Keynesian Civil War on CBO Report

[UPDATE below.]

Paul Krugman, May 20:

Where Are the Deficit Celebrations?

For three years and more Beltway politics has been all about the deficit. Urgent action was needed to avert crisis. A Grand Bargain absolutely had to be reached. Fix the Debt, now now now!So where are the celebrations now that the debt issue looks, if not solved, at least greatly mitigated? And it’s not just recovering revenues: health costs, the biggest driver of long-run spending, have slowed dramatically.

What we’re getting from the deficit scolds, however, are at best grudging admissions that things may look a bit less dire…

[T]hink about the personal career incentives of the professional deficit scolds. You’re Bowles/Simpson, with a lucrative and ego-satisfying business of going around the country delivering ominous talks about The Deficit; you’re an employee of one of the many Pete Peterson front groups; and now, all of a sudden, the deficit is receding, and you had nothing to do with it. It’s a disaster!

And so the deficit progress must be minimized and bad-mouthed.

Ezra Klein, May 22:

Stop celebrating our falling deficits.

It’s time to stop celebrating last week’s Congressional Budget Office report. Our deficits aren’t dropping because we’re doing something right. They’re dropping because we’re doing everything wrong.My initial piece on the CBO report led with the surprising news that the agency had knocked more than $600 billion off its projections for the deficit over the next decade. But as I wrote then, the deficit is following a weird path. It’s not a gradual decline. It’s not a temporary uptick as we spend to create jobs followed by a sharper decline as the economy recovers. It’s a sharp decline followed by a gradual rise — it looks a bit like a Nike Swoosh.

The types of policies matter, too. We want to cut the deficit by reducing spending on programs that don’t add much to the economy and raising taxes on people who can afford it. Instead, a lot of our deficit reduction is coming through sequestration, which everyone agrees is pretty much insane, and which focuses on the part of the budget that isn’t growing. Basically none of the savings are coming through entitlement reforms that will grow in the second or third decades, or through tax reforms.

It’s as if we took all the good ideas people had to help the economy and reduce the deficit and did the opposite. But because Washington myopically focuses on the number that denotes the deficit rather than the policies behind it or how well it matches the likely path of the economy, many in town are celebrating the report and declaring their work pretty much done, at least for now.

I take great comfort in the above quotes, for the following two reasons:

(1) No matter how you slice it, Krugman or Klein has to be completely full of it. It is impossible for them both to be correct on this.

(2) Ezra Klein apparently doesn’t read Paul Krugman’s blog.

UPDATE: Let me make sure you guys don’t just think this is a funny gotcha based on Krugman’s rhetorical flourish. I am not basing my post on the clearly contradictory titles of Krugman and Klein’s respective blog posts. There’s a reason I quoted both of them at length: their substantive analysis of the CBO report is totally different. Krugman is saying the good news on the deficit front is coming from ObamaCare and other sensible reforms, which the myopic budget slashers had nothing to do with. Klein, in contrast, is saying that the bad news on the deficit front is coming from short-term gimmicks that don’t rein in long-term entitlements like Medicare and Medicaid.

So to be clear, I wasn’t using a figure of speech when I said “full of it.” I mean, at least Krugman or Klein (a) didn’t bother reading the CBO report to see what was driving the revision, (b) tried to read it but made a mistake, or (c) is consciously lying.

(Note that I am not accusing Krugman of lying, or of being stupid. I am quite prepared to believe that he didn’t read the report carefully before firing off his blog post about it.)

Krugman: Government Policy Has Always Been at War With the Deficit Scolds

At this point I have whiplash from reading Paul Krugman’s blog. I am swamped with stuff so I won’t document the below claims with links; perhaps I’ll come back and do it for posterity. In any event, for the last several years, Krugman has been complaining:

(1) Europe and the US are engaged in “unprecedented” fiscal austerity. The actual policies these people are implementing are insane. For some reason–perhaps to appease the “invisible bond vigilantes” by summoning the “confidence fairy”–policymakers think they need to bring deficits down “now, now, now,” not realizing that the time for budget tightening is down the road, after we’ve returned to full employment.

(2) What’s even more heartbreaking, is that there is no justification for any of this madness. Intro econ courses teach this stuff. Unfortunately, the Very Serious People (VSPs) have hijacked the debate, abetted by a few prominent economists who should know better: guys like John Cochrane and Casey Mulligan. Krugman has been lamenting that nobody listens to him. He, Brad DeLong, and the other people who have been just hitting it out of the park with their predictions, have zero influence on policy. They have been the Cassandras of the Great Recession.

(3) The CBO just announced that the deficit this year will be $200 billion lower than they thought back in February. This difference in forecast is due to $98 billion in lower total outlays–again, this fiscal year alone–and $105 billion in higher expected revenues. To repeat, this change in the CBO’s forecasts occurred from just February to May. At the same time, officially reported economic growth in the first quarter was 2.5%, which is tied for the 6th best out of the last 8 quarters. The official unemployment rate continues to steadily fall. The Fed is even considering pulling back QE3 because of the surprisingly strong job growth.

(4) Paul Krugman cites this as yet another moral and prediction victory on his part. He explains that cutting the deficit by 25% this year alone proves he has been right all along. Further, the deficit scolds are again shown to be fools. Fortunately, Krugman can explain to us the psychological motivation of these scoundrels. In Krugman’s words:

[T]hink about the personal career incentives of the professional deficit scolds. You’re Bowles/Simpson, with a lucrative and ego-satisfying business of going around the country delivering ominous talks about The Deficit; you’re an employee of one of the many Pete Peterson front groups; and now, all of a sudden, the deficit is receding, and you had nothing to do with it. It’s a disaster! [Emphasis original.]

So I’m really confused at this point. Apparently policymakers have been listening to Krugman all these years, as they slash spending and raise revenues to bring this year’s deficit down 25% in just a few months. And, the economy hasn’t hit an additional hiccup in the face of this unprecedented fiscal austerity, just like Krugman has been predicting.

Mystery Right-Winger Sneaks Into an NPR Story on ZIRP

I was pleasantly surprised by this NPR story this morning, which said that the Fed’s zero-interest-rate policy was turning savers into collateral damage. But if you listen closely, around 3:30 you’ll recognize a familiar voice.

IRS Scandal Bask

I actually haven’t looked into it too closely, being of the “dog bites man” flavor. Here’s my main reaction to it, but I want to give people here a chance to correct me:

This scandal isn’t so much that the IRS was harassing political opponents, like forcing them to hire legal teams and spend a bunch of money just to tread water. Rather, the extra scrutiny was on applications for tax-exempt status.

In other words, what the Tea Party and other groups were being threatened with, was to have to pay the same onerous taxes that…the secretary down the street has to pay.

That’s just how awful our default tax code is, that when the government selectively makes certain people have to bear the full weight of it, we shriek out in horror.

(So, is the above basically right, or were, say, individual Tea Party people targeted for a full audit that ruined their lives etc.?)

Potpourri

==> Some people complained to me when this came out, but I thought Russ Roberts did a good job keeping Sumner honest in this interview. At the very end, Russ says something like (not exact quote), “You tell interesting an interesting story, Scott, it might even be true.”

==> Joe Salerno on the Fed realizing low interest rates might be a problem.

==> Some funny “memes” about the White House scandals and the press.

==> Tom Woods plays with fire. Although the lady in the video is speaking nonsense.

==> JP Koning uses a very Misesian argument about why stocks aren’t a good hedge against inflation.

Relax, Everyone, Krugman Sees No “Signature” of an Asset Bubble

In a recent post Krugman wrote:

Antonio Fatas is annoyed at Gillian Tett, who talks to the I-see-bubbles crowd and assumes that they have The Truth — namely, that those crazy central banks are flooding the world with liquidity, driving asset prices to crazy levels, and it will all end in terrible grief. Pretty much the same discussion we’ve been having about the armageddon hedgies.

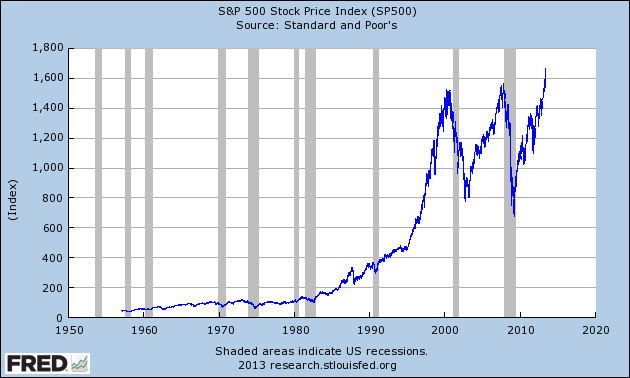

As Fatas says, it’s hard to see what exactly in the data supports this view. Short-term interest rates are near zero because the economy is so depressed, and will stay that way for a long time. Long-term rates are low because people, rightly, expect short-term rates to stay low for a long time. What about stocks? Here’s profits versus the S&P 500…

[Here Krugman inserts a chart showing a decent fit between the chart of after-tax corporate profits and the S&P500 from 2004 to the present.]

Then he admits:

Now, there are some real puzzles here. Why have profits been so strong in a weak economy? Why, with profits so high, don’t businesses find reason to invest more (equipment investment is actually fairly strong, but construction remains weak). (For the seriously wonkish, why do average and marginal q seem to be so different?)

But these seem to be real-side puzzles, not monetary/financial puzzles. I don’t see anything in the data that has the “signature” of what you’d expect if the big problem was that Ben Bernanke is flooding the market with artificial liquidity that has nowhere to go. [Bold added.]

Put aside the laugh line for a minute. What I want to focus on is this: Krugman is here admitting that he is puzzled at why businesses aren’t investing more, and he says this is a “real-side” problem.

Hasn’t he spent the last few years shouting down people who suggested that? I distinctly remember on TV Krugman mocking George Will for blaming “regime uncertainty” (not Will’s term), and Krugman said matter-of-factly businesses weren’t investing because of weak demand.

Did Arnold Kling get control of Krugman’s account for an hour and sneak this one in?

Anyway, this looks like a bubble’s John Hancock to me:

Krugman asks (of his own chart), “Does that scream ‘bubble’ to you?”

The IRS Scandal

Help me out here. The only reason this IRS scandal has any traction, is that the IRS itself admitted it had targeted Tea Party and other groups. There were lots of conservative types complaining about special scrutiny before, and nobody cared.

So why did the IRS come forth with this? And doesn’t it seem weird that all the other scandals broke at the same time?

I have no real explanation for all of this, I’m just very surprised. It would be like Krugman saying, “You know, the big drop in even short term deficit projections, despite (what I have described as) massive fiscal austerity, and all with no ill effect on unemployment, is really really awkward for the Keynesian position. I’m sorry I misled my readers; I’ll try to restore your confidence in IS/LM in the future.”

But Krugman would never say such a thing; instead he would run victory laps. It would be left for his critics to allege it. So is the IRS more intellectually honest than Paul Krugman?

Recent Comments