No Guys, Obama Isn’t Saying Struggling Homeowners Are Deadbeats

Oh man, this is even less borderline than the “you didn’t build that” controversy. In the debate over the debt ceiling, Obama used an analogy:

OK, it’s obvious what he’s saying. If you have committed to a certain expenditure, but that at the last minute decide you simply aren’t going to pay it (even though you have the financial ability to do so), then you’re not saving money etc.

We can debate whether this is a good analogy or not, but my interpretation above is clearly what he is saying.

Yet now that clip is running around Twitter etc. with people saying:

How many homeowners, who may have fallen on hard times, offended by President Obama calling them a deadbeat because they missed a payment?

C’mon guys. There’s plenty of outrageous stuff to flip out about, rather than putting words in Obama’s mouth. This is just going to distract from truly horrendous things, like him claiming the legal ability to blow up Americans with no trial.

A Risk-Free Prediction on the Economics “Nobel” That Is All Upside

I am not making a formal prediction here, so if it doesn’t pan out, no harm. However, it occurs to me that to the extent one thinks the various Nobel Prizes (and related “Nobel Memorial Prize in Economic Science” award) are issued for political reasons,* rather than strictly for merit, then I would expect this year’s economics award to go to William Nordhaus for his pathbreaking work on the economics of climate change, and his development of formal models to calculate the social cost of carbon. (The reason Nordhaus “needs” to get it this year, is that the case for intervention on the basis of anthropogenic global warming is taking a serious hit due to the over-predictions of warming from the vast majority of the IPCC’s models. The people who want a carbon tax etc. really need to make a strong push over the next year or two, because each passing year of stable global temperatures makes it that much harder politically.)

* Do you think it’s a total coincidence that the Peace Prize this year went to the group now disarming the Syrian government of its chemical weapons?

Salon’s Alex Pareene More or Less Endorses Rand Paul for 2016

Actually he does the exact opposite, but I’m just warming you up so Pareene’s column doesn’t shock your system too much when you read it. (HT2 EPJ)

In his column titled “Rand Paul’s Strategic Islamophobia,” Pareene writes:

For normal Americans, the annual Values Voters Summit is an opportunity to take a look at the Republican Party and be appalled and amused at how vehemently anti-modernity and hysterically bigoted it remains despite basically all demographic trends. For Republican politicians, it is an opportunity to say crazy stuff to adoring crowds in the hopes of riding their enthusiasm and donations all the way to second or third place in the next Republican presidential primary campaign. Sen. Rand Paul today addressed the summit, and he wanted everyone to know that while he may have a bit of a “peacenik” reputation, he definitely hates Islam just as much as the people who want to bomb the Middle East forever.

Wow! That is surely hyperbole, right? I wonder what Rand Paul said that would allow Pareene to “paraphrase” him like that?

We get no such quotes. But hang on, Pareene continues with his summary:

Paul’s speech (which greatly resembles one he gave to an evangelical audience last June) hit nearly every toxic fixation and delusion of the evangelical Right. He generously indulged the persecution fantasy that fuels so much of the modern conservative movement, claiming that “there’s a worldwide war on Christianity,” waged largely by Islam, but also by “liberal elites.” It is “a war that the mainstream media is ignoring,” he said. Mainstream media liberals are too scared and too PC to say it, but Paul wasn’t: We must blame Muslims more or less as a homogeneous undifferentiated mass.

OK get ready, Pareene does follow the above with a direct quotation from Rand Paul. Everyone ready? Remember, Pareene said Paul wasn’t afraid to come out and say: “We must blame Muslims more or less as a homogeneous undifferentiated mass.” OK ready? Here’s what Rand Paul actually said, which Pareene then paraphrased that way:

Ever since 9/11, commentators have tried to avoid pointing fingers at Islam, which is somewhat fair. It is fair to point out that most Muslims are not committed to violence against Christians, but it’s not the whole truth. The whole truth is – and we shouldn’t let political correctness stand in the way of this truth – the whole truth is that there is a minority of Muslims who condone killing of Christians, but, unfortunately, that minority number is in the tens of millions.

Like I said, in this article Alex Pareene more or less endorses Rand Paul for 2016.

A U.S. Carbon Tax: The Rest of the Story (Part 1 of 4)

Over the summer, I organized a conference for the Institute for Energy Research (IER). My purpose was to present truly “consensus” facts from the economics literature on carbon taxes. If you will go with me on this journey, I am pretty sure you will realize that the case for a carbon tax is much weaker than you have been led to believe, ESPECIALLY if you are a professional economist interested in climate change issues.

I gave the first talk, shown below. If you want to see my commentary on this video, go here. But I encourage you to just click “PLAY” and let the deprogramming begin…

Krugman on Treasury Default: 57% of the Budget “Isn’t That Much”

I realize I’m blogging a lot of my favorite Keynesian lately, but he keeps pushing the envelope. In the debt ceiling saga, the standard line of the Administration and its defenders is that Republican obstinancy will force Treasury Secretary Lew to default on government bonds, thus causing a global financial meltdown. Plenty of people (not just me but David R. Henderson and Steve Landsburg) have pushed back, saying that of course this isn’t true. The government has enough money coming in from taxes to pay off bondholders, if it wanted.

So here’s Krugman’s post today to deal with that argument:

The debt ceiling situation remains extremely foggy….And nobody knows what comes next. The immediate question is whether Treasury can, in fact, “prioritize” — pay interest on the debt while stiffing everyone else, from vendors to Social Security recipients. If they can, they might choose to do this to avoid financial meltdown.

But as I and many others have emphasized, even if this is possible, it would be a catastrophe, because the Federal government would be forced into huge spending cuts (Social Security checks and Medicare payments would surely take a hit, because there isn’t that much else). [Bold added.]

OK now let’s stop and think about what he’s saying here. Can everyone agree that Krugman is arguing that

(a) net interest to Treasury holders

(b) Social Security

and

(c) Medicare

constitute such a large fraction of the budget, that it would be impossible to make payments to all three categories if the Treasury is forbidden from borrowing more money? Krugman isn’t here making a political or a security argument, saying something like, “I predict Lew will stick it to Social Security and Medicare recipients, because that’s the path of least resistance” or “I predict Lew will stick it to Social Security and Medicare recipients, because otherwise we’ll be taken over by terrorists.”

Nope, Krugman is saying that once you add up those three categories, “there isn’t that much else” to cut from the budget.

Let’s see just how wrong this statement is:

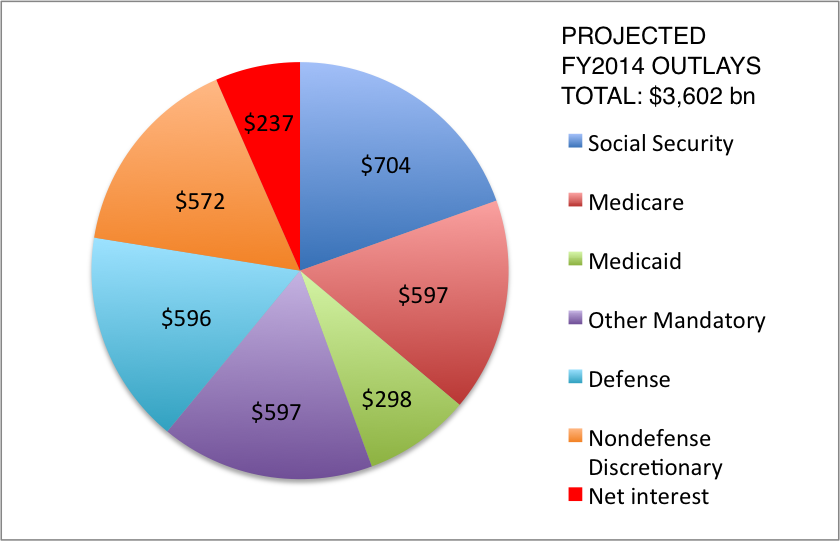

So, those three categories add up to $1.538 trillion, out of total projected outlays of $3.602 trillion. In other words, they constitute only 43% of the total budget. So the other 57% of the federal budget is “isn’t that much else” in Krugman’s mind.

Last way of putting this: The projected cashflow deficit for FY2014 is $560 billion (at least back in May when CBO made its projections). Nondefense discretionary spending alone (at $572 billion) could thus cover it. Everyone got that? According to the government’s own (loaded) classification system, it could still pay all bondholders, meet all “mandatory” spending obligations (which covers Social Security, Medicare, and Medicaid), and it doesn’t need to cut a penny from defense, all within a balanced budget.

Now if Obama, Lew, Krugman, et al. want to argue, “No way should we have to cut spending, we’re wrecking the world economy to teach these Republicans who’s boss,” OK fine. But thus far they have been saying things that are simply not true.

Really: I am curious for a Krugman acolyte to defend his statement quoted above. How can he possibly claim that 57% of the budget “isn’t that much else”? This is ridiculous.

Potpourri

==> I think President Obama should read from this website in celebration of Columbus Day, in order to win over Sean Hannity.

==> My favoriet go-to guy for climate science is Chip Knappenberger. Here’s his archive at Cato. In particular, y’all should be aware of the skullduggery in the latest IPCC report (AR5), in which they hem and haw about the fact that almost all of their models overpredicted the actual amount of warming that occurred during the last 15 years. And here’s Roger Pielke Jr. on the attempt to associate “extreme” climate events with human emissions. This one is not even close; even the IPCC doesn’t try to make the case, so you’d think people in the media and government would drop it. But don’t worry: By the year 2047 we will have definitive proof, according to a new study; so let’s go ahead and tax carbon.

==> John Cochran (not the Chicago John Cochrane with an “e”) has a good article on stimulus at Mises.org.

==> Jeremy Hammond, Steve Landsburg, and David R. Henderson all jump on Krugman for various things.

==> In a liquidity trap, it’s expansionary when the Post Office destroys stamps.

==> This is why I didn’t go into modeling.

==> An interesting post from Gene Callahan on Mises and Hayek.

==> Did I ever mention that I can’t stand Neil deGrasse Tyson?

==> Not even military officials give disinformation about ninjas.

Krazy Krugman Kalls

This is mostly bookkeeping for myself, if and when the Krugman Debate happens. I’m noting the best botched predictions (that I hadn’t previously known) that Niall Ferguson had found in his 3-part series.

Krugman likes to pride himself on having noted the housing bubble well before most others. Now what’s odd is that Krugman gave (nuanced) support for Greenspan’s creation of the housing bubble, even as late as 2006, but put that aside. What Ferguson made me realize is that Krugman didn’t realize the consequences that would follow from it.

==> On January 1, 2008, Krugman wrote:

So did the U.S. economy dodge a bullet?

Yes, it did — which is why I haven’t been as sure about a looming recession as, say, Larry Summers or Marty Feldstein, let alone Nouriel Roubini. (No, I’m not always a doom and gloom guy — only when the situation warrants, which has been pretty often lately.)

While we dodged a bullet, however, there are between one and three more bullets headed our way.

First, housing has further to fall. There’s been a further plunge in building permits and starts since the credit crunch began in August; these take a while to be reflected in construction spending, so there’s a fresh hit to GDP definitely in the pipeline. Even now, residential investment as a share of GDP is only down to its long-run average; you’d expect it to fall below that average for an extended period.

Second, there are hints of a slump in business investment, especially commercial real estate, which seems to have had a bubble of its own and is feeling the effects of the credit crunch.

Third, there are hints that consumers have finally started to cut back.

On the other hand, exports still seem to be growing fast.

So I’m actually uncertain about where things go this year.

UPDATE: When interpreting the above quotation, remember that the recession officially began in December 2007. So the above is a failed post-diction.

Also, notice that (apparently) Martin Feldstein and Larry Summers predicted the recession sooner than Krugman did. I guess that’s why Krugman and his followers laud these guys so much?

==> Then, in February 2008, Krugman was still saying:

Carmen Reinhart and Ken Rogoff have an alarming paper on parallels between the United States and countries that have experienced financial crises in the past. The bottom line of the paper, which has already gotten a lot of attention, is that we look an awful lot like those other countries — and that if their experience is any guide, things could get really, really bad.

…

The truth is that I’m not nearly as pessimistic as some. But comparisons like this do worry me.Update: So does this: the Fed reports that banks are sharply tightening credit. This suggests another downward leg in spending ahead.

So yeah, it’s good that he was starting to get antsy–though “not nearly as pessimistic as some”–seven months before all hell broke loose, and two months after the recession officially began. But I’m not sure it shows how awesome his much-ballyhooed model is. In any event, using Austrian business cycle theory, for a bank client in July 2007 I became far more alarmed than what Krugman is saying above, as of February 2008. A simplified version of that analysis ran at Mises.org in October 2007.

Last point: Notice the difference in analysis. I was explaining why I though there were “real,” structural problems with the economy. In contrast, Krugman is just trying to predict how much various groups will spend. Sometimes it’s breathtaking when you see the huge chasm between Austrian and Keynesian macroeconomics.

Krugman on America Becoming Greece: “Show Me the Model!”

Professor Paul Krugman, scientist, has patiently been showing with his formal analysis that it’s literally impossible for a country with most of its debt denominated in its own fiat currency, to have a Greece-like catastrophe, at least while it’s stuck in a liquidity trap. If anything, a loss of investor confidence would help such an economy. Indeed, Professor Krugman has become so exasperated that in his latest post on the topic, in which he can’t believe that Ken Rogoff still isn’t seeing the point, Krugman says this:

Just to come back to my original point: I find it quite remarkable that nobody has managed to produce a coherent model to justify the seemingly simple story that anyone, even a country that borrows in its own currency, can suddenly turn into Greece. Again, show me the model!

In that context, someone should send Krugman this video (HT2 Niall Ferguson):

Recent Comments