Dan Carlin’s “Hardcore History”

I’ve only started listening to my first episode, but I’m 3 hours in (sic) and it’s amazing. This episode–which is 5 hours long–is ostensibly on the Cuban Missile Crisis, but so far we’re just up to the Bay of Pigs. If you’re interested in politics and history I strongly recommend it. Even if you don’t like Carlin’s commentary, he reads tons of source quotes that makes it worth your time, especially if you’re like me and have huge road trips every month.

Glenn Greenwald on Deep State vs. Trump

GG is perfect for this position. If someone like me says this, people assume it’s because I hate poor people or immigrants. But when GG says he is not defending Trump, but rather is pointing out the huge dangers of letting the CIA take over the government, I hope progressives listen. (Plus some of the #NeverTrump libertarians too, if I can dream.)

Latest Lara-Murphy Show and Contra Krugman

I can’t remember if I posted this already, but in ep. 34 of the LMS, we talk about the general economic prospects of a Trump Administration.

In ep. 73 of Contra Krugman, Tom and I talk about tariffs and the wall. A quick highlight reel:

7:15 I suggest the layout of the show: We first talk about tariffs on Mexican products, whether this would “pay for the wall,” and then the broader GOP tax reform plan (swapping a VAT for income tax).

8:50 Tom discusses the Rothbardian point that businesses can’t simply “pass on” a new tax to its customers. It’s more nuanced than that.

12:30 Along the same lines, I explain that yes, Trump fans are wrong for thinking “Mexico will pay for the wall” because of a tariff. However, Trump critics went too far the other way when they said, “Ha ha, a tax on Mexican imports would just raise prices for Americans.”

20:40 I make my civil libertarian point that a giant wall gives me the heebie jeebies. NOT because all Earthlings possess a “right to immigrate,” but because a necessary condition for a future US police state is a border barrier keeping people in.

25:00 I discuss the Feldstein/Krugman article and how it kinda sorta validates the Navarro/Ross position on income taxes versus VATs, and how the US is at a disadvantage.

Contradictory Trump Criticisms

Trump could be a bad president even if the vast majority of his critics are often making silly arguments. So my present post should not be construed as me saying, “Why’s everyone so upset?”

However, lately I’ve noticed that a lot of the criticisms of Trump aren’t even internally consistent. What’s even weirder is that I see a lot of truly the same people making these pairs of claims. (Note that some of these aren’t literal contradictions, but I hope you see my point with them.)

1a. The Trump/Pence Carrier deal was bad because it would lead to rent-seeking, with every US firm pretending it was going to outsource to try to get the same treatment.

1b. The Trump/Pence Carrier deal was bad because now businesses would be cowering, afraid to let the president know they were considering outsourcing and thus receiving the scrutiny Carrier got.

2a. Trump is Hitler and we need to stop him now before he becomes too powerful.

2b. Trump is a complete buffoon who doesn’t know where the pantry is in the White House.

3a. Trump is establishing a totalitarian state. Look at how he’s outlawing the press.

3b. Trump is a jerk for picking a Secretary of Education who will get the federal government out of the schools.

4a. Trump is a fascist.

4b. Trump is picking people who will deregulate business.

5a. Trump is a madman who will start a war with his bellicose approach to China.

5b. Trump is selling out American interests by cutting backroom deals with the Chinese in exchange for their concessions on his business interests.

6a. Trump is a monster for supporting Israel over the Palestinians.

6b. Trump is an anti-Semite.

7a. Trump is Putin’s puppet.

7b. Trump will start WW3.

“The System Is The Beast”

Dan Hagen (my musician friend from Nashville) and I have released another single…

If you’re dying to throw money at me, I think it’s now available at iTunes and other online stores; let me know if that’s not the case.

Scott Sumner on Taxes

I had urged him to write up an “explainer” type piece, summarizing key lessons on taxes. He came through. So far, his is the single best piece I’ve seen on the issue of border tax adjustment. I am working on some blog posts / podcast episodes to walk through these things as well.

I’m not going to bother excerpting from Scott’s piece, because for its full punch you need to just read it. He starts out with the tax incidence stuff–does it matter whether the government levies a 25-cent tax on the gas station or on the consumer? Then he ends up showing how a tax on imports coupled with a subsidy to exports won’t significantly change the volume of trade, so long as the currency adjusts. *That* is the key claim that guys like Krugman and others are citing, but nobody has slowly spelled out why it works.

To reiterate, Scott’s piece is the single best one I’ve seen so far, if you want someone to explain that initially counterintuitive result.

P.S. Scott is still wrong about the Fed.

Potpourri

==> I haven’t had time to look at this, but two mathematicians claim Godel’s results prove God.

==> Federal spending grew more under Reagan and George W. Bush than under Obama.

==> This Elon Musk guy is starting to give me the creeps. When he starts work on SkyNet, we’ll know what’s up.

==> Two excellent articles on the Flynn situation: Glenn Greenwald and at Bloomberg Eli Lake.

==> BTW I assumed the GOP “blueprint” for tax reform was really long, but it’s only 35 pages, if you want to skim it.

Contra Krugman-Feldstein

[UPDATE below with more (apparent) mistakes.]

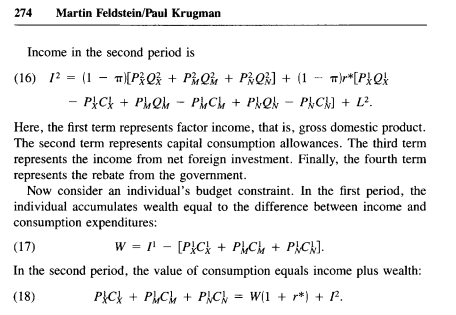

I’ve been studying this chapter by Feldstein and Krugman on VATs/income taxes (from a 1990 NBER book). It’s excellent, as far as a mathematical model goes. I highly encourage academic economists to check it out.

I think I found a typo, if that motivates some of you to look at it. On the bottom of page 266 they write:

So in that equation (7), in the first two terms after the equals sign, should the superscripts be “1” instead of “2”?

UPDATE:

I found two more equations that I think contain mistakes. They both come from page 274:

For equation (16), it seems they are missing the third term altogether? (On the previous page, it was established that L1 was the rebate from the government in period 1, so clearly the L2 in (16) is the rebate from the government in period 2. And what Feldstein/Krugman call “capital consumption allowances” seems to line up with the second term in (16), since this term represents the after-tax real return on the saved output carried forward from period 1.)

Now, looking at equation (18), I have three problems:

First, should the superscripts on the left-hand side be “2” not “1”?

Second, on the right-hand side, if we’re looking at period-1 Wealth and period-2 income separately, wouldn’t it be more natural to include the growth in W in the period-2 income? In particular, equation (16) included the real return to capital brought forward from period 1, so it seems the (1+r*) that is multiplying W in equation (18) is redundant. (I think that equation (16) represents income for the firm, whereas (18) is for the household, but it still seems like an inconsistent treatment of the timing of income.)

Third, even if we assume (inconsistently) that that I2 in equation (18) doesn’t include the real return on wealth created in period 1, then why is W being multiplied by (1+r*)? Shouldn’t we also account for the income tax?

In summary, it seems that there are several typos (if not outright errors) in this paper, but I still think it is a good example of using a mathematical model to address a question in economics. It shows the strengths and weaknesses of the approach. (It’s ironic that I set out to give Krugman his due, and ended up complaining about a bunch of typos.)

Recent Comments