The Policeman Is Your…

The thing that is disturbing about this video is the guy on the phone is the only rational person in the whole scene. Listen to how he talks to the 911 operator, for example. By the end of the video, the cop comes over, yells at him, hangs up his phone, and tosses it onto the grass.

WARNING: A few stray naughty words in the above.

Ms. Yellen, It’s a Trap!

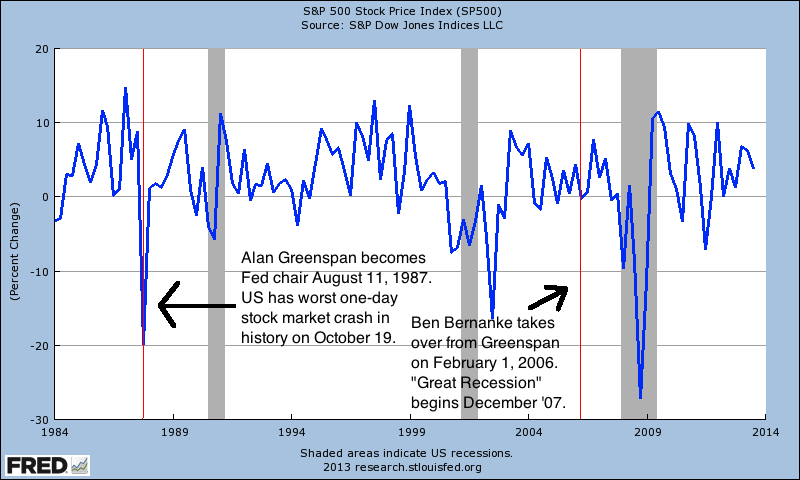

That Larry Summers is one sly dog. With his “surprise” move to continue QE3, Big Ben just bought himself some time to safely exit the scene, following the pattern of the last two Fed handovers:

(It should go without saying that the red lines above are only approximately correct. You can tell I don’t have mad skillz when it comes to the MacBook’s Paintbrush program. Also, the above shows the percentage moves in the quarterly average of the S&P500.)

As I said on Facebook tonight:

If I were a cigar-chomping financial titan, running the world through backroom deals with my fellow Good Ole Boys, we’d think it was pretty funny to have the first black president and first woman Fed chief at the helm when the US economy collapses. Thank goodness We the People run this country.

A Sleeper Hit

I always get email notifications that people are leaving comments on this video:

I barely ever click on them, but for kicks I did, and the guy said, “I’m glad this video has so few views…I feel bad for your students Murphy” (or something like that).

So I was curious and checked it, and there are 63,000+ views. Holy frick.

I’m being serious: Explain to me why this video has so many views. It’s over 10 minutes long. There is no cleavage. No cats. What’s going on here?

One obvious factor is that somehow it got into the circles of pro-Reich people. (Doesn’t that look like a Nazi thing?) But OK, fine, how do I do that some more? I’m not saying I want to have a formulaic approach to getting big YouTube views, but I would like to understand exactly why this video took off.

Geometry Is Definitely Analytic in *This* Anecdote

I was trying to show my 8-year-old some stuff in geometry over the weekend. First I drew a generic rectangle and asked him what it was. He of course identified it as a rectangle. Then I asked him to tell me why it was a rectangle, and we began making a list that I titled, “Rules for Being a Rectangle.” We did the same procedure for a square.

Then we had the following exchange, which I thought was pretty funny:

BOB: Okay, now that we’ve figured out the rules for rectangles and squares, let me ask: Is a rectangle a square?

SON: (Pauses.) Not usually.

At first this disappointed me, since he’s very bright and we had clearly laid out the rules; I wanted him to give me the “correct” answer of no. But then I thought that maybe he meant only a special subset of rectangles were squares, and so if you randomly sampled from the set of all rectangles, it would usually not be a square, but hey once in a while you’d get a square. So, I gave him the benefit of the doubt, clarified what the precise situation was, and then moved on. This is when it got interesting.

BOB: Okay, let’s try this question: Is a square a rectangle?

SON: (Pauses.) Not usually.

Now I was really flummoxed. What the heck was this kid thinking? Let’s find out.

BOB: “Not usually”? Why do you say that?

SON: Because most people would call it a square!

I love this kind of stuff. This happened to me all the time when I was teaching at Hillsdale College. I’d write down what I thought were perfectly straightforward exam questions, and then bright students would miss tons of them. After a while I realized that their “problem” was that they were giving decent answers to their interpretation of what the question meant, it’s just that they weren’t interpreting the questions the way trained economists do.

Scott Sumner Is of Two Minds When It Comes to the Monetary Approach of Michael Woodford

Apparently it’s “Bash Scott” month here at Free Advice, but again, I don’t think I’m quibbling over trivialities here:

Back on September 10, Scott wrote a post titled, “Listen to the expert” which quoted a news article touting Columbia University’s Michael Woodford as one the world’s most important and influential scholars publishing on monetary policy. After quoting liberally from the cheery article, Scott commented:

The expert says NGDPLT [nominal GDP level targeting–RPM]. So just do it. (Yes, he also says taper, but that’s a trivial issue compared to NGDPLT.)

PS. Gauti Eggertsson (Woodford’s student) has a new blog.

PPS. Woodford was born in 1955 and is currently 57. Ditto for me. Bernanke and Krugman were born in 1953. Boomers rule!

So you’d think from the above that Scott thinks Woodford is an (the?) expert on monetary policy, and that because Woodford is in favor of Scott’s policy proposal (namely, targeting the level of NGDP), this is evidence that it is a good idea.

That’s why I was intrigued to read today, September 17, Scott write the following in a post about whether a central bank can depreciate its currency in the midst of a liquidity trap:

PS. The exchange rate does help in one respect. It forces people out of the horrible Keynesian/Woodfordian “rental cost of money” approach to monetary policy, and into a much more enlightening Fisher/Warren “price of money” approach. By doing so it allows us to think about the problems much more clearly…

As usual with my posts on Scott (and Krugman), this isn’t an outright contradiction. But it’s also not as if Scott said Woodford had a horrible approach to making eggs, or that he had a cumbersome approach to monetary policy. No, the guy Scott held up as a (the?) world’s expert on monetary policy one week ago–and since that expert agreed with Scott’s policy ideas, it was evidence we should implement them–is now someone who has a “horrible…approach to monetary policy.”

Ishn’t dat veird?

P.S. I’m assuming it’s the same Woodford in both posts. Technically, maybe there are two of them running around, but I’m pretty sure Scott’s talking about the same guy.

Even More Sumner Shenanigans

I almost feel bad piling on Scott, because although I disagree with his monetary views tremendously, I actually think he’s a cool guy with a good sense of humor. But this is science; we must be merciless.

When the news broke yesterday that Larry Summers was pulling his name out of the running for Fed chief, Scott wrote a post titled, “S&P futures soar 17 points (1%) on Summers dropping out.” Here are some excerpts from that post:

God I love seeing financial markets respond to monetary policy news. Now let’s see the Fed do something exciting on Wednesday. And for God’s sake, let’s get an NGDP futures market up and running.

Update: Taking into account the fact that there was already some expectation Summers would drop out, I’d guess his decision created upwards of a trillion dollars in new global stock market wealth. Not bad!

Monetary policy is really, really important.

There was just one little wrinkle in Scott’s victory party. The very news article that he quoted, in order to show how the Summers announcement drove up stock prices, also said: “In debt markets, futures for the U.S. Treasury 10-year note leaped over a full point, a sizable move for Asian hours, as investors took yields lower.”

Now you’re thinking, “Duh, Yellen will buy more Treasury debt than Summers would have, so the price of Treasury debt went up and its yield went down.” But no, Scott has taken great pains to spank anyone espousing such a naive theory.

So today, Scott asked his readers (at the end of the post) if they had any data on TIPS spreads to get to the bottom of this mystery. Here’s how it played out, with Scott commenting on their findings:

Update: In the comment section John Hall has data suggesting not much impact on TIPS spreads, albeit the 10-year may be up a couple basis points. So real rates fell. Possible explanations:

1. Not much impact on NGDP expectations.

2. Significant impact on NGDP, but fairly flat SRAS.

3. Some market segmentation—TIPS spreads don’t precisely measure expected inflation changes.

Or perhaps a bit of each. If I had to guess I’d say NGDP expectations rose, but by a very small amount.

I don’t think I’m merely being a wiseguy by saying there’s a bit of an inconsistency in Scott’s commentary from yesterday to today, am I?

Potpourri

==> The WSJ and I are pen pals.

==> Next week on Friday (September 27) I’ll be giving a talk at San Jose State on interventionism in the Austrian tradition. (I’m in California because on Saturday I’m giving the keynote address for a celebration of Mises’ birthday. I still haven’t gotten his present, gah!!)

==> Alex Tabarrok should tell firefighters to crack down on unregulated supper clubs and thereby justify their budgets.

==> This “Nomocracy in Politics” seems like a website with a fairly unique perspective.

==> Daniel Kuehn in his inaugural EconLib article, where he challenges the conventional view that immigration policy should cater to highly skilled immigrants in the STEM fields. Obviously I don’t think the government should be using guns to influence the movement of people at all, but I could still see somebody saying–even after reading Daniel’s article–that “if the feds are going to limit immigrants to X people per year, then they should give preference to people who would earn a high salary right off the boat.” (And actually I bet such people would come here on ships, not boats.)

==> Some celebrities who were quite sweeping in their denunciations of hawkish US foreign policy under Bush, but are now strangely silent. (BTW I’m just assuming the article is being fair, and that these celebrities really have been silent under Obama. I’d be happy to correct this, if any of you have counterexamples.)

==> Nick Rowe admits that nominal GDP targeting is a vicious dog with sharp teeth.

==> Can you imagine if you were an MBA student, minding your own business, and then you had Nick Rowe teaching you about the time value of money? You’d probably drop out and switch to philosophy. (BTW I’m just being “funny,” Nick’s post is awesome. I’m just joking that 99% of his students probably have no idea how deep he gets into this typical stuff that most lecturers would breeze through without giving it much thought.)

==> Just for fun.

==> Another surprise monetary policy announcement, another example of easier money leading to lower interest rates. Yawn.

Seeing Through Jonah’s Excuse

In church today we started the book of Jonah. I’m sure everybody, believer and skeptic alike, knows the basic plot of the story: God commands Jonah to go to the great city of Ninevah and tell the wicked people there that God is going to destroy them. Jonah runs away, is swallowed by a fish (whale?), and ends up doing what God told him originally. The people of Ninevah are horrified at the news and repent, leading God to withdraw His threat.

Now here’s where the story gets really interesting. Most people would bask in their role in changing the ways of a great city; after all, most prophets were ignored, and that was certainly heartbreaking (if not lethal), but here Jonah the prophet had everybody listen. Yet look at how Jonah reacts like a sulking teenager (Jonah 4: 1-3):

4 But it displeased Jonah exceedingly, and he became angry. 2 So he prayed to the Lord, and said, “Ah, Lord, was not this what I said when I was still in my country? Therefore I fled previously to Tarshish; for I know that You are a gracious and merciful God, slow to anger and abundant in lovingkindness, One who relents from doing harm. 3 Therefore now, O Lord, please take my life from me, for it is better for me to die than to live!”

Let me answer Jonah’s question (which I’ve put in bold): No, that’s not what you said when God approached you; at least, that’s not in my Bible. And if that really had been Jonah’s objection–namely, that he knew God wouldn’t follow through with the threat to the Ninevites–then why is running to Tarshish a rational response?

To me, it’s crystal clear that Jonah was simply lying (or rationalizing, maybe he didn’t realize he was inventing an excuse on the spot). He ran away because he was afraid; he didn’t want to go into a foreign city where the people would hate his guts anyway, to tell them they were sinful and going to be wiped out. (For a much milder scenario, if God commanded me to go the Academy Awards and tell all the movie stars that they were horrible role models and needed to stop having pre-marital sex, I wouldn’t want to do it either.)

Now once I heard a preacher catch a move like this, when it was the Samaritan woman at the well to whom Jesus talked. As you can see in verse 20 at this link, when Jesus busts her for having multiple husbands, she quickly changes the subject in a complete non sequitur. So like I said, I once heard a preacher on that story point out her nice move, but I don’t think I’ve ever heard someone suggest that Jonah was simply covering himself by saying, “Oh God this is why I didn’t want to go to Ninevah, I knew you would forgive them.”

Indeed, our pastor today took Jonah at face value, and then went into a (totally correct) discussion of why Jonah was wrong to think this way, the irony of him begrudging God’s forgiveness of sinners, etc. But, I think we need to recognize that Jonah was rewriting history–sort of like when Moses told the Israelites it was their fault that he couldn’t enter the Promised Land.

Recent Comments