Christina Bianco Sings “Oh Holy Night” as Divas

This was too funny and would distract from the serious subject matter, but now that it’s Monday how can I resist? Just start it at 0:45.

I would pay a lot to go to a sparsely populated karaoke bar with Ms. Bianco.

Crime Bask

Does anyone know where I can get disaggregated crime data that would show how many homicides were related to various types of drugs? Ideally, I’d like to be able to say that during such and such a period, X homicides were due to cocaine-related drug deals, while Y homicides were related to heroin-related drug deals, etc. Any ideas?

My Favorite Christmas Song Lyric

“Long lay the world / in sin and error pining”

I love every word of that. It reminds me of my favorite Bible verse (Job 28:28):

And to man He said,

‘Behold, the fear of the Lord, that is wisdom,

And to depart from evil is understanding.’”

Sorry kids if you can’t stand her, but if I’m going to play the song it has to be Celine Dion’s version:

Where Are the Rothbardian Defense Agencies?

I answer Gene Callahan’s objections in this post at Mises Canada. An excerpt:

As I said upfront, Callahan’s mistake here is forgivable, because even many Rothbardians have probably made it when discussing prohibition. So let me explain that intellectual error, then circle back to deal with Callahan.

We all have the empirical evidence in front of our faces that prohibition goes hand-in-hand with increased violence. We saw it in the U.S. clearly during alcohol Prohibition, with Al Capone and other gangsters ruthlessly running the liquor trade when it was illegal, to be replaced (of course) by peaceful, legitimate businesspeople once it was legalized. On the basis of this historical example, current proponents of legalizing marijuana, heroin, cocaine, etc. will argue that the violence currently associated with these illicit substances is due to the prohibition, not the nature of the drugs themselves.

So far, so good. But the problem comes in when the proponent of legalization wants to explain why drug prohibition goes hand-in-hand with violence.

The post was already getting to be long, so I didn’t make this point, which I think is another deadly one to Gene: For Gene’s position to make any sense, he has to look at the cocaine trade as being less regulated than the aspirin trade. In other words, to “test” the workability of pure laissez-faire, Gene is telling us to look at the cocaine industry to get the best approximation to the total absence of government involvement.

When I put it like that, does everyone see the problem?

When “Force” Ceases to Have Meaning

I’m only shining a spotlight on this guy because he represents a broader pattern. Check this tweet out:

Now I looked and thought, “That has to be complete BS. They are passing a law forcing women to buy rape insurance? Huh?!” They’re making it sound like the police are forcing women to have such insurance to cover their investigation costs etc. (a la the controversy over Sarah Palin when she was governor).

Now if you click the link, at first it seems the Tweeter wasn’t kidding. For the HuffPo article starts like this: “Michigan lawmakers passed a controversial measure on Wednesday that will ban all insurance plans in the state from covering abortion unless the woman’s life is in danger.”

Let me stop right here. That HuffPo opening sentence? IT IS FALSE. That is not at all what the Michigan law does. Even if you read the very next sentence in the HuffPo article, you start to get a better sense of what actually happened: “The law, which takes effect in March, will force women and employers to purchase a separate abortion rider if they would like the procedure covered, even in cases of rape and incest.”

Starting to get the picture?

Since it’s obvious no information can be gleaned from the HuffPo article or our friendly Tweeter, let’s click the HuffPo link to the actual website explaining the bill (now law?):

An initiation of Legislation to enact the Abortion Insurance Opt-Out Act. The initiated law would require the purchase of coverage for elective abortion in a health care plan to be by an optional rider only; require notice to employees for whom elective abortion coverage is purchased by their employer; and provide penalties for violations of this act.

THE PEOPLE OF THE STATE OF MICHIGAN ENACT:

Sec. 1. This act shall be known and may be cited as the “Abortion Insurance Opt-Out Act.”

Sec. 2. A qualified health plan offered through an American health benefit exchange in this state pursuant to the Patient Protection and Affordable Care Act, Public Law 111-148, as amended by the Health Care and Education Reconciliation Act of 2010, Public Law 111-152, shall not provide coverage for elective abortion. This section does not prohibit an individual, organization, or employer participating in a qualified health plan offered through an American health benefit exchange in this state from purchasing supplemental coverage for elective abortion outside of the exchange by an optional rider as provided in this act.

Sec. 3. An expense-incurred hospital, medical or surgical policy or certificate, or health care corporation group or nongroup certificate delivered, issued for delivery, or renewed in this state, or a health maintenance organization group or individual contract offered outside of an American health benefit exchange shall provide coverage for elective abortion only by an optional rider for which an additional premium has been paid by the purchaser.

Sec. 4. An employer may purchase an optional rider to provide coverage for elective abortion if the employer provides notice to each employee that elective abortion will be included as a rider to his or her health coverage and that the coverage may be used by a covered dependent without notice to the employee.

Everyone see that? I included the screen shot just so there could be no excuse for the HuffPo writer’s falsehood: This is about not having tax dollars used to fund abortions. This doesn’t “force” anyone to buy “rape insurance,” except in the sense that the government “forces” me to donate to my church (since the government won’t use tax dollars to support it).

Now, in light of what this law actually does, you can see just how absurd our original Tweeting friend is.

How can we even rationally discuss politics if people are throwing around words in this fashion? And is it really so inconceivable that some people might object to having their tax dollars used to pay for what they honestly believe is the killing of babies?

Normally I don’t like to discuss abortion but ObamaCare has sort of forced this upon us, hasn’t it?

Illustrating “the Collapse” in Government Spending

[UPDATE below.]

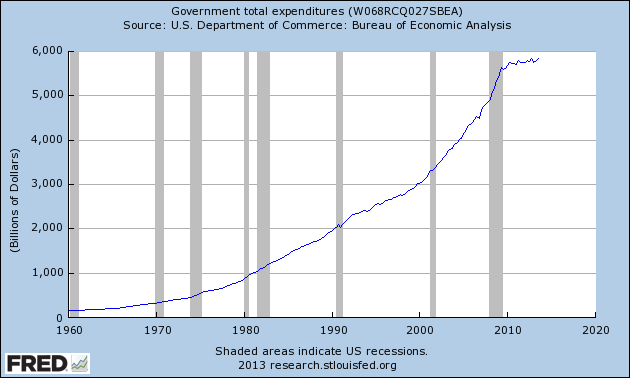

Frequent commentator MajorFreedom linked to this, and I thought it worth highlighting. Remember, I had linked to David R. Henderson’s critique of Paul Krugman, who put up a graph–in a post titled “Unprecedented Austerity”–showing percentage changes in (a three-year average of) total government spending at all levels in the U.S. Krugman then said of this graph: “You can see that there was a brief, modest spurt in spending associated with the Obama stimulus–but it has long since been outweighed and swamped by a collapse in spending without precedent in the past half century.”

Because it was a graph of percentage changes, and because it had surged at first due to the stimulus, Henderson pointed out that it was very misleading. The particular figure Krugman used didn’t even fall below the 0% line until the very end of the series.

Anyway, here’s the absolute level of “total government expenditures”:

As Krugman might say: Feel the collapse!

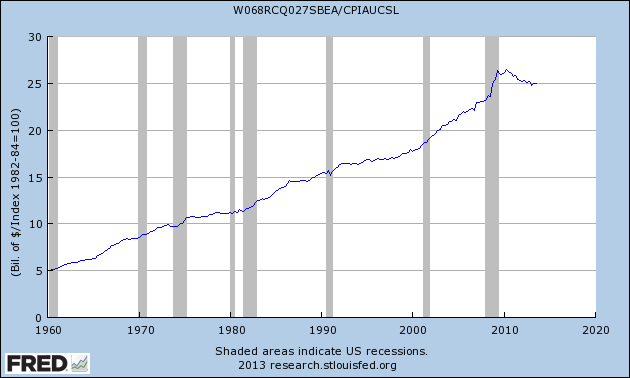

UPDATE: Krugman adjusted for price inflation. I’m not using his exact measure (I’m using CPI because that’s easier for me to grab from FRED) but here’s the above chart, dividing by CPI:

So yes, you do see an actual fall. Is it a “collapse”? It looks a lot less so in this graph than in the one Krugman posted. (Again, the reason–as David pointed out–is that Krugman chose to graph percentage changes, so the stimulus surge followed by an actual reduction [in inflation-adjusted numbers] made it look like a huge swing in his graph.)

Potpourri

==> I’m being serious: Mark Spitznagel sent me this, and neither of us can tell if this is a complete fabrication about “Krugman’s response.” Thoughts? I’d call in the world’s leading forensic expert on the writing of Paul Krugman, but that would present a conflict of interest.

==> What kind of crazy upside down world are we living in, when The Economist magazine writes in (tepid) support of raising the minimum wage in order to reduce income inequality? Don Boudreaux and David R. Henderson react, and Ben Powell quotes from the ghost of Krugman Past to cast serious doubt upon the infamous Card/Kruger findings.

==> Richard Ebeling wants to End the Fed.

==> From the same issue that held Krugman’s infamous Internet prediction, David R. Henderson remembers the great Julian Simon.

==> This Nelson Mandela sign language thing just keeps getting weirder.

==> Somebody explain to me what the heck Nick Rowe is doing in this blog post. I don’t think he’s making the point I did about Bitcoin.

==> Alex Tabarrok has a really intriguing post on media underreporting of suicide.

If Bitcoin Is a Bubble, Is All Money Always In a Bubble?

I by no means am an expert on Bitcoin. The more I hear the experts talk about it, the more I realize I don’t know. (And as an aside, when I hear a proponent of Bitcoin say on NPR, “This isn’t even version 1.0 yet,” it doesn’t make me want to rush out and embrace it.)

However, as I mentioned in this previous post, I am hearing a lot of self-described Misesians make arguments against Bitcoin that prove far too much. So in this post, I’m going to go over the following representative version of a very popular example of what I mean:

TYPICAL ARGUMENT AGAINST BITCOIN: Bitcoin is just a giant bubble; it’s tulip mania all over again. Since it’s essentially a private fiat currency, it has no fundamental value at all; any value it has is due to the speculative motive. People are only accepting it because they think they can unload it down the road to the bigger fool, for more money. This might last for a while, even years, but it’s built on sand and can collapse at any moment. In contrast, a commodity money like gold or silver is based on the fact that it’s genuinely useful in non-monetary outlets. So there is a floor holding up its exchange value.

OK, so the wording might vary from person to person, but during the last two years, I have definitely seen plenty of arguments similar to the above. Here’s my problem with it: This argument comes dangerously close to saying that all money, even commodity money, is always in a bubble, unless it ceases to be money.

It is standard Misesian monetary theory to say that a commodity (such as gold) gains in exchange value as it turns from a mere commodity into a medium of exchange and finally into money. This should be obvious: Originally, in a state of direct exchange, gold had a certain exchange value against other goods and services because of its direct uses (jewelry etc.). But then if people wanted to start holding it as a medium of exchange, this would increase the demand for gold, and hence drive up its “price” (i.e. how much it could fetch in the market in terms of other goods). Therefore, if a goldbug is arguing that having an exchange value above the “commodity value” (which in the case of Bitcoin is zero) makes something a bubble, then all money–including gold money–is always in a bubble.

Let me restate the argument like this: There are people claiming that Bitcoin’s non-monetary price is zero, and hence if it’s trading for anything at all, it is in a bubble. But by that logic, gold’s non-monetary price might be (say) $250, and so if it’s trading right now for $1,250, then $1,000 of that is clearly just due to a self-fulfilling prophecy, where people are willing to pay $1,250 for gold because they think that’s how much (at least) it will be worth in the future. If something were to shatter that expectation, then the price of gold would plummet back down to its fundamental value of $250. Thus, if we accept this line of reasoning, the only real difference between Bitcoin and gold is that Bitcoin has a floor of $0 while gold has a floor of (say) $250.

Last thing: One way out of this apparent bog is to make a distinction between holding commodity money for speculative purposes, versus holding it for exchange purposes. In other words, someone could accept a gold coin today not because he expects to unload it off on a “greater fool” tomorrow, but because he wants a more liquid form of wealth to make his purchases easier. (Indeed, we see that people hold paper money even knowing it will fall in purchasing power.) But if that’s the route one takes, then why can’t we say the same thing for Bitcoin? Sure, when it’s zooming up in price daily, people might be jumping on board primarily for speculative reasons, but in general how can we rule out a priori the possibility of a long-run equilibrium, in which Bitcoin is valuable precisely because it is a good medium of exchange that has an established purchasing power?

Recent Comments