Niall Ferguson’s 3-Part Critique of Krugman

I think Ferguson misses the mark on a lot of these, but there were 3 or 4 gems in here that I hadn’t known about. (I’ll blog them separately so as not to lose track of them.) Anywhere, here are the links:

My favorite paragraph of the series, from Part 3:

For too long, Paul Krugman has exploited his authority as an award-winning economist and his power as a New York Times columnist to heap opprobrium on anyone who ventures to disagree with him. Along the way, he has acquired a claque of like-minded bloggers who play a sinister game of tag with him, endorsing his attacks and adding vitriol of their own. I would like to name and shame in this context Dean Baker, Josh Barro, Brad DeLong, Matthew O’Brien, Noah Smith, Matthew Yglesias and Justin Wolfers. Krugman and his acolytes evidently relish the viciousness of their attacks, priding themselves on the crassness of their language. But I should like to know what qualifies a figure like Matt O’Brien to call anyone a “disingenuous idiot”? What exactly are his credentials? 35,550 tweets? How does he essentially differ from the cranks who, before the Internet, had to vent their spleen by writing letters in green ink?

Danny Sanchez Interviews Me, Part 2 of 5

This is the second of five parts of a detailed interview Danny Sanchez had with me, over the summer when I was at the Mises Institute. It is partly to promote my upcoming Mises Academy online class, but we discuss a lot about Austrian economics in general.

Danny Sanchez Interviews Me About Basics of Economics Etc. Part 1 of 5

This is the first of five parts of a detailed interview Danny Sanchez had with me, over the summer when I was at the Mises Institute. It is partly to promote my upcoming Mises Academy online class, but we discuss a lot about Austrian economics in general.

Two Views on the HealthCare Exchanges

CBS News has a story on the ObamaCare website, with the bold from me:

Healthcare.gov launched more than a week ago, and while millions of Americans have signed into the site, not many have been able to actually sign up for insurance because of glitches with the website.

…

No one knows how many people have managed to enroll because the administration refuses to release those numbers, but the website’s launch has been rocky.Media outlets have struggled to find anyone who’s actually been successful. The Washington Post even illustrated that sought-after person as a unicorn, and USA Today called the launch an “inexcusable mess” and a “nightmare.”

White House officials initially blamed the problem on an unexpectedly high volume as they had more than 8 million hits in the first week, but after it went offline over the weekend for repairs, officials now acknowledge other problems.

…

However, computer experts say the website has major flaws.“It wasn’t designed well, it wasn’t implemented well, and it looks like nobody tested it,” said Luke Chung, an online database programmer.

Chung supports the new health care law but said it was not the demand that is crashing the site. He thinks the entire website needs a complete overhaul.

“It’s not even close. It’s not even ready for beta testing for my book. I would be ashamed and embarrassed if my organization delivered something like that,” he said.

So if nothing else, this is bad news for those who championed greater government involvement in health care, and said the people worried about it were a bunch of paranoid nuts who really, deep down, just wanted poor people to die, right? Nope, here’s Krugman from October 1 in a post titled “Good Glitches”:

So, very early reports are that Obamacare exchanges are, as expected, having some technical glitches on the first day — maybe even a bit worse than expected, because it appears that volume has been much bigger than predicted.

Here’s what you need to know: this is good, not bad, news for the program….

The big fear has been that a combination of ignorance and misinformation would keep people away, that they wouldn’t sign up either because they didn’t know that insurance was now available, or because Republicans had convinced them that the program was the spawn of the devil, or something. Lots of people logging on and signing up on the very first day — a day when the Kamikaze Kongress is dominating the headlines — is an early indication that it’s going to be fine, that plenty of people will sign up for the first year of health reform.

Yes, there may be some negative news stories about the glitches. But Obamacare is not up for a revote. As Jonathan Bernstein says, the only thing that matters is whether it works. And today’s heavy volume is yet another sign — along with abating health costs and below-expected premiums — that it will.

You see, in a liquidity trap, if people can’t sign up for a program, that’s a good thing for the program.

Less snarkily: This is just Klassic Krugman: With confidence he is downplaying the “glitches” when he obviously has no idea what he’s talking about. It’s not that Krugman is a pretty good amateur computer programmer, who saw the source code and simply has a difference of opinion from Luke Chung. No, Krugman just took the White House’s word for it that the glitches were due to high demand, then ran to his blog to defend the program. And, in fact, he said something that is probably flat-out false: “Lots of people logging on and signing up on the very first day…” We don’t know if it’s false, of course, because the most transparent Administration in history isn’t releasing any details about President Obama’s signature accomplishment.

So again, when progressives wonder, “Man, why do libertarians hate Krugman so much? It’s just because he’s so right about inflation, I guess” no, that’s not it.

Two Obvious Facts on the Debt Ceiling Showdown

Big “showdowns” in Washington are always hype, with both sides distorting the facts so that the hapless citizen–whether he watches Fox or CNN–focuses on irrelevant details and misses the big picture. When it comes to the recurring conflict over raising the debt ceiling, here are two obvious facts that explode just about everything that the Republicans and Democrats are saying:

OBVIOUS FACT #1: Refusing to raise the debt ceiling is equivalent to insisting on a balanced budget. Any Republican politician who has (a) championed a balanced budget amendment but lamented the difficult road ahead while (b) voted to raise the debt ceiling, is obviously insincere (or doesn’t understand accounting). Either way, genuine fiscal conservatives cannot take such a person seriously anymore.

OBVIOUS FACT #2: If the debt ceiling is not raised, the government by no means needs to default on its outstanding bonds. There is an enormous amount of revenue flowing in, with which the government could pay existing creditors, as well as people owed money through Social Security, pensions to retired government workers, etc. Thus when President Obama and other Democrats say that if they don’t get their credit limit raised, they will crash the Treasury market, they are (using their rhetoric) holding the global credit markets hostage to their spending goals.

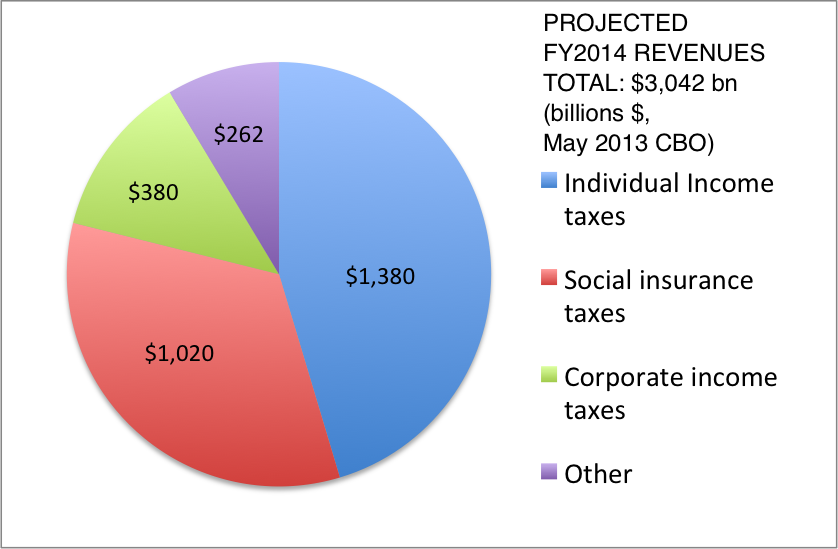

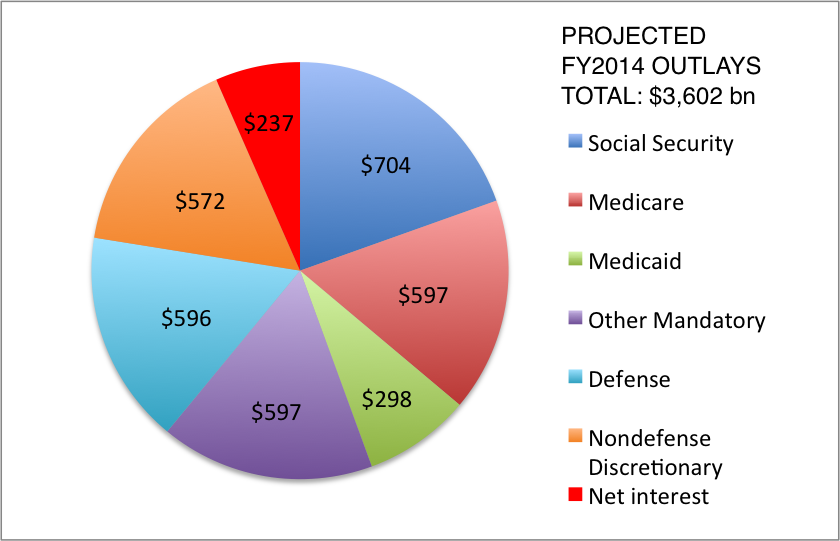

To see just how absurd it is to link the debt ceiling to a Treasury default, consider the following charts which are based on the 2014 Fiscal Year (which runs from October 1, 2013 through September 30, 2014) as estimated by the CBO in May:

As the above charts indicate, back in May the CBO projected a budget deficit of $560 billion for Fiscal Year 2014 (which just started on October 1). So if the debt ceiling isn’t raised, it basically means the government needs to trim $560 billion from its total spending of $3.6 trillion, a reduction of about 15.6% of total spending.

Is such a statement the same thing as saying the Treasury needs to default on its outstanding debt? Of course not. Of the major categories listed above, “Net interest” on existing federal debt is the smallest, representing only $237 billion / $3.6 trillion = 6.6% of total spending. There is no reason the government has to place “Net Interest” on the chopping block first, ahead of Defense and Nondefense Discretionary spending. I separated out all “Mandatory” outlays to show that those don’t need to be touched, either, in order to balance the budget.

It would take about a 48% reduction in Defense and Nondefense discretionary spending, in order to balance the budget and incur no further debt. The government could maintain its payments to Social Security, Medicare, Medicaid, and all other “Mandatory” programs, as well as interest to existing bondholders. The situation would change, moving forward, as Social Security and Medicare requirements grew larger, but the point is that even with no increase in the debt ceiling, there is nothing in the arithmetic forcing the Treasury to default on bondholders anytime soon, unless it chooses to do so.

Tyler Cowen on Treasury Default

This is my favorite Tyler post of all time, with the only possible exception being his unwitting out-of-sample defense of Austrian business cycle theory.

First, Tyler uses his extraordinarily powerful mind to concoct a scenario in which the economy collapses from the debt standoff:

As the evening of October 16th approaches, John Boehner is preparing to invoke the Hastert Rule when a car accident intervenes and he is temporarily out of commission. Coordination collapses and some Republicans believe that on the 17th debt payments can continue while some other federal obligations are violated instead. A combination of insufficient payment prioritization (for bizarre technical reasons) and angry Social Security voters, who irrationally fear missing their deposits, means that some payments are in fact missed on Treasury securities….Interest rates skyrocket and there are numerous collateral calls from clearinghouses and thus a squeeze on Treasuries. Everyone is scrambling after Treasuries and suddenly T-Bill liquidity is quite scarce….

By mid-morning of the 17th the payments system has shut down entirely. The Fed tries everything possible, but even with a flood of monetary liquidity, T-Bills are “not what they used to be” and no flow of reserves can make up for this. The monetary authority cannot become the fiscal authority in the span of an hour or a day, especially when it doesn’t have a fully credible fiscal authority behind it. The payments system remains gridlocked. Elsewhere, the Italian 10-year rate shoots over eleven percent, so the ECB has to invoke Outright Monetary Transactions, but the Germans get nervous and don’t go whole hog with this program. A lot of European credit markets shut down too. A major clearinghouse is nationalized.

…

A full sorting out of the payments mess takes months. In the meantime gdp has shed five or ten percent and borrowing costs are permanently higher. Credit stays slow and the United States enters another major recession. Scott Sumner issues a call for higher nominal gdp.

And in addition to the Sumner jab, Tyler tops it off with a Krugman Kontradiction:

Addendum: By the way, we used to read that an attack of the bond market vigilantes would be good for the economy, but it seems this is no longer the case when the vigilantes are led by Republicans. Hint: an attack of the bond market vigilantes is not good for the economy.

BOOM!

Resolving (Sort of) Krugman on Bond Vigilantes and Debt Default

OK so for the last month or so I’ve been asking: How can Paul Krugman have been arguing repeatedly that an attack by the “bond vigilantes” (because they’re worried about high levels of a government’s debt) be “expansionary” and hence good for an economy currently stuck in a liquidity trap, while at the same time Krugman says there will be “carnage” in the stock market and a likely double dip recession if the US Treasury defaults on its debt?

Daniel Kuehn pointed me to a definitive Krugman post on this issue that I either missed or forgot about, which Krugman wrote back in July 2011. In that post, Krugman had been responding to Nick Rowe, who in turn had written a post asking, “Do Keynesians believe their own models?” So seeing all this, reassured me I was on the right track: Nick Rowe too saw that today’s Keynesians (and Nick included himself in this group as a “quasi-Keynesian”) were using models that implied a debt default would, if anything, be expansionary. [UPDATE: Brad DeLong and Scott Sumner contribute in the comments of Nick’s post, and everybody ends up settling on a particular assumption that makes default either expansionary or contractionary.]

Anyway, Krugman did not agree with Nick, but Krugman agreed it was subtle–it was a “(Very Wonkish)” post to walk through this terrain. Here’s a key paragraph from Krugman, explaining why inflation (which weakens bonds and yet Keynesians love) is good but default risk (which also weakens bonds) is not:

It’s true that, say, a 1 percent possibility that your bond holdings will become worthless within a year is similar to the expectation that inflation will erode those bonds’ real value by 1 percent over the next year. But inflation doesn’t just erode the value of bonds; it also erodes the value of cash. And that’s why expected inflation can help in a liquidity trap: it makes sitting on cash less attractive. The threat of default doesn’t do that. As far as I know, we’re not talking about a loss of confidence in pieces of paper bearing pictures of dead presidents. And that’s why the threat of default isn’t equivalent — and not expansionary.

OK, fair enough, but now I can point out the specific contradiction, or if we’re generous, the specific modeling assumption that Krugman changes when he’s talking about fears of Democratic profligacy versus fears of Republican obstinancy: In the former case, Krugman invokes foreign investors and how their reduced willingness to hold US (or UK, or Japanese) bonds will depreciate the currency and thus boost net exports. Here’s a key excerpt from Krugman’s essay on bond vigilantes from November 2012:

Now ask, what happens if there’s a loss of confidence, causing the risk premium ρ [on US government bonds] to rise? The answer is that the currency depreciates for any given domestic interest rate, increasing demand and shifting the IS curve out. That is, the effect on the economy is expansionary.

Think about it this way: with the Fed setting interest rates, any loss of confidence in U.S. bonds would cause not a rise in rates but a fall in the dollar – and a fall in the dollar would be a good thing, helping make US industry more competitive. [Emphasis in original.]

So to sum up: As best I can tell, when Krugman wants to explain why a debt default caused by Republicans is bad, he says it’s because people will dump bonds but still embrace the currency. When Krugman wants to explain why an attack by bond vigilantes caused by Democrats is good, he says it’s because you can’t dump US bonds without depreciating the currency at the same time.

Yes, I’m being a tiny bit flip with the Republican/Democrat labels, but that was only for brevity. If you replace Republican with “people who want the government to spend less than Krugman wants” and Democrats with “people who want the government to increase spending like Krugman wants,” then it’s not only a fit for past observations but also would be a good predictive model of future Krugman posts.

Obama to Nominate Yellen for Fed Chief

Details here. And holy cow did you folks know this?!

[Yellen] is married to, and has co-authored a number of papers with, Nobel Prize-winning economist George Akerlof, whom she met in the fall of 1977 when they were both economists at the Fed board.

Must…resist…lemons…joke…

Recent Comments