BMS ep. 113: Interview With Oren Cass

This was my ideal type of discussion, where I disagree with the guest and push back on points, but give him a chance to explain himself.

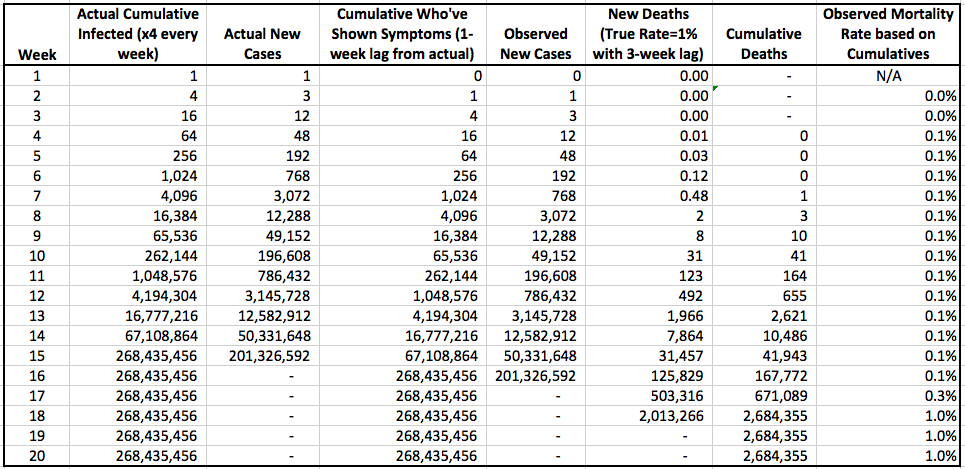

Estimated vs. Actual Mortality Simulation

[EDIT: I changed the original title on this post, to clarify that I wasn’t giving even a back-of-the-envelope estimate of what I thought was actually going to happen. I am just showing how one particular issue affects observations.]

One big thing about the coronavirus that I didn’t fully appreciate at first, is the lag between (a) exposure, (b) showing symptoms, and (c) death. This obviously affects things like the calculated mortality rate for a given region, etc.

Now to be sure, there are lots of other things going on too. For example, a lot of people probably got it, but were mild cases and so didn’t get picked up as “new cases.”

In any event though, I whipped up the following table just to show how the specific lags I’ve mentioned affect things. Let me know if you see any mistakes.

Bob Murphy Show ep. 111: Winston Ewert Applies Computer Science to Intelligent Design

Ewert has a PhD in computer science. Audio here, video below.

Bob Murphy Show ep. 112: My commentary on the coronavirus response

Sundry thoughts, recorded over the weekend, here.

Murphy Twin Spin

==> In the latest Lara-Murphy Show, Carlos and I talk about financial nuttiness and the coronavirus. We recorded this on Saturday, though, so we didn’t know about the Fed’s Sunday surprise.

==> In the latest Bob Murphy Show, I explain the “scientific” approach to Blackjack, and discuss the controversies among academics over the famous Kelly criterion for optimal bet sizing.

My Thoughts on Recent Fed Announcements

At Mises.org. An excerpt:

Now what the Fed announced last week is that it will itselfenter the repo market and be prepared to offer up to $1.5 trillion in (newly created) US dollars in order to allow institutions to pledge their Treasurys as collateral and borrow such vast sums. But these transactions won’t be overnight loans; instead, the $1.5 trillion consists of $500 billion bursts of financing in the one-month and three-month repo contracts.

The whole point of this Fed intervention was to keep the implicit interest rate in the Treasury repo market down to acceptable levels. In other words, if the Fed had not intervened, then repo rates would have soared. Remember, last September the repo rate suddenly jumped from about 2.2 percent to 6 percent in two days. That was deemed a crisis at the time, justifying the Fed’s large (and recently expanded) ongoing intervention in the repo markets.

It’s true that when fear grips the world, investors do look to US government debt as a “safe haven.” That’s why US government bond yields collapsed to record lows recently and stock markets are falling: many portfolio managers are switching from equity to fixed-income assets.

But what the spikes in the repo market reveal is that in the very short term, such as a period of 1–90 days, actual cash is king. Right now, asset managers do not at all view a Treasury security “as almost the same thing” as US dollars issued by the Federal Reserve. One way the market communicates such a change in risk appetites is a “skyrocketing” implicit interest rate in the Treasury repo market. People who control actual US cash right now are not as willing to see that transformed into an “equivalent” amount of Treasurys, and so they demand a higher compensation (interest return) to make the asset swap. This is the market process that the Fed is trying desperately to hammer away.

Bob Murphy Show ep. 109: Larry Reed on Maintaining Hope and Speaking Truth to Power

Here’s the audio, and video below:

Recent Comments