Contra Krugman-Feldstein

[UPDATE below with more (apparent) mistakes.]

I’ve been studying this chapter by Feldstein and Krugman on VATs/income taxes (from a 1990 NBER book). It’s excellent, as far as a mathematical model goes. I highly encourage academic economists to check it out.

I think I found a typo, if that motivates some of you to look at it. On the bottom of page 266 they write:

So in that equation (7), in the first two terms after the equals sign, should the superscripts be “1” instead of “2”?

UPDATE:

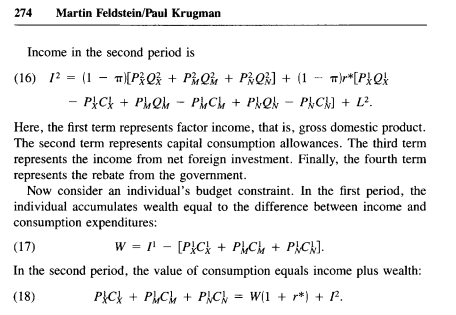

I found two more equations that I think contain mistakes. They both come from page 274:

For equation (16), it seems they are missing the third term altogether? (On the previous page, it was established that L1 was the rebate from the government in period 1, so clearly the L2 in (16) is the rebate from the government in period 2. And what Feldstein/Krugman call “capital consumption allowances” seems to line up with the second term in (16), since this term represents the after-tax real return on the saved output carried forward from period 1.)

Now, looking at equation (18), I have three problems:

First, should the superscripts on the left-hand side be “2” not “1”?

Second, on the right-hand side, if we’re looking at period-1 Wealth and period-2 income separately, wouldn’t it be more natural to include the growth in W in the period-2 income? In particular, equation (16) included the real return to capital brought forward from period 1, so it seems the (1+r*) that is multiplying W in equation (18) is redundant. (I think that equation (16) represents income for the firm, whereas (18) is for the household, but it still seems like an inconsistent treatment of the timing of income.)

Third, even if we assume (inconsistently) that that I2 in equation (18) doesn’t include the real return on wealth created in period 1, then why is W being multiplied by (1+r*)? Shouldn’t we also account for the income tax?

In summary, it seems that there are several typos (if not outright errors) in this paper, but I still think it is a good example of using a mathematical model to address a question in economics. It shows the strengths and weaknesses of the approach. (It’s ironic that I set out to give Krugman his due, and ended up complaining about a bunch of typos.)

Physicist here. I rather think that the terms in the left hand side should be elevated to the power of 2. Why elevate anything to the power of 1?

Ah, it’s not an exponent, but it indicates time. So I agree with you.

I’m finding that equation at the bottom of p266 not p268.

Partly from guesswork…

“Q” means Production (seems to stand for “Quantity”)

“C” means Consumption

“K” means Investment (maybe borrowed from https://en.wikipedia.org/wiki/Economic_production_quantity)

Therefore (7) shows the total of both periods, some sort of GDPish equation covering exports plus imports, with adjustment for interest rates. No units on anything (of course not, this is economics) but I think it might give an answer in dollars.

Purely based on context I would think that (7) would say in words, “Balance of trade must be neutral when we consider the total of both periods (with suitable interest adjustment), so GDP as calculated by consumption will equal GDP as calculated by production.”

In which case I agree with Bob… there’s no way the activity in the first period can simply vanish just because we have shifted from a production calculation over to a consumption calculation. You still need to have a first period in calculation somewhere, so the superscripts need to be “1”.

This equation does not come back later in the paper, however they go on to just work with the production side so the upshot of (7) is to explain that consumption does not need to be explicitly considered (you could figure it out from production).

Thanks Tel, you’re right I had the wrong page number.

And yes, bedwere and Tel, you guys eventually figured out the notation. The superscript is the time period (there are two periods, 1 and 2), while the subscripts indicate the type of good. There are 3 goods in this model: X is the exportable good, M is the importable good, and N is the non-tradable good.

Q stands for physical production or output.

K is how much of period 1 output is set aside physically to carry over into period 2; it goes into the capital (denoted by K usually, because “C” is reserved for consumption). They don’t worry about an aggregate Kapital, they just keep track of the three separate stockpiles of goods carried into period 2.

I have a feeling – not understanding the math used – that whenever you’re talking about T1 vs T2, it is related to your theory on time preference (because I got around to checking out more of your dissertation).

It so happens that, besides my heroic efforts to save the Austrian School from bitcoins, I also defend the pure time preference theory of interest.

An actual decision is made at T1, which means a separate decision is made at T2.

The decision at T1 may be inspired by what may happen at T2, but only decisions – human action – are relevant to economics.

T1 happens on its own demand schedule, and so does T2.

Both of which are ordinally ranked.

*Takes a bow*

Jeffrey Herbener is right: Subjective preferences are the sole determinant of interest rates.

Economic activities will only ever occur when people believe that using a means will achieve a desired end, and so scarcity of any good, per se, will have zero impact on interest rates.

Because even if some, or all, of the components necessary to achieve the ends sought do not exist, or are too expensive, a human will act *as if it did exist, or was not too expensive* (with all the associated influence on interest rates that such action will impose) until the actor realizes the reality of his situation – AT WHICH POINT THESE SAME GOODS WILL CEASE TO BE ECONOMIC GOODS relevant for economic analysis.

guest is there something in particular that you think is wrong in this discussion, because decisions are made in different time periods?

That was clever.

No, sir, I do not.

Krugman just presumes there’s a fixed interest rate … doesn’t even discuss the underlying causes … it is what it is, and that’s the model.

I doubt any of that applies to the USA, which is large relative to world markets, and yeah if tax incentives would cause a significant shift in apparent time preference (Krugman seems to believe it can happen) then interest rates could also be effected (which Krugman ignores).

There’s a whole lot of questions about artificially “pulled forward” consumption, giving the appearance of a booming economy, but nothing to back it up, in terms of genuine productivity growth. The example would be Japan 2014 when they increased their VAT from 5% to 8% and saw a big surge of spending as people got ahead of the tax hike. However they also got a dead zone where people stopped spending after the hike. Is that really a “time preference” or merely reaction to the threat of impending wealth confiscation?

Keynesians rarely get too deeply philosophical over questions like that.

Thinking about this whole article a bit more, here’s some random points:

Equation (7) seems like Say’s Law. Now, I understand various people read a bunch of special stuff into Say’s Law but at least in the most direct tautological format, barter is the deep core of every economy and ultimately I consume equal value to what I can supply (unless I’m getting taxed or ripped off).

So first problem is what Peter Schiff has been going on about for years which is that the USA has managed to consistently NOT have a neutral balance of trade. For a generation the country has run by issuing IOU notes to the world. That’s already a major deviation between the Krugman model and present reality.

But there’s more problems. Suppose a company like Carrier is thinking about moving offshore to some other country and firing all their employees. This fundamentally changes the Production Possibility Frontier in the USA, especially if those employees have serious difficulty getting back into equivalent jobs. But Krugman’s model does not even have a mechanism to consider such an event! It’s just assumed away that such a thing could ever happen. I kind of bugs me to see “proof” that a policy cannot cause some effect, when you haven’t even worked through the real world case that people are pointing out.

That’s not all that bugs me, there’s more. This is the conclusion from the “Idealized VAT” section:

OK, what’s wrong with this picture? The policy has just imposed a tax which is “idealized” in as much as it is a tax on everything and the conclusion is that there will be no change in welfare. Regardless of the rate of the tax imposed, at all possible tax rates, still no change in welfare.

Huh? How? Some guy comes along and say, “We are going to tax the entire economy at a rate of 50%” and the response is, “Oh that will have no effect on me whatsoever, nor anyone else.”

I get it that this is a journal article, it’s for busy economists and a whole bunch of shared background knowledge is presumed, so authors need to stay brief, just make their key points and move on. All that considered, it still seems like a massively counter-intuitive statement.

I find it droll that economists continue to reify models that have only but assumed application to the real world. As I read the descriptions of how the model is presented, and the variables that are attributed to these assumptions, I realized that positivism, as well as mainstream economics altogether–perhaps in an unintended way–gives pretexts as to how the government should stay in tact.

Assuming government money exists, this sort of macro economic estimate seems plausible, but at the true crux of the presumptions, managing inflows and outflows of goods is a private sector venture–typically undertaken by the accounting department of a corporation. Why else defend free trade with economic models but simply for the sole purpose of assuming a government need be in place in the first place?

Government should not exist, all other decisions are voluntary, and the fees applied within the transaction become the responsibility of that entity partaking in the transaction.

I am remembering a debate that took place between the often vaunted Warren Mosler by the statists, and your subtle vanquishing of his arguments right at the beginning of the debate. Forced money is not market money, the buck stops there.