Krugman Ignores Massive Human Suffering

Really! Watch where I take this post.

In a post titled, “Debasing Lincoln” Krugman writes:

Greg Sargent catches John Boehner invoking none other than Abraham Lincoln to inveigh against the deficit. This is pretty funny — in multiple ways.

One is the whole notion of relying on Lincoln as an authority on economic policy. Why should we believe that a lawyer speaking in 1843…knew what we should be doing about an economic slump…170 years later?

Then there’s Greg’s catch: Boehner truncated the quote, leaving out the part where Lincoln called for balancing the budget by raising taxes. And also the point that Lincoln was actually a big government interventionist for his time, a strong advocate of what we would now call industrial policy.

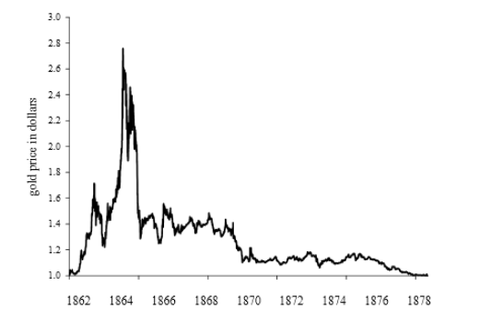

But wait: there’s more. Lincoln’s most dramatic departure from standard economic policy was … drumroll .. debasing the currency (pdf). Here’s the dollar price of gold:

True, he did it to pay for a war; but do you think a 19th-century version of Paul Ryan would have stroked his immense beard and said “Well, under the circumstances, letting the dollar fall to a third of its gold parity is OK?”

Actually, the greenback experience is interesting, mainly for two reasons: nothing terrible happened despite 15 years off the gold standard, and despite this fact all the Very Serious People continued to believe that going off the gold standard was a terrible, terrible thing. It doesn’t much raise your hopes that they’ll learn from recent failures. [Bold added.]

Wow, where to begin?

First, note the irony here. Krugman is chastising John Boehner for not realizing that Lincoln was a tax-raising, big government advocate of industrial policy, who also debased the currency. And yet, when Tom DiLorenzo was a witness for Ron Paul’s monetary committee, Krugman summarized the episode with a blog post titled “Johnny Reb Economics.” His good buddy Matt Yglesias had an even more inflammatory title, “The Strange Case of Pro-Confederate Monetary Policy.” (In fairness, maybe the editors at ThinkProgress pick their blog post titles.) So it seems if you call Lincoln a big government fascist, you get your head bitten off, and if you cast Lincoln as a small government conservative, you get mocked. Tough crowd, these progressive bloggers.

But that’s just incidental. The real jaw-dropper in Krugman’s post above, is his claim that “nothing terrible happened” from 1862 to 1878, and that therefore the Very Serious People who worried about Lincoln going off gold are proven wrong once again.

Naturally, there was the whole Civil War (aka War Between the States aka War of Northern Aggression), with hundreds of thousands of people dying. So obviously the economy was in awful shape during these years.

NOTE: I am not saying, “Krugman thinks hundreds of thousands of people dying is no big deal!” No, what I’m saying is that he isn’t in any way looking at any kind of metric when he says “nothing terrible happened.” That is a throwaway line, anchored to jack squat. For one simple example, the last time I looked up the stats, I ballparked cumulative price inflation in the North at about 75 percent from 1861 to 1864, for an annualized rate of 20 percent for that three-year stretch. (It was far worse in the Confederacy of course, just proving how ridiculous it is to say Tom DiLorenzo was a fan of Confederate monetary policy.) Isn’t that the most obvious “terrible thing” that a gold bug would bring up? Yet Krugman doesn’t even bother to tell us anything about prices; he just assures us “nothing terrible happened.”

Let’s continue, to prove my point. After the Civil War, but when the U.S. was still not back to dollar parity with gold, did we have any kind of economic problems? After all, Krugman’s chart–and his statement “despite 15 years off the gold standard”–show that we need to consider U.S. economic history from 1866 to 1878, if we want to see what the postwar era was like.

Here’s an interesting idea: Before we look it up, let’s first settle something obvious. If there had been, oh I don’t know, the worst depression in U.S. history to that point, then probably that would count as “something terrible” happening, right? Maybe it wouldn’t be the fault of going off gold, but surely Krugman would be either a liar or ignorant if he said “nothing terrible happened,” right?

Well there was this thing called the “long depression,” which the NBER dates from October 1873 to March 1879. Here’s how Wikipedia describes it:

The Long Depression was a worldwide economic recession, beginning in 1873 and running through the spring of 1879. It was the most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. At the time, the episode was labeled the Great Depression and held that designation until the Great Depression of the 1930s. Though a period of general deflation and low growth, it did not have the severe economic retrogression of the Great Depression.[1]

It was most notable in Western Europe and North America, at least in part because reliable data from the period are most readily available in those parts of the world. The United Kingdom is often considered to have been the hardest hit; during this period it lost some of its large industrial lead over the economies of Continental Europe.[2] While it was occurring, the view was prominent that the economy of the United Kingdom had been in continuous depression from 1873 to as late as 1896 and some texts refer to the period as the Great Depression of 1873–96.[3]

In the United States, economists typically refer to the Long Depression as the Depression of 1873–79, kicked off by the Panic of 1873, and followed by the Panic of 1893, book-ending the entire period of the wider Long Depression.[4] The National Bureau of Economic Research dates the contraction following the panic as lasting from October 1873 to March 1879. At 65 months, it is the longest-lasting contraction identified by the NBER, eclipsing the Great Depression’s 43 months of contraction.[5][6]

In the US, from 1873–1879, 18,000 businesses went bankrupt, including hundreds of banks, and ten states went bankrupt,[7] while unemployment peaked at 14% in 1876,[8] long after the panic ended.

This is simply inexcusable. And as I have taken pains to point out over the years, this is typical Krugman. He simply makes stuff up about the historical “record,” with such carelessness in throwaway lines that when you catch him, his fans won’t even care. To wit: “Oh come on Bob, it’s not like Krugman said, ‘The Long Depression wasn’t terrible.’ All he meant was, Lincoln’s debasement of the currency had no ill effects. The Long Depression wasn’t about gold at all; there was deflation!”

In conclusion, let me make sure my point is clear: Krugman likes to dot his i’s and cross his t’s. Not only does he present what he thinks is an elegant, internally consistent theory, but he prides himself on constantly cross-referencing it objectively with “the data.” But he is so sure that he’s right, and he is often so incredibly sloppy in his work, that he will cite “facts” that, if anything, prove the exact opposite of what he tells his readers.

More on Keynesians Loving the Boom

A few posts ago, I pointed out that Krugman unintentionally let slip the fact that he wants policies that reignite a boom. Naturally, a Krugman defender said I was nuts in the comments.

Perhaps this quote from Brad DeLong will be more convincing:

In the 12 years of the Great Depression – between the stock-market crash of 1929 and America’s mobilization for World War II – production in the United States averaged roughly 15% below the pre-depression trend, implying a total output shortfall equal to 1.8 years of GDP. Today, even if US production returns to its stable-inflation output potential by 2017 – a huge “if” – the US will have incurred an output shortfall equivalent to 60% of a year’s GDP.

In fact, the losses from what I have been calling the “Lesser Depression” will almost certainly not be over in 2017. There is no moral equivalent of war on the horizon to pull the US into a mighty boom and erase the shadow cast by the downturn; and when I take present values and project the US economy’s lower-trend growth into the future, I cannot reckon the present value of the additional loss at less than a further 100% of a year’s output today – for a total cost of 1.6 years of GDP. The damage is thus almost equal to that of the Great Depression – and equally painful, even though America’s real GDP today is 12 times higher than it was in 1929. [Bold added.]

I stand by my claim: Keynesians think the mark of a good policy is that it creates a boom. Especially after a major downturn, Keynesians want to see another boom to make up for it. Thus the Austrian critique is no caricature.

And for the finishing blow, let’s not forget this passage from The General Theory itself:

The remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the boom to last. The right remedy for the trade cycle is not to be found in abolishing booms and thus leaving us in a semi-slump; but in abolishing slumps and thus keeping us permanently in a quasi-boom.

I don’t see how there is any argument on this point. The Krugman apologists should just say, “That’s right Murphy, we love booms. Why do you love unemployment? Are you more of a funeral than a wedding kind of guy?”

Another Myth Created Before Our Very Eyes?

David Friedman had some cool posts a while ago, hunting down various myths about social conservatives. (I can’t go look them up right now.) The pattern was: anti-religious people would absolutely flip out over some “nutjob Christian” stance somebody took, it would become common knowledge, and the only problem was…it was either totally backwards or it took the person way out of context.

I’m wondering if there’s something like that in the case of a biology teacher who–as a bunch of my Facebook friends could not believe!!!–might lose his job because he said the word “vagina” during class. And yep, if you go to the news story they linked, both the headline and opening paragraph support the claim:

High School teacher under investigation after saying ‘vagina’ in biology lesson

* Tim McDaniel used term while teaching 10th grade biology lesson on reproduction and anatomyHigh School science teacher is facing the sack after he used the word ‘vagina’ during a biology lesson for pupils aged 15 and 16.

Tim McDaniel, is being investigated by Idaho’s professional standards commission for using term while teaching a 10th grade biology lesson on reproduction and anatomy.

Four parents in conservative community of Dietrich wrote to complain, and now education chiefs in the conservative state are considering his future.

Wow, I can’t believe it! Organized religion is ruining this country, I tell ya.

But hang on, the article continues:

Mr McDaniel, who said he had never received a complaint in the 18 years he had taught at Dietrich School, is also accused of explaining the biology of an orgasm.

…

A disciplinary letter from the Idaho State Department of Education also accused McDaniels of showing a video clip in class depicting an infection of genital herpes and teaching about different forms of birth control.The letter also alleges that McDaniels told inappropriate jokes in class.

…

According to a 2002 survey, 66 per cent of church goers in Lincoln County, where Dietrich is located, are affiliated with the Mormon Church,

But it seems the majority of his students back him.

But still, to possibly get fired for all of this? Oh wait, the article concludes:

Dietrich Superintendent Neil Hollingshead said: ‘It is highly unlikely it would end with his dismissal.

‘Maybe a letter of reprimand from the school board.’

So rather than “OMG a biology teacher got fired by some religious freaks for saying ‘vagina’!!!” the actual story is, “A biology teacher was accused of talking about orgasms in class, showing video of a genital infection, and making inappropriate jokes, and will likely receive a reprimand from the school board.”

I don’t really remember what we learned in high school on this stuff when I was growing up, and I don’t know whether this is outrageous or not. But it’s a heck of a lot less outrageous than a biology professor getting fired for using the medically appropriate word.

Disposing of the Classical Liberal Tradition in Minutes

Steve Landsburg rightfully went supernova on Robert Frank for his (Frank’s) NYT op ed defending Mayor Bloomberg. Frank actually wrote:

But while almost everyone celebrates freedom in the abstract, defending one cherished freedom often requires sacrificing another. Whatever the flaws in Mr. Bloomberg’s proposal, it sprang from an entirely commendable concern: a desire to protect parents’ freedom to raise healthy children.

Being free to do something doesn’t just mean being legally permitted to do it. It also means having a reasonable prospect of being able to do it. Parents don’t want their children to become obese, or to suffer the grave consequences of diet-induced diabetes. Yet our current social environment encourages heavy consumption of sugary soft drinks, making such outcomes much more likely. So that environment clearly limits parents’ freedom to achieve an eminently laudable goal.

In a related vein, Matt Yglesias commented on the new Mercatus U.S. state freedom rankings by writing:

[N]o normal person’s experience of freedom tracks the conclusion that New York is less free than South Dakota. You can, obviously, do a much wider range of things in New York than in South Dakota. People attempting to construct some alternate definition of freedom that will better-track the libertarian political program will try and fail to put together a metaphysically workable distinction between “negative” and “positive” freedoms that immediately collapses in the face of air pollution, unsafe driving, lawsuits, etc.

Look, if Frank and Yglesias want to throw out the entire classical liberal notion of political liberty, I guess they are “free” to do so (ha ha). But you would think they would be a little more reverent about it. By the same token, for all I know maybe it makes sense to plow up corpses and eat them; the ancient taboos may be anachronisms with modern food preparation techniques. But I would need more than a blog post to convince me.

Potpourri

==> I’m not going to bother with a full write-up, but in this post Krugman makes a joke, but inadvertently reveals what we’ve been saying all along: His solution to a depressed economy is to ignite a boom. In this particular post, Krugman is ridiculing the idea that Ireland is in recovery, because they’re not in a boom. Since Ireland isn’t currently in a boom–according to the logic behind Krugman’s sarcastic quip–the policies in Ireland must be bad.

==> John Taylor (HT2 Don Boudreaux) responds calmly to one of Krugman’s critiques.

==> Has anybody been following this Climategate 3.0 stuff? I’m assuming there’s nothing shocking since I haven’t heard much since the story broke?

==> Something is really screwy with this Bryan Caplan post. He quotes Mises on the logic of bureaucracy, and then somehow twists that into Mises supporting government death panels. Instead, I could take the exact same quote from Mises and argue, “See why it’s important to have a free market in health care and insurance? Otherwise we’d have government death panels. Zoinks!”

==> Steve Hanke on Hayek vs. Krugman. (Thanks to von Pepe.)

More On Krugman Judging People On Their Records

In a previous post, I walked through just how hilarious it was, that Krugman complains about people not punishing policymakers who had bad economic predictions, when he himself said there was no one he’d rather be reappointed than Ben Bernanke.

Today I’ve got another gem. In this post, Krugman writes:

The excellent Kathleen Geier — give this woman a bigger job! — has a terrific piece on pundit sins in the runup to the Iraq war, which has applicability to lots of other issues too.

I say “sins”, not just “mistakes”, advisedly. People have a right to be wrong (although they don’t have a right to be taken seriously, or employed in the opinion-giving business, thereafter); they don’t have a right to be wrong, at the expense of other peoples’ lives or livelihoods, for petty, personal reasons. Yet that’s exactly what happened among the war-mongers. As Geier says,

The inability of these pundits to think straight may simply be a symptom of narcissism poisoning. For them, invasion and war were all about presenting their preferred face to the world — and to themselves.

If you’re in the pundit business, you have a moral obligation always to second-guess your own motives, to ask yourself “Am I saying this because I’ve really thought it through? Or am I just feeding my ego?” And let’s be clear: ego-feeding happens on the left as well as the right, on matters economic and social as well as on questions of war and piece.

Do I fall into the sin of self-centered opinionating? No doubt; I am very much a fallible human being. But I try not to, which includes admitting when I was wrong. Can you say the same of any of the pundits Geier mentions — including those who later changed their tune?

Harsh words, eh? Now if you go to Ms. Geier’s piece, you’ll see the very first pundit discussed is Matt Yglesias. Don’t worry, Dr. Krugman! I have mocked that guy for years. He goes with fads and follows the “experts” on monetary policy, just like he admitted he did on Iraq. I would never in a million years write something like this in November 2011:

I’m late on this, but Matt Yglesias has been hired by Slate. Good for him, and them.

I wrote for Slate from 1996 to 1999, in effect cutting my teeth in this popular-writing business, and found it a great experience. Slate has lately gotten something of a bad rep for being the home of snarky contrarianism, and I guess I don’t think back on this incident fondly. But it actually has a great roster now, and Yglesias makes it even better.

UPDATE: For full nuance, click through and read the discussion of Yglesias. It’s possible he gets a pass because he was in college at the time, but by the same token I don’t take him seriously even now. When the dollar crashes, are we going to excuse him because he embraced Scott Sumner in his late 20s with no formal economics training?

Right-Wing Revisionism

You remember that part in the Declaration of Independence that says “Union Forever!” and that pokes fun at the people whining about government tyranny?

Oh wait, that’s a tweet from a Heritage Foundation lady mocking Tom Woods.

Potpourri

==> If you’re interested in the economics of climate change, I throw out some factoids in this blog post that may surprise you.

==> Somebody asked me to find this (I had cited it in my Rothbard study guide), so I thought I’d relay it to y’all: It’s a wonderful essay by Bohm-Bawerk that includes a neat response to the idea that if people decide to save more, that should kill business investment. I read this in high school as part of a Richard Ebeling collection published by Hillsdale College. Ah, to be young and discover Bohm-Bawerk was pure bliss…

==> Now we know why Robert Wenzel doesn’t put up lots of photos of himself: turns out he is really Judge Napolitano having some fun as a blogger.

==> Clash of the Monetary Titans: Look at JP Koning and Nick Rowe having an argument about endogeneity in the comments of this post. I think they created a black hole.

==> I can no longer reconstruct how we came upon this, but my son and I found this “Mario Is Evil” essay quite humorous. (Don’t worry, I scrolled quickly so he couldn’t see the naughty words.)

==> If you’ve never seen Steve Horwitz in video before, this is a good interview. (Note: I didn’t watch the whole thing, so if he uttered some heresy don’t flip out on me. I’m a clearinghouse, not the thought police.)

==> This “Last Psychiatrist” blogger is strangely persuasive.

==> Anthony Gregory writes more on the antiwar movement by 9am, than most people do all day.

Recent Comments