Video (and Fun Intro) to Live Audience Contra Krugman

Dedicated fans have already heard the audio of the actual episode of Contra Krugman that we recorded in front of a live crowd in Seattle, but this video from the Mises Institute captures the intro from Betsy Hansen and my remarks about Walter Block in his high school glory days.

“Get to Higher Ground”: Behind the Message

In this new video, Dan Hagen and I explain why we wrote our song, and our hopes for music to spread the message of liberty.

How Much Would You Pay to Vote?

I think I’ve come up with a thought experiment that will get us through the logjam. I’m not saying this will make everyone agree with me, but I hope it finally gets people to realize that you can’t simply ignore marginal analysis when it comes to voting.

I Stand Athwart the Blogosphere, Yelling Stop

I waited several days to write about this, because it may sound like I’m calling for someone to be fired when that’s not my intention. All I want to do is point out that it’s weird that on one of the leading classical liberal / free-market economics blogs, the resident monetary excerpt applauds the Russian central bank for letting consumer price inflation break 16 percent.

Furthermore, when explaining how the Russian central bank maintained a good labor market despite a collapse in oil prices, the resident free-market monetary expert quotes the following with no criticism:

To maintain reserves when the oil price began to fall, Ms Nabiullina [head of the Russian central bank–RPM] accelerated a plan to allow the rouble to float. It fell by 40% against the dollar in 2015 alone. Propping up the rouble would have been popular, since it would have preserved ordinary Russians’ purchasing power, but it would have meant burning through the country’s reserves again. Instead the CBR channelled dollars to sanction-hit banks and energy companies, to help them repay external debt. Reserves have also been used to finance the budget deficit. As oil prices recover, so the CBR is again accumulating reserves, with a view to hitting the $500 billion mark once again.

Now to be sure, I have been following Scott Sumner’s writings since 2008, so I understand exactly what led him to write his post. He’s not “for” price inflation, rather he’s “for” doing whatever it takes to keep NGDP rising, even if that means double-digit consumer price inflation.

And regarding the block quote above, it’s certainly not that Scott is in favor of the Russian central bank channeling dollars to banks and energy companies, but rather that he was so busy praising them for having the courage to let price inflation break 16 percent, that he didn’t want to distract EconLog readers by criticizing the bailouts of major players.

While I’m complaining, let me bring up two other points:

==> As David R. Henderson noted in the comments, Scott was taking credit for NGDP targeting even though he (initially, at the time he first posted) had exactly zero data on Russian NGDP. It would be as if I heard that some foreign country had a big drop in its unemployment rate and I said, “Although I haven’t been able to find any news accounts of policy changes, the drop in the UR is evidence that they must have improved their score on the Economic Freedom Index.” I am pretty sure I wouldn’t write something like that.

(For what it’s worth, Scott later found out that “NGDP growth slowed from 9.6% in 2014 to 3.2% in 2015, to a predicted 5.8% in 2016.” Is that really NGDP targeting? I think if the unemployment rate had skyrocketed in 2015, Scott could quite plausibly have claimed, “Well what the heck did they THINK was going to happen, letting NGDP growth plummet two-thirds in a year?!”)

==> Scott’s preferred metric is of course NGDP growth, but sometimes “when in Rome” he’ll switch to talking about policy rate hikes or cuts as a proxy for central bank tightness or looseness. Yet the one thing he NEVER talks about is the quantity of money. For example, in this post about the Russians being much better central bankers than the Americans because the former were willing to let their currency fall and CPI to hit double digits, nowhere does Scott compare what happened with the monetary base in the open-minded Russians versus the tightwad Americans.

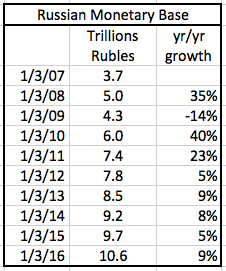

And yet, if this link is accurate, it turns out that we have the following stats for Russian monetary base:

If you go back and look at Scott’s second chart, when he was praising the Russians for letting inflation increase sharply, the big jump occurred in the end of 2014 and throughout 2015. But glancing at the table above, we see that this is actually a period when the Russian central bank was relatively tight, compared to its normal policy (save for the big plunge over 2008).

Yet again, had the Russian unemployment skyrocketed in 2015, Scott could quite plausibly have complained, “Well what did they THINK was going to happen?! Monetary base growth was far lower than it had been just a few years earlier. How are people supposed to sign long-term contracts when the Russian bank is inflating at a rate of 23% through 2010 but 5% through 2014?”

In closing, let me just say that besides the weirdness (to me at least) of a classical liberal blogger praising double-digit price inflation, it also seems weird to me that today’s market monetarists never even bother talking about the quantity of money. I’m always having to go look it up and see how the quantity of money relates to the market monetarist interpretation of an event, since that’s the last thing market monetarists care about.

Let me vainly try to forestall an obvious retort from Scott’s fans: Yes, I KNOW that Scott thinks interest rates and the growth in monetary base can be misleading policy indicators. But as we saw in this very episode, Scott will cite NGDP growth as doing the trick, without even knowing what the numbers are, and even though the numbers (once we find them) are just as (or even more?) consistent with a story about the bank deviating from Scott’s recommended policy and slamming on the brakes to try to arrest the ruble’s plunge.

Contra Krugman as You’ve Never Heard It Before

In front of a live audience! This was from last Saturday’s Mises Circle in Seattle. Good stuff.

How Governments Use Inflation to (Partially) Cover Deficits, Part 2

The scintillating conclusion to our 2-part series at the Lara-Murphy Show.

Also, since I’m such a fair guy, let me point you guys to a critical comment that came in regarding an old blog post about the minimum wage. I thought this was a pretty good critique (though I still think making unskilled labor more expensive means that employers buy fewer hours of it).

It’s Apparently Opposite Day at Krugman’s Blog

For our first ever live audience taping of a Contra Krugman episode on Saturday, Tom and I tackled this op ed from Krugman on inequality.

Naturally we were skeptical of Krugman’s claims, particularly his glowing references to Denmark. But I had no idea just how duplicitous Krugman’s argument was. But Glen Raphael, a commenter on David R. Henderson’s post at EconLog, caught the following:

Later in the article, Krugman writes:

“How does Denmark do it? Partly with higher taxes and bigger social programs, but it starts with lower inequality in market incomes, thanks in large part to high minimum wages and a labor movement representing two-thirds of workers.

“If you follow the link to “high minimum wages”, the first sentence of non-title content is “There is no legally stipulated minimum wage in Denmark.”

Now if you go and look at the link, and then circle back and see that Krugman put a plural on “minimum wageS,” you understand what he must have meant. Namely, there are collective bargaining agreements that ensure “minimum wages” for various types of workers. (Though even on his own terms, it seems Krugman would have to admit that 1/3 of the workers in Denmark are not explicitly covered in this way?)

But boy oh boy, would anybody have thought that from Krugman’s own wording? It sure sounds like he thinks U.S. politicians should raise the minimum wage to be more like Denmark, don’t you think? (As opposed to: Abolish the federal minimum wage.)

Two Good Verses

James 4:7:

“Submit yourselves, then, to God. Resist the devil, and he will flee from you.”

Proverbs 9:10:

“The fear of the LORD is the beginning of wisdom, and the knowledge of the Holy One is understanding.”

Recent Comments