Potpourri

Sorry for the scant blogging, but I’m in the middle of a move to Texas. In six months, when you see the prodigious output of academic journal articles, you will thank me. (Or not.)

Anyway:

==> I have a new Cato working paper on carbon taxes. I co-authored it with climate scientists Pat Michaels and “Chip” Knappenberger. Some of it you guys have seen before, but a lot is new.

==> This was a fantastic episode of the Tom Woods show, where his guest explains how to bring a Costco-type business model to health care.

==> Lew Rockwell interviews John Denson, explaining some of his recent reading on historical U.S. foreign policy. Great stuff.

Steve Landsburg Experiences the Ultimate Male Blogger’s Nightmare

In the comments to this post, both his wife *and* mom showed up to zing him. We all need to be extra nice to Steve this week.

Jeremiah Asks: Why Do Good Things Happen to Bad People?

Jeremiah asks an age-old question (I will omit block quotes to keep the formatting appealing):

Jeremiah’s Question

12 Righteous are You, O Lord, when I plead with You;

Yet let me talk with You about Your judgments.

Why does the way of the wicked prosper?

Why are those happy who deal so treacherously?

2 You have planted them, yes, they have taken root;

They grow, yes, they bear fruit.

You are near in their mouth

But far from their mind.

3 But You, O Lord, know me;

You have seen me,

And You have tested my heart toward You.

Pull them out like sheep for the slaughter,

And prepare them for the day of slaughter.

4 How long will the land mourn,

And the herbs of every field wither?

The beasts and birds are consumed,

For the wickedness of those who dwell there,

Because they said, “He will not see our final end.”

The Lord Answers Jeremiah

5 “If you have run with the footmen, and they have wearied you,

Then how can you contend with horses?

And if in the land of peace,

In which you trusted, they wearied you,

Then how will you do in the floodplain[a] of the Jordan?

6 For even your brothers, the house of your father,

Even they have dealt treacherously with you;

Yes, they have called a multitude after you.

Do not believe them,

Even though they speak smooth words to you.

7 “I have forsaken My house, I have left My heritage;

I have given the dearly beloved of My soul into the hand of her enemies.

8 My heritage is to Me like a lion in the forest;

It cries out against Me;

Therefore I have hated it.

9 My heritage is to Me like a speckled vulture;

The vultures all around are against her.

Come, assemble all the beasts of the field,

Bring them to devour!

10 “Many rulers[b] have destroyed My vineyard,

They have trodden My portion underfoot;

They have made My pleasant portion a desolate wilderness.

11 They have made it desolate;

Desolate, it mourns to Me;

The whole land is made desolate,

Because no one takes it to heart.

12 The plunderers have come

On all the desolate heights in the wilderness,

For the sword of the Lord shall devour

From one end of the land to the other end of the land;

No flesh shall have peace.

13 They have sown wheat but reaped thorns;

They have put themselves to pain but do not profit.

But be ashamed of your harvest

Because of the fierce anger of the Lord.”

14 Thus says the Lord: “Against all My evil neighbors who touch the inheritance which I have caused My people Israel to inherit—behold, I will pluck them out of their land and pluck out the house of Judah from among them. 15 Then it shall be, after I have plucked them out, that I will return and have compassion on them and bring them back, everyone to his heritage and everyone to his land. 16 And it shall be, if they will learn carefully the ways of My people, to swear by My name, ‘As the Lord lives,’ as they taught My people to swear by Baal, then they shall be established in the midst of My people. 17 But if they do not obey, I will utterly pluck up and destroy that nation,” says the Lord.

——–

I totally understand Jeremiah’s question, but I’m not sure I fully understand the Lord’s response. Anyone?

Potpourri

==> Jeffrey Rogers Hummel on backdoor reserve requirements via Basel. BTW, I don’t like the Alchian & Allen argument that Jeff quotes; I think it gets things backwards when it comes to the function of reserve requirements. But that quibble aside, Jeff is an encyclopedia on the details of central banks.

==> I can’t remember if I shared this already: Nick Rowe writes up a great post that explains where he is coming from; I answer in the comments with my gnome fable.

==> OK North Dakota has given the green light to weaponized drones on U.S. soil, but not lethal weaponry. But if the government ever deploys its flying killer robots on U.S. soil, then it will be time to start complaining about liberty.

==> I realized from Levi’s comment that people are genuinely misunderstanding what I was trying to say in that op ed. I’m not going to try to go through it all right now, but check this out. Back in 2013, Ryan Murphy (no relation) was teasing me in the comments here, saying that I should be rich if I know the Fed is driving the stock market. I brought up that guys like Mark Spitznagel made a boatload of money from the two previous crashes, and Spitznagel is heavily guided by Austrian capital and business cycle theory. (Disclaimer: I was a consultant on that book.)

Ryan then said well let’s see how he does in the future. OK, thanks to von Pepe, I see this WSJ story that Spitznagel’s Universa Fund made a billion dollars on Monday (up 20% for the year). Does that count as “profiting from a prediction”? And no, if I understand his portfolio construction, he didn’t give half of it back later in the week, because he didn’t short the S&P, instead he bought deeply out of the money put options. (Click through to the article if you want more details.)

To be clear, I’m not saying, “The scientific validity of Austrian business cycle theory rests on the shoulders of Universa’s 3q performance relative to a passive mutual fund.” And yes, maybe Spitznagel just keeps getting lucky. My modest point is that if you think you can dismiss my perspective with a one-liner, you’re really not even trying to appreciate what I’ve been saying.

Question for Bernanke?

I got this inquiry, with permission to post here:

Message: hey mr. murphy,

i am a junior in high school and this fall, ben bernanke will be speaking at my school. as a follower of yours, i agree completely with your views, and love your wit. i expect that after his speech we will be allowed to ask questions, i was wondering if you had an idea for a question that could really trip him up…

For the record, I do not endorse tripping people.

One Last One on Sumner vs. Murphy

I am really going to drop it after this, partly because we have devolved into metal chair bashing, and partly because I plan on doing some technical papers while at Texas Tech, and Scott may be one of the few bloggers who appreciates them…

Anyway, in this post Scott first lectures me on how the EMH is falsifiable. Right, I know the academic EMH in the journal articles was falsifiable. What I claimed in my post is that in practice it is non-falsifiable.

What do I mean? Check out this screenshot, showing the comments under Scott’s post:

THAT is what I mean when I say in practice, the EMH is non-falsifiable. We could have the stock market drop 40% in a year, have major investment banks fail, and enter the worst world economy since the Great Depression…and still Scott would be high-fiving his audience when they say, in a Joe Pesci voice, “What? Where’s the problem? Minga, you Austrians act like the market did something.”

(And actually, why does the Great Depression get such a bad rap? I mean, humans went to the moon afterwards. How bad could it have been?)

If you want to believe in the EMH, I’m fine with that. But don’t think it keeps passing empirical tests with flying colors, if you’re using it the way most people on the internet are (including Fama).

Announcing the IBC Workshop

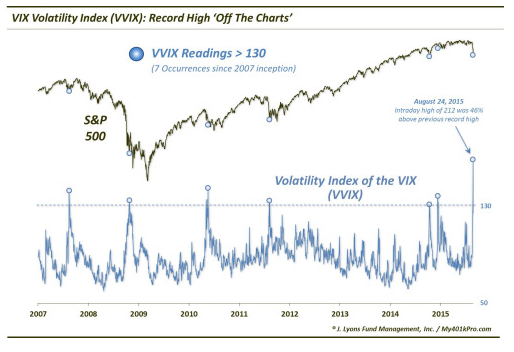

The footage of us lecturing comes from a February 2015 workshop we put on in Birmingham. I realized that you guys don’t understand the quite specific presentations my co-author, Carlos Lara, and I have been giving to audiences during the summer. No, I wasn’t telling them, “I expect a spike in the VVIX on Monday, August 24,” but I certainly gave them the big-picture theory of the boom-bust cycle and then reasons that I thought Yellen was going to hold pat and let the market go down. (For purists, I made clear the distinction between Austrian business cycle theory, and my personal guess that Yellen was going to let a crash happen before launching a QE4.)

I have work to do for clients, so let me just quickly say that I regret not a single word of this 2011 piece, which Scott Sumner somehow thinks is damning. (Hint: I was telling people that the stock market was being driven by the rounds of QE. What has happened since then is entirely consistent with that theory. So if you think the Fed can just keep quintupling its balance sheet every 7 years, I grant you, there’s no reason to be wary of the U.S. stock market.)

A Note on Stock Market Volatility

So if I promise to criticize myself, can I get a blogging gig at EconLog?

I understand the Efficient Markets Hypothesis, and I think it’s a very good way to take a first crack at the markets. The thing that annoys me about many EMH proponents is that they think they are being empirical and scientific, when they often are clearly able to explain any outcome in their framework. Steady growth? Just what EMH predicts. Massive crash? Just what EMH predicts. In practice, the EMH is non-falsifiable, which is ironically the criticism many of its proponents level at others.

I think this following passage from Scott is a tad slippery:

Murphy seems to suggest that the fact that Austrian economists were not surprised by the volatility is a point in their favor. But why? Who was surprised? If you had asked me a year ago “Do you expect occasional volatility, up and down?” I would have said yes, and also that I had no idea when that volatility would occur, or in which direction the market would move.

Look, there was nonstop coverage of this on NPR when it happened. They were trotting out all kinds of people, including Austen Goolsbee, to make sure Americans kept their money in Wall Street. I’m not making this up, give me a break.

Monday showed the biggest intraday point swing in history. (Granted, you would want to look at percentage swing for a better comparison, but I can’t find such a ranking.)

And according to this guy’s analysis, by one measure of market volatility–the VVIX–Monday blew the previous record out of the water:

If you want to say I’m a broken clock, or that we should wait and see what things look like in three years, etc., that’s fine. But come on, don’t act like predicting “more of the same” two weeks ago is consistent with what just happened.

Recent Comments