“Why Jesus?”

I’ve been watching a lot of Ravi Zacharias lately. If you’ve never heard him, try giving him a chance. He is very educated and of course his voice is transfixing.

A *Possible* Scenario In Which the SNB Wouldn’t Want 100% of GDP in Euros

What is really odd in the econoblogger debate over the SNB’s recent decision to drop the Swiss franc/euro peg is that some people (including prominent monetary economists) are acting like there is not even a possible danger here. Bill Woolsey actually asked me in the comments here at Free Advice: “Is the argument here that officials in the SNB would get carpal tunnel syndrome by typing in numbers in their computer? Or are we supposed to be worried about exhaustion by those working at the SNB trading desk, purchasing all of those foreign assets?”

No, that’s not really the argument. And I find it alarming that this sarcasm is the extent of the brainstorming that really sharp guys (not being sarcastic when I say that) have put into thinking through the possible downsides of more aggressive monetary policy.

I’m not predicting this would have happened in the next 18 days, but suppose–just to show the kind of thing that perhaps the SNB officials wanted to avoid–that at some point down the road, consumer price inflation in Switzerland started rising again, and they wanted to tighten. But at the same time, the ECB was getting ready to loosen. So the officials at that point have no choice but to abandon the peg, because now it’s interfering with the domestic price inflation goals.

Oh shoot, when they drop the peg, they lose a boatload of money on their euro-denominated assets. The SNB literally goes bankrupt, in an accounting sense. Even worse, now they lack the ability to withdraw the reserves of Swiss francs from the banking system, because their mechanism is to sell off euros and buy back francs, but now the exchange rate moved way against them.

But just because the Swiss franc appreciates against the euro, doesn’t mean the Swiss franc is appreciating against goods and services. It is possible to imagine a scenario where they totally lose the ability to restrain domestic price inflation to their target goal, because they foolishly loaded up their central bank’s balance sheet with (say) 120% GDP worth of a foreign currency.

To repeat, I’m not saying the above was likely to happen anytime soon, but surely that’s the kind of thing that worried SNB officials. I don’t mind if Sumner and his crew think the benefits outweighed the possible risks, but I have yet to see any of them even acknowledge there were risks with the franc/euro peg.

Scott Sumner Busts Krugman

Scott Sumner has been lighting it up at EconLog in his running commentary against Keynesians, notably Paul Krugman. (The two most recent examples are here and here, but it goes back further.) Scott’s running theme here is that guys like Krugman picked the U.S. austerity episode as the hill to die on, and then when they died, they not only didn’t see the problem, but instead ran around bragging about how awesome their model had performed!

Scott has made an analogy (one I made in the past, as well) with the Keynesian debacle over the Obama stimulus package, where the economy did worse *with* the stimulus than the Keynesians were warning would happen *without* the stimulus. Regarding the sequester, the opposite happened: The economy did better *with* the “austerity” than they predicted would happen *without* spending cuts and tax hikes. Summarizing his latest post, Scott writes: “Two grand Keynesian experiments and two abject failures. Followed by two times where the Keynesians started crowing about how they’d been right about everything. You can’t make this stuff up.”

I love it! Scott is really zinging Krugman on this one, and I’m glad he’s not dropping it because some of our prominent Keynesian bloggers were quite unambiguous in their description of how awful the sequester was.

If I might go beyond Scott’s remarks, isn’t it astonishing to see really sharp guys like Krugman, who watch officials follow their policy advice and run unprecedented deficits for years on end, and then when the officials finally throw in the towel because it’s not working, Krugman shrugs and says, “What are you doing?! There was no reason to stop! My plan would’ve worked if you just hadn’t been such a chicken about it! Not only are you idiots wrong, but in the long run you’ll end up with *bigger* deficits because of your stupidity!” Such amazing intelligence with a guy like Krugman, coupled with a major blind spot. Krugman really can’t see that his plan was fundamentally mistaken; he always comes up with excuses after the fact and truly doesn’t realize that running massive deficits isn’t the path to prosperity. It’s amazing to behold.

In completely unrelated news, back on December 21 Scott was pointing to the SNB’s peg as a great illustration of his point that once you firmly announce a policy rule and convince markets you’re serious, it’s a piece of cake to maintain. Nowadays he is complaining to everyone about what idiots the SNB officials were for abandoning the policy for no good reason. They thought they were protecting their balance sheet? Not so, Scott tells us they’ll end up inflating more, now that they dropped the peg. In any event, Scott can’t understand why critics of the peg are pointing to its abandonment, as if that has anything at all to do with whether it was a credible policy.

Mr. Reporter, Don’t Make Tom Woods Angry. You Wouldn’t Like Him When He’s Angry

Apparently Tom knew that someone from the Washington Post was in the crowd, presumably to get juicy tidbits about what secessionist nutjobs Ron Paul was associating with. Here’s the speech Tom gave:

BTW Tom’s opening joke is on the audio version here. It’s the Bruce Banner before he turns into the Hulk.

Scott Sumner’s Incredible Arguments on the Swiss Currency Peg

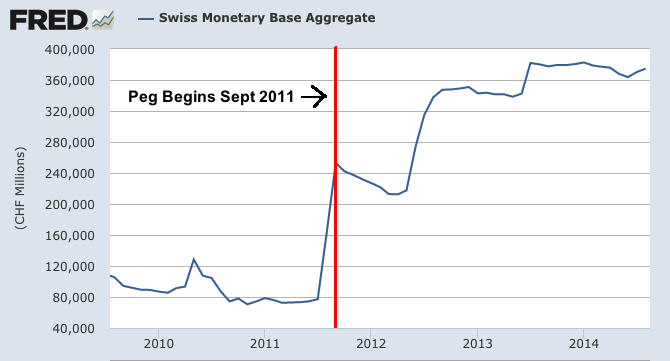

My latest at Mises CA. If you’re in a rush, here’s the graph to accompany Scott Sumner’s defense (made in December before the dropped it) where he said it was a piece of cake to maintain the peg:

I found some monetary base data that is quite interesting. From January to September 2011 the Swiss monetary base soared from 79b SF to 253b SF. That’s Zimbabwean money printing, and it shows why Krugman is so contemptuous of the inflationistas. Switzerland got essentially zero inflation. But then something interesting happened; after the currency was depreciated and pegged at 1.2 SF/euro, the base actually fell to 215b by May 2012. Once investors stopped thinking the SF was going to move ever higher, they no longer had a strong incentive to speculate in that asset. It became easier to defend the currency.

Alas, there was one more attack in mid-2012, as eurozone investors worried about a collapse in the euro. Naturally, in that environment the SF would be attractive at even a zero expected rate of return. The base rose again to 349b SF in September 2012, at which point growth slowed sharply (it’s 376b today.) More importantly, the 1.2 SF/euro peg held. Krugman was wrong, currency depreciation is not difficult if it is followed up with a level targeting regime.

Do you see how odd that is? As I summarize Scott’s position in my post:

As long as speculators don’t attack you, you should be fine.

“Ain’t That a Kick in the Head”

My friend Sam is my chief karaoke accomplice in Nashville. He made this video because he’s bored.

Potpourri

==> At IER, I discuss the refreshing honesty from James Hansen.

==> My colleagues at IER assembled a fact sheet on ANWR.

==> I don’t think I linked this here yet? Anyway Matt Ridley’s recent post on why he’s a climate “lukewarmer” is really good. He sounds like the epitome of a reasonable guy. Naturally people went nuts on him.

==> This story is really interesting about someone flipping the discriminatory baker thing around when he was denied service after requesting a cake with offensive words. However, I would feel a lot better about it if we were certain the guy was doing it purely to make a point. I had people assuring me on FB that that’s what it was, but I dunno… (To try to help keep the discussion in the comments on point: It is certainly true that the Old Testament has strong prohibitions against homosexuality. But that doesn’t mean “God hates gays” unless you think God hates every single human besides Jesus.)

==> UPDATE: I originally thought this Mark Perry piece was saying something else. Texas was not the only state to add net jobs since the recession began. Rather, it is showing that Texas added more net jobs than the U.S. as a whole. I.e. the net jobs created in some of the other 49 states were more than offset by the net job losses in some of the 49 other states. (Don’t judge me, I had the flu a few days ago and haven’t gotten enough sleep.)

Swiss National Bank vs. the Federal Reserve

In light of the recent announcement of the Swiss National Bank abandoning its peg to the euro, I thought people should realize just how much the SNB had inflated. The following chart compares the SNB “monetary base” (you can think of it as its balance sheet, close enough) with that of the Fed. They are both indexed to 100 at the start of the graph:

As the chart shows, by mid-2011 the SNB had expanded more (percentage-wise) than the Fed, and it’s never looked back. Currently, the SNB’s base is eight times what it was in late 2007.

One last thing: Keynesians around the world denounced the SNB for throwing in the towel, showing an insufficient willingness to inflate in order to promote prosperity.

Recent Comments