Larry Summers: Artificially Low Interest Rates Cause Bubbles

Tyler Cowen finds this quotation from Larry Summers writing in the Washington Post:

The second strategy, which has dominated U.S. policy in recent years, is lowering relevant interest rates and capital costs as much as possible and relying on regulatory policies to ensure financial stability. No doubt the economy is far healthier now than it would have been in the absence of these measures. But a growth strategy that relies on interest rates significantly below growth rates for long periods virtually ensures the emergence of substantial financial bubbles and dangerous buildups in leverage. The idea that regulation can allow the growth benefits of easy credit to come without cost is a chimera. The increases in asset values and increased ability to borrow that stimulate the economy are the proper concern of prudent regulation. [Bold added.]

I have two reactions:

(1) Remember a few months ago when I said that Larry Summers (and Krugman, who was jokingly accusing Summers of plagiarism for taking Krugman’s position) was confirming the Austrian position, and some of you clowns denied that they said low interest rates lead to bubbles? Well, I hope you email Summers and tell him he just misrepresented himself.

(2) Summers and I agree on the positive question: The string of bubbles in recent decades is due to the textbook policy response of the Fed lowering interest rates in response to a bad economy. We just disagree on the normative question: Summers thinks an economy going through successive bubbles is better (“far healthier”) than one spared a string of bubbles, whereas I hold the opposite judgment.

Am I a Creationist?

Someone recently asked me this. I am pretty sure I said “no,” but only because I know that the person meant, “Are you committed to the view that God created all of the various species in a literal 6-day timespan as laid out in Genesis?” I am not committed to that position, and so I said “no.”

But actually, anybody who’s a monotheist in the tradition of the West’s major religions would be a creationist in the sense that, “I believe in a supreme Being, and yes He created everything in the universe.” For example, it would be ridiculous if I said, “I believe J.K. Rowling created James and Lily Potter, but that natural reproductive mechanisms explain the birth of Harry Potter, whom Rowling did not create.”

More generally, there is a massive amount of confusion about what it means if someone challenges the standard Darwinian paradigm. For example, Michael Behe is one of the leaders of the Intelligent Design movement; his signature argument is the claim that the bacterial flagellum could not have plausibly arisen through incremental improvements favored by natural selection.

Now a lot of cynics simply assume that Behe must think God created the bacterial flagellum in its present form, about 6,000 years ago. But no, as I understand it, that’s not Behe’s position at all. I am pretty sure Behe has no problem if someone claims the earth is billions of years old, and that all current life forms can trace their origin back to a single ancestor.

Rather, what Behe objects to is the claim that is repeatedly made by modern Darwinians–though they often might not realize that they are making it–that all you need to explain today’s structure of life forms is random mutations and the time span of the universe. In particular, modern Darwinians will often argue (again, not realizing that this is a distinct claim from the hypothesis of common descent) that there is no guidance or intelligence necessary to the entire explanation. To repeat, this is a much stronger claim than to say that all life forms evolved from a common ancestor.

Now you can say Behe hasn’t made a good case; that’s fine. But what really frustrates me in these debates is when people say that in principle his claim is “un-scientific.” No, it isn’t. Suppose for the sake of argument that intelligent aliens evolved in another solar system, then traveled to Earth a few billion years ago. At that time, Earth was completely barren of life, but it had potential. So the aliens designed a super seed cell, which contained the genetic blueprints for all of today’s various species, then turned it loose on the planet.

According to a lot of the critics of the ID movement, if the above did happen, then scientists are forbidden from even trying to come up with possible ways to test this hypothesis and learn the truth. They can think about it on Sunday in church, but from Monday through Friday at their actual jobs, they are forbidden from wondering what the evidence would look like if the above were true, versus a completely terrestrial origin of life.

Potpourri

==> Not only do they have huge audiences, but Lew Rockwell and Alex Jones have awesome radio voices.

==> Tom Woods and I discuss ObamaCare. We’re not fans. (Hopefully no one will get pregnant in 2014.)

==> My understanding is that I make an appearance in this BitCoin discussion.

==> The Lara-Murphy Report interview with Gerald O’Driscoll.

==> Jeff Tucker on the Nutcracker.

==> Richard Ebeling isn’t afraid of (market) deflation.

==> I thought this was an interesting article on sexism in science. I too find that people underrate my intelligence in light of my physical attractiveness. (Oh c’mon you know I had to make a joke like that.) The part about the obituary was especially interesting, because I could see someone arguing that during a transition phase, people have to battle the stereotypes by writing such pieces. However, judging by his comments, I don’t think that’s what the obituary writer was doing; he “just doesn’t get it” as the feminists would say. (I’m not being sarcastic, I think there was an issue with his obituary, and that he doesn’t see why it reflects a double standard.)

Memorial Video for the “Night of Clarity” 2013

Matt Harris (with help from wife Pacey) put together this excellent memorial of the event Carlos Lara and I hosted last summer in downtown Nashville. Stay tuned for the NOC 2014!

Krugman Unwittingly Confirms Scott Sumner’s Whole Point

[UPDATE below.]

Free Advice readers know that if i’m Batman, then Paul Krugman is the Joker while Scott Sumner is the Riddler. (Now that I re-read that sentence, it turned out even cooler than I had imagined when I started typing it.) So this raises the question: What if Krugman ever directly attacks Sumner? Which side do I defend?

Well in this case, the answer is easy, since Krugman is so obviously making Scott’s own point for him. Before I quote Krugman, let’s review Scott’s position:

==> According to Sumner, the fiscal multiplier is basically zero, assuming that the Fed is doing its job. That’s because of monetary offset. Let’s say we have a demand shortfall, leading to unemployment above the natural rate. That would prima facie give scope for Congress/President to run a budget deficit and boost output without causing significant price inflation. Yet the only reason this is possible (according to Sumner), is if the Fed is engaging in too tight monetary policy. On the other hand, suppose the feds go ahead and enact a fiscal stimulus package. The Fed could simply tighten yet again, in order to achieve the same level of slack/low price inflation they had originally (and which the Fed desired for some inexplicable reason). Thus, once you take into account the Fed’s ability to offset fiscal action, and furthermore when you realize the only possible scope for corrective fiscal action is if the Fed is (a) asleep at the wheel and (b) refrains from sabotaging the fiscal action, which it always has the power to do, then you realize the Keynesians are really wrong.

==> Further, according to Sumner, a great illustration of this is the year 2013. We had the sequester and government shutdown, with Keynesians flipping out about this “unprecedented austerity” and how awful it was to cut spending at this critical juncture in our tepid recovery. Yet the Fed postponed the taper and made other expansionary moves, even explicitly mentioning the need to cushion the blow of sequester in some of its announcements. Since the Fed was able to offset the effects of the sequester in 2013, Sumner concludes triumphantly, clearly the Keynesians are wrong for focusing so much on fiscal policy and flipping out whenever Republicans want to trim the budget deficit.

OK, I think that is a fair summary of Sumner’s position. Now watch Krugman attack it on January 4, 2014:

One way to look at the US economy in 2013 is that it was, in effect, trying to begin a strong recovery, but was held back by terrible federal fiscal policy. Housing was making a comeback, state and local austerity was, if not going into reverse, at least not getting more intense, household spending was starting to revive as debt levels came down. But the feds were raising the payroll tax, slashing spending via the sequester, and more.

Incidentally, these other factors are why I don’t take seriously the claims of market monetarists that the failure of growth to collapse in 2013 somehow showed that fiscal policy doesn’t matter. US austerity, although a really bad thing, wasn’t nearly as intense as what happened in southern Europe; it was small enough that it could be, and I’d argue was, more or less offset by other stuff over the course of a single year. [Bold added.]

It would be hard for someone to confirm his opponent’s position more than what Krugman just did. I mean, that would be like arguing that Austrian business cycle theory is wrong, because the evidence suggests central banks can affect the timing of business cycles. Oh wait, Krugman did say that in his critique of me. (See the section “Answering Krugman” in my reply.)

UPDATE: At his blog, Scott makes the case even more strongly, by quoting what Krugman actually wrote in April 2013:

[A]s Mike Konczal points out, we are in effect getting a test of the market monetarist view right now, with the Fed having adopted more expansionary policies even as fiscal policy tightens.

And the results aren’t looking good for the monetarists: despite the Fed’s fairly dramatic changes in both policy and policy announcements, austerity seems to be taking its toll.

Sorry Krugman fans, he completely stepped in it this time. Back when he thought the data would go his way, he declared 2013 a good test of market monetarism’s claims about fiscal policy. Then when the data moved against him, he said 2013 wasn’t really a good test because other things could offset what happened to fiscal policy.

Keynesians Wrong on Sequester Just Like Stimulus

My latest post on Mises Canada. The money part:

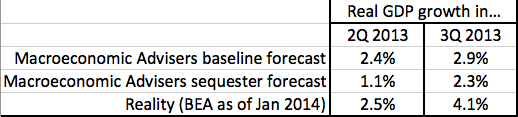

For example, in February 2013 Paul Krugman wrote a piece titled “Sequester of Fools,” in which he referred to the “fiscal doomsday machine” that was being unleashed upon the nation. He claimed that the sequester would cost 700,000 jobs, and justified this number by linking to a Macroeconomic Advisers analysis, which was completely Keynesian in its approach. It said (just as Krugman and the others said, in decrying the sequester) that reduced government spending would reduce economic growth. The Macroeconomic Advisers analysis first made a baseline forecast of U.S. growth without the sequester, then showed what GDP growth would be (broken down by quarter) if the sequester occurred. The bulk of the action occurs in the 2q and 3q of 2013. We are now in a position to compare the Keynesian forecasts to reality (as codified by the Bureau of Economic Analysis):

As the table…shows, we have the mirror image of the stimulus debacle: Actual U.S. GDP growth in both quarters was greater with the sequester than what the Keynesians told us would be the case without the sequester.

But remember, the IS-LM framework has come through this period with flying colors.

A Tribute to Ben Bernanke

This contains a technically true but very misleading narrative, making me now doubt the Rudolph Record. (HT2 Greg Mankiw)

To Understand Public Policy, First Understand Markets

That’s the title of my promo for next week’s 6-week Mises Academy online class, going through the middle section–covering the economics of the pure market economy–of my textbook, Lessons for the Young Economist.

Recent Comments