The SWAT Team Is Your Friend

If this guy just would have died, then the police wouldn’t have had to charge him with felony assault. These poor cops can’t please some people no matter what.

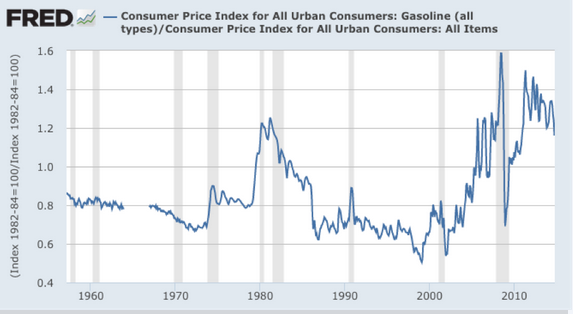

Gas Prices Still High By Historical Standards

I was actually surprised by how much. Here’s the article, but check out this chart:

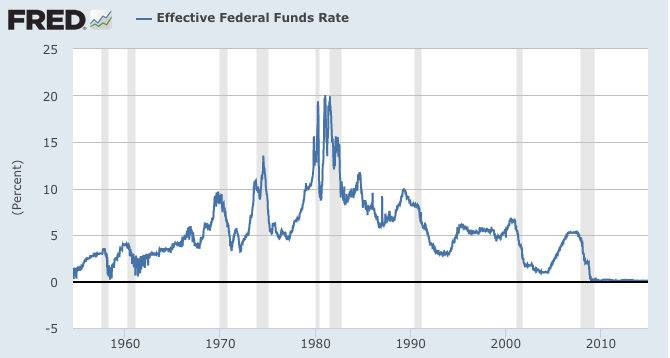

Stock Market Still Utterly Dependent on Easy Money

The Fed’s announcement today sent stocks soaring. From a CNBC story:

U.S. stocks surged on Wednesday, with the Dow marking its best session of the year, as investors celebrated a rally in the energy sector and the Federal Reserve’s pledge to be patient in raising interest rates.

Stocks rose after the Federal Reserve retained the phrase “considerable time” in its policy statement, and also introduced another word, “patient,” as the central bank readies to raise interest rates next year.

Specifically, both the S&P500 and Nasdaq indices were up more than 2 percent. In her remarks Fed chief Janet Yellen said that the Fed would likely keep rates pat for a “couple” more of its meetings, meaning that the first rate hike wouldn’t occur until April (if then).

Here is some historical context for the virtually 0% federal funds rate the U.S. has had since 2009:

If you think that interest rates serve a function in the market economy, helping to allocate scarce savings among possible investment projects, then you should be very concerned that the Fed’s policies for the last several years have been distorting the entire capital structure of the economy. To learn more, check out this collection of essays on so-called Austrian business cycle theory. For a quick fable that introduces the idea, here’s my “sushi article.”

Potpourri

==> I’ve been really enjoying Tom Woods’ show lately. Not to downplay the other guests, but make sure you catch Michael Malice on the cops and Scott Horton on the Senate torture report.

==> Speaking of the torture report, apparently Americans aren’t too worried about it. And Dick Cheney explicitly says that he would rather torture 25% innocent people rather than allow 30% guilty people return to the battlefield. Blackstone, he’s not.

==> Jeff Deist of the Mises Institute had me on to talk about recent police cases and the connection to Rothbard.

Does Government Spending Boost the Economy?

At the Freeman I take on the recent Business Insider article. An excerpt:

Edwards seems to think that the above chart shows at least a correlation between government spending and economic growth. After all, he wrote that the BEA chart “seems to show that government has a pretty straightforward effect on GDP.” But as Scott Sumner pointed out in amusement when he saw the article, the chart does nothing of the kind.

Look carefully at the legend. The various colored rectangles are different components of government spending. Specifically, the rectangles indicate how the change in each component — positive or negative — relates to the change in overall GDP. The black line is not GDP growth, but is instead the sum of the various components of government spending. In short, Matt Klein at the FT is telling us that if we take the BEA’s word for how much each component of government spending contributed to GDP growth in each quarter, then we can stack those numbers on top of each other and even add them up! Contrary to Edwards, the FT chart doesn’t “show” anything at all, except that the BEA each quarter announces how much various components of government spending contributed to, or subtracted from, GDP growth.

And:

The exact opposite happened with the so-called sequester. For example, the firm Macroeconomic Advisers, using a Keynesian model, predicted that the spending cuts would knock 1.3 percentage points off of second quarter 2013 growth, and 0.6 percentage points off of third quarter 2013 growth. Here’s what really happened:

It’s the mirror image of the Keynesians’ stimulus blunder. The economy grew faster with the sequester than the Keynesians said would occur without the “drag” of the spending cuts. In the case of the Obama stimulus, their excuse was, “Wow, the economy was worse than we realized, good thing we got that deficit spending in there, inadequate though it was.” In the case of the sequester, their response would have to be, “How about that, the economy was stronger than any of us realized. We dodged a bullet, since the sequester dragged down growth so much.”

U.S. Government Policy and Oil Prices

For those who like articles discussing really bad predictions confidently made by Krugman, this one’s for you. Also a nice Obama quote from 2012:

“As a country that has 2 percent of the world’s oil reserves, but uses 20 percent of the world’s oil — I’m going to repeat that — we’ve got 2 percent of the world oil reserves; we use 20 percent. What that means is, as much as we’re doing to increase oil production, we’re not going to be able to just drill our way out of the problem of high gas prices. Anybody who tells you otherwise either doesn’t know what they’re talking about or they aren’t telling you the truth.”

Tom Woods and I Dissect an Article Complaining About Cheap Gas

For your listening convenience I’ve embedded the video below, but go to Tom’s show notes for all the relevant links, both to the offending article and to the other information Tom and I brought up during the interview.

Standard Financial Models Wouldn’t Predict That Yields Would Spike After End of QE3

When it helped his cause, Krugman understood the stock/flow distinction and why you wouldn’t think the well-anticipated end of asset purchases would cause a sudden change in market price. Yet that didn’t stop Krugman from arguing recently that Treasury yields since the end of QE3 must mean Fed hasn’t been holding down yields.

I walk through the evidence and logic in my latest Mises CA. Then I end with this analogy that I hope will make it perfectly obvious:

Suppose the central banks around the world announced, “We have been reading a lot of Mises lately and so during the course of 2015, we are going to smoothly replace all of our bond holdings with gold, while maintaining the total market value of our balance sheets. Then we will stop our net purchases of gold in December 2015, and maintain our balance sheet’s market value from that point forward, adjusting our holdings of gold accordingly.”

Would it be reasonable to assume that these actions by the central banks would push up the world price of gold, higher than it otherwise would have been? I hope we can agree that would be a reasonable view.

Now the trickier questions: Would the world price of gold respond immediately to the news, or would it spike only when the central banks actually started buying gold on January 2?

Finally, would the world price of gold suddenly crash in December 2015 when the net purchases stopped, and go back to whatever it would have been in the absence of the purchases? Or might it permanently prop up the world price of gold (relative to the counterfactual) if central banks held several trillions of dollars worth of more gold?

Recent Comments