Relax, Everyone, Krugman Sees No “Signature” of an Asset Bubble

In a recent post Krugman wrote:

Antonio Fatas is annoyed at Gillian Tett, who talks to the I-see-bubbles crowd and assumes that they have The Truth — namely, that those crazy central banks are flooding the world with liquidity, driving asset prices to crazy levels, and it will all end in terrible grief. Pretty much the same discussion we’ve been having about the armageddon hedgies.

As Fatas says, it’s hard to see what exactly in the data supports this view. Short-term interest rates are near zero because the economy is so depressed, and will stay that way for a long time. Long-term rates are low because people, rightly, expect short-term rates to stay low for a long time. What about stocks? Here’s profits versus the S&P 500…

[Here Krugman inserts a chart showing a decent fit between the chart of after-tax corporate profits and the S&P500 from 2004 to the present.]

Then he admits:

Now, there are some real puzzles here. Why have profits been so strong in a weak economy? Why, with profits so high, don’t businesses find reason to invest more (equipment investment is actually fairly strong, but construction remains weak). (For the seriously wonkish, why do average and marginal q seem to be so different?)

But these seem to be real-side puzzles, not monetary/financial puzzles. I don’t see anything in the data that has the “signature” of what you’d expect if the big problem was that Ben Bernanke is flooding the market with artificial liquidity that has nowhere to go. [Bold added.]

Put aside the laugh line for a minute. What I want to focus on is this: Krugman is here admitting that he is puzzled at why businesses aren’t investing more, and he says this is a “real-side” problem.

Hasn’t he spent the last few years shouting down people who suggested that? I distinctly remember on TV Krugman mocking George Will for blaming “regime uncertainty” (not Will’s term), and Krugman said matter-of-factly businesses weren’t investing because of weak demand.

Did Arnold Kling get control of Krugman’s account for an hour and sneak this one in?

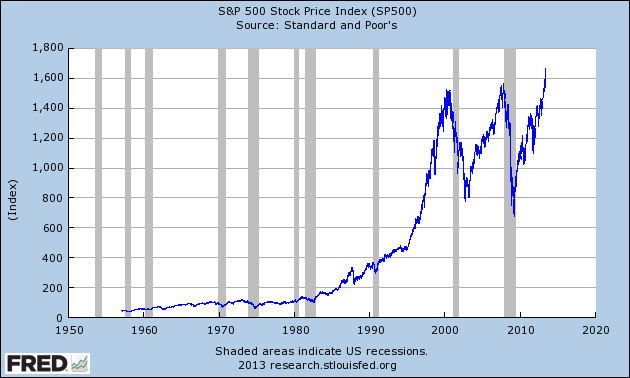

Anyway, this looks like a bubble’s John Hancock to me:

Krugman asks (of his own chart), “Does that scream ‘bubble’ to you?”

Last time this happened, Bernanke didn’t see the signature, either (or at least CLAIMED to not see it).

Ben Bernanke was Wrong

http://www.youtube.com/watch?v=9QpD64GUoXw

Compare:

Peter Schiff Was Right 2006 – 2007 (2nd Edition)

http://www.youtube.com/watch?v=2I0QN-FYkpw

You should use a log scale when data is spread over such a long period. Clearly there is no bubble now.

S&P 500 Stock Price Index

http://research.stlouisfed.org/fredgraph.png?g=iCd

Maybe this is obvious, but what is the need to use a log plot for long time periods?

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:what_are_charts

The relevant section is the one titled _Price Scaling_.

Both charts reveal what Bob is talking about.

FTA:

Well, yeah.

Clearly there is no bubble now

http://www.youtube.com/watch?v=2I33k8vV3Sk

I agree the log scale is essential. However, the log scale reveals interesting features:

– progress was stagnating in the 1970’s up to 1980 or so.

– it broke out and began climbing from 1980 to 2000.

– basically the whole US economy hit a wall in 2000 and have stagnated ever since.

Don’t tell me I’m totally oversimplifying, because I already know I am, for starters inflation is not taken into account. However, just in broad terms the year 2000 is a significant turning point.

http://research.stlouisfed.org/fred2/series/CIVPART/

Oh look, year 2000 is a turning point in this graph too.

The really funny part is that we know, in that chart there was a bubble. And both before the bubble and now, profits and the S&P tracked fairly well. Now, could it be that as a bubble builds in stocks, profits could also increase? Clearly. We have to go back to the tech bubble of the 90s to see a counter case to that. Clearly, corporate profits tell us literally NOTHING about whether there is a bubble or not.

How do you know what a bubble’s John Hancock is? You have a grand total of n=2 observations to base that on.

I don’t think your comment makes any sense Dan. There have been plenty of bubbles throughout history. If you want to say, “How do you know it’s a bubble, until it pops?” ok fair enough. But we have plenty of examples of asset prices going sky high, then collapsing again.

“There have been plenty of bubbles throughout history … we have plenty of examples of asset prices going sky high, then collapsing again.

Absolutely — like gold:

http://research.stlouisfed.org/fred2/series/GOLDAMGBD228NLBM

And the dollar:

http://research.stlouisfed.org/fredgraph.png?g=iEg

Like he didn’t see the housing bubble until how late in the game? When do you think he’ll see this bubble? right before the dollar collapses, maybe?