My Opponents OutDo Me

During my debate with MMT guru Warren Mosler last week (raw video available here), I thought I had some good zingers that I was anxious to unleash on poor Warren. For example, I had an analogy for MMT, in which a couple is worried about their finances, and the wife says she will take a second job. The husband then says, “Nope, we aren’t constrained by paychecks. I’ll just go hold up liquor stores. Yes, if I do that too much, I’ll end up in prison, but that’s a far different constraint from ‘budget’ as you keep framing it.”

Mildly amusing, eh? Warren himself chuckled. You can imagine my surprise when Warren then gave his own analogy for MMT, in which people in the room won’t pay him anything for his business cards. But then he explains that there is a man with a gun outside the room, who won’t let them leave unless they have one of the cards. Voila! Now people are scrambling over themselves to perform jobs for Mosler. Unemployment is solved.

Anyway, a similar thing happened to me today in my argument with Daniel Kuehn. I had posted a link to my IER article talking about the White House’s update of the “social cost of carbon” (one set of parameter values made the figure jump up 120%, in just 3 years), and I said:

As the above table illustrates, the latest White House “update” isn’t a minor tweaking of the numbers, polishing off a few decimal places, as it were. No, depending on which framing of “the” social cost of carbon we choose, the increase ranges from 34 percent up to a whopping 120 percent.

Often the climate change activists will tout revisions of this nature as further evidence that the (alleged) emergency is real. “See? We told you things were bad! We should’ve implemented a carbon policy years ago.”

Yet hang on a second. Suppose you were getting ready to take the first manned mission to Mars, which government scientists had been planning for years. Three years ago, they thought the trip would take a certain amount of fuel for the ship and oxygen for the crew, and planned accordingly. Now, they release a new estimate saying, “Whoops, we changed our computer simulation of your trip, and it turns out you’ll need 120 percent more fuel and oxygen than we thought. On this latest simulation, with the old numbers, you and the rest of the crew would suffocate before you even reached Mars.”

With that much volatility in the estimates, how much confidence do you have in these computer simulations? Are you anxious to put your life in the hands of scientists who change their estimate of key variables by 120 percent in a mere three years?

Well, Daniel felt this was “an awful argument.” He went on to say:

The fact that the numbers are all over the map should give pause as to the extent of the regulatory measures we pursue. They should not give pause to “the entire enterprise” as you put it. If zero or negative social costs were included in generally accepted social cost ranges then THAT would give pause about “the entire enterprise”. [Bold added.]

Ah, at this point I thought Daniel had stepped in it. I know the estimates of the social cost of carbon–from the peer-reviewed literature of people whose career field is “economics of climate change”–and yes indeed, several studies find a negative social cost of carbon, i.e. find that emitting carbon dioxide on the margin will shower net benefits on humanity.

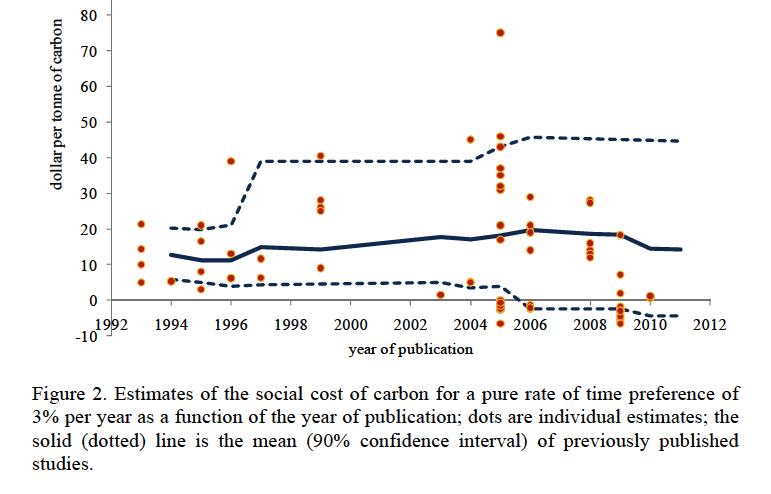

You can imagine my surprise then when Daniel himself buttressed his position with the following chart taken from page 25 of this 2011 literature survey by Richard Tol:

Note: In the snapshot above, I cropped it below one outlier, in the 2005 x-axis at about $77 $120 or so.

So like I say, I’m somewhat nonplussed. I was getting ready to dropkick Daniel with a chart like the one above, and yet he thinks this proves his point.

Anyway, there ya go kids: Even if you think it’s “settled science” that humans are at least partially responsible for increasing global temperatures since 1850, there is still another step in the argument, to show that this is harmful on net. As the above survey from Tol shows (and yes I imagine people can quibble with how he selected his representative estimates), the dispersion has increased over time, such that since 2005, we can’t even reject the hypothesis “carbon emissions help added: shower positive externalities on humanity” with 95% confidence.

So when social cost estimates go negative we reconsider because maybe mitigating climate change would hurt us.

We agree on that.

Now let’s see if we agree on what to think if social cost estimates are largely positive and only some studies in one review have a very small negative estimate.

My view is Tol’s view (which I quoted). Do you agree with me and Tol or do you disagree with us? Yes or no?

Now let’s see if we agree on what to think if social cost estimates are largely positive and only some studies in one review have a very small negative estimate.

Wait a second. If I dig up a second literature review, that also has negative SCCs, are you going to back down? Or will say (as I suspect), “Right Bob, my position all along has been that the median estimate of the SCC is above zero. What the heck is your point?”

I think you’re reading too much into that. I was just laying out what we had at hand (the minimum wage debate a couple months ago showed that a couple meta-analyses are nice to have).

I noticed you didn’t answer my question.

I’m not knocking Tol’s study obviously. I’m the one that has explicitly said I read the evidence the same way he does. Twice.

You still haven’t weighed in on whether you agree with him on that, and if not why not.

Daniel, would you expect estimates to get better over time, worse or stay the same?

Cost estimates?

No idea – I’m not a climate scientist.

I meant both (cost estimates and temp estimates as related to CO2). I don’t think you need to be a climate scientist to have an educated opinion. Satellite data and ocean data is improving at a fast rate. The feedback of water vapor is the key component to extreme warming scenarios.

I clarified as related to CO2, because there are some major variables I think we are far from figuring out.

Or do you mean the costs themselves? Presumably those would get worse over time.

I agree costs will likely go up, but I believe that will be after a 50+ yr benefit.

However, the cost to intervene will likely go down as our technology and understanding increase. As for economic tools, I think we learned from Europe that cap and trade has major issues.

Right – cost to intervene will obviously go down unless we’re assuming technological regress. The question I guess is which outpaces the other (there will be more intervention to be done the longer we wait which means potentially less pleasant sorts of intervention like geoengineering).

Ya – that’s why most economists strongly prefer a carbon tax to cap and trade.

I agree that which outpaces is the critical factor. I would expect that putting a drag on the economy slows technological progress. I also expect turning CO2 back into hydrocarbons to become feasible. It’s an awesome way to store energy.

Yes, but how often do politicians listen to economists? California went with cap and trade. And meanwhile, you have opposing policies like tariffs on solar panels, home interest deductions…

Come on Bob – if you write a post like this featuring me you can at least answer my yes or no question. Do you get out of that table you post above what Tol gets out of it or something different?

I answered you in the other post, Daniel.

‘I thought I had some good zingers that I was anxious to unleash on poor Warren.’

Of course, that’s the difference between you and Mosler; he’s an economist/investor, you’re a side show/wannabe philosopher. He builds cars in his spare time; you struggle to give away free advice. Much respect to you for accepting the challenge. doubtful Mugsey Bogues would ever play Michael Jordan one on one.

Good luck 🙂

That’s just like your opinion.

1. What does building cars or even being an investor have to do with understanding business cycles?

2. I saw no evidence whatsoever that Mosler knew anything about Austrian theory, concepts or analysis. Did I miss something?

3. I’ve never seen any evidence that AP “Hut Tax” Lerner knows anything about Austrian theory, concepts or analysis.

4. Let’s not forget that David Colander, co-author of a 1980 book with the original Abba Ptachya Lerner (King of the MMTers, author of “The Economics of Control”) wrote that two years before his death, Lerner wanted to make it illegal to change prices without a permit in order to control “inflation”:

Initially he [Lerner] toyed with various administrative wage and price control policies, but he found those lacking and soon gave them up. He replaced them, first, with a tax based incomes policy and ultimately, a market based[!!!] incomes policy in which property rights in prices are set and individuals have to buy the right to change prices from others who change their price in the opposite direction. It was this idea that formed the basis of our market anti inflation (MAP) book. (Lerner and Colander 1980) Under MAP, rights in value added prices would be tradable so that any firm wanting to change its nominal price would have to make a trade with another firm that wanted to change its nominal price in the opposite direction. Thus, by law, the average price level would be constant but relative prices would be free to change [page 12]

http://cat2.middlebury.edu/econ/repec/mdl/ancoec/0234.pdf

These MMTers have us on the run.

And Austrians get called cultists. Sheesh. Do you like spending all of that time on your knees.

What exactly are the exact details of Daniel’s position on anything? You can get the details here.

http://www.romneytaxplan.com

That’s funny sandre.

When you say that you can’t reject the hypothesis that carbon emissions help humanity, you’re discounting all the utility that people get from driving, transporting food, power generation, etc. correct?

Oops right John B. I’ll clarify that in the post.

Good. You really had me thinking you had gone over to the dark side for a second.

After thinking about this for a second, it occurs to me that it would help to clarify what kind of “net cost/benefit” you and Daniel were debating.

Were you debating strictly whether the environmental impact from carbon emissions would be a net cost or benefit to humanity? If so, that seems more like an argument over the ideal climate than about carbon. The net cost of not using carbon at all would be the death of billions of people. It seems like that would overwhelm any concerns about carbon besides carbon emissions causing extinction level climate change.

Not to mention the fact that you would have to kill billions of people just to get to the point where you could kill billions of people.

MMTers, Keynesians, climate beggars, and all other statists of every stripe may use different methodology, but they’re all driving toward the same goal. These degenerates want to decide who lives on the earth and how they are allowed to live if they make the cut.

Seems like a bad lifestyle to me, but evidently 90% of humanity are racing to be the best thieves and murderers they can be.

If I saw similar manufacturing data, I would wonder why variability went through the roof in 2005 and why the data trended downward following that.

I’m not sure I agree that using all previous data to establish the confidence interval is the best approach. If I were to use a moving confidence interval, I would use one that weighted recent results more heavily because the role of feedback is increasing with time, not decreasing. In general, it makes more sense to use a confidence interval for the entire dataset and also to look at the data with a possible change point around 2005, using separate before and after confidence intervals. Mean shift alone suggests looking at that. Using a moving average, instead of a mean to date would tell a much different story.

The temp estimates on the GDP-temp chart seem a bit high. It doesn’t say what time period it is for. Assuming a 1.5 per doubling of CO2, there seems to be a prediction of quadrupling of CO2.

You forgot your “shameless self-promotion” tag brah.

Statists do a really good job at contradicting themselves. In the debate with Mosler one of the most hilarious mainstream comments straight out of Keynesian textbooks was when he said that the gold standard was horrible because governments went off of it during wars, and this is because governments should have the ability to print as much as they can to get boost it out of the doldrums (see around 1:70:00 of the video for actual commentary). Wars are good? He was talking to us after about how the Fed printing is why America wins all the wars. I think Keynesians are all secret in-the-closet warmongers.

Another funny statement was when Mosler made the comment that banks never had negative capital during the financial crisis, but is he aware of the huge crash in the derivatives market and margin calls that took place from placing such bets. Their balance sheets were practically negative. See here: http://www.frbsf.org/economic-research/files/el2012-15-1.png

Indeed it may look like banks are not running negative capital, but the first things to go on a bank balance sheet are the derivatives. This is a significant drop in equity, especially when the left side of the balance sheet is made up of weak and inflated assets. It all begins with a strong asset side, and banks were inflated. They were negative in capital due to inflated shares and risk weighted assets. These capital ratios and their calculations is what got the banks in trouble in the first place. Government bonds were looking good all the way.

What is are “externalities” anyway? I mean, don’t bother with hand waving, explain exactly what it is in an empirical sense. What hypothetical measurement would demonstrate the existence of a “externalities” (either positive or negative)?

http://www.youtube.com/watch?v=1hH5b1fMLpY

“His completely erroneous comparisons about the Federal budget to a household budget notwithstanding, this idiotic Austrian stalker doesn’t even know the difference between an analogy and a fact-based example – which is what Warren Mosler (and later John Carney) provided to educate him about issuers and users of currency.

Also, why would you wear ugly Hush Puppies shoes with white socks with a black suit, red tie and blue shirt. As if he isn’t ugly looking (or ignorant) enough, even his fashion taste is utterly appalling.

Exactly what you would expect from an “Austrian economist”.

Harsh words.

Also, why would you wear ugly Hush Puppies shoes with white socks with a black suit, red tie and blue shirt. As if he isn’t ugly looking (or ignorant) enough, even his fashion taste is utterly appalling.

Wth? I had $600 shoes from Bergdorf Goodman, a navy blue suit, and brown socks on. This commentator is describing my attire as he would like it to be, not as the world really is.

I’d expect a lot better from the MMT crowd in terms of civility. They are never going to gain as much influence as they would like if they keep slinging these unwarranted ad hominem attacks around in substance of an actual critique.

That’s what I wanted to show you. That Schitt Report guy and his band of merry men is quite persistent with keeping his anti-neoliberal echo chamber agenda afloat. It’s like someone created 20 similar accounts obsessed with a very narrow topic.

I would take that guy more seriously if he wrote an educational economics blog of some sort or an insightful financial analysis website.

Seymour well, Mosler himself was perfectly charming, and plenty of people at MMT blogs in the comments were saying stuff like “Murphy means well, he’s just ignorant” etc. Imagine how Keynesians feel reading Free Advice!

Ahhh that Mosler, if you are going to threaten someone with a nine, show a bit of class and be a gentleman about it.

“Let me help you with those groceries madame. That dress really suits you, good to see you looking after yourself. About the robbery… I hope you got some extra cash out because it would be a tragedy if the kids never saw their mummy again. OK, thanks for that, see you next week.”

The Mafia seem to go to a bit of effort to look their best, so I guess it must be an effective technique.

Bob:

Umm, Bob, you read FA much? “means well”? The standard trope from Roddis and Major_Freedom and a few others here is that Keynesians are monsters. Questioning their motives is the first and default attack here.

He wrote “MURPHY means well…”, not, “Murphy, Roddis and Major_Freedom mean well…”

Don’t let your hatred of Roddis and Major_Freedom have an impact on your reading comprehension, ok?

Richie you are the one with a reading problem. Bob compared that remark to how a Keynesian might be treated here. The crtics over there gave the Austrian credit for meaning well. That does not happen to Keynesianism here.

No Ken B., you indeed have a problem with reading comprehension. I was trying to get Seymour to not judge MMT by the remarks of a lone commenter making fun (erroneously) of my fashion sense. I was saying that a Keynesian who came to Free Advice could also point to one or two ad hom jerk attacks and conclude that Austrians can’t debate on the issues.

Ken B., I am forced to apologize. I was in a rush and saw only what you quoted. I didn’t read Dr. Murphy’s entire comment.

No, Richie, don’t apologize on this one. Ken B. really did completely misunderstand my comment.

Actually Bob, since it seems we agree on the facts I’d say you have a writing problem on that comment. “No they polite, imagine it like Keynesians reading here” seems a straightforward reading.

Yes, in the rare cases when Ken B. admits that he misunderstood something I wrote, it turns out it’s because I am unclear.

Like the listeners in that linked video I guess, who had “listening problems.”

What video Ken B.? I don’t know what you’re talking about.

When I read Bob’s post, it seemed pretty clear to me. I thought it was obvious that Bob meant Keynsians may feel as though they are offended in an uncivil way when they read some of the comments on FA.

The video in the comment that started this thread. The $600 hush puppy video.

Ken B:

FYI, I understood what Murphy meant, because it was clear as crystal. I think Richie was right. You let your negative feelings towards myself and Roddis cloud your judgment of what Murphy said.

I just ask in a nice way for that elusive market failure that justifies the Keynesian invasion and for the identity of the first Keynesian in the galaxy who understands basic Austrian concepts and analysis. Is that so wrong?

Then search for the word “moron” in the body of these Mike Norman posts.

http://mikenormaneconomics.blogspot.com/search?q=Moron&max-results=20&by-date=true

Interesting, counted 44 times…

“An MMT site bringing you dogma-free economics without the pleadings of self interest.”

Ironic, huh?

Left a bunch of comments and they were properly taken and visible. After 2 hours it is all gone without trace. I didn’t think it was possible on youtube. One learns new stuff every day I guess. I refuted all the misguided people comments and explained why that description is false and also what’s the story of poor Mike.

For the record, I made that graph because someone had argued that this particular literature suffers from confirmation bias. That obviously is not the case.

The irony of Modern Monetary Theory is that in reality it’s anything but modern. It’s nothing more than a rehash of the theories espoused by the old monetary cranks with a lot of sophisticated models and statistics thrown on them.

Daniel Kuehn still trolls various Austrian econ blogs? Persistence… not always a virtue.

Misunderstanding “troll” … not always a virtue.

No argument here.

Economist Frank Ackerman has called the “social cost of carbon” the most important number you never heard of. What is the social cost of carbon, where do the numbers come from, and why should policymakers take care when using them?