Potpourri

==> Tom Woods and Gary Chartier talk anarchy and the law. Just plug your ears when they say maybe I’m not right about this stuff.

==> This oddity in the Ferguson grand jury is definitely a point in favor of the camp that says the government didn’t want an indictment. Then here’s Scalia, though I haven’t read him yet on this.

==> Judith Curry on the legacy of ClimateGate, five years later.

==> Has anybody heard of this John Bugas guy and his thoughts on what sound like consumer sovereignty?

==> His monetary views are nuts, but aww, I can’t stay mad at him.

==> When it comes to his weight, Krugman adheres to morality tales and punishment for the boom’s excesses. I, on the other hand, have engaged in several rounds of quantitative easing in the last few years, yet it went hand in hand with belt tightening.

==> Speaking of business cycle analogies that aren’t actually analogous, Larry White caught this interesting tidbit from Chris Rock’s interview:

What has Obama done wrong?

When Obama first got elected, he should have let it all just drop.

Let what drop?

Just let the country flatline. Let the auto industry die. Don’t bail anybody out. In sports, that’s what any new GM does. They make sure that the catastrophe is on the old management and then they clean up. They don’t try to save old management’s mistakes.

That’s clever. You let it all go to hell.

Let it all go to hell knowing good and well this is on them. That way you can implement. You hire your own coach. You get your own players. He could have got way more done. You know, we’ve all been on planes that had tremendous turbulence, but we forget all about it. Now, if you live through a plane crash, you’ll never forget that. Maybe Obama should have let the plane crash. You get credit for bringing somebody back from the dead. You don’t really get credit for helping a sick person by administering antibiotics.

The Case for a Carbon Tax Is Much Weaker Than You Think

This is a pretty “Square One” type of post, where I explain the textbook case for a carbon tax and how reality differs from it in myriad ways. The context is a carbon tax (I mean, “fee”) introduced by Senators Whitehouse and Schatz. An excerpt:

Furthermore, even if we set aside the problem of “leakage,” there is still the matter that the U.S. and state governments already impose significant penalties on CO2emissions, and give subsidies and mandates encouraging “alternative” technology and fuels. For example, federal and state gasoline taxes were not set up as carbon taxes, but to the gasoline consumer they have a similar effect. Currently, federal and state gas taxes average about 42 cents per gallon, which is higherthan what the “optimal” tax on a gallon of gas (about 37 cents) would be, if the social cost of carbon were indeed $42/ton.

To carry this point further, Sens. Whitehouse and Schatz should also put in their bill the elimination of the ethanol mandate, the EPA’s power plant regulations, all CAFE standards on fuel economy, all energy efficiency mandates, and they should remove all regulatory hurdles for the Keystone Pipeline—after all, once their proposed carbon tax has cured the “market failure,” we should let individual businesses and households choose their optimal behavior guided by the market. That’s what the textbook analysis says, upon which they rest their legislation. Are they willing to do all of that, or do they not actually believe in the textbook treatment of negative externalities after all? These considerations show that the Whitehouse and Schatz plan isn’t really about adjusting the “costs of pollution” but instead is about giving the federal government more control over the economy, and energy sector in particular.

Can I Pass the Scott Sumner Turing Test?

I have been reading Scott pretty regularly since mid-2009 at least, and at this point I’m pretty sure I have learned his pet peeves. For example, when this analyst writes: “Might falling oil prices affect AD? Not with monetary offset–the Fed will simply adjust the date at which they start raising rates.”

…then I think Scott would tear his hair out and respond along these lines:

Man, Milton Friedman must be rolling over in his grave. How many times do I need to tell people that the “ultra-low” rates since 2009 go hand-in-hand with tight money? If the Fed did the sensible thing and targeted nominal GDP growth, then inflation expectations would rise and so would the natural rate of interest. Thus rising nominal rates would go hand-in-hand with looser money. I can’t believe how many times a week I still have to point out this basic stuff, that you can’t gauge the stance of monetary policy by looking at interest rates. It’s like the Great Depression and Japan never happened. If you tell me that the Fed will postpone rate hikes beyond 2017, that tells me the Fed will continue with its ultra-tight monetary policy for the next three years, meaning the Fed is holding down AD, not boosting it as the commentator above implies.

What do you guys think? Would you have believed the above was Scott writing?

Krugman: “Sticky Wages I Win, Flexible Wages You Lose”

I have pointed this out before, but it’s funny when Krugman shakes his head at the morons who dispute the sticky-wage case for Keynesianism (e.g. when he recently posted a chart about wage adjustments in Spain during the crisis), when he earlier had taken Casey Mulligan out to the woodshed for thinking sticky wages/prices had anything to do with Keynesianism during the crisis. Full details here. The conclusion:

(1) Krugman can’t believe the idiots who try to reject the Keynesian policy prescriptions by denying that there are sticky wages and prices. Just open your eyes, guys! Wages are clearly sticky and so the classical solutions fail; that’s why we need bigger government deficits.

(2) Krugman can’t believe the idiots who try to reject the Keynesian policy prescriptions by looking at the empirical relevance of sticky wages and prices. Try reading what the Keynesians are actually writing, you liars! If wages fell it would exacerbate nominal debt burdens; that’s why we need bigger government deficits.

(3) The empirical evidence for the need for bigger government deficits is overwhelming at this point. The Keynesian model came through this crisis with flying colors. Anyone who denies that is a knave or fool.

“Reason” Symposium on Predictions of Price Inflation

I was one of the contributors to this. Whenever you do something like this, by the time the editing process is done, the tone of the finished piece has strayed a little bit from the original draft. So let me reiterate here, I am way more introspective about what happened than Peter Schiff seems to be, though it’s true I am not falling on my knees at Krugman’s feet the way Brad DeLong suggested.

Anyway some excerpts from my piece:

It’s true that consumer prices did not zoom up as I had predicted, but my objection to the Fed’s post-crisis policies was never dependent on that specific forecast. Indeed, the distinctive feature of Austrian business cycle theory is that “easy money” causes the familiar boom-bust cycle by affecting relative prices. Regardless of the purchasing power of the dollar, the Fed’s actions have definitely interfered with interest rates, hindering the communication of information about the condition of the credit markets. By postponing needed readjustments in the structure of production, the Fed’s actions have allowed the problems apparent in the fall of 2008 to fester.

I am still confident that a day of price inflation reckoning looms and that the U.S. dollar’s days as the world’s reserve currency are numbered, though I have no way of gauging the duration of this calm before the storm. Still, my 2009 predictions about consumer price inflation were wrong, and it’s useful to analyze why.

…In 2009 I thought more and more investors would begin to anticipate this process, anticipating that the money supply held by the public eventually would start to soar, so that large-scale price inflation would become a self-fulfilling prophecy.

But the U.S. economy has stayed in this holding pattern, where people expect low consumer price inflation and so commercial banks keep their excess reserves earning 25 basis points parked at the Fed rather than make new loans. Thus the process I described above has been thwarted; the quantity of money held by the public right now is much lower than it would be, if the banks decided they would rather make loans and earn a higher interest rate than the 25 basis points currently paid by the Fed.

…

In the Austrian view, therefore, consumer prices are not a reliable gauge of the “looseness” or “tightness” of monetary policy. Irving Fisher infamously thought the Fed in the 1920s had done a good job because the CPI had been tame, whereas Mises knew that a crash was brewing by the late 1920s.

Last thing, in the form of a request: Please do not just inform me, “Bob, you should have talked about such-and-such.” There are word limits on these things. If you’re going to tell me I should have talked about such-and-such, then tell me what paragraphs I should have taken out.

Molinism and Murphyism

A reader encouraged me to check out “Molinism,” which Wikipedia describes in this way:

Molinism, named after 16th Century Jesuit theologian Luis de Molina, is a religious doctrine which attempts to reconcile the providence of God with human free will. William Lane Craig and Alvin Plantinga are some of its best known advocates today, though other important Molinists include Alfred Freddoso and Thomas Flint. In basic terms, Molinists hold that in addition to knowing everything that does or will happen, God also knows what His creatures would freely choose if placed in any circumstance.

…

William Lane Craig calls Molinism “one of the most fruitful theological ideas ever conceived. For it would serve to explain not only God’s knowledge of the future, but divine providence and predestination as well”.[7] Under it, God retains a measure of divine providence without hindering humanity’s freedom. Because God has middle knowledge, He knows what an agent would freely do in a particular situation. So, agent A, if placed in circumstance C, would freely choose option X over option Y. Thus, if God wanted to accomplish X, all God would do is, using his middle knowledge, actualize the world in which A was placed in C, and A would freely choose X. God retains an element of providence without nullifying A’s choice and God’s purpose (the actualization of X) is fulfilled.Molinists also believe it can aid one’s understanding of salvation. Ever since Augustine and Pelagius there has been debate over the issue of salvation; more specifically how can God elect believers and believers still come to God freely? Protestants who lean more towards God’s election and sovereignty are usually Calvinists while those who lean more towards humanity’s free choice follow Arminianism. However, the Molinist can embrace both God’s sovereignty and human free choice.

Take the salvation of Agent A. God knows that if He were to place A in circumstances C, then A would freely choose to believe in Christ. So God actualizes the world where C occurs, and then A freely believes. God still retains a measure of His divine providence because He actualizes the world in which A freely chooses. But, A still retains freedom in the sense of being able to choose either option. It is important to note that Molinism does not affirm two contradictory propositions when it affirms both God’s providence and humanity’s freedom. God’s providence extends to the actualization of the world in which an agent may believe upon Christ.

Yes, this discussion of Molinism is by far the closest I have seen to my own attempts to reconcile God’s sovereignty with humanity’s free will. (To be clear, I don’t remember ever hearing of Molinism before.) Here’s an excerpt of a post I wrote back in 2012 on this:

From our perspective, it appears that we can influence the material world. For example, I can use my “mind powers” to control my right hand. We take it for granted because we can all do it, but if I could move a rock the way I can move my hand, it would be astonishing. Yes, we can trace the cause-and-effect from the muscles in my hand up to my brain, but nonetheless it sure seems like I am “freely choosing” to open and close my hand. It really looks like I control a small part of the events in the universe, and the only way a strict materialist can really deny that, is to ultimately deny that the term “I” means anything. (That’s why going down the path of materialism, leads to nihilism and drunken Facebook sessions.)

Now the tricky part: I think what happens is that God anticipated what everybody would subjectively want to do, and then designed the laws of the material universe such that it sure looks like we are controlling atoms with our thoughts, when “really” we are just watching a movie unfold before our eyes.

Here’s an analogy: Suppose that a filmmaker could perfectly anticipate where every moviegoer’s eyes would look on the screen. Then he put up each of our names on the screen, and they started moving around. In other words, when the movie started, I would see “Bob Murphy” moving around the screen at the theater, no matter where I looked on the screen. But the guy to my right would see his name up there too, and no matter where he looked on the screen, the letters of his name would perfectly track his line of sight.

If we watched this movie for 10 minutes, and there was never a hitch, we would all be absolutely convinced that we were controlling the movement of the letters. We would think the movie theater had employed some new technology, and that there were sensors in the theater that took our muscle movements as input, and then translated that into commands for the projector, so it would “know” where to shoot the letters for us to see. This, we would convince ourselves, was the only explanation for our apparent control over the letters.

But no, suppose it really were a regular movie, put onto the film months previously. The way it works is that the filmmaker somehow knew exactly who would be watching the film that day, where we’d be sitting, and exactly where we’d be looking, down to the 10th of a second, for the whole film.

A word of warning: If you go back and read my full 2012 post, note that I claim C.S. Lewis wrote, “You don’t have a soul–you are a soul. You have a body.” Apparently C.S. Lewis never said that, even though people often attribute it to him.

Jury Nullification Outreach

I was asked to help spread the word about this effort:

BLACK MARKET FRIDAY, BLACKOUT BAD LAW

Get involved in the efforts of bringing JURY NULLIFICATION mainstream.

NO VICTIM NO CRIME

If you’re in the NYC area or know someone who is during December up to January 5th donate your time to juror rights outreach. Outreach to take place at the Daniel Patrick Moynihan US Court House in NYC.

GET INVOLVED

https://www.facebook.com/events/1500824033520677/

Fully Informed Jury Association

(406) 442-7800

http://www.FIJA.org

Facebook: https://www.facebook.com/FIJANational

Twitter: https://twitter.com/fija_aji

Donating online to the Fully Informed Jury Association is easy, fast, and secure.

To donate online, please visit our website at http://fija.org/support-fija/

Thank you for your support!

Keep in mind the jury nullification is not the same thing as this type of nullification.

Also, the obvious disclaimers that you should be fully informed about the legal issues surrounding such strategies before you go down this path. The big picture here, however, is that I hear people all the time complaining that they can’t do anything individually to roll back an overbearing State. At the same time, they complain when they get called up for jury duty. Well…

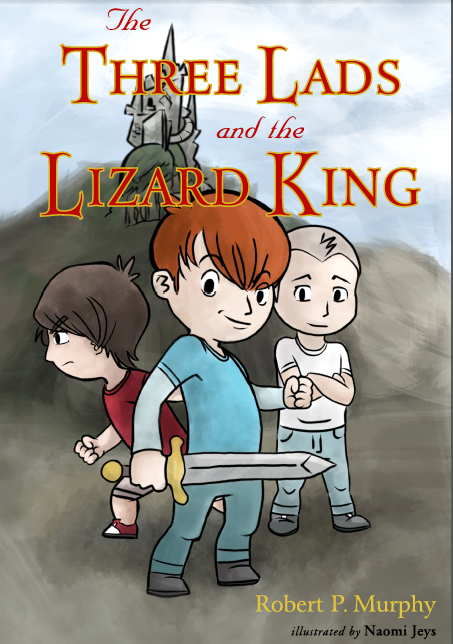

Update on *Three Lads and the Lizard King*

Just a reminder that the children’s book I wrote (originally for my son) is available on Amazon.. (Incidentally, Amazon was using the wrong ink on the books for the first 20 copies or so until they fixed it, so if you ordered early on and got some funny results on the inside, just notify Amazon and they’ll replace it because it’s their mistake.)

Here’s the very nice review that G. Morin posted at Amazon–and I promise I didn’t ask him to do this:

Full disclosure: I’m already an admirer of Robert Murphy’s professional writing (economics) – he writes in a clear and engaging style and can make a subject as mundane as economics actually interesting and entertaining. So I was curious about his foray into the world of children’s literature. I must say I was pleasantly surprised. Not that I expected Bob to do a poor job but I’m thinking “It’s a story for 8-10 year olds… how interesting can it be for a 40 something year old?” Thankfully my skepticism was shattered. Each chapter was a page turner. As each chapter ended I had no choice but to proceed to the next. I literally read it cover to cover in one sitting. There is no higher honor for an author then to write a book that is so engaging that the reader simply cannot set it aside. Bob achieve’s that with this book

For those of you who are fans of his economic works you won’t be disappointed either. He manages to weave some basic lessons about money, value, trade, etc without hitting the reader over the head with it. I think most children will absorb the lesson without even realizing it it was in any way educational (it’s also a lesson most adults need as well). But it is only a part of the overall story, I don’t want to give the impression the whole thing is just some econ lesson in disguise. Overall it has everything a good children’s book requires: relatable characters, adventure, exploration, overcoming challenges and some good old fashion fantasy. Highly recommended. You won’t be disappointed.

Recent Comments