ability to verify your work. (I’m saying that in case the links make the blog hold up your comment in moderation. If that happens, post the numbers alone to get your money, and then later post the comment with links to verify and I can Accept that once I’m back in front of a computer.)

Quick Response to Market Monetarists on Cruz

I really have to be quick because I need to get on the road, so I admit I’m not doing this justice. But I just want to note the progression of the argument here:

1) Ted Cruz said, “In the summer of 2008…the Federal Reserve told markets that it was shifting to a tighter monetary policy.”

2) When I asked Scott Sumner to defend that, he wrote, “Bob, I’d guess he’s responding to Fed statements that they were increasingly worried about inflation, and likely to tighten in the future. (Which of course they did.)”

So already, note that Scott has moved the goalpost. Cruz said the Fed announced it was shifting to a tighter policy, whereas Scott said the Fed told markets it likely would in the future. That’s a weaker claim.

And even that isn’t true; Scott is exaggerating (in his favor) what the Fed actually said. Here are the Fed statements from June and August of 2008: Nowhere in them do they say they are likely to tighten in the future. Notice that not only does the Fed NOT say it is likely to tighten (as Sumner erroneously claimed they said), but the Fed doesn’t even say it’s more worried about inflation than growth! And the Fed also says in these statements that it thinks the spike from energy prices is temporary, and that inflation will moderate in the future. This is remarkably dovish, given that at that point, year/year CPI inflation was the highest since the fallout from the late 1970s, except for one other period around the early 1990s recession.

3) David Beckworth defends Cruz by showing a graph plotting the difference between 1-year and shorter-dated Treasury yields. This graph shoots up in the fall of 2008, and Beckworth says that standard economic theory interprets this as saying that the markets are predicting a future hike in short rates.

Again, I’ll elaborate when I am settled at my vacation spot, but in the meantime, let me just say no, that’s a very misleading way to look at it. (I’m not accusing David–or Scott for that matter–of deliberate obfuscation. I’m saying they are so sure of their framework that they can’t see how everything is pointing against them.) Look at the chart below, where I graph the actual values of the 1-year and 1-month Treasury yields, along with the difference between them:

So the green line in the chart above is what David is focusing on. Yep, it shoots up in the fall of 2008 all right.

But why did it do that? It’s because short rates fell through the floor, while longer rates didn’t fall as much. So how in the world is this proving to us that the Fed tightened?!

I’m asking people to please review the above chronology, if you are on the fence about Market Monetarists versus orthodox Austrians. You have to turn everything upside down if you’re trying to argue that Fed tightening caused the financial crisis of 2008.

Potpourri

==> Tyler Cowen lobs a softball, and his clever critics in the comments throw their backs out they swing so hard. Very entertaining all around.

==> Gene Callahan at his blog has been posting some provocative things on the conventional view of how (natural) science progresses.

==> Surely anthropogenic climate change can be used to justify a new land tax? Wrong.

==> Speaking of climate change, Tom Woods invites the “heretic” Judith Curry onto his show.

Recent Comments