Mish vs. Murphy

So somebody sent me this article by Mike “Mish” Shedlock, where he takes me out to the woodshed. Here is the relevant portion:

Flashback November 23, 2010: Austrian economist Robert Murphy predicts “high inflation” and and writes a post Has Mish Deflated the “Inflationistas”?My response which in retrospect has clearly carried the day was Failure to Consider Constraints – My Response to “Has Mish Deflated the Inflationistas?”

I invite you to read my detailed response to someone who was clearly wrong but here is the key snip.

OK, the term “high inflation” (note his quotation marks) isn’t in the November 23, 2010 article. Indeed, I don’t make any predictions at all. Instead, I go through and point out three bad calls Mish made because of his “credit deflation” worldview.

Now in fairness, I think what Mish means is that he is linking to one of my earlier pieces where I am worried about price inflation. If you read his original response to me, you will see the discussion.

Also, I should note that Mish was cool about linking to my Krugman Debate. I didn’t realize he had done that, until just now. (I think because it was buried at the end of his blog post; I must have stopped reading it when I thought he was done with me, when it first came out.) Since that is the case, I can now tell this story:

Back when the Krugman Debate was launched, I of course was trying to get various people to promote it. I wanted the thing to take off and gain currency outside the readership just of Mises.org etc. So when Mish called me up out of the blue, and said he was really interested in the debate and was going to push it on his blog, I was thrilled.

The only problem was, I had a pending article at Mises.org that was critical of Mish. Like, it was going to run within a few days of him calling me. So I was in a quandary. Obviously I wanted Mish to push the Krugman Debate, but I also didn’t want to be a jerk and not mention that I disagreed with his deflationist perspective. I considered telling the Mises guys just to pull the article, but that would have made me feel dirty.

So, my solution was to send Mish an email giving him a heads’ up, just so I wouldn’t feel funny if he pushed the debate and then my “hatchet job” (not really) came up the next day or something. I can’t remember if he answered that email, but as far as I knew, he never mentioned the Krugman Debate, and I filed away another cynical encounter with my fellow human beings.

Thus, I am very pleasantly surprised now to see that Mish in fact did still promote the debate, notwithstanding our tiff. (To be clear, the reason I am telling the story publicly now, is that it has this happy ending. Back when I thought Mish changed his mind out of spite or because he didn’t want to promote somebody who was an idiot on inflation, I didn’t blab the episode because that seemed ungentlemanly.)

Anyway, back to the big argument: inflation or deflation? Mish and I do NOT refer to prices with those terms. I have in mind money broadly conceived (including demand deposits and maybe some other things), whereas Mish includes “credit” though I’m not sure exactly how he defines that specifically. The point is, neither of us mean prices when we use the terms with no qualifier.

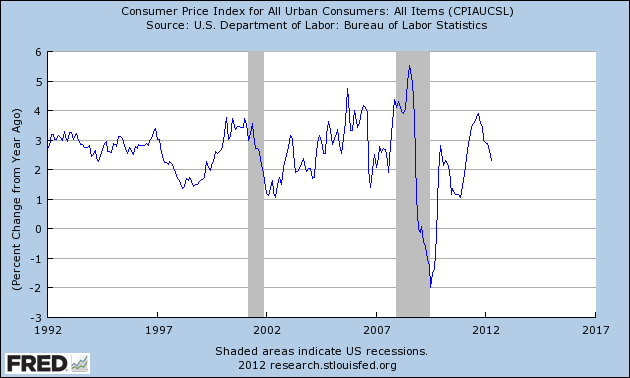

However, in terms of telling the public what we think is going to happen, surely the movement of consumer prices is key. And on that score, I think Mish and I were both wrong. He has been running around telling people that Bernanke is a small player compared to the global credit system, whereas I have been warning people that the excess reserves could leak out and spiral out of control very quickly (calling them a genie in the bottle). Here’s what has actually happened to CPI:

Note the units: It’s percentage change over the previous 12 months. Yes, consumer prices dropped sharply when the crisis first struck, but then with QE1 they turned around. Since then they rose

steadily, started falling and them zoomed up rapidly (because of QE2? I am not going to bother matching it up), peaked at almost 4 percent, a rate rarely achieved in the last 20 years. Then CPI’s increase slowed, so that the yr/yr growth rate has fallen down to a bit above 2 percent.Obviously this is nowhere near where I thought it was going to be. But, someone running around saying “deflation” for 3 years has been wrong too.

As I said to the guy who is a fan of both of us, back when he was feeding me Mish’s response to me, “Well we’ll just have to wait and see. If prices rise very quickly then I’m right. If prices start falling then Mish is right. If we have modest price hikes for a few years then Krugman is right.”

I’m paraphrasing, but that’s basically what I said to the guy. On that score, then, I think of the three of us, Krugman has the most justification for running victory laps (though even he too threw the deflation threat around a bit much, just not as much as Mish).

If any of you are regular Mish readers, I would love some clarity here. What is his position? Is he merely saying, “I bet we won’t have hyperinflation in the next two years?” Well no kidding, most people don’t think that. It seems to me he has been saying a lot of more.

08 Jun 2012Let’s Lynch for the Right Reasons At Least

Holy cow, the people on FB and the blogosphere in general are going absolutely nuts over Rand Paul killing all those Girl Scouts with a 5 iron. Ha ha not really, all he did was endorse Mitt Romney. But the reaction was about the same.

I like to think of myself as the little angel–OK perhaps the little Buddha–who sits on the right shoulder of the libertarian movement. No matter what the situation, I want to whisper, “Are you sure?” before we lynch someone.

For example, I don’t think Roderick Long’s post, entitled “It Usually Ends With Rand Paul,” makes any sense:

So Rand Paul has endorsed Romney. Despite the fact that Ron Paul is still running. And despite the fact that Gary Johnson is running. I guess he’s an ambitious man.

I submit that the middle two sentences make no sense whatsoever. Before Rand’s announcement, Ron Paul himself said he wasn’t going to be the nominee (and by extension, the next President of the United States), and nobody thinks Gary Johnson has a shot at the White House.

So what does someone being in the race have to do with his eligibility for nomination? E.g. let’s say Rand Paul had endorsed Gary Johnson. Why couldn’t Roderick say, “What?!! Are you nuts?!! Johnson isn’t going to win. If you’re going to throw your endorsement away on principle, then at least pick someone really pure and versed in libertarian theory, not a former governor who apparently doesn’t live at the library.”

To be clear, my point is this: I think Roderick’s post would have made a lot more sense if he just said, “Rand should have kept his mouth shut.” But to instead say he should have endorsed his dad–when everybody knows Rand would have preferred his dad won–or a guy who has no shot and isn’t even a purist protest candidate, makes little sense to me.

To reiterate yet again, I’m OK with people aiming the 2-minute hate at Rand Paul, I am just acting as defense counsel to make sure we are procedurally fair. This isn’t the Obama war room, for crying out loud.

07 Jun 2012Potpourri

==> I have a long but very wide-ranging conversation with John Bush on “Rise Up Radio.” I think it starts at the 2:00:00 mark or so. He is going to be one of the Roasters at the upcoming Porcfest extravaganza, and so he and I take some shots at each other at the end, etc.

==> Richard Ebeling is spooked by John Maynard Keynes.

==> I may have already blogged this, can’t remember. Anyway a nice NPR story on how Obama, shortly after winning the Nobel Peace Prize, began overseeing lists of people who would be killed by flying death robots. Yawn. I think we all were taught in 5th grade that this would happen in the White House.

==> When it comes to Scott Sumner, I give credit where credit is due.

==> I had grand plans to write up a big critique, but I’m just too busy. Here you can try to guess at how I was going to actually defend Bernanke from Scott Sumner. (Meaning, Bernanke’s statements are very comprehensible and Sumner is somehow claiming victory, as he often does. I imagine when Scott eats at a Chinese place and opens the fortune cookie, he always exclaims, “Just as I’ve been saying for 3 years on my blog!”)

06 Jun 2012Murphy Twin Spin

Man really busy basically for all of June… To prevent some of you from going into horrible withdrawal, here are two recent articles:

==> Another of my columns at the The American Conservative, this time on government’s role in dividing us. I mention gay marriage and contraception coverage, but those are just a springboard to my more general point. And let’s just say there is no danger of the first commenter wanting to marry me. (I.e. he hated my article.) UPDATE: This is actually a pretty good summary of the article:

In other words, part of the reason people care so much about whether the government agrees on who can get married, is that the government exercises so much power over the rest of our lives. If the federal government were a minor institution in society — charged with repelling foreign armies, negotiating treaties, and not much else — then nobody would much care what the president of the United States thought about gay marriage. The reason President Obama’s recent “evolution” on the issue so energized his supporters is that the federal government sticks its nose into all areas of our lives. If federal officials think the globe is warming too quickly, that women aren’t paid enough, that speculators are pushing up the price of oil, that Americans are too obese, that a foreign ruler isn’t treating his dissidents properly, or a million other thing[s], then find your kids and hang on to your wallet. Infused with vast power over us, the opinions of federal officials come to be tremendously important to everyone. If Obama came out and said he doesn’t permit his daughters to listen to country music because of its historical ties to the Confederacy, that would cause a national uproar, not because anybody looks to Obama as a model parent or music critic, but because they’d worry that his administration might go ahead and ban music they consider offensive.

==> A rarity for me on the Internet: In this EconLib article, you wouldn’t be sure whether I favored more or less government intervention. It is close to a pure analysis of economic modeling, with just about no policy conclusions! Savor it while you can. An excerpt:

Non-economists often think that “economists study money.” The reality, though, is that most academic economists hardly think about money at all. Whether we’re talking about tariffs, wages, Social Security taxes, or pollution, the analysis (though often couched in dollar terms for the benefit of the general public) really is grounded in microeconomics and would work just as well if we were talking about a barter economy. In fact, in a typical Ph.D. program, students study models with money in them only when explicitly trying to answer questions about central-bank policy. Even in these cases—in which the very purpose is to draw conclusions about appropriate monetary policy—the underlying logic of the model doesn’t really have a role for money. Instead, economists insert money into the model somewhat awkwardly, through various ad hoc assumptions.

03 Jun 2012The Fine-Tuning Argument for an Intelligent Designer of the Universe

Daniel Kuehn is nonplussed by the so-called fine-tuning argument:

I never quite understood why people get so excited about alleged “fine tuning”. The multiverse idea seems quite plausible to me, but I think even that overcomplicates it.

If certain conditions are required for us to exist and observe reality, and if we do exist and observe reality, then you really only have two options:

1. We exist and observe and the universe does not meet these conditions, or

2. We exist and observe and the universe does meet these conditions.The conditional probability of 1 is zero, so the conditional probability of 2 is one. Far from being something to marvel at – an apparently “fine tuned universe” seems like a logical necessity to me.

…

UPDATE: And we should be careful to not take the fine tuning argument too far either. It’s often framed as “there can’t be life without certain physical constants”, so a God presiding over life would be very interested in these constants. But my understanding is that its not just an issue of life; matter itself would not exist without these constants. So there’s nothing especially pro-flourishing-life about the fine tuning issue. Its even baser than “for living things to exist and observe we need x, y, and z” – it’s that “for stuff in general to be stuff we need x, y, and z”. Again – this is less an issue of awe and wonder and more an issue of logical necessity.OK I don’t think the above works at all. There may be great rebuttals to a theist (like me) who points to the allegedly finely-tuned universe as an independent argument for the existence of God, but I don’t think Daniel’s reaction is a member of that set. I can make my modest point with a simple analogy.

Before I do that, however, let’s be clear on what the fine-tuning argument is. I turn to my trusty research assistant, Wikipedia:

In 1961, the physicist Robert H. Dicke claimed that certain forces in physics, such as gravity and electromagnetism, must be perfectly fine-tuned for life to exist anywhere in the Universe.[4][5] Fred Hoyle also argued for a fine-tuned Universe in his 1984 book Intelligent Universe. He compares “the chance of obtaining even a single functioning protein by chance combination of amino acids to a star system full of blind men solving Rubik’s Cube simultaneously”.[6]

John Gribbin and Martin Rees wrote a detailed history and defence of the fine-tuning argument in their book Cosmic Coincidences (1989). According to Gribbin and Rees, carbon-based life was not haphazardly arrived at, but the deliberate end of a Universe “tailor-made for man.”

…

The premise of the fine-tuned Universe assertion is that a small change in several of the dimensionlessfundamental physical constants would make the Universe radically different. As Stephen Hawking has noted, “The laws of science, as we know them at present, contain many fundamental numbers, like the size of the electric charge of the electron and the ratio of the masses of the proton and the electron. … The remarkable fact is that the values of these numbers seem to have been very finely adjusted to make possible the development of life.”[8]If, for example, the strong nuclear force were 2% stronger than it is (i.e., if the coupling constant representing its strength were 2% larger), while the other constants were left unchanged, diprotons would be stable and hydrogen would fuse into them instead of deuterium and helium.[9] This would drastically alter the physics of stars, and presumably preclude the existence of life similar to what we observe on Earth.

I purposely left in all the hyperlinks. I assume most of you have heard of Stephen Hawking, but in case those other names are unfamiliar, go ahead and click on them. These aren’t theologians and they aren’t mere “science beat” journalists, they are actual scientists, with PhDs in technical fields and some of whom with fairly impressive academic positions. Maybe they’re all nuts, but this isn’t some obscure theory dreamed up by an archbishop.

Now, there is healthy debate within the ranks of cosmologists, astrophysicists, etc. on whether “fine-tuning” is a big deal or not. Click the Wikipedia link to read more on this. But if you want to grapple with it, the way to do it is, say, argue that for all we know, all sorts of non-carbon-based life would emerge in a universe that couldn’t support solar mechanics the way ours can. Or you could argue that actually, there’s a lot more leeway in how far the charge on an electron could go, either way, and still support life as we know it.

But what doesn’t work, I claim, is to give Daniel’s response, and merely point out that hey, if the universe couldn’t support life, then we wouldn’t be alive to fuss about it in the first place. Here’s my analogy on that score:

Suppose Daniel and I stow away on a new ship owned by J.P. Morgan. We quickly strike up friendships with the other vagabonds on the giant vessel, and at one point Daniel is so happy he stands on the bow and yells, “I’m king of the world!”

Unfortunately we end up hitting an iceberg, and Daniel and I soon find ourselves floating in freezing water, hanging on to a piece of wood. As the numbness moves up our legs, I admit that maybe Bill Anderson should cut Krugman some slack. Daniel, for his part, admits that Krugman is a jerk. We close our eyes as the icy sea consumes us…

Yet we’re not dead. We are amazed to come to our senses in an underwater cave of sorts, only about 20 square feet in floor space and about 8 feet high. We can see fish swimming around on the outside, yet there is an impermeable barrier keeping the water from filling the cave. After a few hours pacing around the cave, I suddenly exclaim, “Daniel, I just realized, how come we haven’t suffocated?! Our breathing should have turned all the oxygen in here into CO2 by now, right?”

We examine the rocky wall and realize there are tiny holes, through which (we conclude) the atmosphere inside our small room is constantly being exchanged.

As the days pass, we discover new things about this strange place. Driven by hunger, we eventually try eating the slime mold on the cave walls, only to find that it is delicious, and apparently can sustain human life. with no ill side effects. When thirsty, we simply put our tongues up to the invisible barrier, which lets the ocean water through but filters out the salt. I don’t want to share any indecent details, but the cave’s special properties also allowed us to dispose of our waste products in a sanitary way. We also notice that one of the rats from the ship managed to find its way into the cave with us, and it too feasts on the slime mold and drinks from the barrier.

Since we’ve solved business cycle theory by Day 7, eventually Daniel and I begin discussing the finer things. I declare, “Some intelligent being must have designed this cave. It is clearly intended to support human life. This doesn’t look like something people could have done, so maybe you’re right, Daniel. Maybe aliens do exist!”

Daniel scoffs. “Are you saying that just because we’re alive? Look, if we hadn’t sunk into a cave with these properties, we would have drowned. So stop being so awed every day about ‘oh wow this cave is so cool,’ you’re really getting on my nerves with that broken record. Look, using your exact same reasoning, I could walk around talking about aliens who apparently love rodents, since they designed a cave for that rat over there.”

How many people side with Daniel in this hypothetical argument? Would I be wrong to be flabbergasted by this cave?

02 Jun 2012Two Good Places for Econ Learning Besides *Free Advice*

Every once in a while I like to give back to the community…

==> I have been picking my way through the new edition of Steve Landsburg’s classic The Armchair Economist. This is truly one of my all-time favorite books. I can remember how much I relished going through it, after I had just finished Hillsdale College and was working in Chicago waiting to start in NYU’s doctoral program. I don’t even agree with everything Steve says in the book; when he’s wrong, I think he’s spectacularly wrong. But even in those cases, he is so darn precise that it helps you to clarify your own thinking on the topic.

Something I got from this reading–I don’t know if this is new material or was in the first version? I can’t remember–is that it has, hands down, the best layperson’s explanation of the Lucas Critique that I have ever read. I don’t want to spoil it by even hinting at his analogy. Let’s just say, not only would my dad and his buddies totally understand the Lucas Critique after reading this, but they might actually be glad they read it. (Note that those are two different statements.)

==> I touted it once before, but if you never checked it out I encourage you once again to look around Tom Woods & Friends’ new Liberty Classroom. They have added economics lectures now (taught by Jeff Herbener), and there are totally free lecture samples in various topics available. [NOTE in the first post, I incorrectly said there is a free Austrian lecture, but I had misunderstood something Tom posted on Facebook.]

31 May 2012Potpourri

* Here’s an interesting video in which Christopher Hitchens claims to disprove the existence of God in fewer than 10 minutes. I actually did like his argument about North Korea. It’s a viewpoint so foreign from mine that it’s hard for me to even formulate a response.

* Speaking of a purely rational morality, David Gordon is giving a FREE 2-hour seminar tomorrow on Henry Hazlitt’s Foundations of Morality. Check it out!

* I’m actually kind of a big deal in Canada this week. I was the lead author on this study. This idea of a “Dutch Disease” is a big deal right now in Canada.

* Porcfest is less than a month away!! Here is a list of the Special Guests this year. Really, if you can get out there (it’s a bit of a pain), I can’t imagine you’d regret it.

* Here’s a “Moneylith” video I’ve been asked to pass along…

30 May 2012Social Security Update

Hey kids, last month the latest Trustees Report for Social Security and Medicare came out. Check out the following excerpt summarizing the condition of Social Security. Note that because they have a bunch of IOUs from the Treasury in the “trust fund,” which are rolling over at interest, the trust fund can grow even in years when SSA takes in less from payroll taxes than it pays out in benefits. With that subtlety in mind, here ya go:

Social Security’s expenditures exceeded non-interest income in 2010 and 2011, the first such occurrences since 1983, and the Trustees estimate that these expenditures will remain greater than non-interest income throughout the 75-year projection period. The deficit of non-interest income relative to expenditures was about $49 billion in 2010 and $45 billion in 2011, and the Trustees project that it will average about $66 billion between 2012 and 2018 before rising steeply as the economy slows after the recovery is complete and the number of beneficiaries continues to grow at a substantially faster rate than the number of covered workers. Redemption of trust fund assets from the General Fund of the Treasury will provide the resources needed to offset the annual cash-flow deficits. Since these redemptions will be less than interest earnings through 2020, nominal trust fund balances will continue to grow. The trust fund ratio, which indicates the number of years of program cost that could be financed solely with current trust fund reserves, peaked in 2008, declined through 2011, and is expected to decline further in future years. After 2020, Treasury will redeem trust fund assets in amounts that exceed interest earnings until exhaustion of trust fund reserves in 2033, three years earlier than projected last year. Thereafter, tax income would be sufficient to pay only about three-quarters of scheduled benefits through 2086.

If you’re really a hardcore wonk you can look at Table V.F2 in the formal Medicare report to discover that over the next 75 years, Medicare and Social Security’s combined cashflow deficit (i.e. disregarding their stockpile of Treasury IOUs) has a present discounted value of $38.6 trillion.

In other words, if the government needed to (say) levy a one-time, lump sum tax on Americans today, to put a pile of money aside that would earn interest and could be drawn upon to make up for shortfalls for the next 75 years (because payroll “contributions” for Medicare and Social Security wouldn’t cover the benefits to which people were legally entitled under existing law), the government would need to get a pile of $38.6 trillion today.

Of course, another school of thought would say this blog post is a giant scare tactic, fueled by my hatred of the sick and elderly.

Recent Comments