David Friedman Perpetuates the “Buy and Hold” Myth

David Friedman has a very interesting post up concerning equity versus bonds. Whenever economists start thinking about the stock market, we get tied into knots. (In this case, Friedman ends up concluding that profiting from insider trading is mathematically impossible, and not for the reason you might think.) I’m not criticizing Friedman on that score, incidentally; it’s worth thinking through these things, even though (like with the finitely repeated prisoner’s dilemma) such “rationality” often leads to something that common sense needs to veto.

Anyway, it’s not with Friedman’s armchair reasoning that I have a problem. Rather, it’s a casual empirical claim. He writes:

In the U.S. in the 20th century, stocks have consistently outperformed bonds. For an economist, this is puzzling. If you consistently get a better return buying stocks than buying bonds, why does anyone buy bonds? One would expect investment to shift out of bonds and into stocks until the return on both investments was equal.

There are several solutions that other people have offered to this puzzle. One is to argue that investors are risk averse and bonds have a more predictable yield; the rebuttal has been that, except over very short time periods, stocks almost always outperform bonds, so nobody investing for more than a few years can reduce his risk by buying bonds. Another is to claim that the U.S. market in the 20th century is a special case; investors in stocks just happened to be lucky, many times over.

It’s the part in bold that shocked me. My reaction was, “What in the world is Friedman talking about?!”

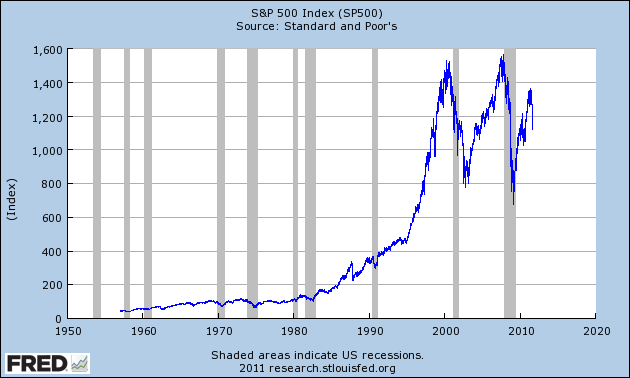

For example, one of my favorite charts recently has been the long-term S&P 500:

It’s true we would technically need to worry about dividends, but c’mon: People who bought into the market in 1999 have yet to break even. That’s a heck of a long time to wait for the magic of “buy and hold” to assert itself.

Some people in Friedman’s comments pointed this out, and others rushed to his defense, sarcastically noting that post-2000 is not in the 20th century.

OK great. How about this test? Would you rather have invested in stocks or bonds, during the two decades from 1970 to 1990? The 1970s had massive price inflation, so surely being stuck in bonds would’ve killed you, and the 1980s had the Reagan boom, so the stock market should’ve taken off like a rocket. Plus, we’re not talking about a piddling year or two pullback here; we’re talking about 20 frigging years.

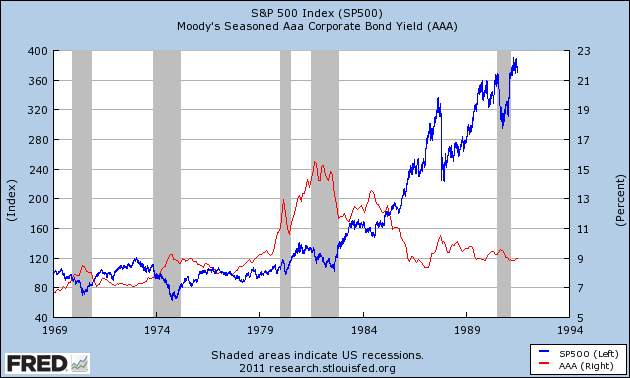

So if Friedman’s casual claim is to be correct, surely the equity investor should have destroyed the bond investor from 1970 to 1990, right? Let’s roll the film:

The above chart shows the level of the S&P 500 in nominal (not inflation-adjusted) terms (blue, left axis), against Moody’s AAA seasoned corporate bond yield (red, right axis). From 1970 to 1990, the S&P appreciated 287%, for an average compounded annual growth rate of 7%.

We can stop right there. We don’t need to do any fancy calculations to see how bonds did. For the entire period, they yielded at least 7%, and reached yields as high as 15% in the early 1980s. Moreover, bonds didn’t drop 20% in a single day as stocks did in 1987.

All in all, I don’t think there’s any puzzle here as to why people still hold bonds. Friedman might want to quibble with my comparisons; for example, some bonds, even ones rated AAA, might have defaulted in that 20-year period. But the above comparisons aren’t even close. Friedman made it sound like there were just a few pockets in the 20th century when bonds outperformed stocks, yet that isn’t true.

I don’t have a citation, but “black swan” author Nassim Taleb gave a paper at the Austrian colloquium at NYU one time, arguing that the “equity premium puzzle” disappears once we plug in a more accurate distribution of stock returns. When investors aren’t using a Gaussian (think “normal”) distribution, and instead more realistically take into account events in the market like 1929-1932, 1987, and 2008–rather than treating them as “once in a million year” outcomes, as the typical models do–then you don’t need unrealistically high risk aversion to get investors to hold some of their wealth in bonds.

Bob, you seem to have forgotten to include the dividend yield on stocks. If that were say 3-5% over this period (I’d be surprised if it were much less), that would give stocks the advantage over bonds (as per Friedman’s claim). We should also, strictly speaking, subtract taxes (dividends, interest and capital gains being in general taxed differently).

It’s telling there was a ‘lost decade’ of returns for the S&P, and yet a balanced stock portfolio with small, international, etc, earned more than 7%. This also does not consider that in rebalancing you sell stocks at their highs and buys at their lows. No one recommends buy and hold; they recommend buy and monitor. You’re not giving so called ‘buy and hold’ people adequate analysis.

I suppose I could use Bob Murphy as a proxy for all Austrians in terms of looks and intelligence, but I think that would probably be just as much of an incomplete analysis.