Krugman’s Latest Post: “Murphy Was Right”

Well, not his exact words, but see for yourself. I’m serious, this isn’t a Kontradiction, this is a flat-out contradiction, is it not?

If you want to be super squirmy and get him out of this Houdini-style, I suppose you could argue, “Krugman 2014 is clearly contradicting Delong 2013, but not necessarily Krugman 2013. Krugman 2013 wasn’t endorsing all of DeLong 2013, just saying that Murphy 2013 hadn’t delivered a death blow to DeLong 2013.”

But if that’s the route you want to take, you should apply for White House press secretary.

Tom Woods and I Discuss Private Defense

I’m being serious, I think Tom and I make this sound pretty plausible. So if you’re a free-market-loving minarchist, tell me what you think we’re missing.

Remember everybody, Tom Woods is going to be at the Night of Clarity on August 15! If you jump for joy when it’s another of his shows where I’m the guest, I really can’t understand why you wouldn’t make plans to see us both in hopping downtown Nashville. Full details here.

One funny thing I realized while listening to the playback: I think that insurance companies would play a big role in a modern, industrialized society based on voluntary relations. This naturally leads some critics to worry, “Wouldn’t the insurance companies turn into the State in your world?” I have come up with responses to that, but I noticed that in Tom’s discussion at one point, he throws out three examples of real-world insurance companies. Their names? Allstate, State Farm, and Progressive. Uh oh.

Intro to RPM and Lessons for the Young Economist

A brief intro to myself and textbook.

Here’s the student text.

Here’s the teacher’s manual.

VA Scandal Widens

I haven’t had time to blog it, but from the NYT June 15:

Staff members at dozens of Department of Veterans Affairs hospitals across the country have objected for years to falsified patient appointment schedules and other improper practices, only to be rebuffed, disciplined or even fired after speaking up, according to interviews with current and former staff members and internal documents.

The growing V.A. scandal over long patient wait times and fake scheduling books is emboldening hundreds of employees to go to federal watchdogs, unions, lawmakers and outside whistle-blower groups to report continuing problems, officials for those various groups said.

In interviews with The New York Times, a half-dozen current and former staff members — four doctors, a nurse and an office manager in Delaware, Pennsylvania and Alaska — said they faced retaliation for reporting systemic problems. Their accounts, some corroborated by internal documents, portray a culture of silence and intimidation within the department and echo experiences detailed by other V.A. personnel in court filings, government investigations and congressional testimony, much of it largely unnoticed until now.

The department has a history of retaliating against whistle-blowers, which Sloan D. Gibson, the acting V.A. secretary, acknowledged this month at a news conference in San Antonio. “I understand that we’ve got a cultural issue there, and we’re going to deal with that cultural issue,” said Mr. Gibson, who replaced Eric K. Shinseki after Mr. Shinseki resigned over the scandal last month. Punishing whistle-blowers is “absolutely unacceptable,” Mr. Gibson said.

Now when I brought this issue up a few weeks ago, some of you in the comments wagged your fingers at me, saying this was an isolated incident in Phoenix. I’m not saying you need to ruin your weekend, but your apology should be in the comments on this post by Monday COB I would think.

Stephen Hawking and John Oliver

I’m sure they helped Hawking with his lines, but this is nonetheless surprisingly funny:

A Conversation on Bitcoin, Gold, and Music

Tatiana Moroz had me and Amagi Metals’ Stephen Macaskill on her show to discuss sundry topics, including the launch of TatianaCoin which is an intriguing new way for artists to crowd-fund projects from their fans.

I also shamelessly plug the Night of Clarity, at which Tatiana will be performing. It’s August 15. Larry Reed, Nelson Nash, Tom Woods, and David Stockman will be speaking. Plus, downtown Nashville is really hopping now. Come on down kids! Full details here.

Potpourri

==> My new Mises CA post catches NPR sounding surprisingly Rothbardian. They need Gene Callahan to vet their broadcasts.

==> Vijay Boyapati discusses his view of Austrian monetary theory and Bitcoin.

==> I know this can’t possibly lend credibility to the people saying the US government has been experimenting with weather control, but anyway…

==> Dan Sanchez on Dick Cheney, prophet on Iraq.

==> This glitch in Super Mario Bros. is awesome. At first you won’t understand what the player is doing, but then it becomes clear.

==> Because it hurts Piketty, now estate tax data must be discredited. (HT2 Phil Magness) Apparently trusts were invented in 1985.

Is There a Reason For Stock Market to Be So High?

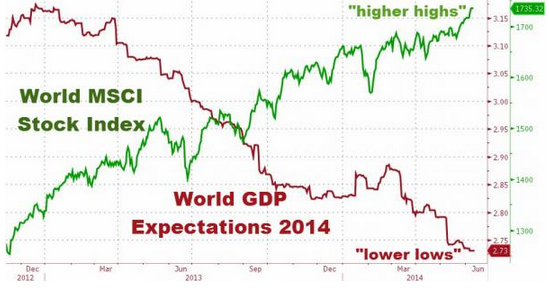

ZeroHedge has an interesting post relaying an FT report that central banks and other government institutions around the world have invested $29.1 trillion in market investments such as equities and gold. The ZeroHedge article then gives this interesting chart:

Analysts who reject “conspiracy theories” might tell a plausible story about the above chart along the lines of, “As the conventional outlook on economic growth slipped, central banks around the world announced more aggressive measures to boost growth. This showed investors that central bankers were less worried about [price] inflation, and so investors revised their long-term forecasts to include stronger real growth as well as higher [price] inflation. The result was higher spot prices of stocks.”

Yet notice that even this type of “non-conspiracy” explanation still shows that global stock markets are rising because of central bank policy, not because of a healthy economy. Anybody who comes to the table with the idea that printing money doesn’t generate lasting prosperity should conclude that the stock market is overvalued.

Does that mean it will crash next Tuesday? Of course not; if it did imply that the market would crash next Tuesday, then people would try to get out beforehand and the market already would have crashed (and our heads would explode because I just contradicted my premise).

The “rational expectations” worldview keeps you honest, as it were, but it doesn’t actually mean the guys at ZeroHedge (or here at this blog) are wrong when we say, the stock market is very vulnerable.

Recent Comments