Currency Devaluation, Export Advantage, and Commodity Prices

I am mostly doing this as a placeholder. I wrote this article for Mises back in late 2010. A lot of it is standard stuff, but I got into the step-by-step adjustment to a currency devaluation, showing the sense in which it would shower benefits on certain groups. I vaguely remember that it took me a while to juggle all the figures around, so that in the finished draft, it was a nice smooth exposition with round numbers.

After I wrote it, I had tried several times to find it again, but couldn’t. But the other day I accidentally stumbled upon it, and so now I’m making this post in the hopes that it helps me find it in the future.

Anyway, here’s an excerpt:

At this point, it’s tempting to think that the Fed’s announcement would have no effect on the pattern of global production and trade, and that it would merely tinker with nominal price tags. But this isn’t the case. Because domestic prices have various degrees of flexibility, the devaluation of the dollar in our example would give more than a fleeting advantage to American exporters.

Consider the wheat farmers: After the speculators quickly respond to the Fed’s announcement, the price of wheat rises from $5 to $8 per bushel. It’s certainly not that the wages of the employees working on the farm, or the mortgage payments made to the bank, will jump by a comparable percentage in a few moments. On the contrary, much of the American farmer’s expenses will remain fixed in price even though the sale price of wheat has risen 60 percent. American wheat farmers will therefore find the dollar devaluation to be very lucrative. From their perspective, it will appear as if millers (both domestic and foreign) for some reason have a hankering for American wheat, and the American farmers will increase their output to satisfy the new demand.

Things are the opposite for the European farmers. The demand for their product will collapse, such that the new equilibrium price falls to €4 from its original level of €5. This 20 percent drop in price cannot be simply “passed on” to workers, who have labor contracts specifying how many euros per hour they must be paid. Consequently, European farmers will scale back their production of wheat.

In the grand scheme of things, the Fed’s announcement of its plans to print more dollars will allow American wheat farmers (and other exporters of fungible commodities) to gain market share at the expense of farmers in other countries, whose currencies appreciate against the dollar. This is why Keynesian economists stress the (alleged) virtue of weakening a currency in order to “stimulate exports” and hence boost national output — net exports are a component of GDP in the standard formula.

Our Most Rational Minds Considering All Hypotheses?

I am not intending this to be smug. I mean this post sincerely.

In a recent SlateStarCodex post, Scott Alexander–who is one of the most open-minded, thoughtful bloggers I follow–wrote:

I realize this is pretty unsophisticated-sounding, but I’m basing this off of my continuing confusion over the rise of Christianity. Christianity came out of nowhere and had spread to 10% – 20% of the Roman population by the time Constantine made it official. And then it spread to Germany, England, Ireland, Scandinavia, Eastern Europe, Armenia, and Russia, mostly peacefully. Missionaries would come to the tribe of Hrothvalg The Bloody, they would politely ask him to ditch the War God and the Death God and so on in favor of Jesus and meekness, and as often as not he would just say yes. This is pretty astonishing even if you use colonialism as an excuse to dismiss the Christianization of the Americas, half of Africa, and a good bit of East Asia.

I’ve looked around for anyone who has a decent explanation of this, and as far as I can tell Christianity was just really appealing. People worshipped Thor or Zeus or whoever because that was what people in their ethnic group did, plus Thor/Zeus would smite them if they didn’t. Faced with the idea of a God who was actually good, and could promise them eternity in Heaven, and who was against bad things, and never raped anybody and turned them into animals, everyone just agreed this was a better deal. I know this is a horrendously naive-sounding theory, but it’s the only one I’ve got. [Italics original, bold added.]

Alexander’s post reminded me of Bryan Caplan’s EconLog post from a bit earlier, where he (Bryan) challenged the discussion of religiosity in the new book by Kevin Simler and Robin Hanson. I can’t really excerpt the essence of his post, but suffice to say, Bryan entertains a bunch of different explanations for the “function” of religious belief, literally without one sentence devoted to the possibility that God exists.

To be crystal clear, I’m not complaining that Alexander and Bryan are (apparently) atheists. I wouldn’t even have blogged this if they had both said something like, “(To be sure, we realize half of our readers probably think they have a GREAT explanation for this puzzle. But in light of the serious empirical and philosophical problems involved, I reject this move as cheating, a literal deus ex machina that is not scientific.)”

It’s just weird to me that they didn’t even seem to consider, even just as a checklist in covering their bases, that if there really were a God of the kind that various cultures have believed in, then all of the problems would be a lot more tractable.

A Numerical Example on Corporate Tax Cuts and Wage Increases

In my last post I mentioned that a lot of economists are puzzled that corporations are announcing wage hikes right when the tax cut goes through. I’ve now jotted down some numbers to show exactly what I mean.

But before I dive in, let me say what I think the fundamental problem is: The way professional economists (especially in academia) think about firms and production, there is no corporate net income. So it shouldn’t be surprising if they miss what may seem obvious to the layperson.

(Let me stress again that I’m not making fun of the economists here. These are all really smart people. I’m pointing out that standard models of perfect competition with “zero profit” don’t typically include the explicit earning of interest as a return to financial capital. Instead, interest is conceived as a return to the physical productivity of capital equipment. I’ve mentioned this problem before, when I was trying to help some Texas Tech students get ready for their first-year qualifying exams.)

So my “take” here is to ask: Why do corporations need net income in the first place? It’s because the shareholders need a return on their invested equity. If they thought they would get a 0% return, then they’d be better off putting their funds in bonds.

You can either think of it as a very short-term thing, where there is no such thing as pure arbitrage. No matter what the corporation invests in, there’s a chance it will fail. So ex ante, the corporation needs to expect to earn a positive return, even for a timeless transaction. Competition *won’t* drive revenues down to explicit out of pocket costs for factors.

Or, you can think of it with certainty, but then you need to include the time element. That’s what I’ll do here. (And someone tell me if you think I’m botching how accountants in the real world would handle this type of calculation vis-a-vis the tax authorities.)

So, suppose there’s no corporate tax. There’s constant returns to scale. There is just one input, labor. If a corporation pays a wage w, it gets an intermediate product, and then it takes 12 months to market and finally sell it for $110 to the final consumer.

If we suppose that the shareholders require a 10% return on their equity, then in equilibrium it must be that the wage is $100. The corporation would report (right?) net income of $10 for each unit produced. But we economists would say, “That’s not pure profit, that’s just accounting profit. It’s the interest return on invested financial capital.”

OK what if the corporate tax rate is 35%? Then the wage paid is about $95 (rounding down). The product sells for $110, so before-tax net income is $15. But the corporation only keeps 65% of it, i.e. $9.75. And a $9.75 interest earning on the invested $95 works out to a 10.3% rate of return.

Now what if they lower the corporate tax rate to 21%? Then the wage paid jumps to $98 (rounding up). The product sells for $110, so before-tax net income is $12. The corporation keeps 79% of it, i.e. $9.48. That’s a 9.7% rate of return.

So, if you are OK with my rounding to the nearest dollar, we see that cutting the corporate income tax rate from 35% to 21% immediately boosts wages by $3/$95 = 3%. This has nothing to do with investing in physical capital equipment and boosting productivity. This is just the new equilibrium wage needed to keep the rate of return on shareholder equity the same.

What am I missing, friends?

Are Economists Overthinking Tax Cuts and Wages?

In the wake of companies announcing pay hikes after the tax cut package, lots of economists are weighing in on whether the two can be related. Krugman is quite sure they have nothing to do with each other, and John Cochrane basically agrees with him (even though the tone is miles apart, the underlying analysis is very close). David R. Henderson is more open-minded (and he’s linking to Veronique de Rugy), but even s/he is very cautious.

Believe me, I understand the type of model all four of the above, professional economists have in mind when discussing this stuff. Nobody is denying that a big cut in the corporate income tax rate could affect wages *eventually*, through higher investment that leads to higher productivity that leads to higher wages because of competitive labor markets. And so they they are bouncing around the plausibility of companies raising wages pre-emptively to reduce worker turnover etc.

But are economists overthinking this?

Consider: Suppose they jack up the corporate income tax rate to 100%, and enforce it ruthlessly. I think I can come up with a pretty standard neoclassical model in which corporations don’t want to hire workers (or rent machinery for that matter), if no matter what happens, the corporation has no benefit from the operation. So in that scenario, even though the wages would be deductible, there would be no reason to hire workers and so the wages of workers would fall. Starting from such a standpoint, a cut in the corporate income tax rate from 100% down to 21% would immediately increase the demand for labor and hence the equilibrium wage rate of workers.

If you buy that, is it impossible to tell a story in which cutting the corporate income tax rate from 99.9999% to 21% immediately boosts wages? And not because of expectations of an effect in Year 8, but because of immediate considerations?

If you buy that, why are we so sure it’s impossible that cutting the corporate tax rate from 35% to 21% could have an immediate and direct impact on the demand for labor?

(HINT: I think these economists might be employing models in which there’s no uncertainty. But once you factor that in, I think this apparent mystery could dissolve.)

Potpourri

==> The latest Contra Krugman, in which Tom complains about a bunch of presidents. Guy is a serious whiner.

==> Jeff Deist takes a swing at the Nobel laureate too.

==> Scott Horton has trained his young apprentice well.

==> I haven’t listened yet, but David Gornoski got Jordan Peterson to sit down for an hour+ interview.

==> NSA oops!

==> My thoughts on the Trump Admin’s solar tariffs.

More on My Proposed Solution to the Mind-Body Problem

My girlfriend sent me this interesting link that she was assigned in one of her classes. It reminded me of my earlier Free Advice posts in which I propose a solution to the mind-body problem. Here’s the short version (but follow the link to get the fuller context):

==> To (finally) recapitulate my own solution to these vexing problems: Imagine that a filmmaker could perfectly anticipate where everyone in the movie theater would look, for 2 hours straight. He makes a film accordingly. The people then go sit in the theater, and they soon realize as they’re watching the screen, that each person apparently has a little colored dot assigned just to him/her. That is, each person is looking at the screen, and sees a dot (or the person’s name spelled out, if you prefer) and–no matter how the person moves his/her eyes–that dot (or letters spelling the name) moves around perfectly in response. After just a few moments of this, the people in the theater would be certain that there was some kind of advanced technology, whereby sensors in the theater tracked their eye movements, and then in response moved the images on the screen. But nope, there is no such interaction at all; the dots (or letters) on the screen are just light that is being shot out of the projector in the back of the theater, using the same processes as the Disney move in the next theater. The crucial difference is (to repeat), the filmmaker on this particular film somehow knew exactly what everybody would choose to do, beforehand.

==> If you get my analogy, then you can see why I think an intelligent Creator can solve the mind/body problem. You have a soul with free will. You perceive the unfolding universe through the perspective of your physical body, and you appear to have (limited) control over what happens in the physical universe. However, if we focus on any portion of the physical universe, it doesn’t seem to be controlled by your intangible soul at all; that doesn’t even make sense. We can “explain” everything perfectly well without invoking a soul at all, except we’re left with this gaping hole of why the heck are we conscious and does it sure SEEM like we’re controlling things with our minds?!(My answer is that God created our souls and the physical universe such that there was a symmetry between them, where our truly free choices dovetailed perfectly with the mindless operation of the laws of physics in the material universe.) Yet we just ignore that question as “unscientific,” and don’t really worry about it because it’s so commonplace–just like new, human minds coming into existence and being based inside of organic creatures that shoot out of mother’s wombs every day.

So in discussing the above, I came up with two new things, one a plus and the other a minus.

On the plus side, my proposal handles “out of body” experiences quite easily. In contrast, the strict materialists have to just assume that the numerous accounts are all mistaken. (And incidentally, there are documented cases where the guy who dies on the operating table later reports hovering above his body and seeing things that occurred after he was clinically dead. This isn’t just a bunch of people talking about seeing a light and grandma beckoning.)

On the negative side, I need to flesh out a lot more how the soul experiences sensations that seem to be anchored in the material world. After all, it’s not just watching a movie, it’s smelling, feeling pain, etc. I guess I could just extend the analogy to all of the senses. Does the phantom limb phenomenon help my case or hurt it?

ICE Removals Under Trump vs. Obama

[UPDATED with more info about interior removals under Obama.]

I kept hearing conflicting statistics, but thanks to a commenter at Scott Sumner’s blog, I found the relevant reports to sort it all out.

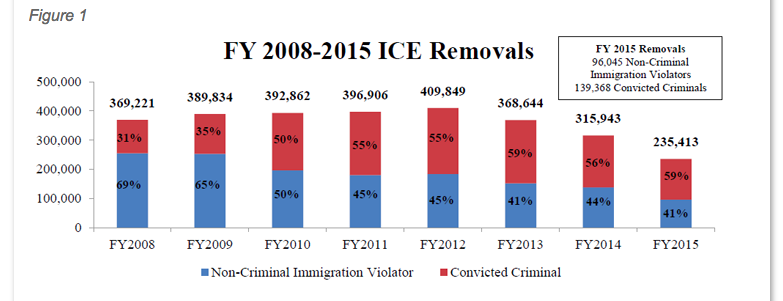

So if you want to make it seem like Trump is deporting way more people than Obama–and both Trump’s fans and critics might want to do so–you can produce a chart like this:

So the above figure is looking at ICE activity from the day Trump was inaugurated, to the end of fiscal year 2017. Then it compares to the same time period, a year earlier. And yep, that’s a big surge. It either proves Trump is a heartless monster (if you’re a critic) or it proves he’s enforcing his campaign promises (if you’re a fan).

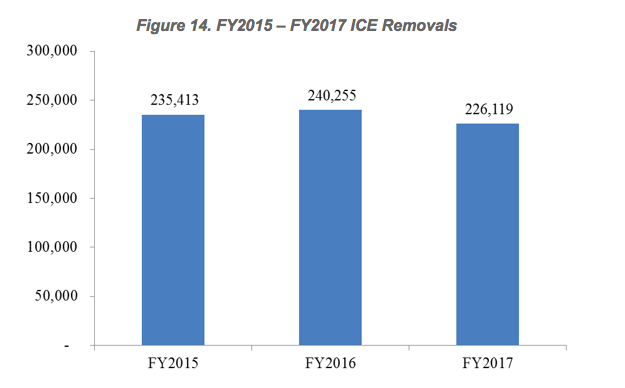

However, you may also have heard people throwing around stats suggesting that immigration removals are way down under Trump. If you want to make that case, you can grab Figure 1 from this 2015 report, and compare it to Figure 14 from the 2017 report. And look what you find:

vs.

Notice FY 2015 appears in both, and it’s the same exact number, so you know this is apples to apples. As you can see, when we look not just at “interior” ICE removals, but also include border removals, then in the first year of the Trump Administration, total ICE removals were about 45% lower than they were at the peak year under Obama.

I’m not drawing any conclusions from all of this, just trying to clarify what’s going on.

UPDATE: Whoa! I missed this on my first pass. Look at this:

So, under Trump, ICE had 61,094 “interior” removals (that’s taken from the first chart I posted above). But in FY2009, the first fiscal year under Obama, ICE has 237,941 interior removals. And that’s not some holdover from the Bush years. Three years later, the figure was 180,970.

For people freaking out about the number of people inside the US whom ICE has deported under Trump, it looks like the analogous figure for Obama was typically three to four times higher.

Recent Comments