Potpourri

==> The Mises Institute is now offering a flat-fee option for access to all of the archived Mises Academy lectures.

==> Ron Paul talks to Mark Spitznagel about sundry topics, including foreign policy.

==> Alex Tabarrok has an interesting post about Ferguson and the modern-day “debtor’s prison.”

The EMH versus the CAPE

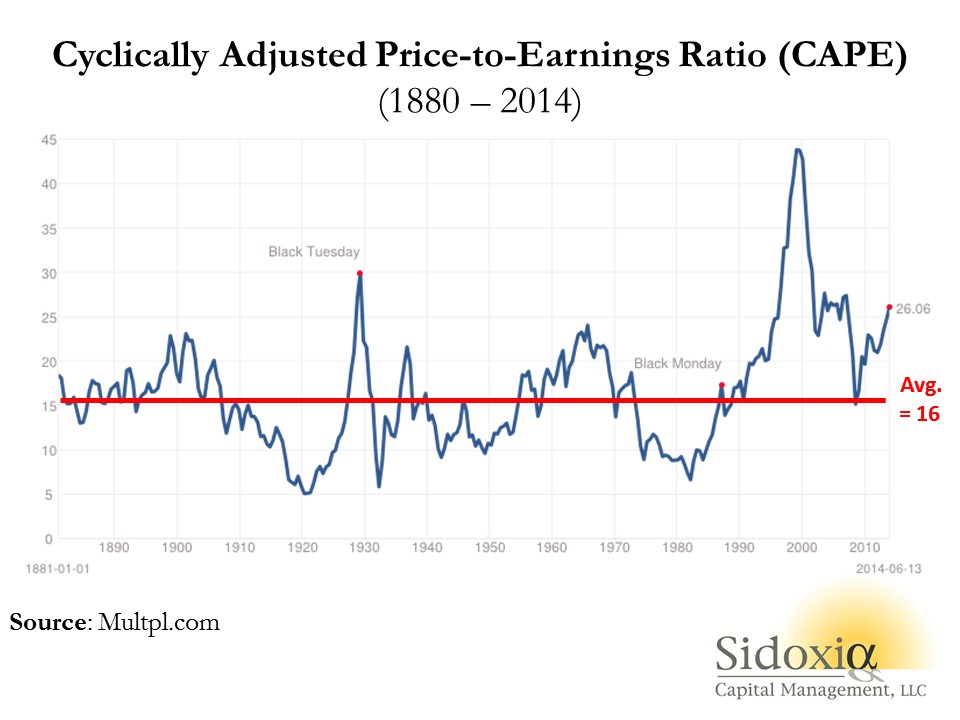

Robert Shiller’s CAPE (cyclically adjusted price/earnings) ratio is well above its historical average:

Shiller himself has been pointing out that the only periods since 1881 where the CAPE has been this high were 1929, 1999, and 2007 (on the way up, we should say for precision).

Scott Sumner, proponent of the Efficient Markets Hypothesis (EMH), is unfazed. Here’s Sumner commenting on the CAPE chart:

Any fool can data mine and find spurious correlations. The real test is how they do out of sample. Robert Shiller became famous in 1996 with his “irrational exuberance” claim (or at least one degree of separation from famous, as it was when Greenspan repeated this claim that the public took notice.)

…

What do you see [in the chart of the CAPE]? I see a trend line that seems to have shifted upward from 16 in the mid-1990s, precisely when he made the irrational exuberance claim. The new average looks like about 25. And the current ratio is above 25. So the out of sample test was about as complete a failure as one can imagine. The model simply did not perform out of sample.

How in the world does Scott get that the CAPE “was about as complete a failure as one can imagine”? Now if the CAPE had leveled off since 1996, or if the stock market had risen at a steady growth rate with a bit of volatility, then sure, Shiller would have been totally wrong.

But that’s not what happened. A few years after his “irrational exuberance” call, the market crashed hard. Then when the CAPE zoomed back up [edited–RPM], the market again crashed hard, falling back to the historical average. What would the data have to look like, for Shiller to think he was on to something?

The irony is, no matter what happens, Sumner will still think he is right. If the stock market crashes 40% next week, Sumner will say, “That means nothing, EMH is still correct. If Shiller’s model actually had predictive power, people would’ve shorted the market this week.”

I’m not making a joke. That is literally what Sumner would say. And he wouldn’t even be crazy to do so; that’s the non-falsifiable world of the EMH. But what’s annoying is that Sumner seems to think he’s looking at the data with an open mind and then forming his conclusion, when in fact “believing is seeing” in finance as much as other fields.

UPDATE: I should clarify that having the market crash while the CAPE falls back down, is not itself a tautology. For example, if the government suddenly declared that all existing CEOs would be executed, that would probably make the S&P 500 fall substantially. But part of the mechanism would be that earnings themselves would fall sharply. The CAPE ratio is capturing the relationship of asset price to underlying earnings. (It goes back 10 years, adjusting for price inflation, rather than the more conventional current-year P/E ratio.)

The Difference Between Physics and Economics

Pay attention to the way he teaches the class about conservation of mechanical energy starting around 1:45. If an economist did something comparable in class, he would be killed in front of his students. But they would still clap.

Fun Facts About the “Individual Mandate” of ObamaCare

In my latest Mises CA post I walk through the CBO’s forecast. An excerpt:

Isn’t it interesting that the “universal coverage” provided by the “Affordable Care Act” will still yield–according to the government’s own projections–almost 4 million Americans who will prefer to pay an average tax of more than $1,000 to the government for 2016, rather than buying health insurance that year?

Potpourri

==> Phil Magness caught this: Compare Slate’s current outrage over pro-sweatshop views and this oldie from an economist presumably not being funded by billionaire brothers.

==> If you’ve never considered the issue of intellectual property, this Tom Woods interview with Stephan Kinsella is good.

==> I didn’t write this, but thought it was appropriate. Judging from my Facebook feed, libertarians hate not only the government, but also the ice bucket challenge and “pay it forward” schemes at Starbucks. As I summarized it, “Libertarianism: The worry that someone, somewhere thinks he is a smart and good person.” (By the way, I’m not talking about gentle criticism. I’m talking about eye-rolling “You think raising $50 million for a charity is a good thing! You idiot!!”)

UPDATE: Oh by the way, the reason I bristle so much against the hostility to the ice bucket challenge etc. is that I did the same thing when I was younger. I can’t find it now, but I know that in grad school I wrote an angry-young-man article complaining about Habitat for Humanity. (My point was that it would be far more efficient for people to donate money and then the group would hire professional homebuilders.) I realize without knowing me personally it might be difficult to glean the tone of my “anti-libertarian” volleys; they are mostly meant to be funny reflections on how we differ from the rest of society.

Medical Ad Bask

I want to write a post on how the regulations concerning disclosure of health risks for medical products are actually counterproductive, because the announcer on TV or radio ends up rushing through an absurd list of nightmare possibilities such that people no longer even listen.

Does anyone have any good examples of this? Like, do you remember a particularly funny ad where the warnings were incongruent with the product? (Or, failing that, we can always go for potty humor if the announcer warns of diarrhea.)

A Different Approach to Law Enforcement

The more I delved into pacifism, the more I began to question humanity’s entire approach to punitive law enforcement. Yes, obviously it would be better to have “voluntary prisons” (yes there’s a sense in which that’s an oxymoron, but also an important sense in which it’s not) rather than the State version. However, I wonder if the very notion of punishing lawbreakers by physically segregating them from society is the best remedy. Obviously people have the right to tell a criminal to get off their land, I’m just wondering whether that perpetuates the cycles of crime in general and violence in particular. In short, I wonder if the very existence of prisons actually breeds more crime, all things considered.

(I realize people will be quick to say, “You idiot! Your pacifist utopia would be overrun by bank robbers and serial killers!” But then again, right-wing warhawks also told Ron Paul fans with supreme confidence that the U.S. would be overrun by Muslims if we followed his naive foreign policy. So I don’t expect libertarian non-pacifists to be persuaded in one fell swoop, but I hope you recognize why your objections don’t bowl me over, either. Before you jump on me, consider: Without prisons or other violent law enforcement, the State couldn’t exist. So you wouldn’t have taxes, the Drug War, etc., or at least you would have very neutered versions of all those things.)

Anyway, my point in bringing this up is that it sheds light for me on controversial Christian doctrine. Consider this passage from Romans 7: 1-6:

7 Do you not know, brothers and sisters—for I am speaking to those who know the law—that the law has authority over someone only as long as that person lives? 2 For example, by law a married woman is bound to her husband as long as he is alive, but if her husband dies, she is released from the law that binds her to him. 3 So then, if she has sexual relations with another man while her husband is still alive, she is called an adulteress. But if her husband dies, she is released from that law and is not an adulteress if she marries another man.

4 So, my brothers and sisters, you also died to the law through the body of Christ, that you might belong to another, to him who was raised from the dead, in order that we might bear fruit for God. 5 For when we were in the realm of the flesh,[a] the sinful passions aroused by the law were at work in us, so that we bore fruit for death. 6 But now, by dying to what once bound us, we have been released from the law so that we serve in the new way of the Spirit, and not in the old way of the written code.

I’ll let those who have studied Christian doctrine hash it out in the comments; the interpretation of the above passages are very controversial, even within a given sect.

For the purposes of this post, however, I want to take the argument this way: It is plausible for me to conjecture that the ultimate motivation for sin is a psychological hole or weakness. For example, to understand why someone becomes a mass murderer, I don’t think the answer lies in society’s inadequate punishment for this behavior, the way we might explain a shortage of water bottles as due to improper incentives. Instead I would want to look at this person’s past and see if there are clues there.

More generally, I think we can explain an enormous amount of bad behavior as being ultimately due to fear.

Now then, suppose that the best way to get humans to stop sinning is NOT to threaten them with eternal torment, but instead to assure them that no matter what they do, the most holy and perfect Being in the universe loves them infinitely and is looking forward to spending eternity with them in paradise. When people truly relax and their fears melt away–because they know they lack the power to ruin their own salvation–then their natural inclination is to reflect God’s love on everyone around them. Yes, they could “be a serial killer and still get into heaven,” but why would they want to do that?

CBO Keeps Revising Downward Its Estimates of Coverage Provided by ObamaCare

My latest post at Mises Canada. An excerpt:

Yes that’s right: CBO now predicts that in 2019–nine years after passage of the Affordable Care Act, which was supposed to provide “universal coverage” to Americans–in fact only 26 million nonelderly people will have gained coverage, with 30 million Americans still lacking health insurance.

I’m curious, does that figure surprise anyone? I mean, I know ex post everyone likes to say, “Yeah I knew that, duh,” but seriously, is this the impression one would get from listening to President Obama discuss it–or reading Paul Krugman for that matter?

Recent Comments