How to Identify the Good Guys

Brad DeLong writes: “A certain asymmetry here, by which, IMHO, you can tell the good guys who respect argument and evidence from the bad guys who do not…”

Then he goes on to show that Keynes and Paul Samuelson showed much more respect for Hayek’s contributions, than vice versa.

Using this criterion, we should look around at economists today, and judge their goodness by the sympathy and precision with which they treat their opponents.

For example, if someone summarized Hayek’s position by saying “Derp. No-class. Derp.” it would be a no-brainer. There are other examples I could give, but I want to leave a margin for subtlety.

It Helps to Know the Author

UPDATED below.

My son and I have been reading the Harry Potter books (we’re on the 5th one now), and we also recently spent 12 hours together in the car, driving to my parents’ house. My son was asking me to give a meta-analysis (not his term obviously) of the series, since he wanted to know why I periodically remarked that the books were surprisingly well-written. I said something like the following, which has obvious ramifications for my Christian perspective on life:

“You can tell J.K. Rowling really loves certain characters in the books: The characters who are good, but also who break the official rules so long as it doesn’t really hurt anybody. (If you think about it, that’s what’s special about Harry and his friends, including Hagrid and even Dumbledore.) The books are entertaining because bad things happen to the heroes, and Voldemort really is bad, but you know that the whole series is moving inevitably to Harry ultimately defeating him. How do we know this? Well, the more you read, the more you understand the values that J.K. Rowling has, and what lessons she’s trying to teach. Yes, even the heroes make mistakes–that’s what makes the books more interesting, since nobody’s perfect–but you know that everything is going to work out in the end, because you start to know J.K. Rowling and she’s the one who invented the whole Harry Potter world.”

UPDATE: I can’t remember exactly how the discussion went, but I just remembered that I had told my son that Hermione was my favorite character, because she actually worked for her accomplishments. In contrats, Ron was kind of a pain and Harry was just coasting through life in a series of lucky breaks. What Harry brought to the table in terms of his merits was his goodness, bravery, and determination, but he was the star (and would ultimately be the one to defeat Voldemort) mostly because of the intervention of others, whether his mother, Dumbledore, Dobby the elf, Sirius Black, etc.

Sensing that my son was thinking I was criticizing Harry Potter (both the character and the series), I clarified that J.K. Rowling knew what she was doing, and that this was part of the charm of it: Harry didn’t want to be famous, he just wanted to be a “regular” kid (in quotation marks because he wanted to be a wizard, just not a wizard famous since infancy for something he had nothing to do with).

Then I explained that this was similar to Frodo being the only one able to carry the Ring of Power, precisely because he didn’t want to be given such a task. I pointed out that an obvious Christian wrote Lord of the Rings, and it accorded with the Christian idea that we are saved because of the work of Jesus, not our own efforts; we’re just “born lucky” into the family of God. Clark asked if J.K. Rowling was Christian, and I said I would guess that she was, but I didn’t know for sure. Just now, in writing this blog post, I googled the issue, and it seems that J.K. Rowling was definitely inspired by Christianity, though I don’t know if she calls herself Christian. (I’m not reading that particular article because it looks to have spoilers about the 7th book.)

Speaking of which: NO SPOILERS in the comments; we’re only on book 5.

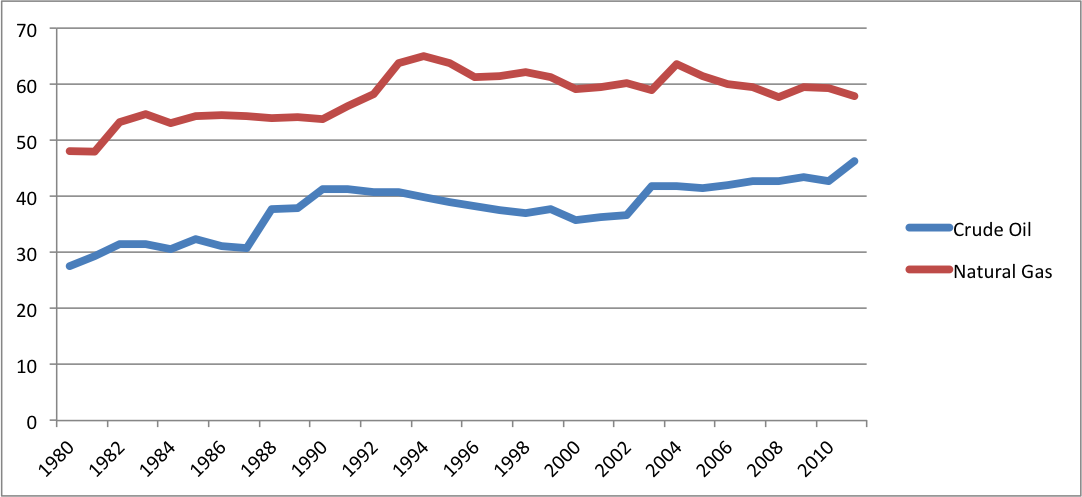

“Years Left” of Oil and Natural Gas

This post is mostly for my online class in Energy Economics. Here is the EIA data for worldwide total proved reserves of oil and natural gas, annual figures, divided by that year’s total production of each (with “dry natural gas” being used for the latter). According to some naive treatments, in 1980 the world had 27.5 years left of crude oil, and yet we didn’t run out in 2008, even though annual consumption had increased.

(In case you’re mystified: “Proved reserves” means reserves that have been located with reasonable certainty, and can be recovered under existing conditions. It would be a waste of manpower and other resources to go locate every last drop of oil on planet Earth; the industry only locates enough for a comfortable margin, and then finds more as demand warrants.)

Questions for Keynesians

1) When it comes to the “zero lower bound,” what’s the relevant maturity? Scott Sumner and Tyler Cowen are celebrating the end of the liquidity trap, but their argument makes no sense to me: Short-term Treasury yields are still basically zero, and long-term yields were never near zero. But then, if the Keynesian answer is indeed, “Right, Sumner and Cowen don’t know what they’re talking about,” why is it that central banks must work through short-term bonds? Why can’t we stimulate more consumption and investment spending by lowering long-term yields?

2) Nick Rowe has some first-derivative kung fu by which (he claims) a New Keynesian model shows that an expected drop in government spending will fill the output gap. Is this true? I don’t remember Krugman or DeLong talking about this.

“Love Shack”

If you’re too busy to soak in the entire episode of epicness, just watch from 4:00 to 5:00. It’s not bad.

Krugman Debate Update

Well, I adopted a laissez-faire approach to see if this problem would magically cure itself, but alas, it looks like it’s here to stay. With no notice, the entire site ThePoint.com went defunct. This was the third-party host of the pledges for my debate challenge to Paul Krugman.

In the grand scheme, this actually isn’t a big deal (for those who like the campaign), since I was eventually going to have to alter the original terms anyway. In the original version, Krugman would have had to debate me in Auburn, AL in order to fulfill the terms of the pledge, making it that much more unlikely.

Still, it’s a shame to have ThePoint go down, now that the pledge total was over $107,000 (highest I saw).

Now that we are starting from scratch, I’m seeking your input on a few key matters:

==> Should I continue with this tomfoolery, or just move on with my life, now that I’ve made my point (such as it was)? When answering, keep in mind that there are still lots of funny videos I had in mind. On the downside, even I’m getting sick of talking about Paul Krugman; I don’t want to be 65 and still have people come up after a talk and say, “So when is Krugman going to debate you?!”

==> If I start up a new pledge drive, which site should host it? I want it to have the same feature as ThePoint offered, where people don’t actually pay anything unless a set of specific conditions occur.

==> If I start a new pledge drive, what should be the philanthropic endeavor? I had originally picked the Fresh Food Program at the NYC Food Bank (with their blessing–I checked with their Development person back when I started), but it runs the risk of seeming like we’re making a joke about poverty. So, is there some other entity whom Krugman’s fans would love to see receive $100,000+, but yet my fans wouldn’t mind enriching?

Krugman Joins the Club

Back on June 29, Krugman had a post called “The Always-Wrong Club,” which covered familiar ground for our hero:

Aha. Floyd Norris reminds us of the 23-economist letter from 2010, warning of dire consequences — “currency debasement and inflation” — from quantitative easing. The signatories are kind of a who’s who of wrongness, ranging from Niall Ferguson to Amity Shlaes to John Taylor. And they were wrong again.

But that won’t diminish their reputations on the right, even a bit.

This is ironic, since Krugman also made a totally-wrong call about inflation in 2010, which soon enough blew up in his face.

But don’t take my word for it. On July 5 Krugman admitted with not a trace of embarrassment:

First of all, I think many of us used to believe that sustained high unemployment would lead to substantial, perhaps accelerating deflation — and that this would push policymakers into doing something forceful. It’s now clear, however, that the relationship between inflation and unemployment flattens out at low inflation rates. We can probably have high unemployment and stable prices in Europe and America for a very long time — and all the wise heads will insist that it’s all structural, and nothing can be done until the public accepts drastic cuts in the safety net. [Bold added.]

So, if I understand things correctly:

==> When Allan Meltzer explains away the failure of his accelerating inflation prediction, without changing his overall policy recommendations, Krugman says that “[t]his has long since stopped being merely an analytical issue; it has become a moral issue, a test of character. And almost everyone on that side of the debate has failed.”

==> When Krugman explains away the failure of his accelerating deflation prediction, without changing his overall policy recommendation, it proves how IS-LM analysis has come through this crisis with flying colors, and is proof that people should be listening to Krugman’s spot-on advice.

Can the Fed Become Insolvent?

In light of my recent posts on Morgan Stanley’s analysis of this question–which show that a rise of less than a percentage point across the yield curve would render the Fed “bankrupt”–let me direct you to my original Mises.org essay on this question. I walk through various hypothetical Fed balance sheets to show what we mean by saying it could become insolvent.

Then, in this article I walk through the January 2011 change in accounting rules that–many of us suspected at the time–was instituted so that technically, the Fed can’t have negative equity from a fall in its asset prices. Instead, it would have a negative liability owed to the Treasury. (Just think about that for a second.)

To be clear: I am of course not predicting that Bernanke would fall on the sword if the Fed should go bankrupt. It would, however, drive home to more people around the world just how screwy our “modern” monetary system really is. Just like nothing really changed with the idea of a trillion dollar platinum coin, and yet the public–including Jon Stewart–finally got it with that ridiculous proposal.

Recent Comments