Yet Another Podcast Twin Spin

==> In Episode 78 of Contra Krugman, we talk about Krugman railing against the anti-reality Republicans. I am swamped with work so I have to be brief in my outline:

6:00 I remind people that it was progressive Democrats who started using the phrase “fake news” as a political weapon.

8:25 Tom explains that he was the target of a Two Minute Hate.

15:20 Tom is a softie and takes Krugman’s side, in his criticism of Trump taking credit for job numbers.

19:40 I point out Krugman’s hypocrisy when he says CBO is “scrupulous about avoiding partisanship.” Nope, that’s not what Krugman thought in June 2015 when they warned about the deficit.

23:15 I clarify the recent CBO’s report that 14 million people will lose health insurance under GOP plan. CBO itself says most of the increase would be due to repeal of the penalties under ObamaCare.

29:15 I note that CBO also says $210 billion of the forces increasing the deficit (due to repeal and replace) is due to loss of penalties from the employer/individual mandates. That’s shocking… the “affordable care” guaranteed by ACA was so bad that Americans would rather pay $210 billion in fines over a decade, rather than buy this coverage.

33:15 I zing Krugman’s idiosyncratic use of language whereby 2% of the population turns into a “handful” of people.

==> Episode 36 of the Lara-Murphy Show: I explain the basics of “tax reform” from the perspective of pro-market economists. I’m not necessarily endorsing all of these principles, but it’s relevant to the current political debates.

“The God of the Old Testament”

I think a lot of people–including me when I was younger–think that there are two separate Gods in the Christian Bible. First there’s the mean vindictive God of the Old Testament, and then there’s the nice guy Jesus in the New Testament.

However, you do see all of Jesus’ character traits in the “God of the Old Testament.” For example, I grabbed the following from Baker’s Theology of Exodus:

On this occasion, Moses receives a special revelation of Yahweh’s character. He requests a look at God’s glory (33:18 ). The audacity of the request is overlooked, and Yahweh promises to reveal all his “goodness” ( 33:19 ). Whether the “glory” and the “goodness” are the same is not explained. But when Yahweh passes Moses on the mountain, six words or phrases are proclaimed that provide one of the fullest descriptions of the Lord’s character, no matter whether glory or goodness. Yahweh is compassionate, gracious, slow to anger, abounding in steadfast love, abounding in faithfulness, and forgiving ( 34:6-7 ).

According to the Bible, Jesus and the God of Abraham are the same. (Jesus said, “[B]efore Abraham was, I AM.”)

I have said this before, but the way I interpret the “two different personalities” is that in the Old Testament, you see God in His role God Almighty, creator of the heavens and earth. So yes He sends plagues and orders massacres, but you must keep in mind that He is in control of everything that happens and whether you die from a heart attack, an avalanche, or Joshua’s sword, in a sense “God killed you.” In this setting, God taught us how to live by issuing a long string of commands and giving rewards and punishments accordingly.

However, in the gospel accounts, God has become a man in order to teach us how to live by showing us through His own personal example. He didn’t contradict the Law, but fulfilled its spirit. He showed us how to understand it at a much deeper level. And since He had became one of us, He acted the way a perfect human would act. Jesus in His role as one of us didn’t use violence to resist evil.

If you object that this is all really complicated, yes I agree, but on the other hand if the Bible account were true, then you would expect it to be a bit difficult for a mortal to comprehend.

A Huge Problem (?) in Martin Feldstein Et Al.’s Argument for Border Adjustment Tax

It’s not all karaoke and Krugman bashing around here. Sometimes I roll up my sleeves and do straight econ…

Some of the rank-and-file Republicans pushing the border adjustment tax (BAT) are doing so on explicitly protectionist grounds. (If you don’t know, the BAT would tax imports at 20% and exempt exports, implicitly subsidizing them 20%.) Or rather, they are saying the current tax code unfairly privileges imports and thus the BAT will level the playing field, thereby boosting exports and hurting imports.

However, the actual economists who are for the BAT (or at least think it’s not a terrible idea, like Krugman) think that such talk is uninformed. Martin Feldstein in particular has been writing op eds and blog posts, and making TV appearances, assuring everyone that the BAT won’t hurt imports.

If you haven’t read Feldstein’s argument, you need to please read this example of his position. Otherwise my own reaction is useless.

Now that you’ve read Feldstein, read my critique.

Here’s my strategy in that blog post:

- I first show what Feldstein has in mind, and how his argument basically goes through if we start with a country that has equal imports and exports.

- Then I show that if the government of this country were to exempt one-quarter of the exporters from its subsidy, the original result would no longer hold. Rather than being a wash, on net the scheme would act as a net impediment to trade.

- Finally, I argue that our current situation–where the US has a third more imports than exports–is equivalent to point (2) above, except where the one-quarter of the exports are “stocks and bonds.” If you think of US operations exporting a good called “stocks and bonds,” then it becomes crystal clear that Feldstein’s analysis must be wrong. The dollar won’t appreciate enough to fully offset the direct impact of the tax on imports.

On Trade Deficits: Murphy vs. The World, Part 2 of 3

In a previous post, I objected to Mark Perry’s own post about the U.S. trade deficit. The title of Perry’s post captures his point: “US has a net inflow of goods and a net inflow of capital. Team Trump wants the opposite?”

I pointed out that if a populist in Japan tried to impose schemes to keep Japanese savings “working for us here in Japan,” then surely Mark Perry and other free traders would object–and rightly so. But if a free trader would assure someone in Japan not to worry about their capital account deficit, then how can free traders assure Americans that a capital account surplus is self-evidently a good thing?

(For an analogy, if a free trader looked at kids swapping lunches at school, it would work to say, “Ah, you value what you got more than what you gave up. So this makes you better off.” But it wouldn’t work to say, “Billy got a cookie instead of spinach. And Team Trump wants the opposite?”)

Now Don Boudreaux defends Mark Perry over at CafeHayek. Don writes:

Mark’s point (in summary) is that if the voluntary economic decisions of Americans and foreigners result in a U.S. current-account (“trade”) deficit – which is to say, a U.S. capital-account surplus of the very same amount – Americans should not be upset. The reason is that a U.S. capital-account surplus means that the American economy is a net recipient, not only of imports, but also of capital. And being a net recipient of capital is not only not necessarily a bad thing for Americans, but is likely a good thing.

No, I have to cry foul. If *that* is what Perry had written, then you wouldn’t have heard a peep out of me. But as I took pains to emphasize in my original critique, that’s *not* what Perry wrote. There’s nothing in there about “…is likely a good thing.” No, go read Perry’s post again if you don’t believe me. Clearly, his argument is that it’s self-evidently a good thing when your country has (a) more goods and (b) more capital flowing into it than out of it. And that’s clearly not a good argument, unless you think all of the countries on the other side of the equation are in trouble and that their people should fret about the trade statistics.

But beyond me thinking that Don is being too generous to Perry in his summary of his post, Don and I actually have a substantive disagreement. Here’s Don:

I believe that Bob’s objection misses the mark. A capital-account deficit (that is, a current-account surplus) is indeed more likely than is a capital-account surplus to signal a problem with the national economy. If Japan consistently runs capital-account deficits, this fact is likely evidence that good investment opportunities in Japan are too few – and made too few by poor government policies that make the investment climate in Japan less attractive than it would be absent these poor policies.

I understand what he’s getting at, but I simply disagree. One last thing before I dive into my example. After reading Don push back against me, someone in the comments wrote: “Once again, you are confused. The current account deficit is not the same as the trade deficit.” To which Don gave an exasperated response, wondering how this guy could possibly think Don doesn’t understand this distinction.

OK, so now I’m going to give an example of what I think these critics have in mind. As I always say on these types of posts, on policy matters Don and I are in perfect agreement. But I think I see how Don sometimes is misunderstanding his critics, and they are talking past each other. So please keep that in mind when you try to understand, “What is the purpose of Bob giving us this scenario?”

THE SCENARIO:

A certain nation loves Adam Smith’s quote that what is prudence for a household can’t be folly for a great kingdom, and its people heed the wisdom of Deuteronomy 15:6 that says, “For the LORD your God will bless you as he has promised, and you will lend to many nations but will borrow from none. You will rule over many nations but none will rule over you.”

So in practice what happens is that the people of this nation save a large fraction of their income every year. After a while they have exhausted the great investment opportunities in their country and on the margin, it is more attractive to invest abroad. Thus, in a typical year, the people in this nation acquire more foreign assets on net than foreigners acquire of financial assets that are claims on the nation. That is to say, our hypothetical nation consistently runs large current account surpluses / capital account deficits, both in absolute money terms and as a share of their GDP. (The people always save a large fraction of their income, even as it grows rapidly because of their frugality.)

Now at first, you might think that this means our people end up sending more goods out of the nation than they import each year. But that’s wrong. What actually happens is that their nation runs a trade deficit while they nonetheless experience a current account surplus.

For example, in the most recent year the foreigners held (I’m converting to US dollars for our convenience) $10 trillion worth of foreign assets, in the form of bonds, stock, real estate, etc. That generated an income over the course of the year of $500 billion to our hypothetical people, because on average they earned 5% on their foreign assets.

In contrast, foreigners around the world only owned $4 trillion worth of assets in our country, in the form of corporate stock. (Remember, these people are wary of outside control, so they don’t issue bonds or sell real estate to foreigners. They do allow foreigners to buy shares of corporate stock in IPOs though.) These foreigners earn an average of 2.5% on their stock, meaning they earned an annual income of $100 billion.

Now in addition to these facts, I’ll report to you that our people sold $600 billion worth of goods to foreigners, while our people imported $750 billion worth of goods. In other words, there was a trade deficit of $150 billion. More goods flowed into the country as imports, than flowed out of the country as exports.

However, notwithstanding the trade deficit, there was still a current account surplus of $250 billion. That means our people had a capital account deficit of $250 billion. That is to say, our people invested (on net) $250 billion more in additional foreign assets than vice versa.

If you want to step back and see what’s happening: Our hypothetical people earned $500 billion in (gross) investment income from their foreign assets, and they earned an additional $600 billion from exporting goods. Then with that $1,100 billion in total income in foreign currencies, they paid $100 billion that they owed as corporate dividends to the foreign holders of their stocks, they bought $750 billion worth of imported goods, and with the remaining $250 billion they acquired additional foreign assets.

Now I’m not saying that this is necessarily the goal; certainly you wouldn’t want governments passing measures to try to achieve the above outcome. (For one thing, it’s impossible for every nation to be a net lender to every other nation.) But I think my example is the kind of thing that many of Don’s critics have in mind, and why they think free traders who keep telling Americans that a capital account surplus is a good thing, are missing something.

Murphy Podcast Twin Spin

==> I don’t have time to outline it, but here’s Episode 77 of Contra Krugman.

==> I was on the Johnny Rocket Launchpad. Hilarity ensued.

More on the Tax on “Cadillac” Health Insurance Plans

In response to my earlier post on Scott Sumner and Steve Landsburg, David R. Henderson sent me two of his own posts (I and II) on the 40% surtax on so-called Cadillac employer-provided health plans.

I think I’m generally in agreement with everything David wrote, but I suspect he is still more favorable to the tax than I am (…inasmuch as I am very much against the tax, and I don’t think David would be upset if it passed).

So in response to Scott and Steve for sure, and David not as much, let me offer the following points of pushback:

(1) The tax on Cadillac plans does not undo the “subsidy” in the existing tax code. As David himself conceded, it only kicks in at the margin.

(2) As John Goodman pointed out to David, this approach is all pain. (See Goodman’s own suggestion for using a tax credit approach to get the marginal incentives much better.)

(3) I don’t think it was an accident that the original ACA legislation only had the 40% surtax kick in at a high threshold. They weren’t trying to get rid of third-party payment for health expenses. No, in addition to the Cadillac tax the ACA also contained an employer mandate: a stiff penalty for large employers who didn’t provide adequate coverage to their employees. Thus employers were getting hit from both ends: up to a $3,000 per employee fine for not providing a decent plan, but then a 40% surtax on plans that were too good.

So I think Steve and Scott are being naive when they’re acting as if the Republicans have somehow foiled the architects of the ACA who were doing their best to contain health care costs. No, they weren’t. I think they were trying to ram a one-size-fits-all approach onto the employer plans to match the crappy plans people were getting on the exchanges. So (a) people paying out of pocket, (b) people buying plans through the exchanges, and (c) people getting plans from their employer, were all getting crappy coverage where they would still be devastated if they got hit with a really big medical event. Thus keeping health insurance bureaucratic and unsatisfactory, and giving rise to calls for single payer.

(4) In general, if the public is groaning under the burden of stuff costing too much, you don’t help them out by slapping a new tax on them. For an analogy, loose monetary policy led to rampant CPI inflation in the 1970s. I think some commentators actually suggested tax hikes as a way of “sopping up demand” and restraining annual price increases. No, that wouldn’t really help people pay for their groceries. Or for the analogy I used last time: We can point to all the ways the government itself is responsible for skyrocketing tuition costs. But if all the government did were to slap a 40% tax on colleges for every student they admitted, that would hardly help parents pay for college.

(5) I think the underlying assumption in these analyses is that the government holds other spending fixed, and so any new revenue from the Cadillac tax would simply reduce the deficit. But in practice I don’t think that is correct. So to the extent that it brought in receipts, I think we also have to factor in more IRS audits, more drone strikes, more DEA raids, and all the other stuff that the federal government spends money on. It’s because of this element that I am really surprised to see free-market economists lamenting the “missed opportunity” to tax the @)#($# out of employer-provided health plans. (I realize the main response would be for employers to not exceed the threshold.)

(6) As I argued in my Lara-Murphy post, I don’t think the IRS code by itself is what’s driving the absurdities in health care costs. I think the tax code provisions interact with all sorts of supply restrictions and mandates. For just one consideration: Before the ACA, if a person’s child had a medical condition, it might have been impossible for the person to buy individual health insurance. But if the person went and got a normal office job, then he could get himself and his dependents on the company plan without them even asking about his kid’s medical history.

So this is clearly an advantage to employer-provided coverage, and it explains why coverage isn’t portable. Yet this has nothing to do with tax deductibility. I don’t know if it’s because of a regulation saying health insurers have to provide group coverage to everybody, or if it’s a market outcome that insurers are OK with “community rating” because they figure it will all wash out. But for sure, this type of consideration shows that we’re not merely dealing with pre- and post-tax dollars for the same product.

==> In summary, although I understand and agree with the narrow technical analysis of the inefficiencies of the tax code, and how this contributes to an overallocation of resources into health care, nonetheless I was very much against the ACA’s surtax on (the top end of) employer-provided Cadillac plans. I think many free-market economists are fooling themselves if they (a) thought the architects of the ACA were really trying to improve efficiency and (b) predicted that such a new tax would rationalize health spending and reduce deadweight loss, all things considered.

On Trade Deficits: Murphy vs. the World, Part 1 of 3

I disagree strongly with the rhetoric and substance of Donald Trump and his top advisors when it comes to trade deficits. For example, Peter Navarro’s recent WSJ op ed (which relied on the accounting tautology Y = C+I+G+Nx) could just as well “prove” that increased government expenditures are the way to boost real GDP and create American jobs.

However, most free-market economists are bashing Trump & Co. nonstop on this stuff. So where I would like to make some points is going the other way, namely, where I think pro-free trade economists are putting forth non sequiturs that will actually do little to help the cause. I hope it goes without saying that my point here is to clarify our communication with the public, especially with people who are sympathetic to Trump & Co’s arguments for trade barriers.

In this current post, I want to focus on a recent post from AEI’s Mark Perry. I am going to give a screenshot of the title and then quote the entire post, because I want you to be sure I’m correctly conveying his argument. Perry wrote:

Here’s one way to look at our America’s international trade situation:

1. The US receives more of foreigners’ production of goods and services than they get of ours, which results in a net inflow of foreign-produced goods and services every year.

2. The US also receives more of foreigners’ investment capital than they get of ours, which results in a net inflow of investment capital from abroad.

Protectionists, Peter Navarro and Trump then complain about America’s “trade deficit” for merchandise, but never mention the surplus for services, nor the surplus of foreign investment capital.

Consider a country like Japan’s international trade situation.

1. Japan exports more of its domestically-produced goods and services to foreigners every year than it receives from abroad, which results in a net outflow of domestically-produced goods and services.

2. Japan also sends out more of its investment capital to other countries every year than it receives from abroad, which results in a net outflow of investment capital.

Protectionists, Peter Navarro and Trump then claim that they want the US to emulate Japan’s trade situation to “Make America Great Again.”

So that is the entirety of his post. I think it is entirely fair to summarize Perry’s argument as: “It is clearly advantageous to Americans that they are the recipients of both goods and capital. Only a fool would think it would help the country to transform that situation into one on which we are net exporters of both goods and capital. Yet that’s where Trump’s logic leads us, so he must be wrong.”

Now here’s my problem. Suppose a populist politician in Japan starts railing against the fact that they’re “getting killed by the Americans in our trade dealings.” He wants to pass a measure to “keep our savings here in Japan.”

In that case, surely Mark Perry and other economists would say that’s nonsense, that the voluntary transactions of Japanese manufacturers and investors only make the country richer. Nobody in Japan should look at their aggregate statistics about current account surpluses and capital account deficits and conclude that this is somehow dangerous for Japan.

But if that’s true–and it surely is–then Perry’s post above collapses. If a free trader would tell the people with a capital account deficit that they shouldn’t be worried about the situation, then free traders shouldn’t be telling Americans that having a capital account surplus is self-evidently a good thing.

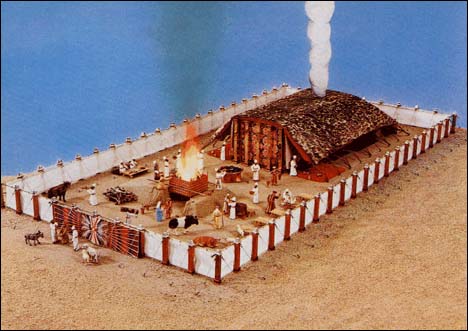

The Tabernacle of Exodus

In my Bible study we just got finished with the book of Exodus. I didn’t realize until reading the commentary on the last chapter that the book wraps up only one year after they left Egypt.

Another thing: When I was younger, I misunderstood all the references to “the tabernacle.” Being raised Catholic, I thought the tabernacle referred to a little cabinet.

However, in Exodus it refers to the tent which contained the Ark and other important items. (The word in both usages means “where God dwells” but they obviously refer to different physical structures.)

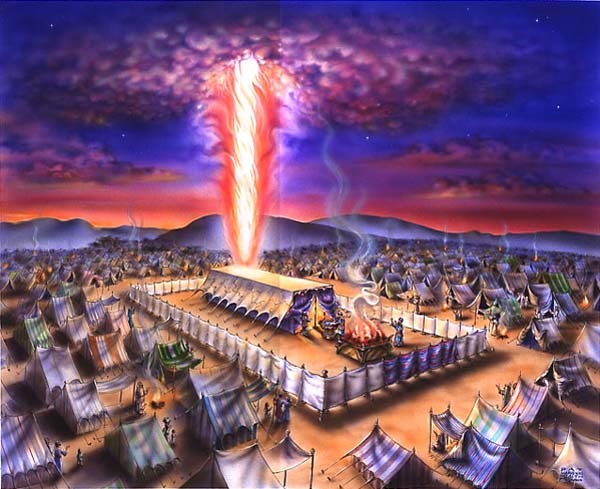

Here are two pictures (which I got from here and here) that helped me make sense of the long descriptions in Exodus of the tabernacle and courtyard:

For those unfamiliar with the text, at night God would hover as a pillar of fire above the tabernacle, while during the day as a column of smoke. Thus the children of Israel would know He was literally in their midst, leading them out of slavery and to the Promised Land.

Recent Comments