A Bald Economist Gives Financial Advice to Young People

That was my original title, but the suits in Auburn toned it down. An excerpt:

It seems counterintuitive, but when a religious person tithes (or when a nonreligious person gives to charitable causes) there is somehow more money each month to work with. For tithing — where a person is supposed to give a specific percentage of income to the church — I think it’s because the practice forces a person to stay on top of his finances.

More generally, by focusing attention away from oneself, things become clearer and it’s easier for a person to do the “responsible” things like avoiding impulse purchases and doing the extra work needed to bring in more income.

This last point is crucial for people who are suffering from depression and are in a financial hole. Part of what keeps them there is that, deep down, they don’t think they deserve to live stress free like the other people they see around them, who somehow have their act together and don’t let bills pile up on the kitchen table. By bringing in the church (or a charity that the person really respects), the depressed and financially beleaguered person can stop dwelling on self-loathing and instead focus on helping others.

Jesus Spoke Logically on Miracles

This is perhaps an anal little point, but apropos my thoughts on miracles and the laws of physics–where I say that by definition, God can’t break the laws of physics, because if He did then they wouldn’t be laws–here is Jesus (Mk 10: 23-27):

23 Then Jesus looked around and said to His disciples, “How hard it is for those who have riches to enter the kingdom of God!” 24 And the disciples were astonished at His words. But Jesus answered again and said to them, “Children, how hard it is for those who trust in riches[a] to enter the kingdom of God! 25 It is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God.”

26 And they were greatly astonished, saying among themselves, “Who then can be saved?”

27 But Jesus looked at them and said, “With men it is impossible, but not with God; for with God all things are possible.”

I think a lot of the people pooh-poohing me and saying, “Bob, God can do anything; He can certainly violate the laws of physics!” would probably also say, “God can do the impossible.” But note that’s not what Jesus said in the above.

In fact, Jesus’ stance on the (im)possible is exactly my stance on miracles. Jesus is acknowledging that God can do things that, to humans, seem impossible (or violations of the laws of physics), yet to God they are possible (i.e. not violations).

So just to belabor the point, Jesus in the above didn’t say, “With men it is impossible, but God can do the impossible.” Rather, He said that the same thing that would be impossible for men, is possible for God.

This makes perfect sense. It would not make sense for Jesus to say, “God can do the impossible.” If God could do it, the thing wouldn’t be impossible, now would it?

Put another way, it doesn’t limit God’s sovereignty to say He can’t do the impossible. That’s just a semantic issue. Rather, the way you handle the fact that God is omnipotent, is to say that for Him, nothing is impossible.

Scott Sumner, the Unbeatable Foe

When last we left, in March our anti-hero Scott Sumner was hanging up the keyboard, having taken credit for getting Bernanke to inflate more, and thereby creating several trillion dollars in worldwide wealth.

But now Scott’s back, and his printing press is more powerful than ever. In the comments of a recent post, I was congratulating Scott on his enhanced visibility in the press, but then said: “Scott, you are huge. But remember back in the spring, when you declared mission accomplished and I dissented? How now, Polonius?”

To this Scott replied:

Bob, I’m not in the “wait and see” school of policy-making like almost everyone else. For me the metaphor is steering a ship. There is no “mission accomplished”. Every nudge of the steering wheel is a tiny victory or tiny defeat. But the helmsman can never rest on his laurals. QE2 helped a bit by reducing unemployment (maybe) from 9.8% to 8.8% over 5 months. But since then the Fed’s let the wheel drift in the wrong direction. I don’t make predictions–I let the markets do that. I just want to the Fed to keep policy at a level where the markets expect success. The markets never expected QE2 to be enough, but they thought it would help. It ended up being far too little.

If you made lots of money selling stocks short, I congratulate you. That would have been a much wiser investment than selling T-bonds short on the expectation that QE2 would lead to high inflation. Didn’t some people make that prediction?

Naturally, I was momentarily stunned by Scott’s rhetorical jujitsu. I conferred with the crafty von Pepe, and he advised me, “There is no way to nail someone that says stuff like that.”

I agreed with von Pepe and summarized Sumner’s argument as follows:

(1) When the stock market went up, Sumner claimed it was because of him.

(2) When the stock market tanked, Sumner said it was because the Fed stopped doing what Sumner said it should do.

(3) How does Sumner know the Fed stopped taking his advice? Because the stock market tanked.

It is futile to argue against such an unbeatable foe. Even if I had all the theory and empirical evidence on my side, he would prevail. As Scott himself said in a previous post, “And that, my friends, is why I can sleep comfortably at night. I am proposing a policy that literally cannot fail.”

Like I said, no matter my blogging abilities, I can’t beat such a foe. I feel like this:

Attack of the Gnomes

Krugman has his alien invasion, but now the Austrians can say:

The Keynesian focus on aggregates such as the “stock” of capital and “supply of labor” leads to faulty policy recommendations. The Austrian School has always had a rich conception of the structure of production. Of the major schools of thought, only the Austrians can appreciate what happens to the economy in the wake of a gnome attack — or the collapse of an unsustainable inflationary boom.

Karl Smith has two responses (and counting?) here and here. I am heading out of town, so can’t do them justice until next week. In the meantime, let me just clarify my point: I am not saying that our present recession is due to a physical rearrangement of capital goods.

Rather, what I am saying is that the arguments that Krugman, DeLong, and Noah Smith have been using, to “prove” that we are currently in a slump because of insufficient demand (rather than a Klingian Recalculation story), would also apply to my gnome scenario. Since the gnome scenario is a supply-side depression by construction, the Keynesians should pause when they are so sure that “the evidence” points to their own explanation.

Another Screen Shot, Please

Can someone capture this headline before they fix it?

Thanks to Taylor Conant:

Murphy vs. Graeber vs. Murphy vs. Graeber

I’m not going to give all the links (they are available if you click on the following), but here is the compilation of anthropologist David Graeber’s response to my article, and then here is my follow-up. An excerpt:

Graeber admits too that the temple authorities didn’t just independently pick silver because it was lying around. No, he says that silver was what was used to facilitate trades with foreigners.

This is exactly what I said the situation looked like, based on my reading of Graeber’s interview. Therefore, far from refuting my article, Graeber is here confirming it.

In conclusion, I still maintain that Graeber has yet to show us that the standard Mengerian story is wrong. Menger said that for money to emerge, you need to have antecedent barter transactions where at least one commodity outstrips its rivals in marketability. It then becomes the commonly accepted medium, and its exchange rate with other goods and services is determined through voluntary trades.

Graeber’s account is still consistent with that general explanation. The fact that the temples used silver as money, a practice which even he says they copied from the merchants who traded with foreigners, proves the point of my original article.

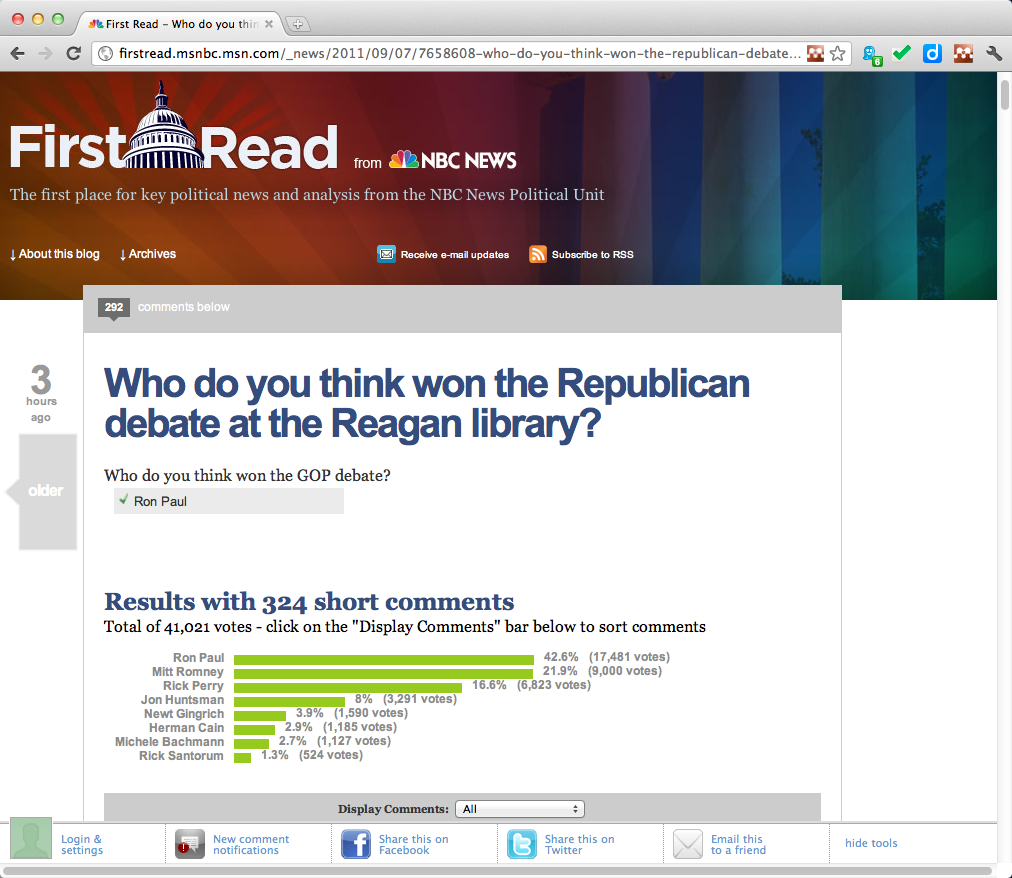

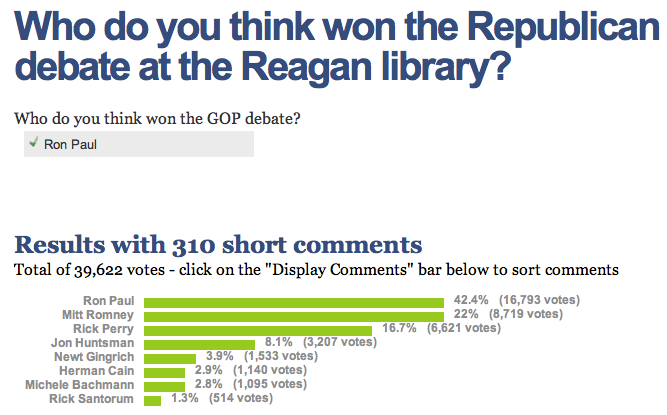

Funny Graphic on Ron Paul from MSNBC

[UPDATE below.]

Someone who knows how the Intertubes work, please get a screenshot of this. Check out how the poll results are graphed here. Notice anything funny, that might set off a paranoid Ron Paul fan? (I’ll update this post if someone can get me the screen shot.)

UPDATE: Thanks to Isaac for sending me these:

Did I Ever Predict Hyperinflation?

[Ironic UPDATE below.]

One of the standard criticisms of guys like Peter Schiff (and lesser mortals such as me) is that we’ve been falsely calling for hyperinflation for a few years now. For example, Krugman repeatedly rips Schiff on this score, and links people to a Google search of “Peter Schiff hyperinflation 2009.” (Incidentally, I don’t know what Schiff did or didn’t say; if you guys want to slug it out in the comments, I’ll read and learn.)

Anyway, in the comments of a recent post (where admittedly I had been poking him in the eye, so I had it coming) MamMoTh said:

Murphy expected the price of gold to rise because of the imminent hyperinflation he foresaw. However, the price of gold rose despite there being no hyperinflation whatsoever, and he seems consider his call clairvoyant.

This kind of thing comes up a lot, so I thought I might as well tackle it head-on. I have admitted in the past that I made specific predictions about CPI that were wrong. But I’m pretty sure I never “called for hyperinflation.” The closest thing I think I came to that was in an March 2009 article in which I tried to coin the term “hyper-depression,” but alas it didn’t catch on. Here’s what I said:

At this stage nothing is certain, but the country is currently headed straight into a period of very rapid price hikes and a very bad recession. It would not surprise me at all if the national unemployment rate and the annualized rate of consumer price inflation both broke through into double digits by the end of 2009. Moreover, regardless of when it actually starts, I predict that things will get much worse before they get better, and that the United States will be mired in a malfunctioning economy for at least a decade, with price inflation in the double-digits (possibly higher) the entire time. We can call this condition “hyper-depression.”

I concluded the article like this:

What people need to realize is that the government is going to keep making this worse. In other words, it is not enough to step back and say, “Well, the feds have already partially nationalized the entire banking system, and brought politics into all major business decisions — including how executives choose to travel to business meetings. What are the effects?” On the contrary, we need to realize that as things continue to deteriorate — and they will — the Obama Administration will keep upping the ante. “What? The first stimulus didn’t work? OK let’s borrow and spend another $1 trillion; maybe that will ‘take.’”

The American people need to prepare themselves for hyper-depression. The future is still uncertain, and if the folks in Washington suddenly found free market religion, that terrible outcome could be avoided. But I’m not holding my breath.

It’s conceivable I said something more damning elsewhere, but I would be surprised. After all, true hyperinflation–the collapse of a currency–would require more than simply a five-fold increase in prices, which is what I have generally been telling people when they ask, “How bad might it get?” (I am there using a back-of-the-envelope calculation of excess reserves.)

Probably the “craziest” thing I have written is this article from December 2009, where I speculate that the guys with the cigars are deliberately destroying the USD, in order to usher in the amero. So if you want to scour my writings for wrong calls, you can look there, but I don’t think I said anything demonstrably false. I explained why Marc Faber was warning of “hyperinflation,” but I didn’t endorse his prediction. (Am I being like Krugman on PIMCO’s Bill Gross and the housing bubble? You decide.)

UPDATE: In the comments Blackadder links to this post from June 2009 where I explicitly criticized Marc Faber for so casually predicting “hyperinflation,” particularly his comparison to Zimbabwe. Take that, smear artists!

Recent Comments