Stock Market Still Utterly Dependent on Easy Money

The Fed’s announcement today sent stocks soaring. From a CNBC story:

U.S. stocks surged on Wednesday, with the Dow marking its best session of the year, as investors celebrated a rally in the energy sector and the Federal Reserve’s pledge to be patient in raising interest rates.

Stocks rose after the Federal Reserve retained the phrase “considerable time” in its policy statement, and also introduced another word, “patient,” as the central bank readies to raise interest rates next year.

Specifically, both the S&P500 and Nasdaq indices were up more than 2 percent. In her remarks Fed chief Janet Yellen said that the Fed would likely keep rates pat for a “couple” more of its meetings, meaning that the first rate hike wouldn’t occur until April (if then).

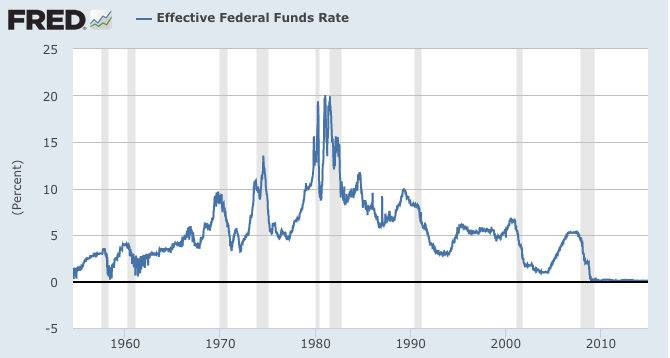

Here is some historical context for the virtually 0% federal funds rate the U.S. has had since 2009:

If you think that interest rates serve a function in the market economy, helping to allocate scarce savings among possible investment projects, then you should be very concerned that the Fed’s policies for the last several years have been distorting the entire capital structure of the economy. To learn more, check out this collection of essays on so-called Austrian business cycle theory. For a quick fable that introduces the idea, here’s my “sushi article.”

I like Prof. Salerno’s recent paper on ABCT: http://mises.org/library/reformulation-austrian-business-cycle-theory-light-financial-crisis-0. It’s a nice summary & update/clarification based on recent criticisms.

There is an alternative narrative:

– The fed uses govt power and central control to set the size of the monetary base

– Pre-2007 it created too much money and allowed an artificial boom to develop

– This blew up in 2007/8 and led to an enormous increase in the demand for safe assets especially money

– The fed (being centrally controlled) did not respond to the market signals this created by satisfying this demand

– As a result of this business confidence crashed and even at 0% no-one wanted (or wants) to borrow

– If the fed had followed optimal money policy (or if the money supply had been left to market forces), then the crash could have been avoided (or at least minimized) and rates never would have hit zero in the first place,

For government bonds, I have to ask- as you approach the limit towards full monetization, what should the interest rate on government debt be? I think the answer is, logically, zero.

With interest rates being so distorted for so long (not to mention generations of industrial decimation already at the hands of government in this country), the “upswing” in “aggregate” industrial “growth” we have witnessed has almost certainly resulted in significant wealth destruction, that will make it very, very difficult for the poorest to cope with when this bubble bursts.