Applying Krugmanian Lessons to the 1990s

Poor Alex Tabarrok. He makes a simple blog post, pointing out the hilarious heads-we-win-tails-you-lose stance of Krugman et al., and the targets of his critique focus on something completely incidental. I will probably muddy the waters myself by focusing on the “incidental” part of his post, but so be it. First, though, let’s review:

1) On April 27, Mike Konczal argued that the new GDP report put the nail in the coffin of the market monetarists versus the Keynesians: The Fed had ramped up its asset purchases, while the Congress slashed spending, and oh man the economy is awful. Krugman agreed with Konczal.

2) Scott Sumner said wait a tic, the GDP report shows stronger growth last quarter than the two years before the (alleged) austerity. So huh?

3) Then the surprisingly good (in blogosphere circles) jobs report came out. Now Krugman et al. are really in an awkward spot. They just set up a test, saying the current state of the economy is an up-or-down vote on Sumner vs. Krugman, and it’s not looking so hot for the Nobel laureate. Scott Sumner claims victory in his ever-so-subtle style.

4) Alex Tabarrok tries to be very calm and professional about it. He takes the very measure of “austerity” that Krugman used–total government expenditures as a share of “potential GDP”–and shows that yes indeed, that measure has fallen like a rock; it’s down 3 percentage points over the last 3 years (those are my estimates from eyeballing the chart). And yet, real economic growth hasn’t suffered at all in this period. So Tabarrok wants Krugman et al. to explain this anomaly. Krugman has been warning his readers that US austerity is really awful when we’re in a fix like we’re in right now, and yet, according to Krugman’s measure of “austerity,” the awfulness has been happening for more than 2 years, with apparently no negative effect on growth.

5) Unfortunately, Tabarrok also wrote a single sentence in his post about his chart during the 1990s Clinton boom. This is what Krugman seized upon, in his I’m-surrounded-by-frickin-idiots response.

6) Matt Yglesias beat up on Tabarrok a bit too, but eventually came around to kinda sorta admitting yeah, Sumner wins the Internet.

7) On Twitter, Tabarrok tries to walk back his single sentence about the 90s, and wants the Internet Keynesians to focus on the fact that one week ago, Konczal said the GDP report proved Krugman beats Sumner, so why doesn’t the jobs report prove the opposite? (And also, why is an increase in GDP growth proof that Sumner is wrong?!) As far as I could see, no Internet Keynesian even attempted to answer him. They just wanted to make sure he realized how utterly stupid his single sentence about the 1990s was.

Anyway, let me engage in the acme of foolishness by looking at the Clinton boom. The problem was that Alex had mentioned that Krugman’s preferred austerity measure fell sharply during the 1990s, even as the economy boomed. Yglesias, DeLong, et al. jumped in to say Alex was forgetting the all-important zero lower bound: Because the fed funds rate was positive during the 1990s, the Fed could easily offset the impact of lower aggregate demand, emanating from (relative) cuts to government spending.

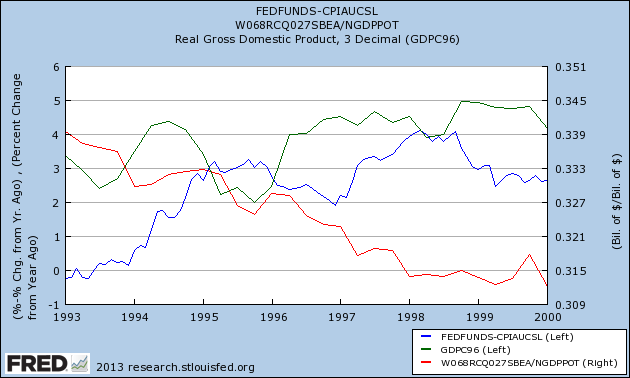

So at this point, I thought to myself, “Bob, what would the data have to look like, to make this excuse appear totally wrong?” Well, if you saw Krugman’s “austerity” measure going through the roof, and you saw the economy booming in response, and you saw the Fed raise (real) interest rates, then that would sorta mess up DeLong and Yglesias’ story, right? I mean, suppose for the sake of argument the data looked like this:

The chart above shows that total government spending as a share of potential GDP (red line) went from about 34% in 1993 to 31.5% by late 1998. That’s some severe fiscal tightening.

And yet, the economy didn’t suffer. Year/year real GDP growth (green line) stayed strong throughout the period, and was hitting 5 percent by late 1998. Hmm that’s kind of weird, right? How is it possible that we had severe fiscal tightening, while the economy continued to boom?

Oh, it’s because we weren’t at the zero lower bound! Thus the Fed must have engaged in looser money to offset the fiscal contraction. You can see this in the blue line above, where the fed funds rate minus the yr/yr CPI inflation rate increased by 400 basis points over the period in question. Wait what–?!

Don’t worry, kids, no Keynesian was harmed in the making of this blog post. They can just say, “Oh c’mon Murphy, man you guys are dumb. The economy was obviously booming hard. In the absence of the government ‘cuts,’ Greenspan would have had to raise inflation-adjusted interest rates by, say, 600 basis points. But since the government pulled back its spending, Greenspan only raised them 400 points. Thus monetary offset of the fiscal contraction. Duh.”

Finally, note that I’m not even saying it would be intellectually dishonest for our Keynesian friends to make that move. But they should at least have the decency to stop pretending their position is objectively based on the hard data, whereas their opponents walk around with confirmation bias.

Another note in the interest of honesty: I picked the starting date of that chart to make my case look as open-and-shut as possible. If you started in, say, 1991 it would be murkier, since the Fed *did* cut rates in that period.

That is not a measure.

Seriously. To measure something is to take a ruler or a vernier calliper, or a volt meter, or a stopwatch or a counter and go out to the physical world and get some numbers based on what really happened. “Potential GDP” never happened, it is a theory, a model, an invention. Do not call this a “measure”, even in jest.

Look, there hasn’t been real growth in the USA. Labour force participation continues to trend downwards just like it has for the past three and a half years. GDP may be up, but GDP is at best a rough and ready measure. Set fire to the Reichstag… and up goes GDP. Using GDP as a measure only works on the presumption that broken windows are not the driving factor. Let’s look at the cost of war in the Middle East and subtract that from GDP because it adds nothing to the well being of the American people.

On top of that, all price inflation estimates are crude and inadequate. Price of what exactly? Thus converting nominal GDP to real GDP is not a reliable process.

The second I saw Tabarrok’s single sentence about the 90s, I winced.

“The chart above shows that total government spending as a share of potential GDP (red line) went from about 34% in 1993 to 31.5% by late 1998. That’s some severe fiscal tightening.

And yet, the economy didn’t suffer. … Hmm that’s kind of weird, right? How is it possible that we had severe fiscal tightening, while the economy continued to boom?”

It is because there was massive injections of private sector debt and capital inflows adding to aggregate demand.

You know, the tech bubble? That attracted a lot of foreign speculators and money.

No Keynesian denies that, if the private sector is booming, then fiscal contraction must suddenly always cause recession.

And if the economy had sputtered, then you would have said that the economy sagged because of the austerity, and if anyone mentioned private sector injections of lending, you would have said that private sector injections of lending relative to potential GDP were insufficient to counteract the “crushing”, “suffocating” austerity, and you would have been here saying the Keynesian model is still vindicated.

Potential GDP is the fudge factor. If the economy slags, then no matter what happens to government spending or private investment, the Keynesian model allows for reference to a counter-factual “potential GDP” that is by definition higher than prevailing GDP.

MF: Why is the former “trend line” consisting of artificially stimulated “free market” prices of goods and services something that can be/should be a) further emulated at all; or b) replicated/emulated by government spending, which is quite a different animal than the terms of voluntary transactions? I’m sure the Keynesians explain this somewhere, right?

No no no no no, it’s totally scientific. If continuous, adequate, perpetual government stimulus was applied for 100 years, and for 100 years there was a constant temporal decline in GDP, then they would admit the theory has been falsified.

But until then, reference to overall trend lines in non-ergodic systems such as whole economies is both permitted (when Keynesians do it) and not permitted (when entrepreneurs do it (better)).

LK,

It is because there was massive injections of private sector debt and capital inflows adding to aggregate demand.

That is not the reason Yglesias, DeLong, et al gave as to why Tabarrok’s comment was stupid. They said it was stupid because the Fed had room to cut interest rates. But, the Fed was raising interest rates.

No Keynesian denies that, if the private sector is booming, then fiscal contraction must suddenly always cause recession.

Right – like when interest rates are not at the zero lower bound.

BTW, do you even read Bob’s posts? Bob explicitly said there is nothing here compromising the Keynesian story, and yet your comment basically says (paraphrasing) ‘Bob, duh, there is nothing here compromising the Keynesian story’ (though, apparently not for the reason Yglesias and DeLong gave, which wasn’t supported by the data on its own).

LK’s M.O. is to kindly remind us every time there is a post about Keynesianism, that Keynesian theory has not been falsified. Just so that nobody gets any sneaky ideas.

Citing evidence is an “m.o.” now?

Well maybe it is; it’s rare enough on FA that only a few of us are ever guilty of it. I think a long fact filled post refuting some claim about 19th century currency would be recognizable as from LK even if unsigned; few could doubt my authorship of a detailed takedown of some of the bible myths floating around here.

“Citing evidence is an “m.o.” now?”

The same unique set of historical data can be interpreted using more than one theory. LK isn’t providing “evidence”, so much as (Keynesian) theory.

His MO is, as I said, ensuring everyone that Keynesian theory has not been falsified. You can understand that as “providing evidence” all you want, but that isn’t what I am referring to.

“Well maybe it is; it’s rare enough on FA that only a few of us are ever guilty of it.”

Yes, and those few tend to make the all too common mistake of believing that if unique history can be interpreted using one theory among many, that one theory is suddenly promoted to the rank of monopoly over data, confirmed where all others are refuted.

Historical data is not economic theory, and historical data cannot prove or disprove any economic theory. It can only ever prove or disprove historical claims.

“I think a long fact filled post refuting some claim about 19th century currency would be recognizable as from LK even if unsigned; few could doubt my authorship of a detailed takedown of some of the bible myths floating around here.”

Cool story.

Here’s a great video of Hayek talking about the mystery of why Keynes’ “theory” became popular even though it was just a long dead and thoroughly refuted “theory” since the 19th century.

Click on 3:30 for that part, though the whole clip is good.

LK, since you are more of an economic historian than economist (you don’t even understand the basics), why not quote this video? I especially the part where he paraphrases Leslie Stephen as saying that the mark of a good economist is that he doesn’t make that particular mistake (the mistake Keynes makes with aggregate demand and employment.)

So LK and Krugman are believers in a theory that has been debunked since the 19th century. Modern day blood letters I tell you.

oops, here it is.

http://www.youtube.com/watch?v=VqU-AZh-wqU

Apart from the fact that Hayek’s claim that the idea that aggregate demand drives employment and output was refuted in the 19th century is nonsense, he himself came to support monetary and fiscal stimulus during a deep depression:

“Even though there are many concerns about organizing public works ad hoc during a depression, everything speaks in favour of having public agencies perform during a depression whatever investment activities need to be carried out in any case and can possibly be postposed until then. It is the timing of these expenses that presents a problem, since funds are often extremely hard to raise in the midst of a severe depression and the accumulation of reserves in good times generally faces the objections mentioned above. There is little question that in times of general unemployment the state must intervene to mitigate genuine hardship either by disbursing unemployment compensation or, as in earlier times, by legislation to help the poor.”

Hayek, F. A. von. 1999. “The Gold Problem” (trans. G. Heinz), in S. Kresge (ed.), The Collected Works of F. A. Hayek. Volume 5. Good Money, Part 1. The New World, Routledge, London. 169–185. at p. 184.

“To return, however, to the specific problem of preventing what I have called the secondary depression caused by the deflation which a crisis is likely to induce. Although it is clear that such a deflation, which does no good and only harm, ought to be prevented, it is not easy to see how this can be done without producing further misdirections of labour. In general it is probably true to say that an equilibrium position will be most effectively approached if consumers’ demand is prevented from falling substantially by providing employment through public works at relatively low wages so that workers will wish to move as soon as they can to other and better paid occupations …” (Hayek 1978: 210–212).

He can’t have it both ways. So at most all you have done is identified how Hayek was badly intellectually inconsistent.

Or just going senile.

LK,

I’m not sure I see a contradiction here.

In the first quote I think Hayek is addressing the problem of essential services and truly desperate people during a depression. He believes the government can help make sure certain key services are provided for, and that truly desperate people are helped, without causing a misdirection of resources or labor. He isn’t talking about the problem of a ‘secondary deflation.’

In the second quote he is addressing the problem of a secondary deflation. He doesn’t seem to think the government can do much to help reverse it without causing more problems, short of sponsoring public works at much reduced wages. This is a different problem than the one he is dealing with in his first quote.

That first quote isn’t Hayek supporting fiscal stimulus; it’s Hayek supporting some measures of preserving social justice.

And the second?

Note that LK previously cited “Hayek, Friedrich A. von. 1975. A Discussion with Friedrich A. von Hayek. American Enterprise Institute, Washington.”

http://socialdemocracy21stcentury.blogspot.com/2012/12/vulgar-austrians-economic-calculation.html

Therefore, his feigned ignorance of what Hayek said is just another lie.

Hayek 1977: You see, another political element was that, of course, politicians just lapped the argument and Keynes taught them if you outspend your income and run a deficit, you are doing good to the people in general. The politicians didn’t want to hear anything more than that — to be told that irresponsible spending was a beneficial thing and that’s how the thing became so influential.

http://www.youtube.com/watch?v=N364sN5E0hQ&feature=plcp

Yes, I am sure Hayek loved to believe the delusion that Austrianism and his liquidationism were rejected by the world at large because every politician was “evil.”

Apparently nobody ever thought his economic theories were just unconvincing.

It has nothing to do with “evil”, but rather with publich choice and incentives.

*public*

And a lack of knowledge on the part of planners. LK still doesn’t understand economic calculation because his dingbat world view depends on ignoring that central concept.

“Apart from the fact that Hayek’s claim that the idea that aggregate demand drives employment and output was refuted in the 19th century is nonsense”

It isn’t nonsense. It is indeed a fact that John Stuart Mill, among other classicals, refuted the notion that aggregate demand drives employment and output.

Hayek was a muddled and contradictory thinker.

LK, you miserable liar. Regarding paragraph 2 and “secondary deflation”, Hayek would say to listen to him prior to your stupid Keynesian boom and establish a society of competitive commodity money before the boom so that it doesn’t happen. He’d say that people should quit bothering him after they’ve screwed everything up and inevitable tragic Keynesian bust has ensued and instead listen to him before they cause a stupid Keynesian boom and bust in the first place. He would say, “What we should do is avoid any attempt to recreate employment or diminish unemployment, by a further dose of inflation”.

Oh wait. Hayek did say that in 1975, as you are well aware. You miserable liar.

Read page 8:

http://www.flickr.com/photos/bob_roddis/7534880036/in/set-72157630494776170/

“LK, you miserable liar.”

Can you guys get your act together. Is LK a miserable liar or is he a blythe and cheerful liar? It’s getting hard to keep track of all the accusations of lying and trolling around here. Perhaps Bob should add color coding to the comments so the rest of us can keep it all straight.

Perhaps you could make an attempt to determine whether or not LK is actually lying. In fact, he’s lied over and over for years on these very pages concerning what Hayek said on the previous page 7 of that very same booklet.

http://www.flickr.com/photos/bob_roddis/7534880182/in/set-72157630494776170/

Bob Roddis wrote:

LK, you miserable liar.

Bob, I don’t know why you guys keep having the same fight, but can you try to be more polite for the sake of the jury?

Does something like “LK is again purposefully misleading” pass muster?

There is no lying or misleading comments above.

Hayek came to give qualified support to the idea of public works fiscal stimulus during a deep depression as in the 1930s. That is a fact.

That is why Hoppe accuses Hayek of being an evil “social democrat”:

“According to Hayek, government is “necessary” to fulfill the following tasks: not merely for “law enforcement” and “defense against external enemies” but “in an advanced society government ought to use its power of raising funds by taxation to provide a number of services which for various reasons cannot be provided, or cannot be provided adequately, by the market.” ….

Additional government functions include “the assurance of a certain minimum income for everyone”; government should “distribute its expenditure over time in such a manner that it will step in when private investment flags” [= fiscal stimulus during a recession]”

http://mises.org/daily/5747/Why-Mises-and-not-Hayek

Hoppe takes down Hayek’s theory even better here:

https://mises.org/journals/rae/pdf/R71_3.pdf

“It is because there was massive injections of private sector debt and capital inflows adding to aggregate demand.”

Nothing about aggregate supply?

Why is epistemology in the mainstream economics profession so terrible? Do Krugman and Sumner really believe that they can prove their cases by pointing to historical data? Go read “Human Action” morons (Krugman and Sumner). If you can make it through the first few pages you’ll see the error of your ways.

Bob,

I replied to the initial Konczal/Krugman posts and followed up with another one given the employment report. The key point I keep making is that fiscal policy has been tightening since 2010 and it hasn’t led to another recession. And let me be clear here: the tightening is tightening to the cyclical-adjusted (i.e.” structural”) balance. That is, controlling for changes in the business cycle, fiscal policy has explicitly been tightening. See here: http://macromarketmusings.blogspot.com/2013/05/is-feds-able-to-offset-austerity.html

If you look at the growth in government spending compared to the growth in private GDP, throughout the 90s it followed the same pattern it does most of the time: the faster government spending grew, the slower the private economy grew (and vice versa). You can see it in a graph on this page I’ve posted before (perhaps the link was ignored since it is a new site and not one of the major econ blogs):

http://www.politicsdebunked.com/article-list/spendingpattern

Most of the time GDP and government spending are both growing, the issue is to compare the rate of growth.

There was no austerity during the 90s. Public investment and consumption was a drag on growth during only one year, 1993. Nominal GDP grew faster than spending so spending to GDP fell.

Table 1.1.2. Contributions to Percent Change in Real Gross Domestic Product

http://www.bea.gov/iTable/print.cfm?fid=FB5606C5D3C970493598F66D8D31550D43CA4090C7E7ED30B0ABEE5CD29ED205B017D6337D66DB0847CE127C0376E4402FA6DF0158C74B11DF7C5DFF54D5ABC1

Overall, this makes sense, but the housing distortion complicates any story. Freddie/Fannie increased the mortgage portfolio by around $500 billion between 1997 and 2000 and increased guarantees by another $200 billion (these are eyeball measurements of a graph from Fed White Paper, “Guaranteed to Fail” p.18, http://research.stlouisfed.org/conferences/gse/White.pdf). It looks like the increase followed the GDP growth instead of preceding it, so maybe it the increase was due to higher demand in an expanding economy, but I would expect it to still have an effect similar to that of an expansionary fed policy.

Personally, I wonder if we are as far below potential GDP as everyone seems to believe or if we were way beyond it for more than a decade due to inflated asset purchases by GSEs. When I think of potential GDP, I picture Roger Garrison’s graph of the production possibilities frontier. It seems to me that we could have been outside the PPF circle even following the collapse of the tech bubble.

Speaking of Keynesian “evidence”, where is the historical laissez faire placebo era that they might compare to periods when their “medicine” was applied? According to LK, the gold standard was myth. According to Mr. Kuehn, the Fed made US entry into WWI possible and was the cause of the distortions that resulted in the depression of 1920. Further, how is it that Keynesians universally ignore, suppress and are oblivious to the unchallenged evidentiary truth of human action and the observable essential importance unadulterated prices and transactions to economic calculation?

Ralph Raico wrote:

According to his supporters and himself, Keynes’s turn to neomercantilism was necessitated by his discovery of fundamental flaws in classic economics. The classical theory, the claim goes, proved impotent to explain the causes of either Britain’s chronic high unemployment in the 1920s or the Great Depression, whereas in The General Theory Keynes did both. He accomplished this feat by exposing the inherent gross defects of the undirected market economy, thereby effecting a “revolution” in economic thought.

Yet the particular crises to which Keynes reacted were themselves the products of misguided government policies. The persistence of high unemployment in Great Britain is traceable in part to Winston Churchill’s decision as chancellor of the exchequer to return to gold at the unrealistic prewar parity and in part to the high unemployment benefits (relative to wages) available after 1920. The Great Depression resulted primarily from government monetary management, in particular by the Federal Reserve System in the United States. Both of these crises are amenable to explanation by means of “orthodox” economic analysis, requiring no theoretical “revolution” (Rothbard 1963; Johnson 1975, pp. 109–12; Benjamin and Kochin 1979; Buchanan, Wagner, and Burton 1991).[5]

As Hutt noted, Keynes in The General Theory turned his back on all the recognized authorities, from Hume and Smith to Menger, Jevons, and Marshall, and on to Wicksell and Wicksteed. Those thinkers, whatever the degree of their adherence to strict laissez-faire, at least held that the market economy contained self-correcting forces that rendered business depressions temporary. Keynes, discarding his “orthodox” predecessors (and contemporaries), aligned himself with what he himself dubbed that “brave army of heretics,” Silvio Gesell, J.A. Hobson, and other social-reformist and socialist critics of capitalism whom mainstream economists had dismissed as crackpots (Friedman 1997, p. 7).

In a popular essay in 1934, Keynes had already ranged himself on the side of these “heretics,” the writers “who reject the idea that the existing economic system is, in any significant sense, self-adjusting…. The system is not self-adjusting, and, without purposive direction, it is incapable of translating our actual poverty into our potential plenty” (1973a, pp. 487, 489, 491). The General Theory was intended to provide the analytical framework to justify this position.

Changes in prices, wages, and interest rates, according to Keynes, do not fulfill the function ascribed to them in standard economic theory — tending to generate a full-employment equilibrium. The level of wages has no substantial effect on the volume of employment; the interest rate does not serve to equilibrate saving and investment; aggregate demand is normally insufficient to produce full employment; and so on. The false assumptions, conceptual incoherencies, and non sequiturs that vitiate these extravagant claims have been frequently exposed (for example, in Hazlitt 1959, [1960] 1995; Rothbard 1962, p. 2;: passim; Reisman 1998, pp. 862–94).[6] As James Buchanan sums up the issue, “There is simply no evidence to suggest that market economies are inherently unstable” (Buchanan, Wagner, and Burton 1991, p. 109).

https://mises.org/daily/4251

I wonder if the pseudoscience of Keynesianism will outlive geocentrism in terms of years as the orthodoxy.

In both cases you had powerful interests to keep the truth at bay, and in both cases the truth had no incentive to shine through.

It seems the only way to massage and prepare the Keynesian infected mind for understanding and accepting economics, is to show how Keynes’ gobbledygook arose in an environment of moral degradation (progressivism) and philosophical irrationalism (relativism, deconstructionism, etc).