More Heretical Thoughts on Inflation

I know, I know, the “bond market” is telling us that there will be low price inflation as far as the eye can see, so I’m just supposed to ignore everything else that is screaming, “Danger danger, Will Robinson!” Now we Austrian types have argued that maybe the yields on US government debt are low because, oh I don’t know, the Fed has purchased a trillion of it and is committed to keeping its yield down for another two years. The deflationist response involves stocks and flows in a way that always baffled me (and Batman’s sidekick).

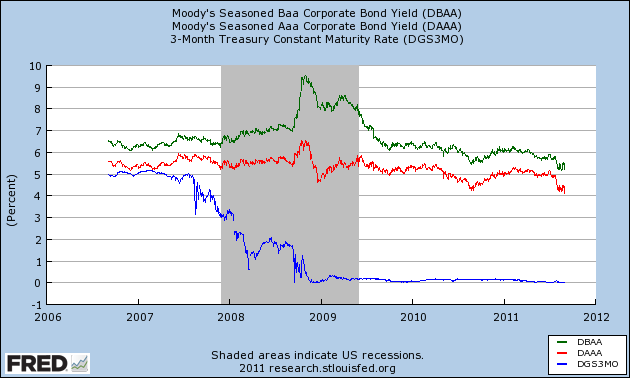

Anyway, for my Sovereign Debt Crisis class at the online Mises Academy, I just cobbled together the below chart (to make an unrelated point):

The above chart doesn’t look to me like investors around the world have rushed into safe assets, and that’s why (incidentally) yields on Treasuries are so low. (If that’s what were going on, wouldn’t the spread between AAA and BAA be bigger now than it was in 2007?) It also doesn’t look to me like there’s a glut of desired saving that can’t clear because of the 0% lower bound. (If that were the case, wouldn’t corporate yields be at least a few points lower now than in 2007?)

Admittedly, the above chart doesn’t by itself scream out, “Price inflation is coming! Run!”

If I didn’t know any better, I’d say that the world is a lot more complicated than economists give it credit for.

David Friedman Perpetuates the “Buy and Hold” Myth

David Friedman has a very interesting post up concerning equity versus bonds. Whenever economists start thinking about the stock market, we get tied into knots. (In this case, Friedman ends up concluding that profiting from insider trading is mathematically impossible, and not for the reason you might think.) I’m not criticizing Friedman on that score, incidentally; it’s worth thinking through these things, even though (like with the finitely repeated prisoner’s dilemma) such “rationality” often leads to something that common sense needs to veto.

Anyway, it’s not with Friedman’s armchair reasoning that I have a problem. Rather, it’s a casual empirical claim. He writes:

In the U.S. in the 20th century, stocks have consistently outperformed bonds. For an economist, this is puzzling. If you consistently get a better return buying stocks than buying bonds, why does anyone buy bonds? One would expect investment to shift out of bonds and into stocks until the return on both investments was equal.

There are several solutions that other people have offered to this puzzle. One is to argue that investors are risk averse and bonds have a more predictable yield; the rebuttal has been that, except over very short time periods, stocks almost always outperform bonds, so nobody investing for more than a few years can reduce his risk by buying bonds. Another is to claim that the U.S. market in the 20th century is a special case; investors in stocks just happened to be lucky, many times over.

It’s the part in bold that shocked me. My reaction was, “What in the world is Friedman talking about?!”

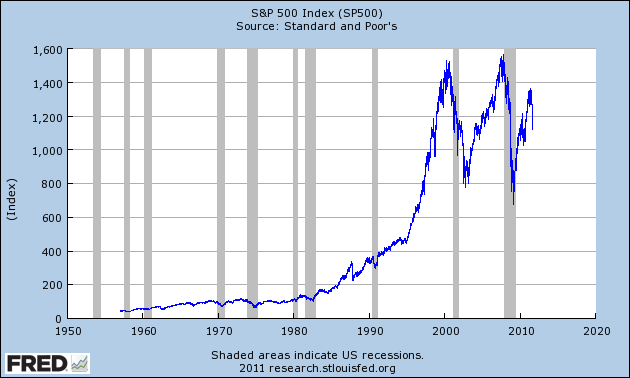

For example, one of my favorite charts recently has been the long-term S&P 500:

It’s true we would technically need to worry about dividends, but c’mon: People who bought into the market in 1999 have yet to break even. That’s a heck of a long time to wait for the magic of “buy and hold” to assert itself.

Some people in Friedman’s comments pointed this out, and others rushed to his defense, sarcastically noting that post-2000 is not in the 20th century.

OK great. How about this test? Would you rather have invested in stocks or bonds, during the two decades from 1970 to 1990? The 1970s had massive price inflation, so surely being stuck in bonds would’ve killed you, and the 1980s had the Reagan boom, so the stock market should’ve taken off like a rocket. Plus, we’re not talking about a piddling year or two pullback here; we’re talking about 20 frigging years.

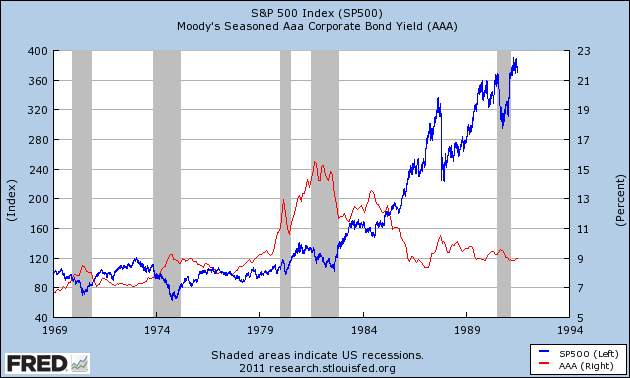

So if Friedman’s casual claim is to be correct, surely the equity investor should have destroyed the bond investor from 1970 to 1990, right? Let’s roll the film:

The above chart shows the level of the S&P 500 in nominal (not inflation-adjusted) terms (blue, left axis), against Moody’s AAA seasoned corporate bond yield (red, right axis). From 1970 to 1990, the S&P appreciated 287%, for an average compounded annual growth rate of 7%.

We can stop right there. We don’t need to do any fancy calculations to see how bonds did. For the entire period, they yielded at least 7%, and reached yields as high as 15% in the early 1980s. Moreover, bonds didn’t drop 20% in a single day as stocks did in 1987.

All in all, I don’t think there’s any puzzle here as to why people still hold bonds. Friedman might want to quibble with my comparisons; for example, some bonds, even ones rated AAA, might have defaulted in that 20-year period. But the above comparisons aren’t even close. Friedman made it sound like there were just a few pockets in the 20th century when bonds outperformed stocks, yet that isn’t true.

I don’t have a citation, but “black swan” author Nassim Taleb gave a paper at the Austrian colloquium at NYU one time, arguing that the “equity premium puzzle” disappears once we plug in a more accurate distribution of stock returns. When investors aren’t using a Gaussian (think “normal”) distribution, and instead more realistically take into account events in the market like 1929-1932, 1987, and 2008–rather than treating them as “once in a million year” outcomes, as the typical models do–then you don’t need unrealistically high risk aversion to get investors to hold some of their wealth in bonds.

Paul and Perry Campaigns Battle Over Reagan

This is hilarious. The Paul campaign put out this attack ad on Rick Perry:

So in response, did the Perry campaign show that Paul, say, was the Texas campaign chair for Clinton’s 1996 re-election bid? Of course not; Ron Paul would never have done such a thing.

Instead, the Perry campaign posted this letter (HT2 Iowa Independent) from Ron Paul explaining why he was leaving the GOP. It contains such shocking things as:

All Republicans rightly chastised Carter for his $38 billion deficit. But they ignore or even defend deficits of $220 billion, as government spending has grown 10.4 percent per year since Reagan took office…

Even worse, Big Government has been legitimized in a way that Democrats could never have accomplished. It was tragic to listen to Ronald Reagan on the 1986 campaign trail bragging about his high spending on farm subsidies, welfare, warfare, etc…

Yep, those two events seem roughly analogous to me, and I’m sure to the average Sean Hannity listener too. Rick Perry was reputedly* Al Gore’s campaign chair in Texas, and Ron Paul was mad that Reagan ran unprecedented budget deficits. As a compassionate conservative once said, “Bring it on!”**

* I say “reputedly” because there is some doubt. But check this out:

Ray Sullivan, a spokesman for Perry’s presidential campaign, recently told us by email: “We have no record or recollection of any leadership position” for Perry in Gore’s 1988 campaign.

Asked why Perry did not say as much when a 1998 opponent repeatedly lofted such claims, Sullivan replied: “We did not (have) access to information about the Gore ’88 campaign organization and therefore 10 years later could not definitively say one way or the other.”

Is that not the oddest denial you have ever read? Are they saying Rick Perry wasn’t sure if he was the campaign chair?!

** Not that I vote. Remember kids, politics is a waste of time.

I’m Sorry, I Still Fail to See Why We’re In a Deflationary Trap

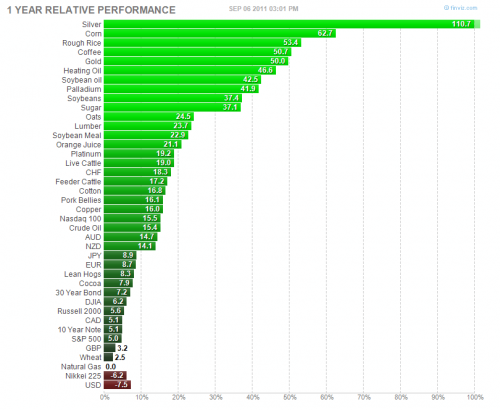

Apparently taking Krugman’s side in the inflationista/deflationista debate, MMTer regular MamMoTh in the comments points us to this chart:

Like I said, MamMoth seems to think the above chart should somehow embarrass the Austrians worried about inflation. I have to confess, I’m not seeing how soaring commodities, with silver and gold at the head of the pack, coupled with a losing USD, show up the Austrians. But then again, MamMoTh named himself after an extinct animal and capitalized various letters to show his unwavering support for MMT, so there’s a lot I don’t understand in the world.

Krugman on Gold: I Am Clairvoyant

This almost freaks me out. The handful of people who regularly tune into my Saturday “office hours” for Mises Academy classes can verify this: It was literally just last weekend when I said something like, “I mean, if it weren’t for gold prices, I might be really concerned about my worldview here. It does trouble me that bond prices are so high; am I really saying all these smart guys in the market are idiots? But on the other hand, the soaring price of gold and silver during this slump should be keeping Sumner and Krugman up at night, too.”

Obviously that’s not an exact quote, but I kid you not, I said something along those lines. And then today I read at Krugman’s blog:

“(Yes, it’s 4:30 AM where I am. I found myself wide awake, thinking about gold prices. You got a problem with that?)

In assessing economic prospects since the financial crisis of 2008, there have been two kinds of people: …inflationistas and deflationistas….

I am, of course, a big deflationista, and as I see it record low interest rates strongly vindicate my position. As I like to point out, if you’d believed the inflationistas at the Wall Street Journal and elsewhere, you would have lost a lot of money.

But what about gold? As some readers and correspondents love to point out, you would have made a lot of money if you’d bought gold early in this mess. So doesn’t that vindicate the inflationistas, to some extent?

My usual response has been that I have no idea what drives the price of gold, to say that it’s a market driven by hoarding in Asia, Glenn Beck followers, whatever. But maybe I’ve been too flip here. Why not think about what actually should be driving gold prices? And I mean think about it, rather than going for slogans about inflation, debased currencies, and all that.

Well, I’ve been thinking about it — and the answer surprised me: soaring gold prices may be quite consistent with a deflationista story about the economy.

Karl Smith, a Gracious Loser

I’m not insulting him, really; check out his post.

And for all of you cheapskates, here is the free debate:

(If anyone feels taken advantage of, let me declare that they hadn’t decided to post it when I was giving instructions on how you could pay and watch the debate after the fact.)

The Theme Song for European Central Bankers

Apparently today would have been Freddie Mercury’s 65th birthday. (And people told me Facebook was useless.) In honor of him:

Introducing the Mises Institute of Canada

On Saturday, September 10 I will be participating in the Mises Institute of Canada’s conference, “Liberty and Oil: the Foundations of Modern Civilization.” As the official description says, we will discuss questions such as the following: “Is resource richness a blessing or a curse? Are Alberta’s oil reserves the source of the relative freedom and opportunity in Alberta, or do they represent a harbinger of future tyranny?”

Liberty and Energy, Intertwined

Rob Bradley, founder of the free-market Institute for Energy Research, knows all too well that liberty and energy issues go hand in hand. Bradley is one of the world’s leading experts on government intervention into energy markets, and he also happens to be an Austrian economist—he picked Murray Rothbard as his dissertation advisor.

Bradley’s career has been devoted to studying the economics and politics behind government intervention in energy markets. His doctoral dissertation, Oil, Gas and Government, is the definitive history of U.S. government meddling in this arena.

Why does Bradley devote so much time to energy issues? The name of his blog, MasterResource, gives a hint. Julian Simon famously christened the creativity of the human mind as the ultimate resource. Rather than viewing people as bellies who would overburden a straining planet, Simon instead looked at people as wonderfully powerful brains who would solve the technical problems of food supply and traffic congestion.

It was Julian Simon who made the famous bet with arch-Malthusian Simon Ehrlich (of Population Bomb notoriety). In 1980, Simon let Ehrlich and his pessimistic colleagues pick five commodity metals. Simon was wagering that their (price-inflation-adjusted) price would go down during the 1980s, while Ehrlich et al. thought that growing population strains would drive their prices up. In October, 1990 Ehrlich mailed Simon a check for $576.07, in accordance with the terms of the wager. Even though the world’s population had grown by more than 800 million people in the interim, nonetheless entrepreneurship had managed to render the five commodities less scarce in an economically relevant sense.

Rob Bradley is therefore paying homage to Julian Simon with the title of his blog. Simon recognized the human mind’s creativity as the ultimate resource. Bradley, however, realized that it takes energy in order for modern man to implement his bold ideas.

“The Left’s War on Terror”

In the summer of 2006 I began working for the Institute for Energy Research. I focused primarily on climate change economics, and in particular the case for a carbon tax (and cap-and-trade). (This research eventually led to a publication in The Independent Review.)

When Rob Bradley asked me to join IER and focus on climate change, he and I knew that this would be a major battleground in the struggle for liberty over the coming decades. When I mentioned my career path to the (U.S.) Mises Institute’s Jeff Tucker, he remarked, “Global warming is the Left’s War on Terror.”

As I thought about it, Tucker’s remark was quite insightful. Just as a war on “terror” by definition could never be won, so too the issue of global warming (or what is now called climate change) was open-ended, and could always provide a bogeyman around the corner to justify some new intervention.

There are other similarities. The War on Terror provides the interventionists on the “right wing” excuses to invade all manner of liberties, from bank transactions (because people might be laundering money) to web browsing (people might be reading jihad recruitment sites). By the same token, the crusade against climate change provides the interventionists on the “left wing” an opportunity to regulate smokestacks, tailpipe emissions, impose compensating “carbon tariffs” on certain imports, and even to tell people what type of light bulbs and insulation they need in their homes.

Furthermore, the issue of climate change gave a huge emotional and moral advantage to those wishing to intervene in the free market. Just as nobody wants to seem “soft” on terrorism, by the same token those who protest against carbon taxes or other regulations “to save the planet” are demonized as heartless monsters and/or hired guns for the big oil companies.

Liberty and Oil

The Mises Circle Calgary recognizes that at this point in the development of capitalism, oil still represents the backbone of Western economies and way of life. In another century this will presumably no longer be the case, but for right now, a relatively free market in oil (and natural gas) is essential for the everyday liberties that Americans and Canadians enjoy.

In the United States, federal intervention in oil markets reached its zenith in the 1970s, with explicit price controls and other bureaucratic micromanagement of the drilling and refining industries. The controls were partially rolled back under Jimmy Carter and then more completely under the Reagan Administration. It was not until recently, with the massive push for regulating carbon emissions, that such heavy-handed intervention seemed politically possible once again.

Canada too has flirted with outright socialization of the oil industry. The National Energy Program (NEP) was introduced in 1980 in the House of Commons by Marc Lalonde.

The Liberals’ NEP publicly sought energy self-sufficiency and conservation, two goals that are always popular among those wishing to interfere with producer and consumer choices in energy markets. The NEP created tax incentives and prohibitions to favor locally-owned oil firms, including a “back-in” provision through which Ottawa took an automatic fourth of the revenues from any oil or gas discovery made on lands controlled by Ottawa.

It turns out that Canada’s efforts at central planning in the oil market were as disastrous as all such attempts. In 1980 there were 9,188 wells drilled in Canada, but that had dropped to 7,186 the following year. The number of drilling rigs in operation likewise fell quickly from 650 to 450. Needless to say, thousands of jobs disappeared from the industry.

In more modern times, Canada’s huge deposits of oil sands are coming under political fire. Business groups, potential workers, and consumers who understand the benefits of lower energy prices are clamoring for the development of this bountiful resource, while environmental groups and other, competing energy interests stand in opposition.

Conclusion

The new Mises Institute of Canada is an ally in the intellectual battle for liberty. Their upcoming conference in Calgary will explore the intersection of liberty and unfettered energy markets. Join us in Calgary this Saturday, September 10th to celebrate the launching of the Ludwig von Mises Institute of Canada and the natural resources that fuel the Alberta economy.

Recent Comments