CK Episode 19: Tackling Inequality

I know it’s on the longer side, but Tom and I agree that this is the best one yet. People in the Houston area definitely want to listen to my message in the beginning.

“Get to Higher Ground”

Dan Hagen and I started working on this last September. It is mostly his creative vision, but I helped write it and of course am the lead vocals. Hope you guys like it.

I’ll post the link for iTunes next week once it’s available, in case you want to support struggling Nashville musicians.

*Free Advice* Readers Know Why Monetary Base Is Down

Dennis Gartman is warning people that the monetary base is sharply down. That seems odd, since the Fed hasn’t been selling assets, right? It’s the same thing that we figured out (due to helpful comments from two of our readers) regarding reserves:

Bank reserves count as part of the monetary base. So when the Fed’s reverse repo operations temporarily suck reserves out of the system, it shows up as a reduction in the base too.

The Connection Between the Stock Market and the Fed

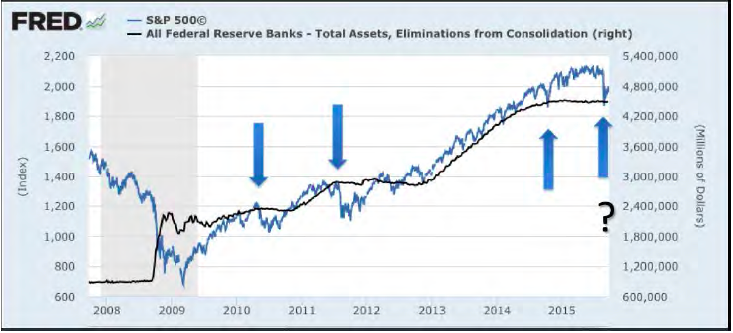

I notice that Roger Farmer has been following this. The below is the chart I put into my article in the September 2015 issue of the Lara-Murphy Report. I was pointing out how the S&P500 had big drops whenever a round of QE ended, and then again in August when (at that point) people were expecting the first rate hike the following month.

That particular hike was postponed, of course, but since we’ve had the actual hike last December… Market is down 9% YTD as of the close on January 20.

A Nice Review of The Primal Prescription

I’m not sure who this reviewer is; it looks like he writes a lot about health care / ObamaCare at this website. Anyway, a nice review of my book (co-authored with Doug McGuff), The Primal Prescription.

An excerpt from the review:

The Primal Prescription is written in a conversational style, avoiding jargon, and brims with anecdotes illustrating the authors’ contentions. It would probably be worth the price for either the history of government interventions into the healthcare system or the guidance on improving one’s health (even if one doesn’t subscribe to the primal lifestyle) and navigating the system; the pairing makes it even more valuable. It is precisely what one would expect from a doctor: diagnosing the problem — in this case, with an economist on board for a second opinion — and discussing treatment options. For the ailing American healthcare system, the cure, the two men conclude, is “freedom and independence.”

Pareto Big Macs

David R. Henderson has a nice post hitting on the sunk cost fallacy in typical discussions over drug pricing. You can see in the comments though that I think this is a trickier topic than perhaps David realizes. (Or, alternatively, David doesn’t realize how much clearer his thinking is on this than the average person’s.)

Let me elaborate on a puzzle I alluded to in the comments. I’m curious to see what you guys think. (BTW, I don’t mean to exclude both of the women who follow this blog; “you guys” is a generic term.)

There’s a general principle from intro to microeconomics that says in a competitive industry, in equilibrium P=MC. So how would we actually apply that in practice to the fast food industry? At the point at which the burgers are already made and sitting on the back warmer, what’s the marginal cost to the firm of the worker picking up the burger and handing it to a customer? 5 cents?

So, in an efficient fast food industry, burgers should be priced at 5 cents. Don’t you dare say that the firm needs to charge at least enough to cover average costs, because (as David points out) that involves a sunk cost fallacy…

Something is obviously not right in the above. But I’m curious to see how you guys would unpack it. If you want to say, “I don’t trust them there textbooks with their funny graphs!” OK fine, but ideally I’d like you to solve it within the world of standard textbook micro, since presumably that can be done.

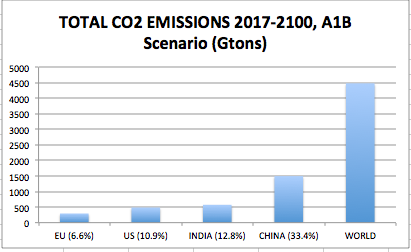

World Doesn’t Need US “Leadership” on CO2 Emissions

My latest article at IER. A nice graphic:

My Take on “The Big Short”

Since there was a lag before this review would run, I focused on the role of the ratings agencies. An excerpt:

The Big Short leads viewers to believe that shortsighted greed is the ultimate explanation for why the ratings agencies gave their blessing to dangerous products. In one scene, a woman working for a major agency says that if her company doesn’t grant a triple-A rating, the Wall Street bank (which is their customer) will simply take the financial product in question down the street to a competitor to get a high rating from them.

This can’t be the full story. After all, why doesn’t every financial product get a triple-A rating? Why doesn’t every company bring its corporate bonds to, say, Moody’s, and demand a triple-A rating or else they’ll walk down the street to Fitch?

Recent Comments