Madoff on Social Security Bask

Hey kids: I’ve heard people claim that Bernie Madoff referred to Social Security as a Ponzi scheme–and he should know! However, I can’t find an actual citation. There are a billion articles of people talking about SS and Madoff, but I can’t find Madoff himself talking about it. Any help?

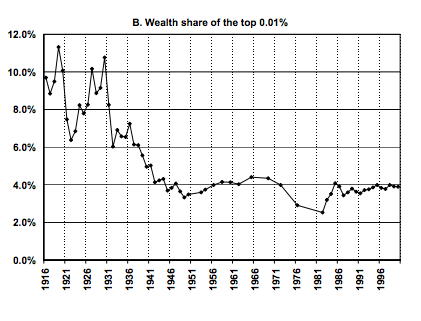

The Entire Inequality Debate Summed Up In One Chart

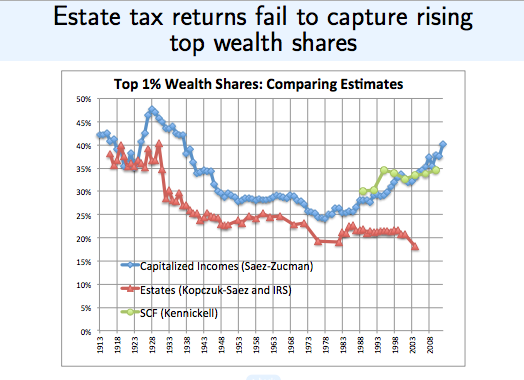

I missed this on my first look, but the most widely cited PowerPoint presentation of all-time–namely Saez-Zucman (2014)–has a chart that explicitly contrasts Saez’s latest findings with his 2004 paper (co-authored with Kopczuk). Here’s the slide:

We see the same pattern as I pointed out earlier, where the Saez (2004) and (2014) estimates move in lockstep, but suddenly diverge in the mid-1980s. (Incidentally, the connection is much tighter for the wealthiest 0.1%–Phil Magness did a great job overlaying the two series.)

In reference to the slide above, Saez and Zucman title it “Estate tax returns fail to capture rising top wealth shares.” In other words, since there is a discrepancy, and since they JUST KNOW that the richest have been getting richer, the explanation is that the estate tax data (red line) must be flawed. Even though it wasn’t flawed for most of the century.

Looking at the exact same chart, here are equally applicable slide titles:

==> “Oh crap, we did something wrong.”

==> “Zucman, you double-checked those Excel formulas, right?”

==> “Saez, you were an idiot a decade ago, weren’t you?”

==> “Why are we the only dataset showing growth since the mid-1990s?”

==> “It’s us against the world!”

==> “Shouldn’t the 1% have lost more in the 2008 crash?”

In closing, let me say that there’s a strategic danger in arguing so much over the empirical results. If it turns out that the new capitalization method is closer to the truth, and the old estate tax return series is horribly flawed, then it’s not as if I’m suddenly going to favor taxing the heck out of rich people.

Nonetheless, I think it’s useful to occasionally point out to you innocent readers the skullduggery that is afoot here.

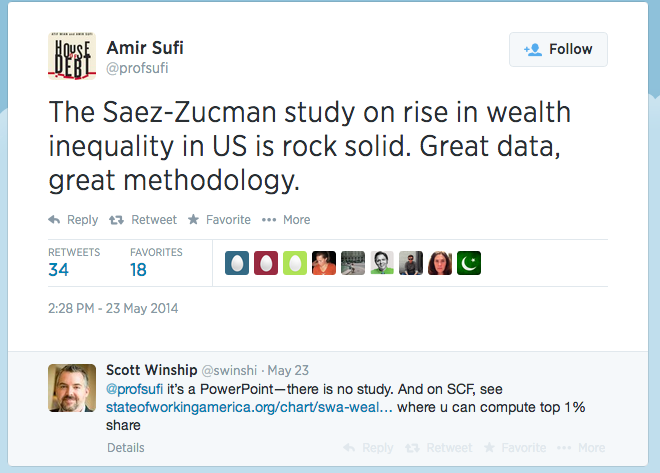

BTW, That New and Allegedly Definitive Saez-Zucman Result IS A POWERPOINT SHOW

Phil Magness tipped me off to this with his innocent Facebook query, wherein he politely asked: Can anyone find an actual paper that explains how Saez-Zucman (2014) gets their results, which–we are assured by Piketty and by Krugman, plus a host of lesser fans–demonstrate quite definitively that Piketty gets the basic story right in his composite trend lines? Because all Phil could find was a PowerPoint presentation.

Well, I assumed Phil had to be mistaken, but I couldn’t find a paper either. Then Phil pointed me to this Twitter exchange:

(Winship is an expert in this area, who has been quoted by Piketty’s fans to argue that Piketty didn’t do anything dishonest. So if he’s here saying that Saez-Zucman (2014) isn’t actually a paper yet, he probably knows what he’s talking about.)

So to repeat: One of the allegedly most devastating responses to Chris Giles’ FT critique, is to say that Saez-Zucman (2014) show that the very wealthiest Americans have surging wealth concentrations, not seen since the Gilded Age. Therefore, even if one thinks Piketty botched some Excel formulas, his basic story is right.

And what’s funny about this, is that “Saez-Zucman (2014)” isn’t a published paper, and it’s not even a working paper where you can see how they came up with their results. No, everybody is linking to a PowerPoint presentation. (It’s this one, right here.)

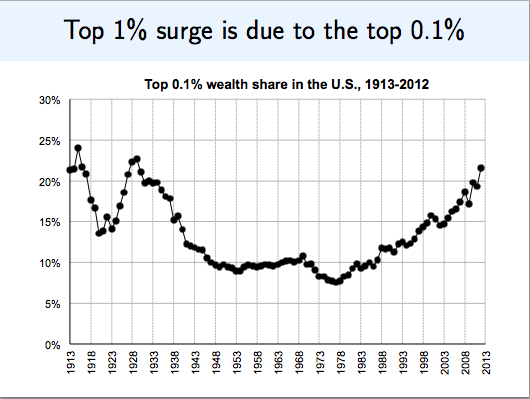

Anyway, here’s one of the bombshell charts from that PowerPoint show:

Yikes! Looks like Piketty was right to sound the alarm. Let’s tax the heck out of those rich people before it’s too late!

But wait a second. Before we enact a global tax on capital, on the basis of two guys’ PowerPoint slide, maybe we should compare their chart with the peer-reviewed literature. For example, when the same guy–Emmanuel Saez–and a different co-author wrote a paper in 2004 (which was eventually published in the National Tax Journal), here’s what they found, using estate tax data:

Interesting, huh? Compare Saez’s 2014 results with his 2004 results. From 1916 through the mid-1980s, they’re about the same, within a few percentage points of each other. It looks like they are both decent measurements of the same thing.

Yet with the estate tax data, nothing happens from the 1980s onward. In particular, from the mid-1970s through the year 2000, the share held by the 0.1% goes from about 7% to about 9%, maybe an increase of 30% or so, tops (I’m just eyeballing the bottom chart–you can look at the exact figures in the NBER link if you want).

In contrast, looking at the middle chart above, we see that from the low point in the mid-1970s through the year 2000, the wealth held by the 0.1% richest Americans went from about 7% to about 15%–i.e. it more than doubled. And of course, after that it continued to take off like a rocket. (Here of course I have to just eyeball the chart–because we’re relying on two guys’ PowerPoint show.)

Now it’s true, Saez and Zucman in their PowerPoint do discuss Saez and co-author’s (2004) results using estate tax data, and why they think their current approach is superior. Yet the arguments they give (on a PowerPoint bullet list, keep in mind) don’t really explain why the estate tax approach worked beautifully up through the mid-1980s, after which it horribly began understating wealth.

Finally, you might say, “OK Murphy, do you have any explanation for why Saez and Zucman (2014) might be screwing things up?”

Actually, I have a guess. They are relying on a capitalization method, where they take reported capital income and then divide by the return on capital in order to compute an estimated value of the asset. Because interest rates, especially short-term rates, have dropped so much since the 1980s, it wouldn’t surprise me at all if something screwy is happening whereby Saez and Zucman are generating an inflated asset value based on short-rates that people in the market don’t think will last for the next several decades.

But to repeat, this is just a guess. I can’t really say what may have gone wrong with the Saez-Zucman (2014) results, because WE ARE TALKING ABOUT A )(#*%(#$ POWERPOINT SHOW.

An Even Better Post From Krugman on the Wonderful Veterans Health Administration

From back in 2006. Some excerpts:

American health care is desperately in need of reform. But what form should change take? Are there any useful examples we can turn to for guidance?

Well, I know about a health care system that has been highly successful in containing costs, yet provides excellent care. And the story of this system’s success provides a helpful corrective to anti-government ideology. For the government doesn’t just pay the bills in this system — it runs the hospitals and clinics.

No, I’m not talking about some faraway country. The system in question is our very own Veterans Health Administration, whose success story is one of the best-kept secrets in the American policy debate.

But here’s my favorite line: “[P]undits and policy makers don’t talk about the veterans’ system because they can’t handle the cognitive dissonance.”

In case you don’t get why that’s funny, it’s because since the recent VA hospital scandal broke, it’s been crickets from Krugman on his blog.

We Are the 99.9999%!

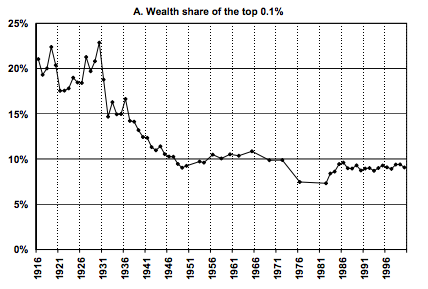

My latest at Mises Canada has some Krugman funnies and I also showcase this chart, followed by my commentary from the post:

This chart shows the percentage of wealth in the United States held by the 0.01%. That’s not a typo. I’m not talking about “the 1%,” and I’m not even talking about “the 0.1%.” No, I’m talking about the “0.01%,” in other words the wealthiest one-ten-thousandth of the population. As the chart shows, as of the year 2000 the fraction of wealth they held had been roughly flat since the mid-1980s, and moreover this flat trend was much lower than it had been through most of the 20th century.

Let me give you some more information about this graph, which probably surprises most readers who may have gotten their information from Krugman or Piketty. This graph isn’t based on unreliable survey data; no, it’s based on estate tax data–the kind that Krugman says he likes (at least when Piketty uses it to bolster his case for surging inequality). Further, let me assure you that this graph doesn’t come from the Heritage Foundation or the Cato Institute. No, it comes from a paper co-authored by Emmanuel Saez, who is a co-author with Piketty on many pioneering papers on inequality.

Does that surprise any of you? Is that the story you’ve been gleaning from those who talk of “inequality deniers”? (Yes, I’ve actually seen that term, so help me, I’ve actually seen that term.)

More on Piketty

==> Here’s Piketty responding to the initial FT critique. (HT2 Daniel Kuehn)

==> Here’s Giles (the author of the FT critique) elaborating.

==> Here’s Magness with some more oddities, but I think Piketty might have explained what was going on here, in the first piece linked above. (Note, to say he “explained what was going on” doesn’t necessarily mean it makes sense. I’m just saying, I think on a lot of these cases now, Piketty at least has given an official reply as to why he made what seem to outsiders to be arbitrary moves.)

(BTW a long time ago I should’ve invented a new tag “Piketty” for these blog posts, but I initially was filing it under “Capital & Interest” because that’s what interested me about it. Anyway, I’m not going to bother now.)

Book Review of Piketty

So you can mentally prepare yourself, here is a short (about 1,000 words) review of Piketty. Next week I’ll publish a much longer review with quotations from the book. The good thing about this “Rare” review is that if you get bored, you can click on a slideshow of Victoria’s Secret models.

The best part:

The most obvious problem with Piketty’s book is that he wants to make workers poorer, just so long as it will hurt rich capitalists even more. No economist denies that as the stockpile of “capital”—which Piketty broadly defines to include real estate and all forms of non-human wealth—expands, that the absolute wages of the workers will rise. After all, if workers have more tools, machines, and equipment augmenting their labor, they are going to be more physically productive per hour, and hence will be paid more.

Yet the continual increase in the workers’ standard of living is not enough to placate Piketty and his fans. Indeed, Nobel laureate Robert Solow admits that capital accumulation will make the workers better off in absolute terms, but worries that they might be worse off relative to the capitalists.

If Piketty and Solow saw a vision of the future that looked like The Jetsons, they wouldn’t marvel at the unbelievable convenience and luxury that the family enjoys, all provided by George’s two hours of labor per week. No, instead of thanking capitalism for providing flying cars to the average family, instead Piketty and Solow would be complaining about how unfair it was that a short bald guy got to own Spacely Sprockets all by himself.

Recent Comments