JFK, Blown Away / What Else Do I Have to Say?

Can people recommend NNJ (non-nutjob) sites discussing the flaws with the single-shooter theory of the JFK assassination? I just saw that Gerald Posner guy on the History channel. I swear the computer graphics they were using didn’t fit the basic facts of the bullet’s trajectory (even though they were using an animation to “show” you that Oswald obviously acted alone). Plus, Gene Callahan blew me off in the comments at this thread, so I’m going to challenge him to a duel on this topic.

Fun With Temperature Graphs!

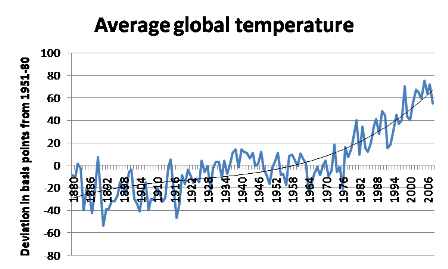

I don’t know who generated it first, but Paul Krugman and Brad DeLong (see the top middle of his website) love this chart:

Yikes! That’s almost as scary as the monetary base.

But on second thought, notice the axis: deviations in basis points from an average.

I’ll rely on the same GISS data (though I’m using the Dec-Nov averages–which I believe real climate scientists prefer–whereas I’m pretty sure Krugman is using Jan-Dec averages) and plot the absolute temperatures:

(Degrees Celsius)

And if you used the only objective scale we have–the Kelvin–the warming would look even less worrisome.

I AM NOT saying that I’ve just blown up the case for limiting greenhouse gas emissions. What I am saying is that Krugman’s chart does a lot of persuasion with its presentation. Another big thing it does (perhaps unintentionally) is obscure the warming of the 1930s, because Krugman kept the x-axis labels at 0 rather than moving them down. So you really can’t “see” anything until the big breakout after 1976.

Will Cap & Trade Lead to a Transitional Gains Trap?

Pete Boettke links to this post concerning the “transitional gains trap” and cap & trade.

The trap arises when a government restricts some activity, often for the specific purpose of increasing prices or otherwise aiding targeted beneficiaries. The limited rights to engage in these activities become valuable as the constraints bind more severely. Owners of these rights become an effective political force for preserving the status quo. Think taxicab medallions, tobacco quotas, land use restrictions and the U.S. sugar program.

I think Margolis’ general point is right. If and when cap & trade goes into effect, it will be extremely hard to unwind it, just as a tariff would be, because all of the carbon-free sectors will go nuts claiming (truthfully) that they will be hurt.

However, I think Margolis’ technical analysis is off, because he seems to be treating an emission allowance as analogous to a medallion:

Carbon cap and trade will establish restrictions on economic activity that will bind future generations. Perhaps that’s what some supporters like about it. But notice who pays. For the most part, it’s not us—not the baby boomers. Sure, we’ll bear some of the cost of these restrictions. But the president’s proposed auction collects the present value of the scarce carbon-use rights from here to eternity, then distributes it in the course of a few years.

The part I put in bold is wrong. The auctioned allowances don’t give you the perpetual right to emit a ton of carbon annually. (In contrast, you buy one taxi medallion, and you get to drive your cab, year after year.) To put it another way, the government is going to have auctions every year.

Now there are complicating factors; for example I’m pretty sure Waxman-Markey allows you to “bank” allowances and possibly even borrow against future allowances. But even there, each allowance still just gives you the right to emit such-and-such amount of carbon dioxide (or other greenhouse gas).

So the point is, if the government decides to abolish Waxman-Markey in 2040, so long as the abolition doesn’t occur until 2041, then nobody gets stuck holding allowances that suddenly drop to a market price of zero. There will still be political opposition to ending W-M if it is ever implemented, but it won’t be perfectly analogous to taxi cab drivers freaking out if NYC suddenly said anybody could drive a cab, and they don’t need no stinkin medallion.

Robert Wenzel Schools Me Yet Again on Economics

A while ago Robert Wenzel took me out to the woodshed (in his mind at least) regarding the “natural” rate of interest. (I don’t have the link handy.) Our latest spat–which is good, to counterbalance the usual lovefest between my blog and his–involves savings.

It all started when Wenzel criticized the Commerce Department’s calculation of the household savings rate. (For the record, I am not necessarily agreeing with the Commerce Department’s method. I’m just saying Wenzel’s attack was off.) In so doing Wenzel said:

Money “in your pocket” is not savings, it is a demand for cash, likewise excess bank reserves (which have gone through the roof) that are held by banks are also funds that are a demand to hold cash. Neither is “savings” in the technical sense of money out in the economy bidding up capital goods. It’s sitting, not bidding up anything. This is not “savings”, but money held “as a demand to hold cash”.

I thought that was silly, so I emailed Wenzel and said, “If I put $10 a week into a jar on my dresser, you’re saying that’s not saving?”

Wenzel then wrote a new post on the topic, in which he subjected his readers to an entirely superfluous ode to the importance of theoretical precision. (Nobody’s denying the importance of crisp definitions, I was saying his definition was a bad one.) Here’s the meat of his position:

Thus, while I know what Murphy means when he calls putting money into a jar “savings,” I would never use the term that way. To me putting money into a jar, a wallet or under the bed is exhibiting a “demand for cash”. It is not out in the market bidding up for goods, in any fashion.

Now, money put into a savings bank, is to me savings. That is, there is no money in the bank after I deposit it there. The money is loaned out to others, who presumably are borrowing the money to bid for goods and services.

Thus, there is great confusion if you call money put in a jar savings (money which is just sitting there) and, at the same time, call money which is put in a bank the same thing.(Where it is, decidedly not sitting there, but out bidding for good and services).

Of course, you can adopt any functional definition you want. But if you go Wenzel’s route, you’re going to end up with some awkward situations.

For example, let’s say I go put $1000 in my savings account. I ask Wenzel, “Hey, did I just save $1000?”

If I’m reading Wenzel correctly, he would have to say, “I’m not sure. Let me call the bank and see if they’ve lent that money out to a borrower. If it’s still just sitting there in the vault, then no, you haven’t yet saved.”

(That might be unfair. Maybe he would say, “Yes you saved, but then the bank’s demand to increase cash balances withdrew your savings from the economy.”)

Another problem: Wenzel seems to be forcing savings to equal investment by definition. In other words, I don’t see what the distinction is between savings and investment in his worldview.

I think the basic problem here is that Wenzel overlooks that a given act can be both saving and an increase in cash balances. Look, suppose I spend $20 on a DVD. I both (a) consumed and (b) reduced my cash balances. Right? Surely Wenzel would agree with those two descriptions.

So, going the other way, if I take $20 out of my paycheck and put it into my piggy jar, I both (a) saved and (b) increased my cash balances.

It’s true, there are things that you have to worry about when someone saves by hoarding cash, versus saving by giving the money to a financial intermediary. But that doesn’t change the fact that devoting some of your income to increasing your cash position is a form of saving.

(The exact definition of saving for me is to consume less than one’s income. And then if you ask what income is, it is how much you can consume without impairing your capital. I’m pretty sure I got these basic definitions from Hayek’s Pure Theory of Capital. I would be very surprised if Wenzel found an Austrian who said that adding to cash balances wasn’t a form of savings, but I am ready to be corrected on that score. Maybe they do somewhere, but again, I’d be surprised to see it.)

Tom Woods Dismantles Wonkette

For the full effect, first skim this Wonkette hit job on Michelle Bachmann (and Ron Paul and Tom Woods and all my friends) and make sure to skim the comments too. Get a feel for the tone and the intelligence behind the production. Now, can you imagine writing a response that is both enlightening, hard-hitting, and yet civil?

Tom Woods did. (HT2EPJ)

Potpourri

* Scott Sumner busts Krugman’s hypocritical condemnation of the WSJ.

* Seeing how fun it was for right-wingers to comb through Krugman’s work, Mark Thoma busts Greg Mankiw (HT2BDL).

* Speaking of DeLong, he must not be all that bad–he made a MadMax reference in this post.

* Continuing to speak of DeLong, what do you kids think? Is it worth criticizing his defense of Greenspan vis-a-vis Wicksell? I’m not asking, “Would you prefer I write an article rather than watch the Daily Show?” I’m asking, the next time I write a Mises Daily, is it worth devoting a column to this issue?

In the Land of Guns and Pickup Trucks

I won’t be posting much until the weekend. I am outside of San Antonio to give a talk on the Great Depression and other bits of Americana. In the meantime, just remember that the government is not your friend.

The Importance of Sympathy

Brad DeLong is once again beside himself. Sometimes the lies of the free market economists are so incredible that even he is surprised:

Does National Review have no editors? Does Thomas Sowell have no friends?

Wherefore this personal attack on a disadvantaged minority? Sowell’s mistake was the following line from a National Review article:“A quadrupling of the national debt in just one year… [is] not [a thing] from which any country is guaranteed to recover…”

DeLong then uses his (and Krugman’s) favorite blogoffect–“Ummm…”–to first stun his opponent, then he moves in for the Reality-Based kill:

Just to make sure we get it, DeLong says of the above table:

The national debt is estimated to be likely to increase by 17% in nominal terms over fiscal 2010. It is not estimated to quadruple. Is there nobody at National Review who will tell Sowell that +17% is not equal to +300%?

I’m going to go out on a limb and guess that Thomas Sowell already knows that 17% is not equal to 300%. (I have omitted DeLong’s signs for brevity.) In fact, looking at the very same table, I can come with a much more plausible explanation for Sowell’s mistake.

I am not defending what Sowell wrote in that column; the idea that the U.S. is going to be conquered by Islamists is silly. (Conquered by Marxists, now you’re talking…) But c’mon Prof. DeLong, he obviously meant “deficit” and not “debt.” A friendly suggestion: Spend less time wondering “why oh why is everyone else so stupid and evil?” and try to understand what your opponents are actually saying. It’s just possible you are wrong on one or two issues of importance.

Recent Comments