Step #2 in My Dispute With Beckworth: Moving From Wages to Interest Rates

In Step #1 we established that the “tightness” or “looseness” of an employer’s wage policy involved the absolute level of wages, relative to what was previously expected. Changes in the expected future movement of wages was incidental, and indeed could give you the wrong answer, in cases where it went the opposite way from movements in the actual payment levels, relative to the original baseline path.

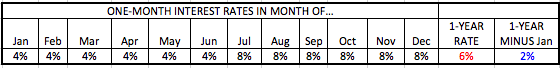

Now we have a similar scenario. As it turns out, not only does this particular company pay wages, but it also lets its employees borrow money. Employees can take loans from the company on either one-month or one-year terms, with corresponding (annualized) interest rates. Originally, here is the rate structure that Bobby and Davie expect to face in the coming year:

So starting next year, Bobby and Davie think that if they borrow money in the beginning of a month and have to pay it back at the end of that month, then the annualized interest rate they pay on such loans is 4% for any loan taken out from January through June, and 8% for any loan taken out from July through December. However, if they just decide in the beginning of the year to borrow the money for the whole year, then they can do that too, at an interest rate of 6%.

Notice that the one-year interest rate is the average of the individual monthly rates. That’s not a coincidence. Knowing the short-term rates ahead of time, someone could just roll over the loan month-to-month. (The math isn’t exact, but it’s pretty close: Rolling over a loan month-to-month works out to a cumulative interest rate for the year of about 5.98%.)

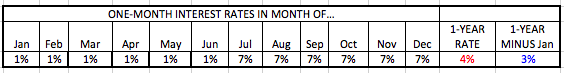

OK, now the boss comes in during the Christmas party and says, “Guess what folks? Our credit department didn’t do too much business this past year, and nobody in here defaulted, so starting next year, we’re going to loosen things up. Here is the new schedule of loan rates for next year, starting in January when you come back to work.”

Naturally, Bobby is very pleased by the news. He says to his buddy Davie, “This is great! With this looser, easier loan policy, it will be easier for me to swing that plasma screen TV I wanted to buy on credit. Relative to what I expected to pay in interest charges, now I am unambiguously better off. Whether I borrow in any given month, or whether I take out a loan for the whole year, I am always paying a lower interest rate than I had expected, before this announcement. Clearly this indicates that our credit department is loosening. Merry Christmas!”

Davie is not so keen on the news. He explains, “Bobby, you made the same mistake as you did with that Grinch wage announcement a couple of months ago. Look: The spread between the one-year rate and January’s one-month rate has increased. Before the announcement, it was 2 percentage points. But now it’s increased to 3 percentage points. And as we all know, the one-year interest rate always works out to the average of the expected short rates over that period. So if the spread jumps from 2 percentage points to 3 percentage points, it can only mean that we are expecting a bigger rate hike in the future, than we were before the announcement. Indeed, I can tell you specifically what it is: Short-term rates are going to jump up a whopping 6 percentage points in the second half of this year. Before the boss made his announcement, we were only expecting a 4 percentage point jump. So I don’t know how in the world you’re calling this increase in expected future rate hikes a ‘loosening’ of policy. These fiends are clamping down good and tight. Fits right in with their $300 wage cut this month, ya know?”

So who is right in this new dispute between Bobby and Davie?

Alright, man, you’re right; I admit it. And my other email’s still being marked as spam. It’s getting annoying. Seriously.

1

Test.

I’ve figured it out. It’s not the email, but I’m forbidden from using the Marginal Counterrevolution as my website.

My guess is that Tyler Cowen has marked the Marginal Counterrevolution as spam due to its support of Trump; thus, it is being marked as spam by Aksimet. Bob, can you mark my comments “not spam”? It might change the system.

E. Harding for real, I went in my Spam folder and don’t see anything from you in the first two pages.

The problem’s definitely with the Marginal Counterrevolution site. Whenever I link to it in the “website” box, my comment disappears, never to return. Same thing with my Econlog comments linking to the site. I continue to blame Aksimet and Cowen for my fate.

I can confirm. I tried using it. Comment vaporized.

My guess is it’s Econlog.

Other things equal, Bob is right to be happy that he can get a better deal on his loan next year than this. If tightness or looseness of policy is determined entirely as “getting a better deal in nominal terms on a loan” then clearly policy will be looser next year than this.

Not that relevant, but I think even with this definition one could argue “there will be more tightening next year than this” based on the 6% jump next year, compared to the 4% jump last year.

Davie is right with his analysts of how the gap between expected long and short term rates will widen when a rate increase is expected.

Transformer, fair enough on your first point–yes, if someone wants to deny that movements in absolute nominal interest rates shed light on the stance of monetary policy, then all bets are off.

However, *if* we are going to say that a hike relative to expectations means tighter credit, and a drop relative to expectations means looser credit, then we also need to decide: relative to *what*? That’s the issue I have been hammering in the last example and now this one.

I am saying with wages, it is crystal clear that if your paycheck is higher in every month under consideration than you had previously expected, then that is a more generous wage policy. It doesn’t matter if the drop in wages from month to month in this period is more than you originally expected.

So, by extension, if interest rates are lower in every month under consideration than what you previously expected, then that is unambiguously looser credit policy. It doesn’t matter if the jump in interest rates from month to month in this period is more than you originally expected.

Do you agree?

So you are proposing that the definition of loose money should be money inflation being higher than ORIGINALLY expected, and not money inflation being higher than the most recent act of making an expectation?

What would that look like in practise? If I set an expectation at 5 years old that may wages will be $100,000 starting at 21 years old, and going up 10% every year thereafter, then does that mean whatever happens, my actual wages will be generous or not generous depending on my expectations at 5 years old?

If not, when does an expectation become “original” as opposed to “this period”?

I think we need to get away from subjective expectations as the basis for deciding definitions of actual events. For what if two people have different expectations? Then, when time passes and the uncertain future turns into a certain past, money would be tight according to one person’s expectations but loose according to the other person’s expectations. But what actually happened to money? Was it actuslly loose or actually tight?

There must be an objective foundation for measurements.

What is the objective foundation in your proposed definition? As far as I can see, you are proposing another subjective measurement, namely, the “original” subjective expectation as opposed to “this period’s” subjective expectation.

Why is the former better than the latter? There is an implicit premise here that older expectations outweigh more recent expectations. Why?

“There must be an objective foundation for measurements.

What is the objective foundation in your proposed definition? As far as I can see, you are proposing another subjective measurement, namely, the “original” subjective expectation”

wouldn’t a futures market solve this problem? We could objectively measure expectations.

That doesn’t solve the problem, anymore than having a futures market in measuring the speed of light in a vacuum without an objective standard of measure can solve it.

Expectations are not universally consistent anyway. Expectations consist of diverse expectations.

“if interest rates are lower in every month under consideration than what you previously expected, then that is unambiguously looser credit policy”

I do not agree (or at least I think you are using confusing terminology).

If you define credit policy as loose “when interest rates are lower than you expected them to be”, then yes – in the example we have looser credit policy in year 2.

But if you define credit policy as loose “when you are overshooting your nominal target”, then you story does not give any information on that – so we just don’t know if credit policy (defined this way) is loose or tight.

You may think that defining the looseness of credit policy in this way is stupid, or dangerous – but it does seem to be the be the way that Beckworth typically uses it. (The tightness of policy in 2008 was not that interest rates were expected to fall, but that this expectation on rates led to falling NGDP expectations and it was the latter that defines the policy as tight).

And on “if someone wants to deny that movements in absolute nominal interest rates shed light on the stance of monetary policy, then all bets are off.”

This seems to keep coming up – an increase in rates will certainly be tightening on the day it happens relative to the counterfactual of it not happening.

But if you define loose money as rates consistent with over shooting your nominal target – then your can increase rates and have both tighter, and still loose money as a result.

“The tightness of policy in 2008 was not that interest rates were expected to fall” = “The tightness of policy in 2008 was not that interest rates were expected to RISE”

This example is outstanding, thank you. Bobby has nailed it. This highlights why I seldom resort to analyzing things in terms of relative growth. Without reference to absolute values, we start to lose our anchor.

Thanks RPLong. If I can clarify things for just one person, all of this is worth it…

Is this the culmination of the argument? When is it appropriate to criticize the analogy?

Sounds like you’re right Bobby. But it sounds like you professional economists should make a more concerted effort to avoid relative terminology altogether. Having a debate take this long and achieve so little is exactly why the marginal lay person economizes their economic thinking and simply avoids the conversation. Although to your credit, your argument was the one aimed at simplifying the discussion

Transformer and Capt. Parker: Please bear with me. In the next installment I will go from these stories to Beckworth’s real-world argument. But, in this final prequel, let’s make sure the three of us are on the same page.

So, *in this hypothetical dispute*, where Bobby and Davie had certain expectations about the nominal level of interest rates in 2016, and then the boss’ announcement made them update their expectations, Bobby says the boss’ announcement was in the direction of a looser credit policy, while Davie said the announcement moved in the direction of tighter policy.

Specifically, Bobby was saying since the actual level of nominal interest rates was lower in every month, compared to what they expected the minute before the announcement, then clearly the announcement must be interpreted as a loosening of policy.

On the other hand, Davie said that the spread between the January and the one-year nominal yield increased after the announcement, and so clearly the boss’ announcement made people expect a now-tighter credit policy, relative to the expectation the minute before the announcement. More specifically, Davie said that nominal rates were now expected to jump 6 percentage points in the second half of the year, compared with an expected jump of 4 percentage points the minute before the announcement.

So, *in this contrived story*, whose argument wins the day? Do you think Bobby or Davie makes the more compelling argument, given the circumstances of this story?

Once you go on record with that, on Monday I’ll post Step #3 when we move to Beckworth’s (first) actual argument.

Its Tuesday

It is not.

(Historians will look back at this, and I will be right 6 times out of 7)

Ok, yes, in the situation you describe Bobby’s argument is the better one.

Shouldn’t the actual rates be compared to the Wicksellian natural interest rate? Otherwise, Sumner et al. still have a fall back.

Bobbie’s argument is the better one.

The fist part of Davie’s “the spread between the January and the one-year nominal yield increased after the announcement” is factually correct.

But the second bit “and so clearly the boss’ announcement made people expect a now-tighter credit policy, relative to the expectation the minute before the announcement.” is not correct. He is mistaken to believe that the fact that the spread widens means that credit will be more expense next year than this.

If we take the change in interest rates as a sign of tightening or loosening (and, thus, ignore Irving Fisher and his modern expositor Milton Friedman), then, yes, the drop in interest rates in any given month is a sign of loosening.

” “This is great! With this looser, easier loan policy, it will be easier for me to swing that plasma screen TV I wanted to buy on credit. Relative to what I expected to pay in interest charges, now I am unambiguously better off. Whether I borrow in any given month, or whether I take out a loan for the whole year, I am always paying a lower interest rate than I had expected, before this announcement. Clearly this indicates that our credit department is loosening. Merry Christmas!”

These workers talk a lot like economists.

The way these workers talk, from the time of the last round of easing, will probably be more to your liking.

I’ll give you that, Gene. In fairness I said that Bobby and Davie had both studied economics.