The Benefits of “Arbitrary” Rules

Just a short post tonight, intended mostly for people who already believe in these things. I think the apparently arbitrary religious rules set forth in the Bible actually serve a useful purpose. For example, if you tithe (i.e. donate 10% of your income to the church), then it forces you to keep up with your finances and actually you have “more money” every month than if you tell yourself, “We can’t do it right now, we’ll get caught up later when our cashflow is improved.”

For another example, I try not to work on Sundays. But when things are really busy I often would do it. Yet the same pattern holds: I think I probably get more total work done in a 7-day period, if I take a break on Sunday and rejuvenate. You really can’t go non-stop full blast for 7 days straight; you end up taking little breaks during the week anyway. And so I think if you just take a full day off and focus on the bigger things (by going to church etc.), then you are off to the races once you go back to work Monday morning.

Oh Gosh

Am I missing some kind of pun or something? Or does Selgin actually have an academic working paper that starts with “Oh Dear”?

I am prepared to withdraw my objection if he’s being a wiseguy (as he’s been known to do) regarding something in the Bagus/Howden paper. I skimmed the title and abstract of their paper and don’t see anything that he’s obviously riffing on.

What Is So Hard About Fractional Reserve Banking for Economists?

I am being deliberately cheeky in my post title… But I think a quote on banking reserves from Alchian that David R. Henderson gives (without him necessarily endorsing it in the original context) is not the same as the other two things to which it is supposedly analogous. Let me just give David’s whole post:

“To rely upon a reserve requirement for the meeting of cash-withdrawal demands of banks’ customers is analogous to trying to protect a community from fire by requiring that a large water tank be kept full at all times: the water is useless in case of emergency if it cannot be drawn from the tank.”

Armen A. Alchian and Willam R. Allen give this unsourced quote on p. 708 of the first edition of their modern classic, University Economics. BTW, I lost my copy of the third edition in my 2007 fire and my friend, Gloria Valentine, Milton Friedman’s long-time assistant, gave me Milton’s autographed copy. It’s inscribed, “To Milton, Herein–somethings old, somethings new, somethings good–borrowed straight from you. Armie.”

I was reminded of this when I read Russ Roberts’ post in which he quoted from an article in The Economist. For days, the Japanese government kept to its policy of requiring that oil refiners keep a minimum of 70 days’ supply in reserve. Specifically:

When the crisis hit, there was a law on the books requiring energy companies to keep 70 days of petrol in reserve. This was quickly lowered by three days, but that did not help. And there is the outrage. It was not until March 21st, ten days after the crisis, that the limit was lowered to 45 days.

See the problem?

Yes, I see the problem with mandated reserves on water and petrol, but not on bank deposits. (At least, not for the reasons David is citing; I don’t think the government should have anything to do with banks one way or the other.)

If banks as a rule keep 100% of their customers’ cash in the vault after they deposit it, that doesn’t mean–as Alchian implies–that there will be no cash in an emergency when their customers want to withdraw it. On the contrary, it guarantees that there will be cash in an emergency when their customers want to withdraw it.

Specifically, Alchian’s argument fails because when a customer withdraws his cash, the bank’s reserve requirement (in absolute terms) goes down. In other words, the government/Fed isn’t saying to banks, “Keep $100 billion in the vault at all times.” No, they are saying, “Keep 10% of deposits in the vault at all times.” Those are totally different things, as you can easily see if you bump it up to 100% reserves.

P.S. Yes I know David has leveled a challenge against me. But, uh, I have to go cut the lawn…

(I will try to answer him after I think about it some more.)

The Murphy-Krugman Debate Edges Closer

I actually got a call on the emergency line on this one from Wenzel. (I imagine there are about 3 of you who live vicariously through us, and so I like to give you some tidbits now and then.) Krugman quotes our friend Daniel Kuehn who in an RAE paper quotes me on the 1920-1921 Depression.

I will have to think about this stuff for a bit. For what it’s worth, I was a referee on Kuehn’s paper and in the interests of intellectually honest, whenever I have discussed the 1920-1921 Depression since reading it, I give a disclaimer like, “Now just so you guys know, the Keynesians could say that the 1920-1921 Depression was caused by the Fed jacking up interest rates to record highs, and the government slashing its budget.”

Anyway, here is what Krugman has written on this in the last day or two: 1, 2, and 3.

As far as Kuehn’s paper: It’s been a while now since I read it, but I remember thinking that he was putting too much stress on what the man, John Maynard Keynes, thought should have been done during 1920-1921. That really has little to do with modern Keynesians.

Also, with your permission, can I complain about Kuehn’s reaction to my quote? He says, “[N]othing could be further from the truth.” Can we please drop this standard phrase–At the end of the day, bottom line is, it’s meaningless, and you can take that to the bank. Say what you will about my statement, it’s not further from the truth, than, say, “Black is white.”

In all seriousness, congrats Daniel on getting a link from the big man.

Last thing: If you’ve somehow managed to miss it thus far, check out the Murphy-Krugman Debate homepage.

The Scott Sumner Stock Sell Signal

Well Scott Sumner has hung up the keyboard. In his “I’m not really serious but actually I am” kind of way, he takes credit for quantitative easing and several trillion dollars in new wealth. It’s too long to reproduce the argument here, but he’s basically saying that bloggers forced Bernanke / gave him the support to inflate more, and that has resuscitated global stock markets.

Don’t worry Scott, you are not being arrogant. I too hold you fully responsible for what happens to the world economy.

Then he drops the bombshell:

…I am complete[ly] burned out, and have been for months. I’ve blogged an average of eight hours a day, seven days a week, for over two years. I’ve only kept going in recent months out of a sense of obligation to keep pushing these issues. But now that lots of other people are saying the exact same thing, it’s time for me to take a break.

Incidentally, I don’t think he’s exaggerating. Scott spends (spent) an incredible amount of time fielding the comments in his blog posts, and he must also have spent a lot of time reading other people’s stuff.

Now that Scott has decided, “My work is done here, the global economy is safe once again,” I just want to remind people of two other events:

==> After breaking the back of inflation and ushering in the Reagan boom, Paul Volcker turned over the keys to the Fed to Alan Greenspan in August 1987. In October 1987, the world suffered the worst stock market crash in history.

==> After presiding over the Great Moderation, and expertly guiding the US economy through the dot-com crash with a surprisingly soft landing, the Maestro Alan Greenspan handed over the keys to the Fed to Ben Bernanke in January 2006. We all know how that turned out.

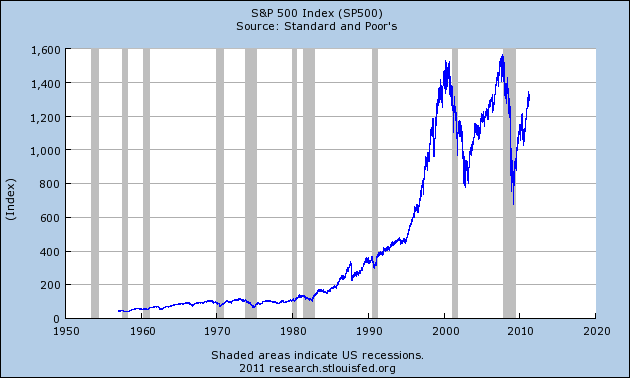

==> And now, Scott Sumner rides off into the sunset, with the stock market looking like this:

SELL SELL SELL.

Murphy Triple Play

I’m finally emerging from a hectic workload–and yet I’m going to Brazil next week. But in the short window we have, I’ll try to catch up on my blogging. For right now, here are three Mises Daily articles that have accumulated on my browser:

* “The Japanese Currency Intervention.” This was a case where I had to write the article that I wanted to read. I.e. nobody was really analyzing from first principles what the deal was with the central bank interventions to weaken the yen after the earthquake. So I took a stab at it. I’m either a fool or a genius.

* “Where is QE2 Taking Us?” This is probably old hat for many of you, but perhaps you haven’t seen the recent monetary base charts, and how they’ve spiked since QE2.

* “The Hathaway Effect and Automated Trading Programs.” They can’t all be artsy films; sometimes you have to pay the bills. This article has a cover photo of Anne Hathaway and an example using VCU. It is so pop econ that I toyed with bringing Jim Cramer on as a co-author. I feel dirty.

P.S. I think I’ve got the comments back to normal (again). I have no idea what keeps happening.

Street in Milan Named After von Hayek

Too many jokes… The Road to Rome. Turn signals as a discovery procedure. The use of bumpers in society. Why I am not a conservative driver. Pileups and Paparazzi.

Recent Comments