The Scott Sumner Stock Sell Signal

Well Scott Sumner has hung up the keyboard. In his “I’m not really serious but actually I am” kind of way, he takes credit for quantitative easing and several trillion dollars in new wealth. It’s too long to reproduce the argument here, but he’s basically saying that bloggers forced Bernanke / gave him the support to inflate more, and that has resuscitated global stock markets.

Don’t worry Scott, you are not being arrogant. I too hold you fully responsible for what happens to the world economy.

Then he drops the bombshell:

…I am complete[ly] burned out, and have been for months. I’ve blogged an average of eight hours a day, seven days a week, for over two years. I’ve only kept going in recent months out of a sense of obligation to keep pushing these issues. But now that lots of other people are saying the exact same thing, it’s time for me to take a break.

Incidentally, I don’t think he’s exaggerating. Scott spends (spent) an incredible amount of time fielding the comments in his blog posts, and he must also have spent a lot of time reading other people’s stuff.

Now that Scott has decided, “My work is done here, the global economy is safe once again,” I just want to remind people of two other events:

==> After breaking the back of inflation and ushering in the Reagan boom, Paul Volcker turned over the keys to the Fed to Alan Greenspan in August 1987. In October 1987, the world suffered the worst stock market crash in history.

==> After presiding over the Great Moderation, and expertly guiding the US economy through the dot-com crash with a surprisingly soft landing, the Maestro Alan Greenspan handed over the keys to the Fed to Ben Bernanke in January 2006. We all know how that turned out.

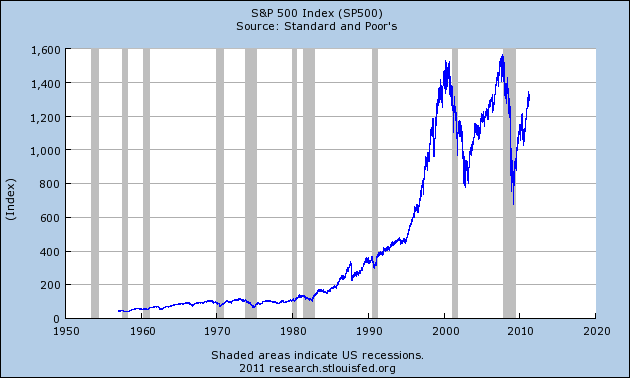

==> And now, Scott Sumner rides off into the sunset, with the stock market looking like this:

SELL SELL SELL.

I’m looking for the Dow back to the previous two peaks before I lighten up too much.

You and four hundred million other investors on Earth. I’m sure you’ll get out first.

It’s a bit off-topic but here’s an All Fools’ Day’s prank by the Polish Mises Institute. (loosely translated by me)

An exclusive interview with Ben Bernanke for mises.pl

Editorial: Are you happy with your work?

Ben Bernanke: It depends on how you interpret satisfaction. It is impossible to speak of the absolute level of satisfaction, but only relative, ordinal level of satisfaction, compared to available alternatives. If we accept such a subjectivist perspective, this my level of satisfaction is high, because I’d rather work here than at Lehman Brothers.

Editorial: In terms of Lehman Brothers … couldn’t it be foreseen?

Ben Bernanke: Of course it could. I’ve always thought that Hayek and the Austrians are right, only that they forget to add that in science there is never any absolute certainty. The Austrians are right to a high degree of 95%. Therefore, even though they are right, it may not have been the case this time.

Editorial: But is it not so that every boom caused by artificially lowered interest rates by the central bank has to end in a crisis?

Ben Bernanke: Of course it is. Reduction of interest rates interferes with the structure of production and leads to relative shifts in terms of allocation of the factors of production. It will have to be corrected by the onset of a recession, which is sufficient to restore equilibrium tendencies in the economy. In addition, the entire process can take place with the relative stability of the general price level. U.S. experience from the 20s shows just that and especially the Japanese experience from the 80s.

Editorial: Why then have you decided on an interest rate cut at the beginning of the 21st century?

Ben Bernanke: We thought that this time things would be different.

Editorial: Why would this time things be any different?

Ben Bernanke: Because all data were completely different than before. Companies have plenty of computers, new technological equipment, trained staff, human capital, a completely new quality of management. We have reached the level where information asymmetries have been largely overcome. We walked into the New Economics.

Editorial: How was the New Economics supposed to prevent the distortions that are caused by interest rate cuts by the central bank?

Ben Bernanke: I do not know, but we cannot be sure that it couldn’t. We return to the 95% probability. Reason was on the side of Hayek, but it could not be there. Why shouldn’t we take the risk? Businesses takes risks every day and contribute to creative destruction. Why can’t the central bank try the same thing?

Editorial: Because the central bank externalizes costs to the society as a whole and causes a loss to the people who do not take the risk?

Ben Bernanke: Yes, this way you can criticize everything.

Editorial: Will interest rate cuts that you’ve made help to restart the boom?

Ben Bernanke: I see no such possibility. Gone are those times, the credit ease, the big bonuses. It is true that I would sacrifice a lot to live it again – a time machine would be a miracle [this is a paraphrase of a Polish song lyric so the sentence might make little sense] – but unfortunately in the current macroeconomic climate it does not seem likely.

Editorial: You seem to refer to the the Austrian School of Economics. So what do you think of the proposals to restore the gold standard?

Ben Bernanke: The idea is interesting. We still have somewhere in a drawer Greenspan’s proposal to introduce this solution. However, the fundamental question is: why?

Editorial: Through the liberalization of money and backing it by a rare commodity you can avoid the manipulation of interest rates, inflation, bubbles …

Ben Bernanke: Yeah, yeah. Avoid business cycles, dramatically reduce the private and public debt, stabilize the financial system, solve the problem of a large and inefficient government, I know these arguments. Still, however, they do not answer the basic question: why?

Editorial: But isn’t all this the purpose?

Ben Bernanke: No, because then it would be an end in itself. As I say, I like the idea. But then again no one ever showed why we should introduce it.

Editorial: What are your predictions for the future?

Ben Bernanke: I think the most interesting things will happen in Europe, much more interesting than here. Bonds of Portugal and Greece have changed the rating of “junk little minus” to “junk big minus,” which means that the Eurozone will be under even greater pressure. I think if they don’t get a recovery, it is within 4 years that the Portuguese and Greek budgets are established in Berlin, or cease to be denominated in euros. My bet is on a camouflaged form of the former.

Editorial: As to the lower ratings of these governments, do you not think that the European Central Bank hindered its reputation of transparency policy by breaking the promise that it would not buy bonds of bankrupt governments?

Ben Bernanke: Transparency policy and communication between the central bank and the environment is a delicate matter. The central bank makes promises and the most important long-term promise is to proceed in such a way that things remain well even if it means breaking some other promises. If the ECB was to keep these other promises, he would have to break the single most important one: that to achieve economic and political priorities it will do everything in its power. So I do not think the ECB broke a promise, even though it indeed didn’t make good on some of them.

Editorial: To wrap things up, here’s one “local” question. Apparently you have been to Poland?

Ben Bernanke: I was once asked to review a doctorate of one outstanding young scientist who wrote his thesis in English. At the last moment, however, I had to withdraw my candidacy, as I have no postdoctoral degree. A similar problem was once experienced by Robert Lucas but his diploma was in time nostrificated at the University of Economics in Ostrow Wielkopolski and he was able to review the paper. In my case it was too late for such a step.

Editorial: Thank you for the interview.

Interview conducted and translated into Polish by Israel Kirzner

Part 1: A new study by Martin Feldstein estimated that QE2 created an extra $2.5 trillion in stock market wealth for Americans.

Therefore QE2 STOLE an extra $2.5 trillion in wealth from some Americans for the benefit of other Americans.

On the progressive side, Yglesias is very good on money.

I’m speechless.

Therefore QE2 STOLE an extra $2.5 trillion in wealth from some Americans for the benefit of other Americans.

Do you not understand the meaning of the word “created”?

Do you not understand that Feldstein might have ignored some important effects when declaring the event to be pure wealth creation?

(In fairness, you probably don’t.)

Feldstein claims:

To be sure, there is no proof that QE2 led to the stock-market rise, or that the stock-market rise caused the increase in consumer spending. But the timing of the stock-market rise, and the lack of any other reason for the sharp rise in consumer spending, makes that chain of events look very plausible.

The magnitude of the relationship between the stock-market rise and the jump in consumer spending also fits the data. Since share ownership (including mutual funds) of American households totals approximately $17 trillion, a 15% rise in share prices increase household wealth by about $2.5 trillion. The past relationship between wealth and consumer spending implies that each $100 of additional wealth raises consumer spending by about four dollars, so $2.5 trillion of additional wealth would raise consumer spending by roughly $100 billion.

Based the above, no new “wealth” was created. Instead, the Fed’s manipulations merely shifted existing purchasing power to those purchasing or owning stocks. The rise in stock values did make the owners of those stocks richer in the short run vis-à-vis people who lost purchasing power and induced them to spend more than would have without the artificial grant of stolen purchasing power.

As Feldstein explains:

The rise in consumer spending was not, however, due to higher employment or faster income growth. Instead, it reflected a FALL IN THE PERSONAL SAVING RATE.

Thus, the grand effect of all this theft and fraud was to dissuade people from responsibly saving and instead induce them into blowing more cash at the mall, further impoverishing our society. The original victims are poorer and the recipients bought stuff they didn’t need and further distorted the price and capital structure.

Great work, you inflationists.

Bob, You must know that you have fibbed. I never claimed bloggers forced Bernanke’s hand. Krugman made that claim. And Feldstein claimed QE2 forced up stock prices. Those are the people you need to be going after–just because I quoted them doesn’t mean I agree (as Mankiw frequently reminds us.) Please let me retire in peace. 🙂