More Heretical Thoughts on Inflation

I know, I know, the “bond market” is telling us that there will be low price inflation as far as the eye can see, so I’m just supposed to ignore everything else that is screaming, “Danger danger, Will Robinson!” Now we Austrian types have argued that maybe the yields on US government debt are low because, oh I don’t know, the Fed has purchased a trillion of it and is committed to keeping its yield down for another two years. The deflationist response involves stocks and flows in a way that always baffled me (and Batman’s sidekick).

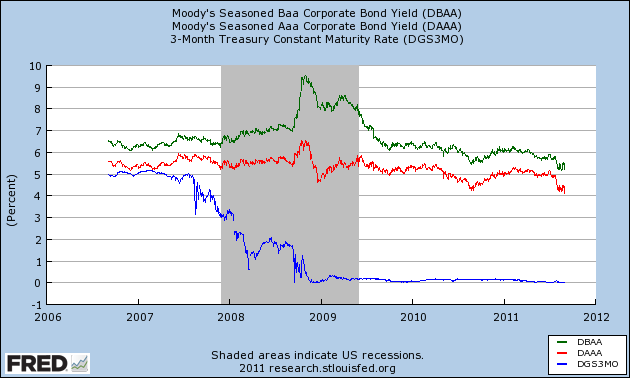

Anyway, for my Sovereign Debt Crisis class at the online Mises Academy, I just cobbled together the below chart (to make an unrelated point):

The above chart doesn’t look to me like investors around the world have rushed into safe assets, and that’s why (incidentally) yields on Treasuries are so low. (If that’s what were going on, wouldn’t the spread between AAA and BAA be bigger now than it was in 2007?) It also doesn’t look to me like there’s a glut of desired saving that can’t clear because of the 0% lower bound. (If that were the case, wouldn’t corporate yields be at least a few points lower now than in 2007?)

Admittedly, the above chart doesn’t by itself scream out, “Price inflation is coming! Run!”

If I didn’t know any better, I’d say that the world is a lot more complicated than economists give it credit for.

Bob, you’re comparing apples with oranges. You have to compare instruments of comparable liquidity. If you look at the 5-year, 10-year and 30-year treasuries of constant maturities you see that those start to diverge at the start of the crisis.

You will then see that the treasuries of longer maturity (and less liquid) are more comparable to corporate bonds.

http://research.stlouisfed.org/fred2/graph/?g=231

I’ve been trying to figure out this cunundrum, so let me toss out something.

There seems to be a monetary black hole. The Fed prints money by buying treasuries. Cash to banks. Debt to Fed. Banks pick up risk free spread by holding as excess reserves – Cash back to Fed. Government sells treasuries, bought by banks to capture low risk spread – Cash to Gov’t, Debt to Banks. Fed buys Treasuries from banks. Cash to banks. Debt to Fed. Cash to banks. Cash to Fed. Cash to banks….

Is any cash actually getting out into the economy? Has this setup distorted banking away from productive lending?

Brian, money is getting out there (assuming of course that the change is due to new loans.) : http://research.stlouisfed.org/fredgraph.png?g=236

The rise in investment seems to confirm it, although the rise is now declining; http://research.stlouisfed.org/fredgraph.png?g=239

No, I know it would be hard to tease out the effect from the data, but it seems odd that the Private Investment trend fell in mid-2010 just as the Fed was cranking out $600B in new money. Excess reserves actually climbed by just over $600B during that same period.

Have spreads compressed to a point where it’s more profitable to invest in treasuries than do the underwriting on AAA corporates? I’m just wondering if interest rate manipulations are distorting preferences in a bizarre way.

The question you need to ask yourself is, “why are banks increasing their excess reserves?”

The answer is because banks discovered in 2007-2008 that they had underestimated the riskiness of their assets (loans to individuals / businesses) . In order to ensure they could pay off their liabilities (deposits) they increased their reserves.

This also happened at the beginning of the great depression. In order to prevent massive deflation like happened at the beginning of the depression (fall in the money supply by 1/3) the Federal reserve pumped money in.

The reserves would have happened regardless, and are not existing just because the Fed bought securities.

If the fiscal authority was contracting relative to trend, then the QE might not have been sufficient to offset it. This is of course assuming that we’re living in a Keynesian/Monetarist world.

In this framework an increase in public debt/deficit can crowd in private investment as it stimulates the economy.

As for your second point: Firms are sitting on lot’s and lot’s of cash, according to the news anyway, there’s no reason why they’d be churning out bonds if they can finance the small things and some even the big things themselves. So it might not be supply of services, but rather it might be demand for underwriting.

Anyway, as I’ve heard, I am sure IB’s can spare the capacity to rake in some additional profit. They’re not exactly constrained at the moment.

I just don’t put any stock in the concept that corporations are sitting on mountains of cash. Who cares? It doens’t mean anything.

First, they don’t have cash locked up in vaults. Any “cash” would be at a bank, able to be lent out. Second, if they are holding treasuries, so what? That means they gave their cash to someone else. It can’t be deflationary unless cash is outside of the banking system.

Excess reserves play a role here I think. They may be an indicator of high demand for money.

You have to remember that banks

Accidentally submitted too early. Will post later.

Possibilities:

a) there is the Sumnerian “interest on reserves is contractionary” argument, I suppose;

b) one heard frequently up until recently, and I am assuming that it is still the case, that corporations were holding large amounts of money and raising debt even though it may have not been necessary (Higgsians might say that regime uncertainty played a role);

c) the recent reports that some bank(s?) were contemplating charging, in effect, a storage fee on deposits suggests an elevated demand for money;

d) is it reasonable to expect that even the highest quality corporate bonds would benefit from safe haven flows? Spreads do widen with the prospect of deflation but both high and low quality yields went up in late 2008 implying default risk was an increased concern for all corporates;

e) the market’s point estimate of inflation either reflects an expectation of high money demand or confidence in the Fed’s ability to withdraw liquidity as necessary;

f) monetary disequilibrium, even of the excess money supply variety, may not always manifest itself in the form of price inflation in components of current GDP alone but perhaps in other transactions as well – i.e., it’s the difference between the MV=PY vs. MV=PT formulations of the equation of exchange. I think perhaps the conventional view, to the extent that people think about it, is that EMH gets them off the hook for having to worry about the broader formulation of the equation of exchange. I may have that wrong though. Anyway, I keep asking about it but am usually met with silence. I believe however that Larry White, Armen Alchian and others have raised the point in various ways. From an interest rate or yield perspective, it perhaps makes sense though that the expected inflation component would reflect a consumption-related measure of inflation or GDP deflator even if “inflation” was present in other prices.