Jeffrey Tucker Launches Liberty.Me

It would be silly for me to paraphrase; you just have to listen to him explain it.

I have contributed one of the “guides” so far, and hope to do more in 2014 as this thing evolves.

Some Sumner Shuffles

I often focus on Krugman Kontradictions, but here at Free Advice we have given examples of Sumner Shuffles. Now Scott is much more slippery than Krugman, so to get a true Sumner Shuffle is difficult. I’ve been checking his blog lately to see what he has to say about the Fed’s “taper” announcement–it was expansionary since the stock market went up, of course–but in so doing I ran across something that doesn’t add up.

Two days ago, Scott wrote:

Over the years my critics, and even some of my supporters, have said; “Sumner is basically proposing higher inflation as a solution.” That was never really true, I was proposing 5% NGDP, level targeting. And even though inflation would have been above 2% in the 2008-11 period, a stable NGDP policy would have prevented that inflation from having the sort of negative effects that economists see as resulting from high inflation. My plan would not have hurt savers, in aggregate.

Even so, there was a grain of truth in the claim. The inflation rate would have run above 2% for a number of years under my proposal. But now even that is no longer true. There have been enough wage/price adjustments to the lower NGDP growth rate that the SRAS has been shifting to the right. This means that today even a 2% inflation rate would produce a robust recovery. [Bold added.]

Now surely the above means that under Scott’s proposal, price inflation would not rise above 2%, or at least it would not be above 2% for the next few years. Right? That’s the only possible way the above statements can make any sense.

And yet today, Scott writes:

Today’s decision did not drop the unemployment threshold, but it weakened it. It should simply be removed. If they promised to wait until expected inflation rose to 2.5% before raising rates, it would mean roughly 2% inflation over the next few years, as the inflation rate is now running below 2%. That’s still too tight, but much better than the old policy, and even better than today’s revision.

I kinda think the people who said “Scott is basically calling for more inflation” could be forgiven for saying that, in light of comments like this. And now it seems that 2% inflation is “too tight,” whereas two days ago it would have produced a robust recovery.

One thing in closing: If someone says, “But Bob, Scott is calling for level targeting of nominal GDP growth…” that person will be locked in a shed with Major Freedom and Lord Keynes for 3 days.

Our Own Troll “Joe” Shows How to Pick Cherries

In my post about part-time versus full-time employment, frequent commenter and critic Joe wrote:

It’s a lot of fun to play the Obamacare vs the Labor Force game. The best one is looking at private sector employment before and after Obamacare was signed into law on March 2010.

Private Payroll Employment (thousands)

March 1999 107938

March 2010 106961

March 2013 113454So in the 11 years prior to the passage of Obamacare, fewer than zero jobs were added to the private sector. In the 3 years following the passage of Obamacare, nearly 7 million jobs were added to the private sector.

It’s quite the job killer.

Now two points of clarification:

==> In my post, I wasn’t saying ObamaCare had caused the change in PT/FT employment. That was actually my point, that it had moved earlier and so (at best) could be blamed on more general “regime uncertainty.”

==> It’s conceivable Joe is just being ironic, and wants to show how one could be extremely misleading with statistics if one wanted. (He does that a lot in the comments here…)

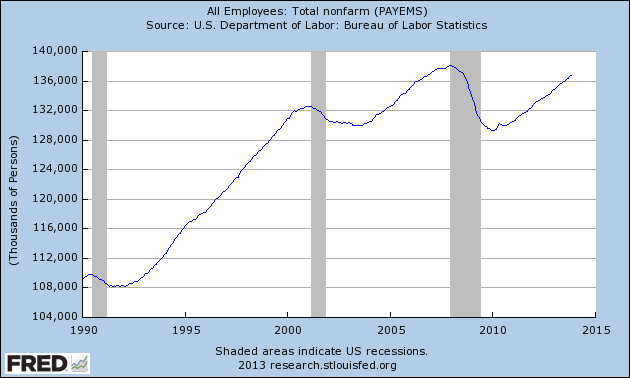

Anyway, I thought this was a good opportunity to show how one can indeed mislead with statistics. I didn’t check the exact numbers, but I have no reason to doubt Joe’s claims above. Yet look at the chart:

Last thing: I know conventional wisdom says, “Don’t feed a troll,” but my plug-in analog clock says it’s before midnight so we should be OK.

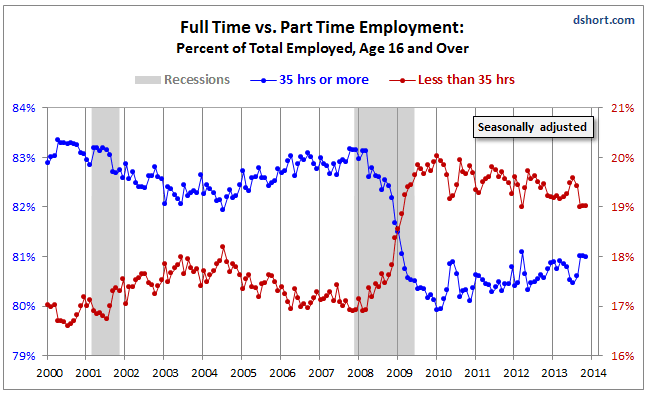

Full-Time vs. Part-Time Workers

Does anyone else find this chart shocking?

Here’s the source. I was looking up the proportion of part-time versus full-time workers to see if the passage of ObamaCare had any noticeable impact.

(Note: Be sure to look carefully at the left and right axes. It’s not that the whole composition of the workforce has flipped.)

I don’t think you can pin the blame on ObamaCare in isolation (it passed in March 2010), but the so-called Great Recession has been qualitatively worse than the dot-com bust. My short explanation is that the combination of economic turmoil and “regime uncertainty” in general (not just ObamaCare) has made employers very reluctant to commit to a full-time hire.

Scott Sumner Wants to Take Income Away From All of Us

In a post titled, “Income is meaningless, example #388” Scott quotes from Matt Yglesias who wrote:

One issue this poses is that analysis of political issues in terms of “income” quartiles can get pretty misleading. A married couple where dad earns $65,000 a year and mom works part time bringing home $15,000 a year is in the fourth quartile of the American income distribution. A 70 year-old widower whose $2 million in savings bring him an annual income of approximately $80,000 is also in the fourth quartile. But their policy-relevant economic interests are unlikely to have very much in common since in reality their financial situations are entirely dissimilar.

Yglesias had it right (in this quote, I didn’t read his whole post): The political jockeying over “income” can get pretty misleading. Yes, that’s exactly right, and everybody who is going to think through such issues had better be aware of the kind of complications Yglesias (and Sumner in past posts) brings up.

But that doesn’t mean income is “meaningless.” I responded in the comments:

Why stop at “income” Scott? These 388 examples all show that numbers are meaningless. Look at how much people are confused by the use of numbers! Meaningless. What the heck is “80,000″ anyway?

(For a more serious defense of the economic concept of income, see this article.)

More on Drug Cartels and Private Law

I realized from the reaction of some people here that I did not assure readers I had fully understood Gene Callahan’s point, when he claimed that drug cartels today offer a real-world glimpse into what Rothbardian defense agencies would look like. So I wrote a follow-up post to be sure I acknowledged Gene’s exact point, and contrasted it with my own:

Thus, to reiterate, Callahan looks at, say, Colombian or Mexican drug cartels, and he sees: These are people who are operating outside of State interference and control. This is what the world would look like if we followed Rothbard’s advice and pulled back the State from every sector, not just the production and distribution of cocaine.

But hold on a second. There’s another effect too, when the government decides to make cocaine (say) illegal: It is now greatly magnifying the role of the State in this sector. In particular, there is an enormous “gang”–the biggest in society–of men with guns (and tanks, bombers, and missiles if push comes to shove) who will throw businesspeople in a cage, or possibly even execute them, for engaging in what otherwise would have been peaceful commerce. This aspect of drug prohibition obviously represents a move away from Rothbardian anarcho-capitalism.

I end with this observation, which is absolutely devastating to the Callahanian position for anyone who has the moral courage to truly ponder it:

So, if Callahan is right, then we should see pot dealers acting as violently as cocaine dealers. But if I’m right, we should see much less violence when it comes to the distribution of marijuana, compared to cocaine. And although I couldn’t find hard numbers to back it up, I think casual observation says that pot dealers are clearly less violent, as a general rule.

Potpourri

==> David R. Henderson reports on media bias in the Denver school shooting (one and two).

==> Some of these kids’ test answers are literally “laugh out loud” funny. Be sure you get what’s going on with the Chinese immigrant one.

==> A classic Rothbard essay on dealing with water shortages. Yes, he lays out the standard stuff about using prices to “ration” (he used quotes too) the available quantity, but it gets funny with what happened in California.

==> You can see me discussing it with him in the comments, but I am somewhat alarmed at how casually Scott Sumner is OK with the governments of the world increasing their debts in order to “provide safe assets” to investors, and furthermore with the idea of governments then using the borrowed funds to invest in stocks.

All Bob Murphy Wants for Christmas Is You

A sappy Christmas greeting from Consulting By RPM, with a special guest.

Film credits to Sam T. No one handles an iPhone like him.

Recent Comments