Money to God vs. the State

This was an interesting section from Guzik’s commentary on Exodus 30:

- ([verses] 13-16) How to take a census with ransom money.

“This is what everyone among those who are numbered shall give: half a shekel according to the shekel of the sanctuary (a shekel is twenty gerahs). The half-shekel shall be an offering to the LORD. Everyone included among those who are numbered, from twenty years old and above, shall give an offering to the LORD. The rich shall not give more and the poor shall not give less than half a shekel, when you give an offering to the LORD, to make atonement for yourselves. And you shall take the atonement money of the children of Israel, and shall appoint it for the service of the tabernacle of meeting, that it may be a memorial for the children of Israel before the LORD, to make atonement for yourselves.”

- Everyone included among those who are numbered, from twenty years old and above, shall give an offering to the LORD: The census was to include everyone aged twenty and over. This seems to be the Israelite age of full adulthood in this sense. Everyone also had to give an equal amount – one-half shekel.

2. This ransom money spoke clearly: everyone owes God; everyone is obligated to Him. “The Lord commanded that every male over twenty years of age should pay half a shekel as redemption money, confessing that he deserved to die, owning that he was in debt to God, and bringing the sum demanded as a type of a great redemption which would by-and-by be paid for the souls of the sons of men.” (Spurgeon)

3. “Later, the ‘half-shekel’ became an annual temple tax (Matthew 17:24).” (Cole)

4. The rich shall not give more and the poor shall not give less…to make atonement for yourselves: This was not a request for a free-will offering, nor was it a proportional tithe. This was more like a flat tax, where everyone paid the same amount, rich or poor – because this was to make atonement. It wasn’t that the money was the atonement, but it marked the ones who were atoned.

5. In this sense, it is not a pattern for our giving under the New Covenant. New Covenant giving should be proportional, under the principle that we should give in proportion to our blessing (1 Corinthians 16:2).

6. Instead of a pattern of our own giving, this money was a picture of the cost of our own redemption. “The rich were not to give more, the poor not to give less; to signify that all souls were equally precious in the sight of God, and that no difference of outward circumstances could affect the state of the soul; all had sinned, and all must be redeemed by the same price.” (Clarke)

Note that Guzik uses the wrong term (in the context of modern policy discussions)–the atonement payment was a poll or a head tax, not a flat tax, which is what the tithe would be. (You tithe ten percent of your income.)

I am sharing because I thought it was interesting that the atonement payment was not tied to wealth; it was a flat fee (which of course is why Guzik described it as a “flat tax”). Far from being unfair to the poor, I think this actually gave them dignity, for the reason described in the quotation above. Their souls were just as valuable.

Part of the broader spiritual message here, of course, is that Jesus will eventually pay the ultimate redemption price for all of us.

I don’t have it in this excerpt, but elsewhere Guzik explained that in general God didn’t want human rulers conducting a census, because this signified that the human ruler “owned” the subjects.

Potpourri

==> We’re #25! We’re #25!

==> Remember how I asked you guys your thoughts about dealing with progressive hypocrisy while Trump is doing bad things? Tom Woods and I have a discussion on the topic.

Contra Krugman Twin Spin

Because I was on the road when Episode 71 posted, I fell behind. So I’ll give the highlights of both Episode 71 and 72 in this post.

Episode 71: On Trump Manufacturing His Own Reality When Things Get Worse

8:30 I explain that Krugman has to do a dance. Originally there was a depression under Obama, then America had to be A-OK at the end of Obama’s term to render Trump’s analysis wrong, and at some point it will have to be awful again, lest Trump not be so bad.

9:50 I explain that Trump’s use of the term “carnage” for inner cities would be par for the course if coming from someone on the left.

14:45 Tom starts listing false things that progressive believe.

23:00 I explain the connection between federal budget deficits and U.S. trade deficits.

30:45 We agree with Krugman that Trump has painted himself into a corner regarding ObamaCare.

39:25 I tackle Krugman’s slippery statistics when he tries to show job creation since 2000 has been adequate.

==========

Episode 72: Will Trump Make Manufacturing Decline Faster?

10:55 I agree with Krugman that Trump has the wrong view of trade; he thinks it’s a zero sum game where one party has to dominate. But then I have a surprise…

17:40 I agree with Krugman that tariffs/free trade don’t destroy/create jobs but rather just rearrange employment.

22:40 I concede a sense in which talking about “job creation” from pro-growth policies is defensible.

24:10 Once again I run through the argument that Trump will unwittingly make the trade deficit “worse” by running a big budget deficit.

25:20 We agree with Krugman that Reagan was very protectionist.

26:45 I point out that Krugman actually has an Austrian-ish theory of what caused the bad recessions of the early 1980s.

Potpourri

==> We at the Free Market Institute at Texas Tech are hosting an IHS seminar on American democracy. You can register even up till the last minute, so come on down. I’ll be talking about secession on Saturday, but all the talks look good.

==> Glenn Greenwald on the depressing consistency of Obama-Trump when it comes to military strikes killing kids.

==> Speaking of using deaths as a way to critique policy, Steve Landsburg does it for Trump’s tariff (or whatever it ends up being) against Mexico. I push back in the comments, because I don’t think Steve would endorse an analogous critique (and I make it, plausibly) of a free trade policy.

==> Is it weird that the AP is running a story with a headline about what Trump said to the Mexican leader on the phone, which both the White House and Mexican government vigorously deny? Is it a completely nutjob theory to consider that the media is saying to Trump, “You think you can insult us and box us out? Now you’ll see much power we really have, tough guy.” ?

But I Thought We Weren’t Supposed to Hold Grudges…?

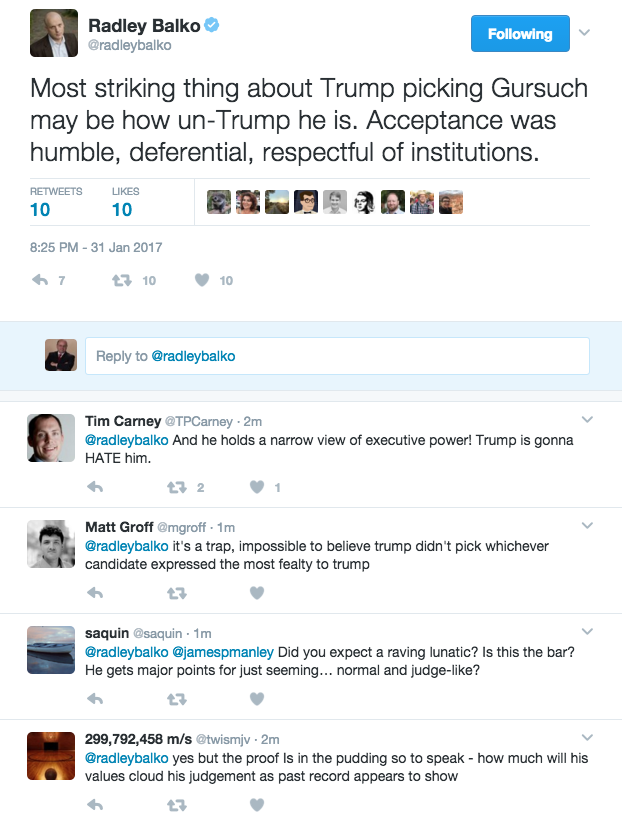

I am not saying it’s exactly the same thing, but you know how Radley Balko was tut-tutting the people who made snarky jokes about snowflakes instead of working to stop current abuses of power?

Well, he couldn’t object to Trump’s Supreme Court nomination as a jackbooted thug, so after saying he was the best we could hope for under Trump, Balko wrote this:

And notice the comments too.

Again, it’s not literally the same sin of which Balko was accusing others, but it’s a kissing cousin. Instead of saying, “Wow, I’m very pleasantly surprised, I applaud this choice and let’s hope this man will work to limit the violation of civil liberties,” instead Balko uses it as an opportunity to criticize Trump’s past behavior (and I suspect, to remind everybody that “Hey guys, I can’t stand Trump’s guts.”).

An Apparent Contradiction in Economic Analysis of Social Security

I am working on an essay on Social Security reform, and I ran into what at first seemed a contradiction. I actually don’t think there really IS a contradiction, but since I am having fun thinking through it, I wanted to share with the other geeks reading this blog.

So right now, a salaried employee has 6.2% of his gross pay taken out for OASDI, while the employer pays an extra 6.2%. (It caps out after a threshold of gross pay, which was $118,500 in 2016.)

Suppose the government allows employees to opt out of this particular payroll tax. What happens to the take-home pay of an employee who exercises this option? I have two different answers, both of which seem to flow from textbook analysis:

(1) In the original equilibrium, the market was competitive and so the employee was getting paid his marginal product. The employer took the 6.2% employer “contribution” to Social Security into account when hiring. Now that the government is removing that implicit fee, the employer will still end up paying the total marginal product to the employee, but now it will be in the form of higher gross wages. Thus the employee will pocket the entire 12.4% of the tax reduction.

(2) As with any case of tax incidence analysis, to figure out how a tax is “borne” by the buyer and seller, what matters is NOT the statutory incidence, but the relative elasticities of supply and demand. By removing a tax on labor, both parties will tend to benefit. The only way the gain would accrue entirely to the employee is if the supply of labor were perfectly inelastic and/or the demand for labor were perfectly elastic, which we have no reason to suppose. (In case you think I got those conditions backwards: Note that if lifting the tax is to help only the employee, that means imposing the tax must only hurt the employee.)

So which answer is right? And why did the wrong one, go wrong?

P.S. It’s actually not right to treat the Social Security payroll deduction as a tax, because it is (loosely) tied to a future payment from the government. It’s more correct to view it as a forced investment in a mediocre annuity program, but even this isn’t exactly right because the withholding/benefit rules are so screwy. But for the purposes of this post, don’t worry about this complication; just treat it like a 12.4% tax on wages that is being lifted.

An Invitation for the Topic: “How Should Libertarians Conduct Themselves As Progressives Freak Out Over Trump?”

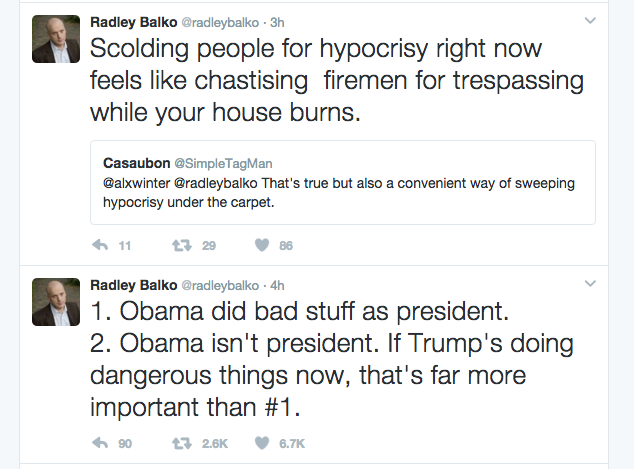

I am going to be discussing this issue on a podcast, and I’m trying to collect my thoughts beforehand. Do not be fooled by my steady resolve and iron will; I take outside complaints seriously on such important things. In particular, I have been thinking about a post from Radley Balko in which he says something along the lines of, “Yes, progressives ignored Obama when he violated civil liberties and engaged in foreign aggression. But the clear and present danger now is Trump and his policies, and we should applaud those who are now speaking out–not mocking them for their hypocrisy.” (That’s just a very loose paraphrase from memory; I give two more recent tweets for a concrete reference.)

On the other hand, I have to also agree wholeheartedly with Kevin D. Williamson at National Review when he writes:

You’ll remember “whatabout-ism,” which was the Democratic talking point of the day a few weeks back. And they’d have a point if the argument were: “It is acceptable for President Trump to do things that are wrong, illegal, or unconstitutional, because President Obama did those things, too, or similar things.” But that isn’t the argument at all. The argument is: Democrats are fundamentally unserious, opportunistic, and dishonest in their assessment of what is happening…

Anyway, I’m bouncing all of this around in my mind until the podcast taping. Feel free to chime in.

Recent Comments