The Demonic Twist to “Anonymous”

For a while now this “Anonymous” hacker group has given me the creeps. But this recent video release has sealed the deal for me:

I don’t know what the deal is with the new message placed on the screen, calling off the operation. Someone can explain it in the comments.

Anyway, this creeps me out because:

(A) It is making threats to achieve political demands. There’s a word for that.

(B) The computer-generated voice sounds like something the villain in a horror movie would use.

(C) The “We are Legion” sounds suspiciously like the demons Jesus cast out of a man (Mark 5: 1-13):

1 Then they came to the other side of the sea, to the country of the Gadarenes.[a] 2 And when He had come out of the boat, immediately there met Him out of the tombs a man with an unclean spirit, 3 who had his dwelling among the tombs; and no one could bind him,[b] not even with chains, 4 because he had often been bound with shackles and chains. And the chains had been pulled apart by him, and the shackles broken in pieces; neither could anyone tame him. 5 And always, night and day, he was in the mountains and in the tombs, crying out and cutting himself with stones.

6 When he saw Jesus from afar, he ran and worshiped Him. 7 And he cried out with a loud voice and said, “What have I to do with You, Jesus, Son of the Most High God? I implore You by God that You do not torment me.”

8 For He said to him, “Come out of the man, unclean spirit!” 9 Then He asked him, “What is your name?”

And he answered, saying, “My name is Legion; for we are many.” 10 Also he begged Him earnestly that He would not send them out of the country.

11 Now a large herd of swine was feeding there near the mountains. 12 So all the demons begged Him, saying, “Send us to the swine, that we may enter them.” 13 And at once Jesus[c] gave them permission. Then the unclean spirits went out and entered the swine (there were about two thousand); and the herd ran violently down the steep place into the sea, and drowned in the sea.

Go ahead and tell me all the good stuff Anonymous is doing in the comments, that their methods might be borderline but they mean well. I’ll listen to you; go ahead and say that. But since they say, “We are legion” I don’t trust them. I realize the term is now used in pop culture, and maybe whoever started using it for Anonymous didn’t know the original source. Well the devil has a funny way of getting people to do his bidding.

Brad DeLong Convinces Me I’m Not Insane

Remember that famous psychology experiment where the unwitting subject is in a room with ten people, and then the administrators show two lines–one much shorter than the other? If the first nine people (who in reality are all confederates with the experimenters) say the shorter line is longer, then the last guy might go against his eyes and agree. But if just one person says the obvious, then the actual test subject is much more likely to say the truth too. In other words, people are afraid to be completely alone in their views, but if just one other person agrees, then they’ll speak what is staring them in the face.

(BTW I am probably taking serious liberties with the details of that experiment. See here for an actual summary.)

Anyway, Brad DeLong says the obvious regarding Scott Sumner. The context is Sumner criticizing modern Keynesians for thinking monetary policy was easy in 2008, since interest rates came down. Here’s DeLong:

Well, I would say that not just “modern Keynesians” but a lot of people believed that monetary policy was expansionary in 2008.

They believed so not just because (safe) nominal (and real) interest rates were falling, but because the money supply was expanding. Indeed, since 2007 the Federal Reserve has tripled the monetary base…If expanding the monetary base to three times its previous size is not “expansionary”, what could possibly be?

Then DeLong quotes some other guy (Matt Rognlie) who argued that we have contractionary Fed policy because real interest rates are too high. DeLong says:

“Wait a minute!” you say. “The ten-year nominal Treasury bond rate has fallen 325 basis points since 2007. The three-month Treasury bill rate has fallen by 500 basis points since 2007. And this is not a case in which apparently low nominal interest rates are really high real interest rates because of expected deflation: expected inflation has fallen by only about a third as much as nominal interest rates have fallen. The real interest rate on ten-year Treasury bonds has fallen from 2.5% per annum in 2007 to zero today…

“And Matt wants us to believe that this pushing-up of the present value of a real dollar of cash flow ten years in the future by more than one-quarter–this more than doubling of the present value of a real dollar of cash flow thirty years in the future–this tripling of the monetary base–is contractionary? What is going on here?!”

What Sumner (and Rognlie) should say, I think–in order to avoid confusing readers who try to wrap their minds around the idea that a large monetary expansion is contractionary–is that monetary policy was expansionary but the expansion was not large enough to cope with the macroeconomic problem.

But for some reason they don’t want to say this.

THANK YOU Professor DeLong. I can put away my bottle of crazy pills now.

P.S. One thing in fairness to Scott Sumner, he does have a point that “real interest rates” (as implied by TIPS yields) spiked in the fall of 2008 during the crisis. (Look at DeLong’s chart to see what I mean.) So if Scott wants to say, “The Fed tightened for a few months right then, and since has loosened but not enough,” then OK I won’t quibble.

Free Advice for Occupy Wall Street Crowd

If you want the average people watching at home to sympathize with you, you should stop dropping F-bombs and not taunt the cops. Doesn’t mean it’s right for them to throw a baton or use their pepper spray, but if the below scene (HT2 Robert Wenzel) had escalated into serious violence, the average American would side with the cops.

In contrast, the footage that Lawrence O’Donnell had–where a cop walks up to a girl who’s just standing there, behind a barricade, and maces her in the face–that will make people sympathize with your protest.

If and when serious violence and property destruction occurs, it will give the government a pretext to impose martial law in select areas. That doesn’t mean we win, it means they win. The video above is emblematic of the State at large–it has a few people with most of the weapons, versus far far more people who are relatively powerless in terms of physical might, but have the ability to turn public opinion against the armed minority. In the video above, the police had guns, batons, and tasers, but the crowd had numbers, cameras, and the ability to boo.

That might strike some as useless, but it’s not. I agree with Mises, Hume, and de la Boetie that all government ultimately rests on public opinion. The way to convince people in Nashville and Boise that you are being victimized is to look like doves being attacked by irrational thugs. Don’t surround the police and make them look like cornered, rabid dogs.

The Old Republic Is Dead

If I were more computer-savvy I’d have my blog play the Empire theme music right now. Regardless of your views on the wisdom of invading Afghanistan and Iraq, of torturing POWs, etc., surely you can agree with me that we have definitively crossed “the line.” I probably put the line in a different ZIP code from where you do, but even so, our government has crossed both of our lines. From Reuters (HT2 Alex Tabarrok):

American militants like Anwar al-Awlaki are placed on a kill or capture list by a secretive panel of senior government officials, which then informs the president of its decisions, according to officials.

There is no public record of the operations or decisions of the panel, which is a subset of the White House’s National Security Council, several current and former officials said. Neither is there any law establishing its existence or setting out the rules by which it is supposed to operate.

Now people like Glenn Greenwald are emphasizing that this report quotes White House officials admitting the evidence against Awlaki was “patchy.” I don’t even care about that. Just go read the two paragraphs above. Seriously, please re-read those two paragraphs.

The Old Republic is dead. My American friends, we are the citizens of an empire. If the people running the US government decide you are an enemy, they can put you on a list and have a drone blow you up. Case closed. If you don’t want to get blown up, just make sure they don’t have a reason to want you dead.

Gremlin Blog Update

Sorry the blog has been acting funny the last couple of days. With the help of Doug Stuart, I think we solved the main problems. We basically restored the files in their state from two days ago, and after some hiccups that seems to be working. (I am going to try a similar thing, and go back to my physique in high school.) Let me know if you have any problems.

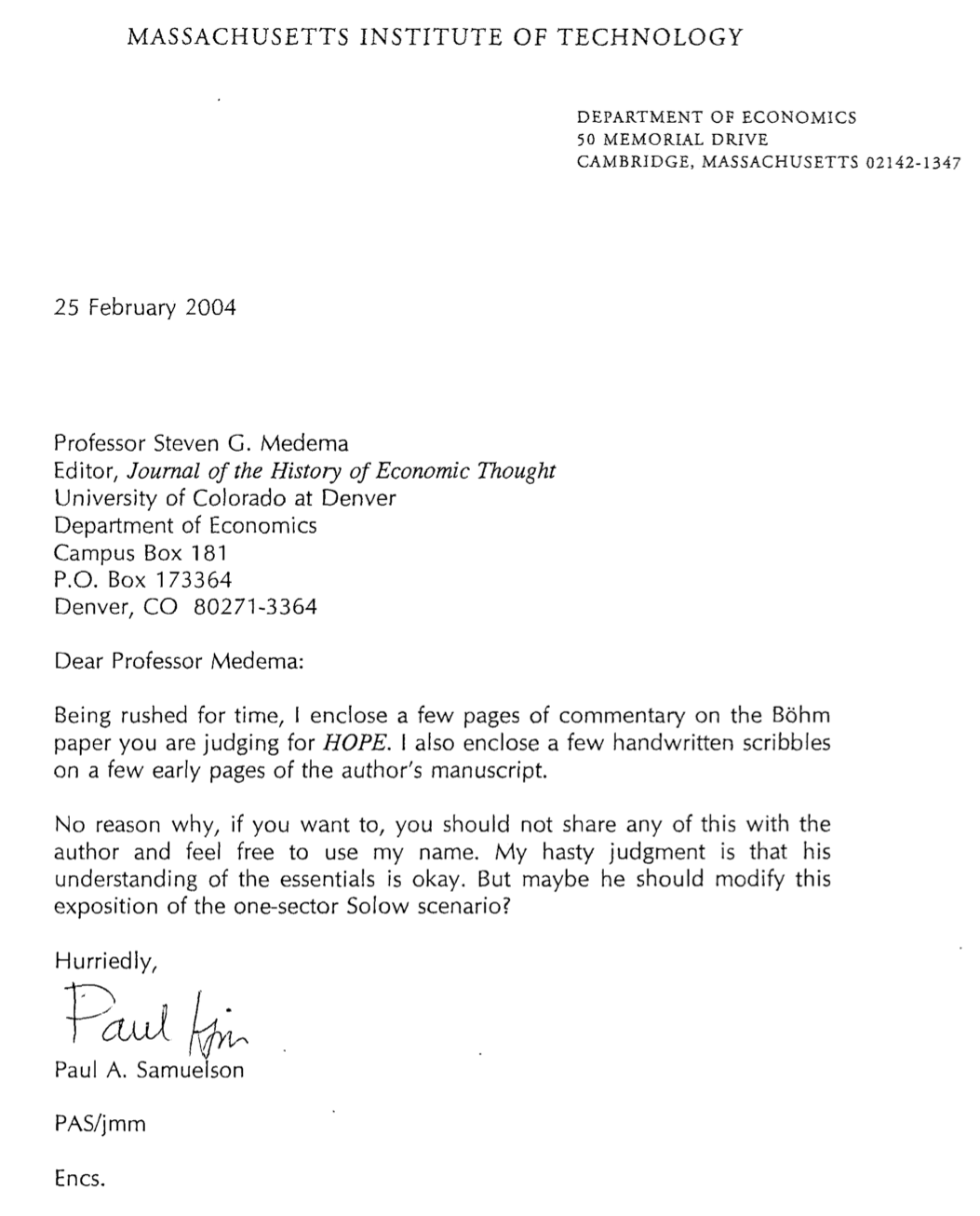

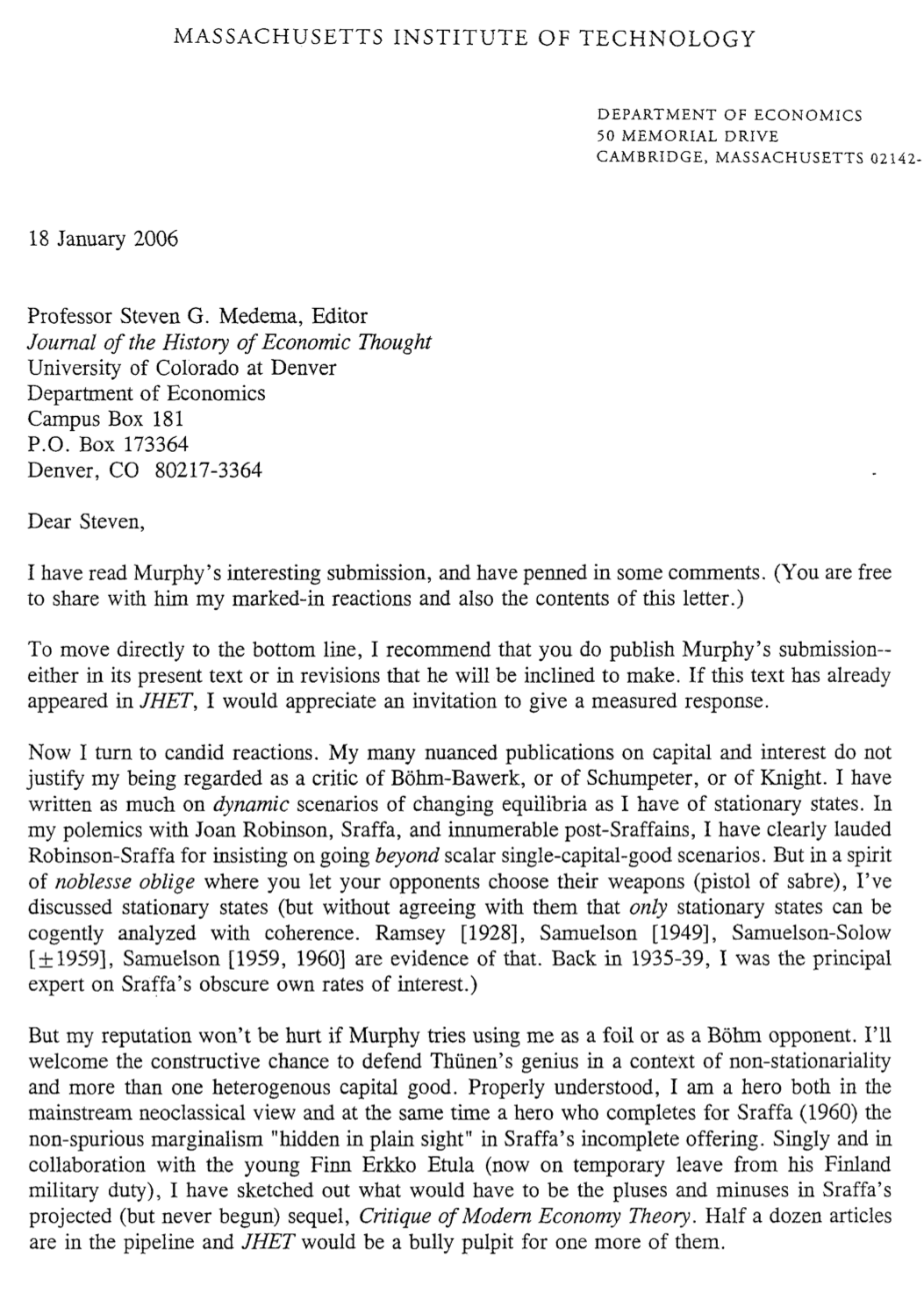

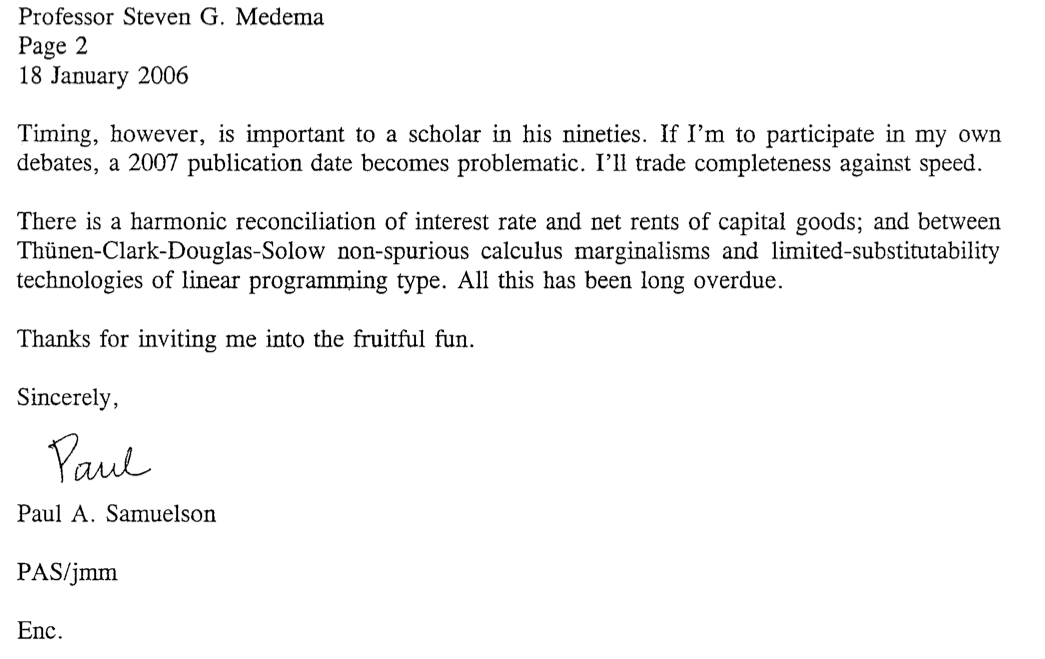

Paul Samuelson Correspondence Regarding My Papers on Capital & Interest Theory

UPDATE: To be clear, I think Samuelson was an amazing character; that’s what I meant below when I say, “They don’t make ’em like this anymore.” Since he died, there’s really nobody left who can criticize Bohm-Bawerk the way he did. Sure it’s fine to debate Krugman, but Krugman doesn’t know Austrian capital & interest theory the way Samuelson did.

Ah, at long last! Corey Sheahan (prompted by Stanislaw Kwiatkowski) was able to go through the Samuelson archives at Duke and dig out his referee reports on my papers on capital & interest theory. (I couldn’t find them after I had moved, so I was worried they were lost forever. Also, in case it’s not clear, Samuelson disclosed his identity to me in both reports.) Here are citations to the two papers involved:

Murphy, Robert P. “Interest and the Marginal Product of Capital: A Critique of Samuelson.” Journal of the History of Economic Thought, Vol. 29, No. 4 (2007), pp. 453-464.

————–“Dangers of the One-Good Model: Böhm-Bawerk’s Critique of the ‘Naïve Productivity Theory’ of Interest.” Journal of the History of Economic Thought, Vol. 27, No. 4 (December 2005), pp. 375-382.

I don’t have handy versions of the published papers, but you can get the basic idea from the Appendix in my dissertation.

Anyway here are Samuelson’s letters. Be sure to read the one from January 2006. They don’t make ’em like this anymore.

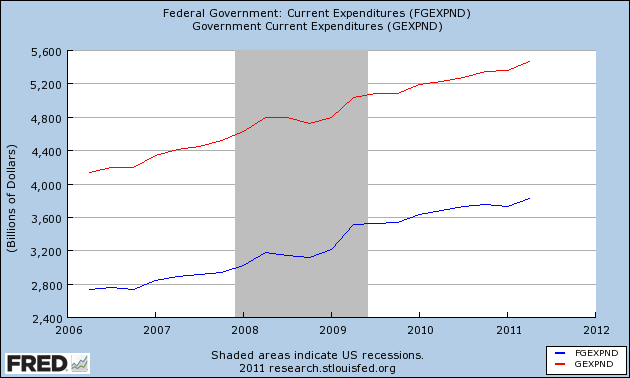

Facts and Other Stubborn Things, Fiscal Edition

Daniel Kuehn is frustrated with guys like me:

I’ve commented on this rhetoric of stimulus in the past. What really baffles me is that we haven’t seen any fiscal stimulus since 2009 (and that was underwhelming)… at what point do Bob and others start saying things like “for the last two years we’ve tried a spending freeze and that hasn’t worked – let’s try stimulus!”. I’m not holding my breath.

Is the following chart an adequate acquittal? I feel like Winston when O’Brien says, “You do not exist,” and Winston knows it’s pointless to argue.

Inflationists in Wolves’ Clothing

I continue my one-man campaign against the disastrous impact of the quasi-monetarists (aka market monetarists) on the punditry. It took Scott Sumner three years to become the new normal; it will just take a collapse of the currency for my own take. An excerpt:

Even though their conclusion strikes me as absurd, these quasi monetarists are serious thinkers and it would be a big task to comprehensively critique their position. (I’ve made modest efforts here and here when they defended QE2.) Yet despite their sophisticated calls for the Fed to “target NGDP growth,” shape expectations, and so forth, in practice their message is being distilled by the secondhanders into calls for unadulterated handouts of paper money. As we will see, I don’t have to engage in caricature; pundits like Matt Yglesias and Martin Wolf are openly calling for helicopter drops of money as a solution to our economic woes.

P.S. A quick point about the title (which is one of the rare ones that was my suggestion and the editor kept): I understand that the normal phrase is, “A wolf in sheep’s clothing.” Do you honestly think I don’t know that? The point of the title is that Martin Wolf (and Matt Yglesias) aren’t recommending something that sounds appealing on the surface, but would actually have bad consequences when you peek under the disguise. No, they are openly calling for helicopter drops of money…in order to give us (price) inflation. My point is, they aren’t even cloaking the rhetoric anymore. Sumner et al. have managed to convince people that what we need is a good dose of price increases to help the middle class.

P.P.S. Holy cow, please don’t lecture me that what Scott Sumner et al. want is to target the level of NGDP, and have it grow at (say) 5% per year. Yeah, I know. I read Scott’s blog. In this article, I’m talking about Yglesias calling for “free money for the rest of us” (sic!) when his call is clearly based on his reading of Sumner.

Recent Comments