Sparks Goes to the White House

This is pretty good; I kept thinking I would stop it but watched the whole thing. (HT2LRC) Warning a few naughty words.

Vote for Bob!

Hey, if you’re into this sort of thing, then feel free to vote for The Politically Incorrect Guide to the Great Depression and the New Deal as the book of the month in the Freedom Book Club.

My Mises Column on the Econ Nobel

Here is my column at Mises today on the new Nobelists. I walk through a watered-down numerical example to give you a flavor of their labor models, in case you aren’t quite able to read the actual journal articles but you want a little bit more meat than I’ve seen in most second-hand accounts.

Then of course I take my marbles and go home to my copy of Human Action, when I say this:

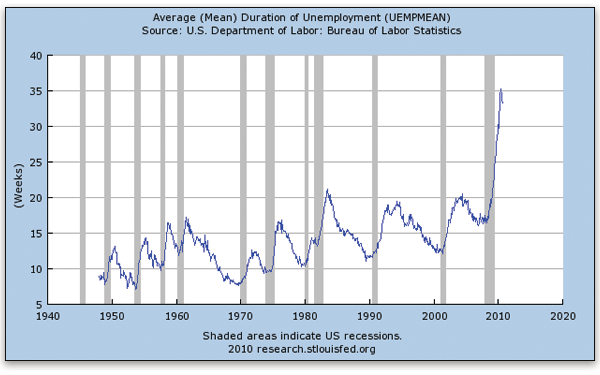

Now, it would be one thing if the problem of long-term unemployment had been a tough nut to crack lo these many decades, but finally mainstream economists were beginning to get a handle on it. Then, it would certainly be appropriate to give the Nobel to those researchers who had paved the way, if not for the solution then at least for the path to a solution. But is that really what’s happened in economic science?

Things Not Looking Good

Here’s the CNBC headline:

Jobless Claims, Inflation, Trade Deficit Each Surge Higher

As far as the inflation, they are referring to the fact that in the Producer Price Index, prices for finished goods this September were 4.0 percent higher than in September 2009, and they rose at a (seasonally-adjusted) 0.4 percent from August 2010 to September 2010, double the rate that “economists” had predicted. (I’m putting it in quotation marks not because I deny that they are economists, but because obviously it is some small sample of polled economists.)

If you click on the PPI link, however, you’ll see that this is just the tip of the iceberg. The prices of intermediate goods have risen 5.6 percent year-over-year, and the prices of crude goods have risen 20.3 percent.

So if you subscribe to a seat-of-the-pants story in which the Fed prints a boatload of money when average households are broke, so that you see prices jump first in assets and raw commodities, and only push their way through the pricing chain slowly… Well you start to wonder how long Treasury yields can stay this low.

Bask On Nobel

Someone told me that one of the Nobelists had a NYT article very recently in which he explained that their work does NOT say that unemployment benefits from the government necessarily raise the unemployment rate. But I can’t find any such article. Any help?

A Snarky Note on the Nobel

I have a Mises Daily on deck for Thursday, regarding this year’s Nobel (Memorial) winners in economics. But here, one observation:

People on both the left and right are chuckling to themselves that Republicans held up Obama’s nomination of Peter Diamond to the Federal Reserve, now that Diamond has won a Nobel Prize.

But this chuckling doesn’t hold up at all. The thing that initially made Arnold Kling spit out his coffee was this line from the WSJ: “Republicans have held up Mr. Diamond’s confirmation because he is not an authority on monetary policy.”

So, did Diamond just win a prize for his work on monetary policy? I don’t think so. According to the official press release:

This year’s three Laureates have formulated a theoretical framework for search markets. Peter Diamond has analyzed the foundations of search markets. Dale Mortensen and Christopher Pissarides have expanded the theory and have applied it to the labor market. The Laureates’ models help us understand the ways in which unemployment, job vacancies, and wages are affected by regulation and economic policy.

It’s true, the press release goes on to say:

Search theory has been applied to many other areas in addition to the labor market. This includes, in particular, the housing market. The number of homes for sale varies over time, as does the time it takes for a house to find a buyer and the parties to agree on the price. Search theory has also been used to study questions related to monetary theory, public economics, financial economics, regional economics, and family economics.

But if that makes Diamond qualified for a top Fed post, then he is also qualified to run Child Welfare Services.

Furthermore, if you go look at MIT’s announcement, celebrating Diamond’s award, the word “monetary” isn’t even in there.

Look, I get what Arnold Kling was saying: The Republican politicians who held up Diamond’s nomination wouldn’t know their Kuhn-Tucker conditions from their elbow. But strictly speaking, the fact that Diamond won this award doesn’t double-down on the situation. There is nothing in this award per se that would lead you to believe Peter Diamond is an expert on monetary policy, which was the ostensible objection that the Republicans raised.

Furthermore, if you go read the MIT summary of Diamond’s work–as well as Diamond’s own comments about how we should get out of our current mess–then you may AGREE with the Republicans’ assessment.

Value-Free Economics

I am saving the meat of this for a Sunday “religious” post, because it will get into theological issues. But to give the background, I met a guy for lunch the other day who is working on a video series to teach basic economics from a Christian perspective.

The guy was asking me about the claim that economics was “value-free.” I explained what this meant in the Misesian system.

The guy challenged me and said he didn’t think economics was value-free, or that it could be. I won’t go into it now–saving it for a Sunday–but I felt very squeamish in giving the guy my pat answer. In other words, I went through the motions of explaining “wertfrei” in standard Austrian economics, but I hardly believed it myself.

(I also told the guy the ominous–but totally true–anecdote that when I was filling out my exit survey at NYU, the 3-digit department code for Economics was 666.)

Anyway, I thought of all this when reading Steve Levitt’s discussion of one of our recent Nobel Memorial winners, economist Peter Diamond (HT2 MR):

Early in my graduate career, I wanted to be an economic theorist. My advisor at the time told me I should give a copy of the paper I was working on to Peter Diamond for comments. I was terrified, but I did it. It was a paper on crime, and a key assumption one always has to make in theory papers about crime is whether one wants to include the utility the criminal gets from committing the crime when adding up social welfare. Early in the paper, I noted that I would not be including the criminal’s utility in the social welfare calculation. Diamond highlighted that sentence, wrote that he thought I should include the criminal’s utility, and read no further in the paper. When I met with him, he simply said there was no point in reading any more once a bad assumption has been made. That’s not the way I think of the world, so that simple offhand comment he made twenty years ago has always stuck with me.

BTW, even though I know this is an exercise in futility, let me assure that I UNDERSTAND WHY DIAMOND SAID THAT. That’s the point, though: Economic science forbids you from assuming that the joy from crime shouldn’t be included in something called “social welfare,” a quantity which everyone assumes should then be maximized. And then we tell ourselves there are no value judgments being smuggled in.

Potpourri

* Goodness gracious, great balls of fire in the geeconosphere. Sis, boom, bah.

* This slipped through the cracks: A podcast with Patrick Donohoe, who is big into the whole life movement. (Doesn’t it sound like a New Agey thing?)

* I warned Bryan that if he didn’t retract his statement that the “first-best” policy for education would be to tax it, that I would write a Mises Daily. I am a man of my word. Here’s the punchline:

At bottom, I think what’s really going on here is that Caplan is trying to tell people that he thinks a person’s decision to purchase more schooling can negatively impact other people. But instead of saying that, Caplan says, “A first-best efficient education policy would actually tax education.”

Yet notice that Caplan could just as easily have written, “An optimal solution to education would actually involve gang members randomly beating up college freshmen.” I am not exaggerating. Caplan’s statement is literally equivalent to my own suggestion in terms of both the economic analysis and even his own (practical and moral) misgivings.

I am not kidding; I really think our proposals are very close. And I addressed at least one loose end in a geeky footnote:

Purists might object to my analogy, because (they learned in grad school) that a government transfer payment is neutral in terms of Kaldor-Hicks efficiency, whereas a gang beating doesn’t seem to be. In other words, if the government taxes a college freshman $500 for going to school, then the freshman is down $500 but the government is up $500, so it’s apparently a wash. In contrast, if a gang member beats up that same freshman, then he imposes harms that are not offset by gains to anybody in society. Hence the “efficiency” of the tax, in correcting the alleged market failure. But this analysis is wrong. In the real world, the government doesn’t gain $500 in disposable income for every $500 it takes from citizens, if for no other reason than the salaries it has to pay bureaucrats at the IRS. Furthermore, in what possible sense is it “efficient” for the government to have $500 more to spend? Since the US government in actual practice uses its funds to impose all sorts of “negative externalities” on people all over the world, even on Caplan’s own terms, it’s not at all clear that extra money in the government’s coffers should be construed as a “social gain.” Finally, for all we know the gang members would be willing to pay more to beat up freshmen than those same freshmen would be willing to pay to avoid the beating. (Maybe the students will get sympathy from their girlfriends or professors and get excused from a hard test.) So we see that, literally, the differences between Caplan’s proposal and mine are merely empirical; they are qualitatively equivalent in terms of the mainstream economic analysis.

As I said, I am being serious. A bunch of professional economists read this blog. If you would never in a million years say with a straight face, “A first-best efficient policy would involve gang members beating up people,” then why can you say that the US federal government should impose a new tax? If anything, I prefer the former policy recommendation.

Recent Comments